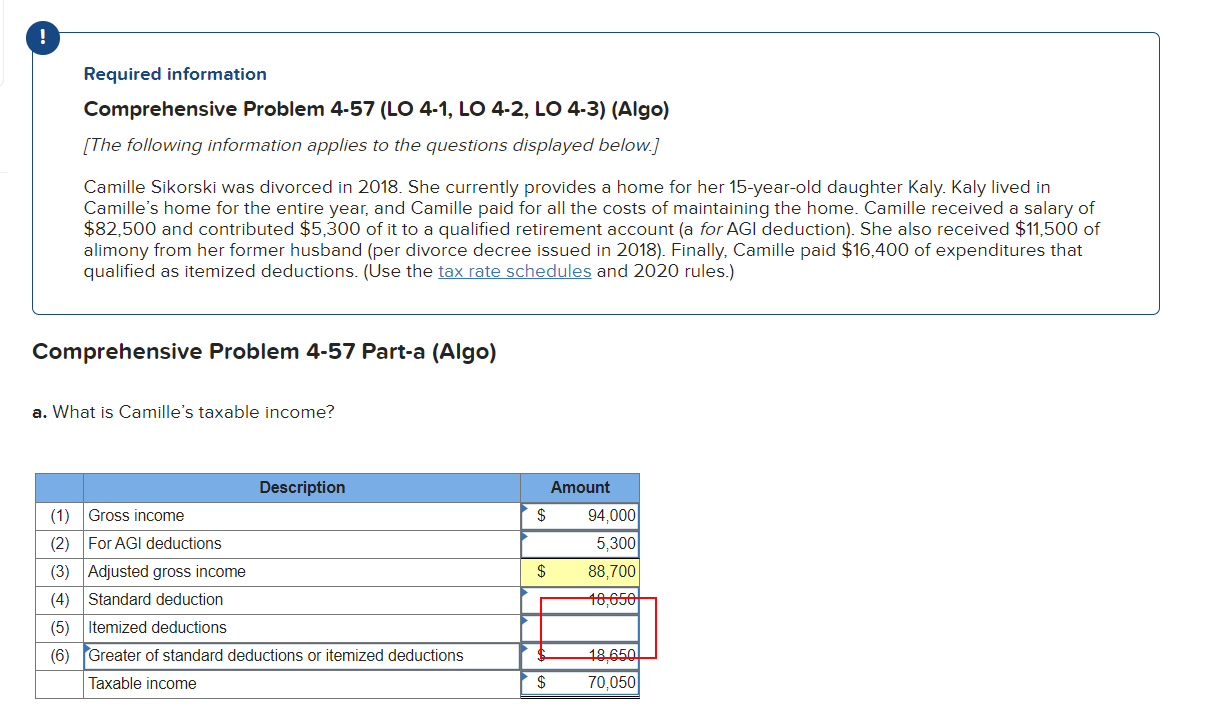

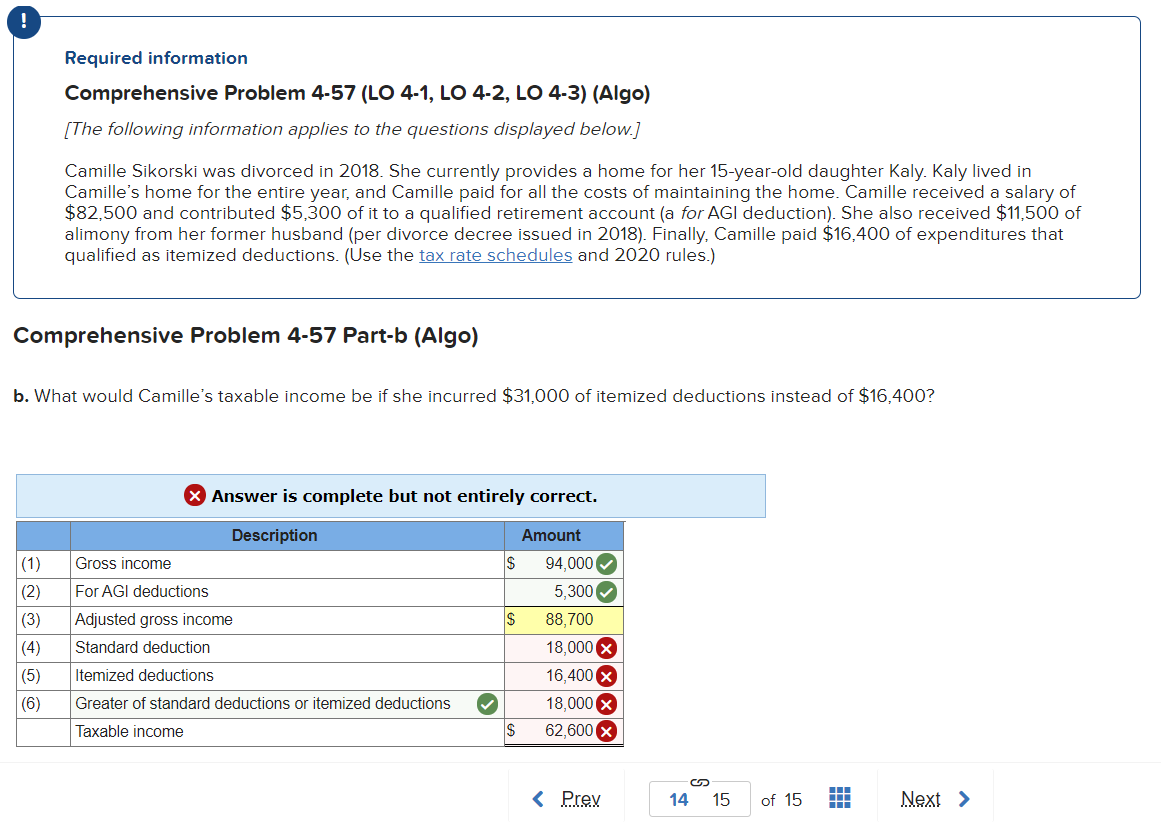

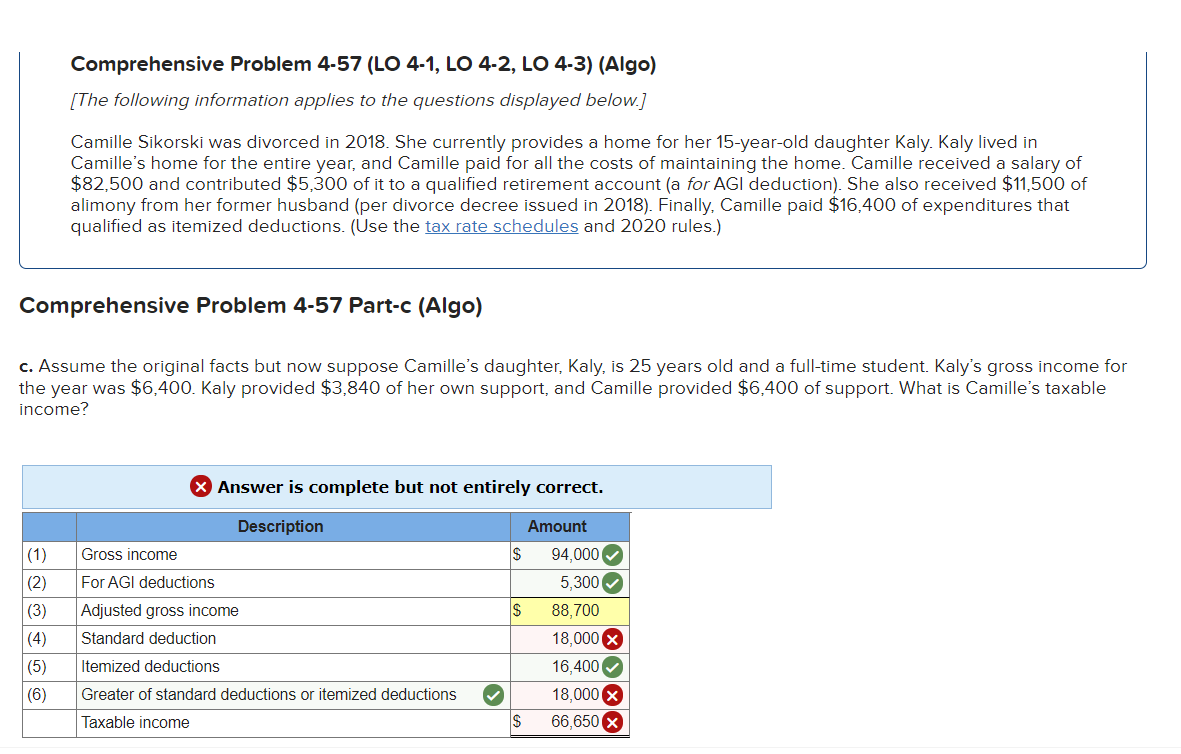

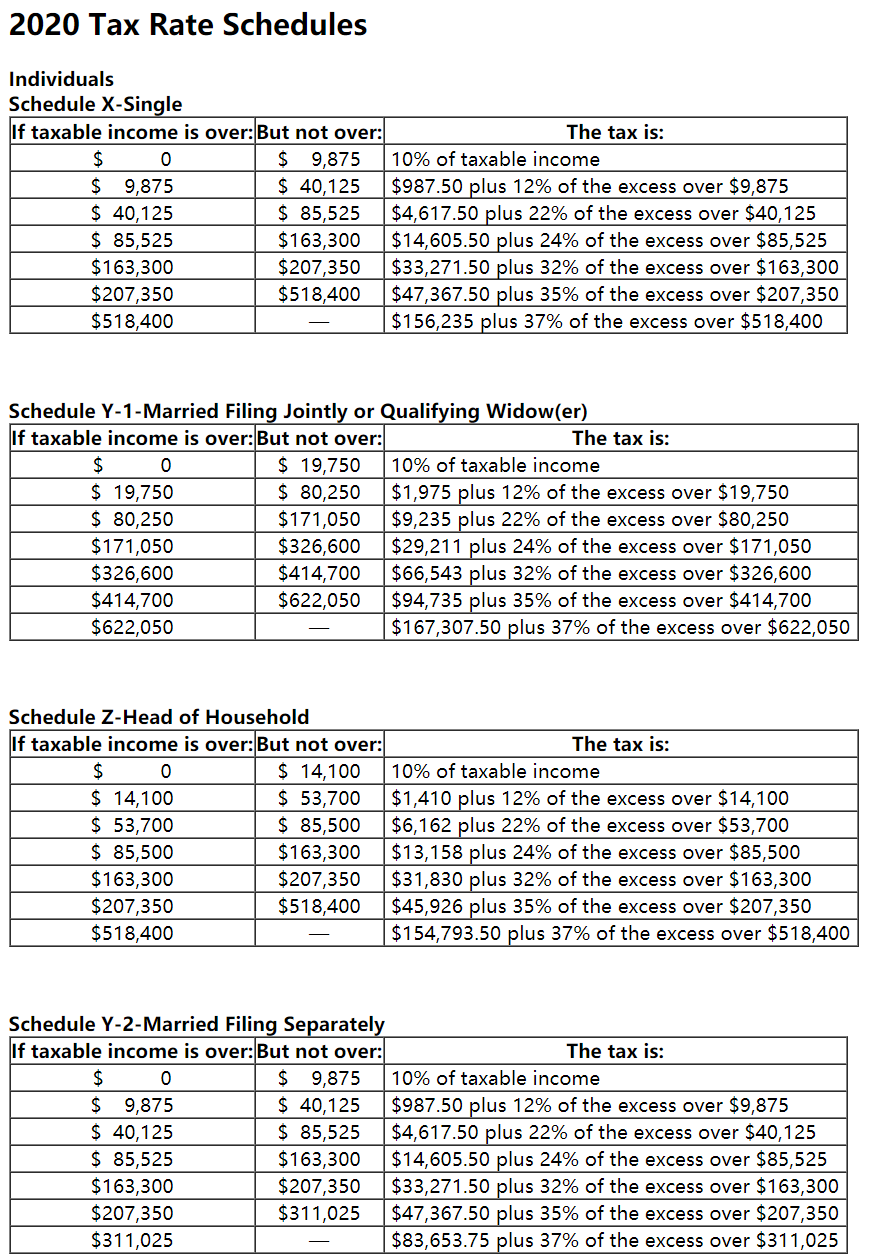

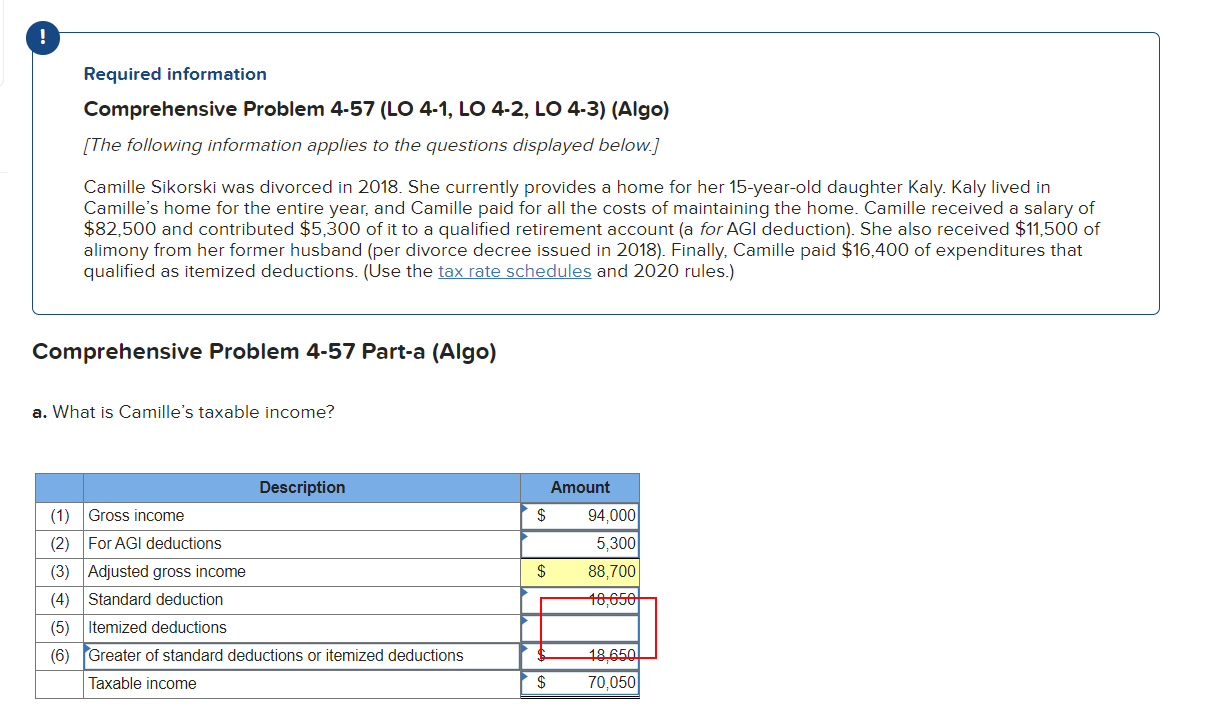

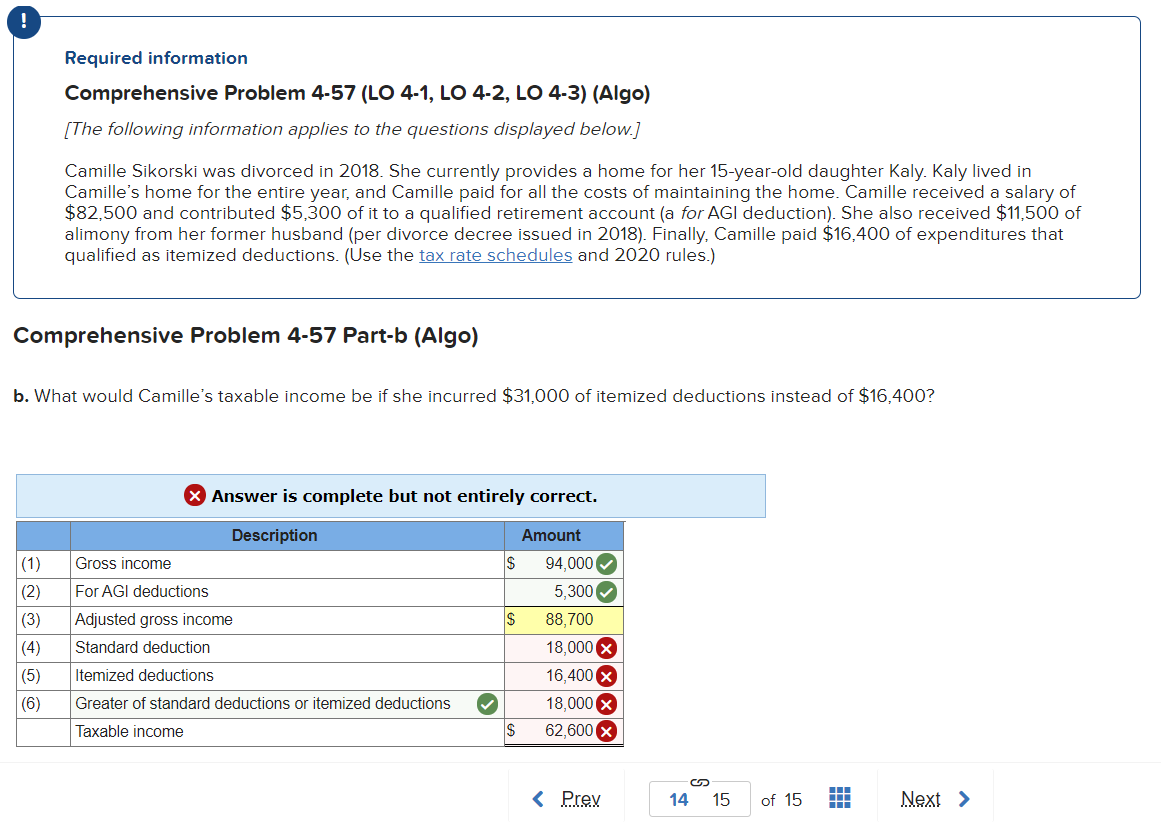

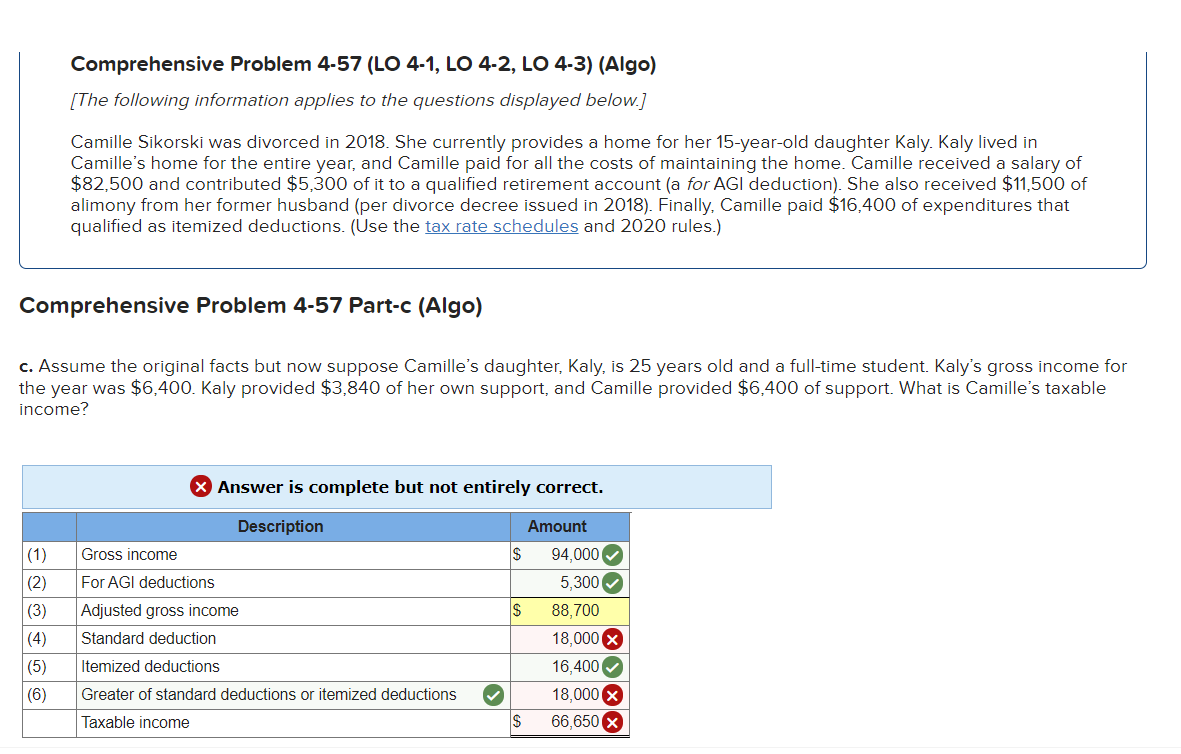

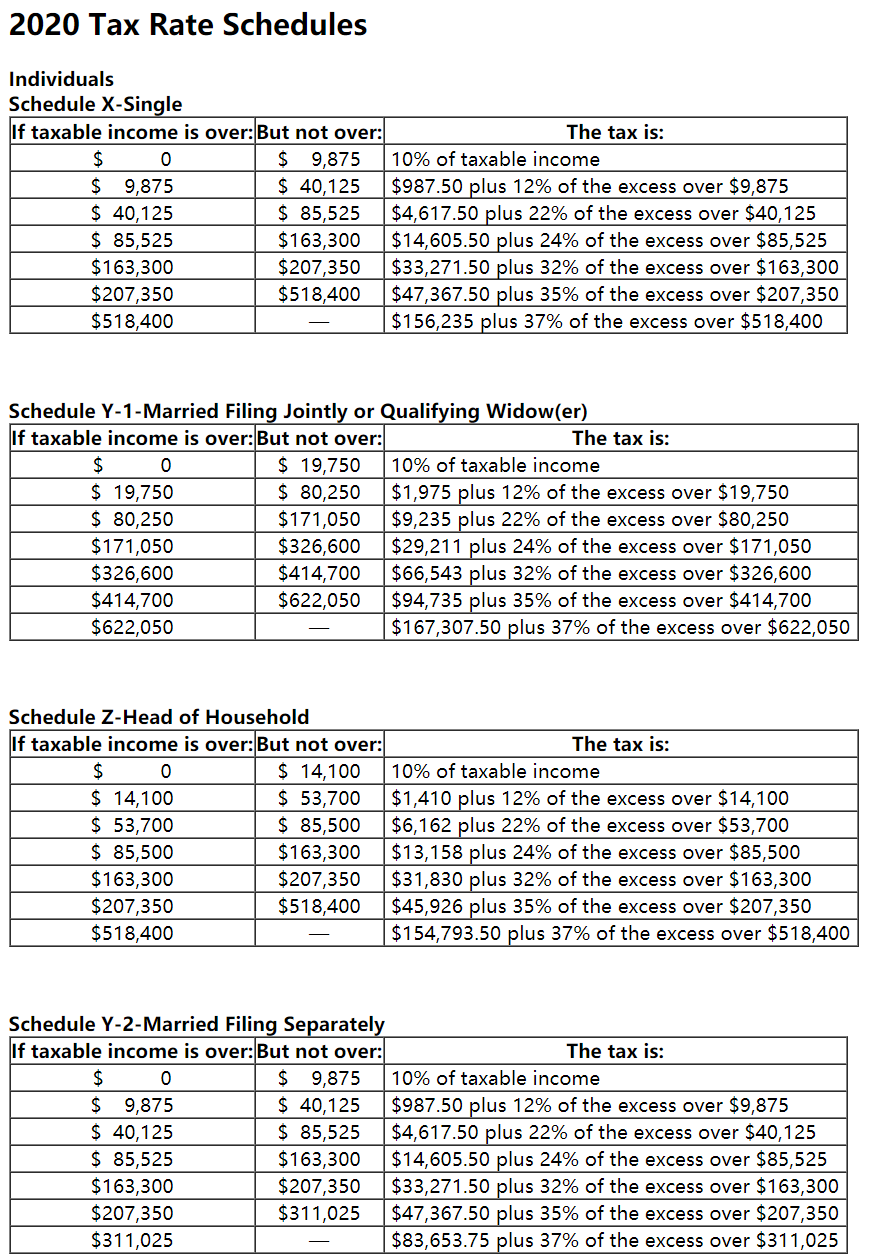

Required information Comprehensive Problem 4-57 (LO 4-1, LO 4-2, LO 4-3) (Algo) (The following information applies to the questions displayed below.) Camille Sikorski was divorced in 2018. She currently provides a home for her 15-year-old