Answered step by step

Verified Expert Solution

Question

1 Approved Answer

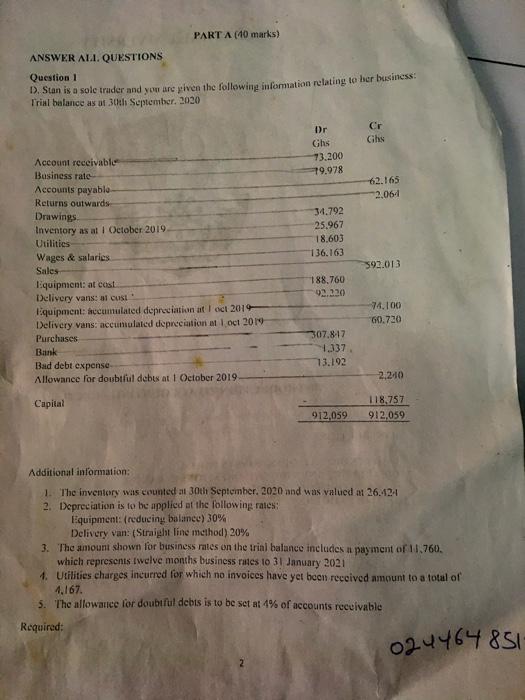

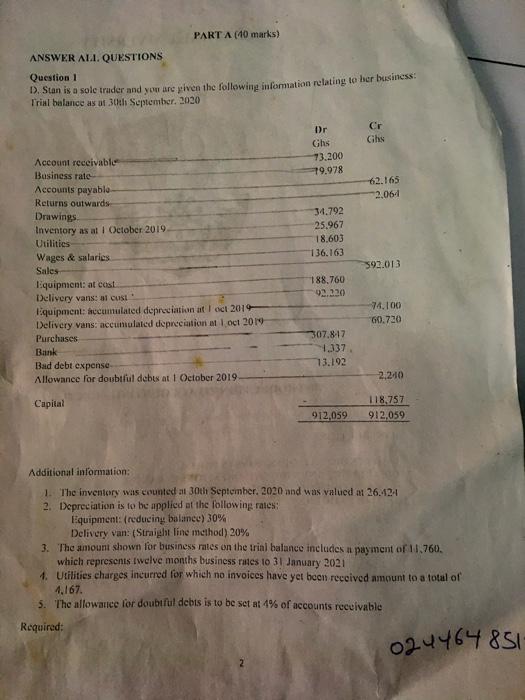

Required: Income Statement Statement of Financial Position PART A (40 marks) ANSWER ALI. QUESTIONS Question 1 D. Stan is a sole truder and you are

Required:

PART A (40 marks) ANSWER ALI. QUESTIONS Question 1 D. Stan is a sole truder and you are given the following information relating to her business Trial balance as at 30th September, 2020 Cr Ghis Dr Ghs 73.200 19.978 42.165 2.064 34,792 25.967 18,603 136,163 Account receivable Business rate Accounts payablo Returns outwards Drawings Inventory as at 1 October 2019 Utilities Wages & salaries Sales Equipment at cost Delivery vans a cust Equipment: accumulated depreciation at I oct 2019 Delivery vans: accumulated depreciation at 1 oct 2019 Purchases Bank Bad debt expense Allowance for doubtful debu at 1 October 2019 392.013 188,760 92.220 74.100 60.730 307.817 4.337 13.192 2,240 Capital 118,757 912,059 912,059 Additional information: 1. The inventory was counted at 30th September. 2020 and was valued at 26.424 2. Depreciation is to be applied at the following rates: Equipment: (reducing balance) 30% Delivery van: (Straight line method) 20% 3. The amount shown for business rates on the trial balance includes a payment of 11.760. which represents twelve months business rutes to 31 January 2021 4. Utilities charges incurred for which no invoices have yet been received amount to a total of 4.167 5. The allowance for doubtfuldebts is to be set at 4% of accounts receivable Required: 024464851 Income Statement

Statement of Financial Position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started