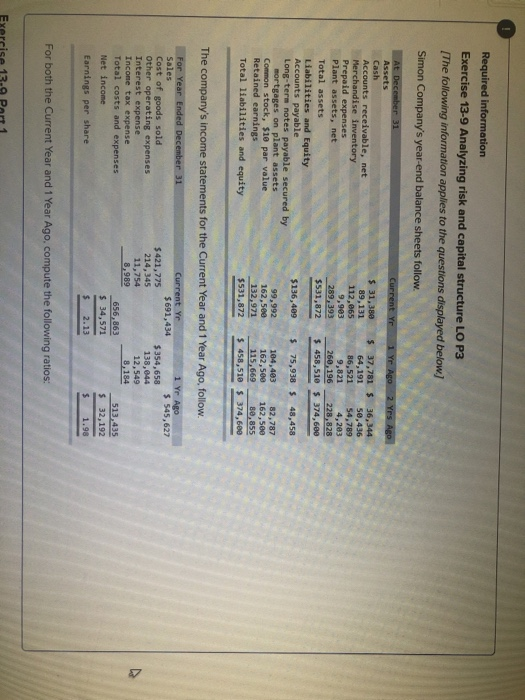

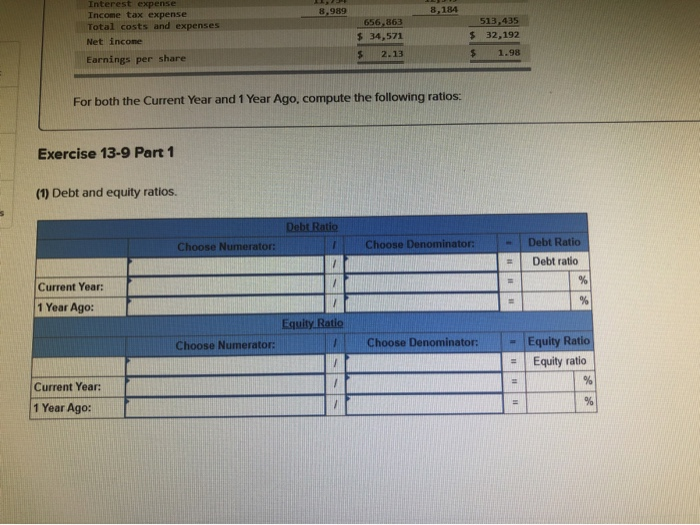

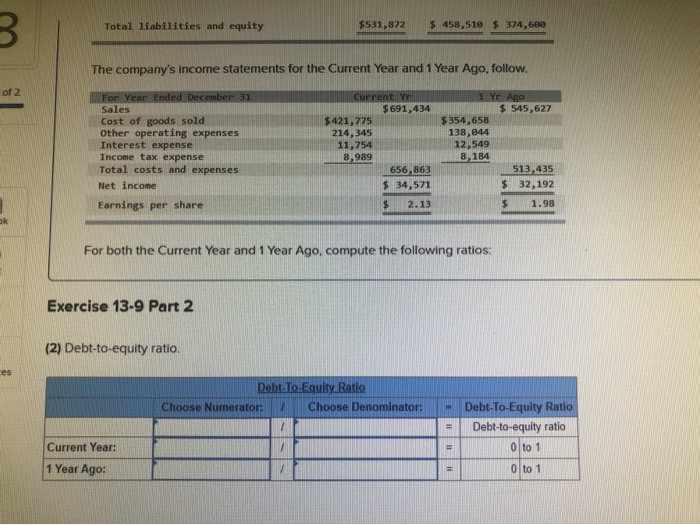

Required information Exercise 13-9 Analyzing risk and capital structure LO P3 [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Yr 1 yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise Inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,380 89,131 112,065 9,903 289,393 $531,872 $ 37,781 $ 36,344 64,191 50,436 86,521 54.789 9,821 4,203 260, 196 228,828 $ 458,510 $ 374,600 $ 136,409 $ 75,938 $ 48,458 99,992 162,500 132,971 $531,872 104,403 82,787 162,500 162,500 115,669 80,855 $ 458,510 $ 374,600 The company's income statements for the Current Year and 1 Year Ago follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $691, 434 $421,775 214,345 11,754 8.989 656,863 $ 34,571 $ 2.13 1 Yr Ago $ 545,627 $ 354,658 138,044 12,549 8,184 513,435 $ 32,192 $ 1.98 For both the Current Year and 1 Year Ago, compute the following ratios: 8,989 8,184 Interest expense Income tax expense Total costs and expenses Net income Earnings per share 656,863 $ 34,571 $ 2.13 513,435 $ 32,192 $ 1.98 For both the Current Year and 1 Year Ago, compute the following ratios: Exercise 13-9 Part 1 (1) Debt and equity ratios. Debt Ratio Choose Numerator: Choose Denominator: Debt Ratio Debt ratio % Current Year: % 1 Year Ago: - Equity Ratio Choose Numerator: Choose Denominator: Equity Ratio Equity ratio % Current Year: % 1 Year Ago: 3. Total liabilities and equity $531,872 $ 458,510 $ 374,680 The company's income statements for the Current Year and 1 Year Ago, follow. of 2 For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $691,434 $421,775 214,345 11,754 8,989 656,863 $ 34,571 1 Yr ARO $ 545,627 $354,658 138,044 12,549 8,184 513,435 $ 32,192 $ 1.98 Earnings per share 2.13 ok For both the Current Year and 1 Year Ago, compute the following ratios: Exercise 13-9 Part 2 (2) Debt-to-equity ratio. Debt.To.Equity Ratio Choose Numerator: Choose Denominator: 1111 Debt-To-Equity Ratio Debt-to-equity ratio 0 to 1 Current Year: 1 Year Ago: O to 1