daughter Kaly. Kaly lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of $82,500 and contributed $5,300 of it to a qualified retirement account (a for AGI deduction). She also received $11,500 of alimony from her former husband (per divorce decree issued in 2018). Finally, Camille paid $16,400 of expenditures that qualified as itemized deductions. (Use the tax rate schedules and 2020 rules.) Comprehensive Problem 4-57 Part-a (Algo) a. What is Camille's taxable income? Amount $ 94,000 $ Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard deductions or itemized deductions Taxable income 5,300 88,700 10,00 18.650 70,050 $ Required information Comprehensive Problem 4-57 (LO 4-1, LO 4-2, LO 4-3) (Algo) [The following information applies to the questions displayed below.] Camille Sikorski was divorced in 2018. She currently provides a home for her 15-year-old daughter Kaly. Kaly lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of $82,500 and contributed $5,300 of it to a qualified retirement account (a for AGI deduction). She also received $11,500 of alimony from her former husband (per divorce decree issued in 2018). Finally, Camille paid $16,400 of expenditures that qualified as itemized deductions. (Use the tax rate schedules and 2020 rules.) Comprehensive Problem 4-57 Part-b (Algo) b. What would Camille's taxable income be if she incurred $31,000 of itemized deductions instead of $16,400? Answer is complete but not entirely correct. Description Gross income For AGI deductions (1) (2) (3) (4) (5) (6) Adjusted gross income Standard deduction Amount $ 94,000 5,300 IS 88,700 18,000 X 16,400 X 18,000 X S 62,600 X Itemized deductions Greater of standard deductions or itemized deductions Taxable income