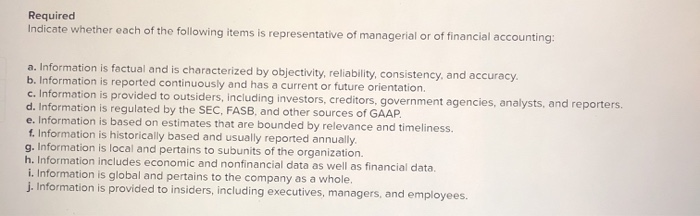

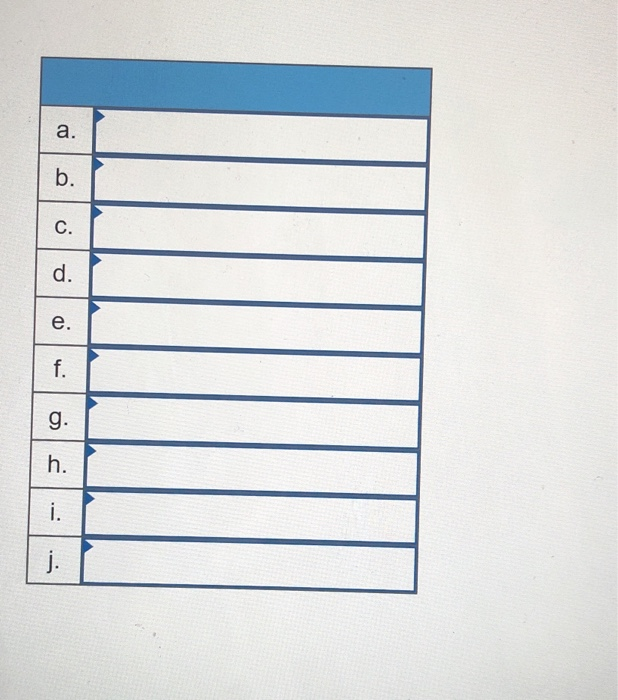

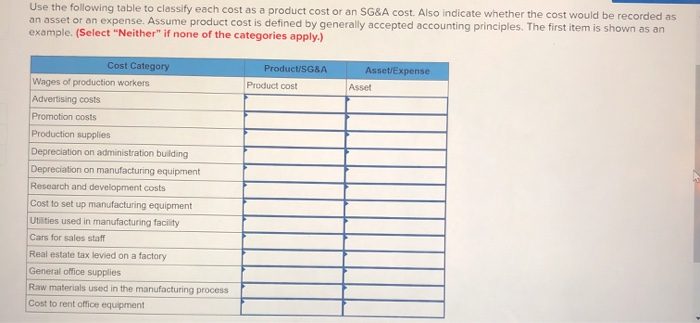

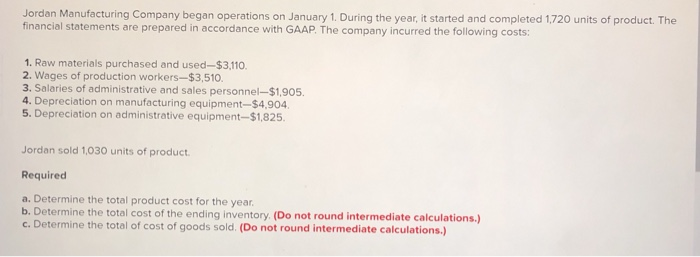

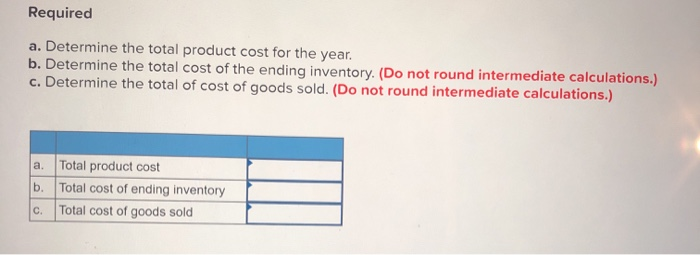

Required Indicate whether each of the following items is representative of managerial or of financial accounting: a. Information is factual and is characterized by objectivity, reliability, consistency, and accuracy. b. Information is reported continuously and has a current or future orientation c. Information is provided to outsiders, including investors, creditors, government agencies, analysts, and reporters. d. Information is regulated by the SEC, FASB, and other sources of GAAP. e. Information is based on estimates that are bounded by relevance and timeliness. f. Information is historically based and usually reported annually. g. Information is local and pertains to subunits of the organization. h. Information includes economic and nonfinancial data as well as financial data. i. Information is global and pertains to the company as a whole. J. Information is provided to insiders, including executives, managers, and employees. a. b. C. d. e. f. g. h. i. j. Use the following table to classify each cost as a product cost or an SG&A cost. Also indicate whether the cost would be recorded as an asset or an expense. Assume product cost is defined by generally accepted accounting principles. The first item is shown as an example. (Select "Neither" if none of the categories apply.) Product/SG&A Product cost Asset/Expense Asset Cost Category Wages of production workers Advertising costs Promotion costs Production supplies Depreciation on administration building Depreciation on manufacturing equipment Research and development costs Cost to set up manufacturing equipment Utilities used in manufacturing facility Cars for sales staff Real estate tax levied on a factory General office supplies Raw materials used in the manufacturing process Cost to rent office equipment Jordan Manufacturing Company began operations on January 1. During the year, it started and completed 1,720 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used--$3,110. 2. Wages of production workers-$3,510. 3. Salaries of administrative and sales personnel-$1,905. 4. Depreciation on manufacturing equipment-$4.904 5. Depreciation on administrative equipment-$1,825 Jordan sold 1,030 units of product Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold (Do not round intermediate calculations.) Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) a b. Total product cost Total cost of ending inventory Total cost of goods sold C