Comprehensive Problem 4-57 (LO 4-1, LO 4-2, LO 4-3) (Algo) (The following information applies to the questions displayed below.) Camille Sikorski was divorced in 2018. She currently provides a home for her 15-year-old daughter Kaly. Kaly lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of $82,500 and contributed $5,300 of it to a qualified retirement account (a for AGI deduction). She also received $11,500 of alimony from her former husband (per divorce decree issued in 2018). Finally, Camille paid $16,400 of expenditures that qualified as itemized deductions. (Use the tax rate schedules and 2020 rules.) Comprehensive Problem 4-57 Part-c (Algo) c. Assume the original facts but now suppose Camille's daughter, Kaly, is 25 years old and a full-time student. Kaly's gross income for the year was $6,400. Kaly provided $3,840 of her own support, and Camille provided $6,400 of support. What is Camille's taxable income? Answer is complete but not entirely correct. Description (1) Gross income Amount 94,000 5,300 (2) (3) S For AGI deductions Adjusted gross income Standard deduction Itemized deductions Greater of standard deductions or itemized deductions 88,700 18,000 x (4) (5) (6) 16,400 18,000 X 66,650 Taxable income 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $ 163,300 $14,605.50 plus 24% of the excess over $85,525 $ 163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $ 163,300 $13,158 plus 24% of the excess over $85,500 $ 163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $ 163,300 $14,605.50 plus 24% of the excess over $85,525 $ 163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $311,025 $47,367.50 plus 35% of the excess over $207,350 $311,025 $83,653.75 plus 37% of the excess over $311,025