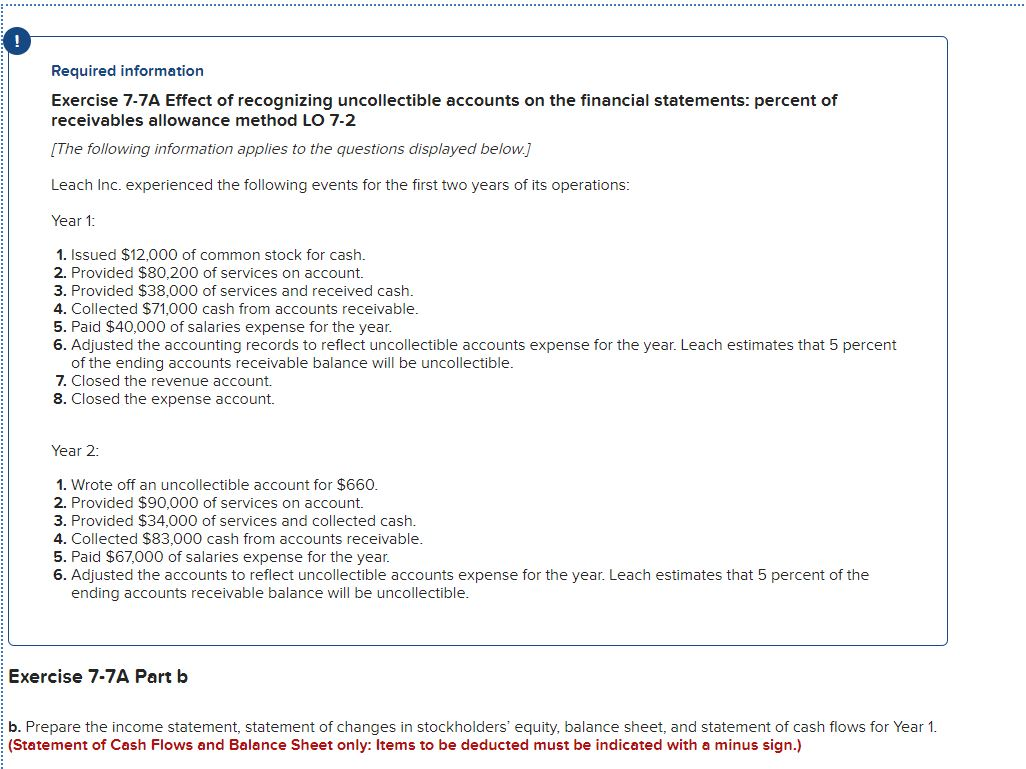

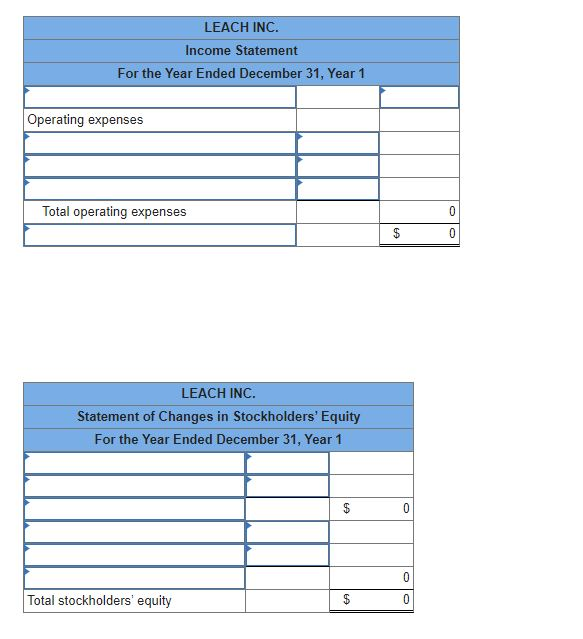

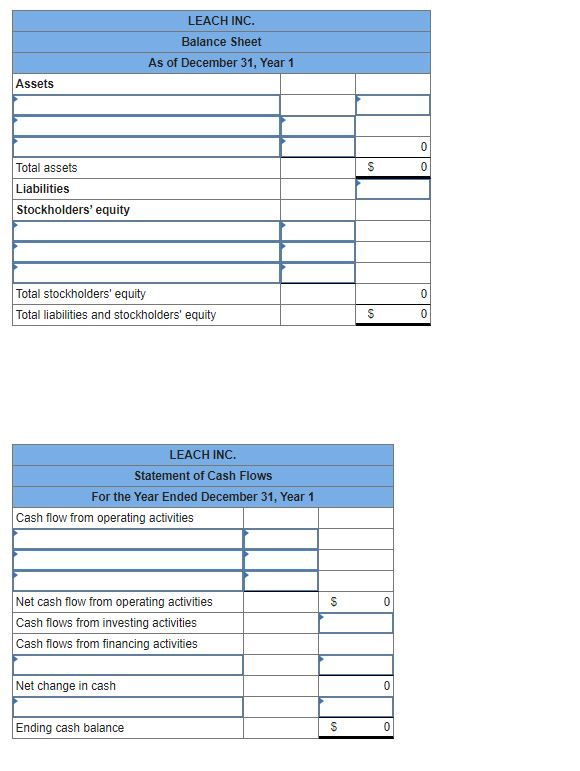

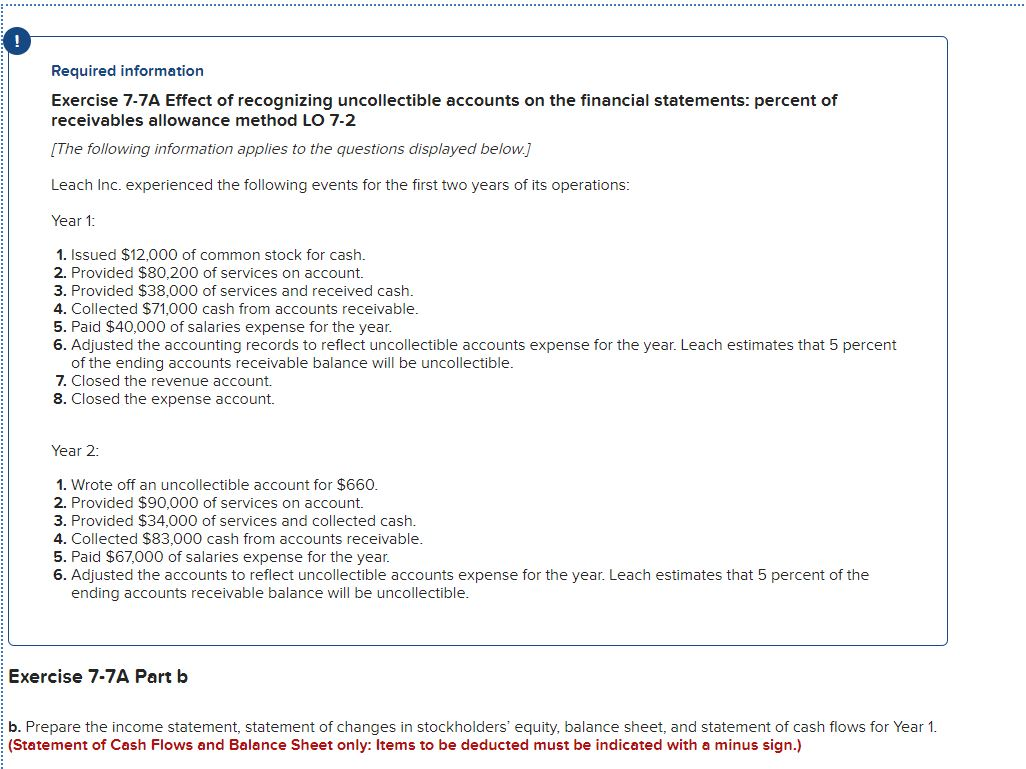

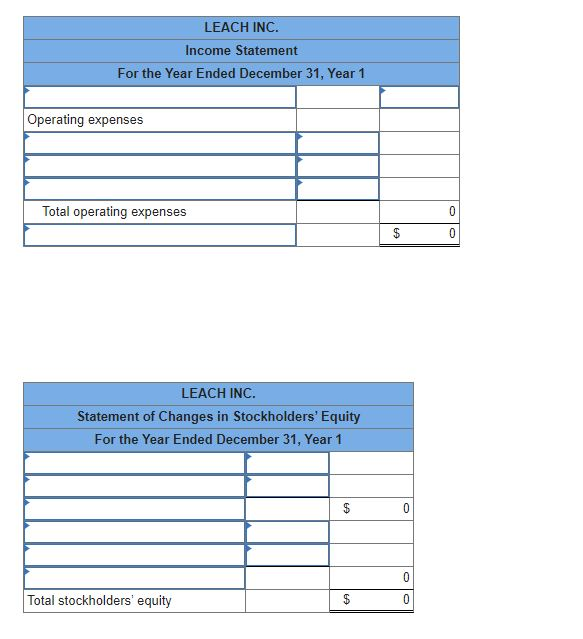

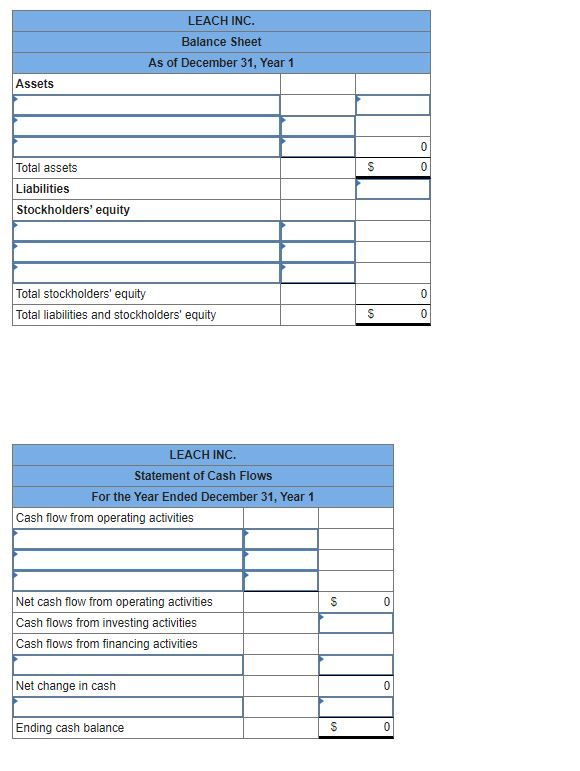

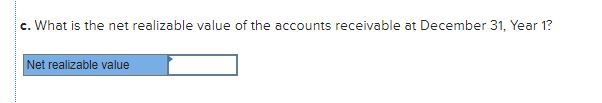

Required information Exercise 7-7A Effect of recognizing uncollectible accounts on the financial statements: percent of receivables allowance method LO 7-2 [The following information applies to the questions displayed below.] Leach Inc. experienced the following events for the first two years of its operations: Year 1: 1. Issued $12,000 of common stock for cash. 2. Provided $80,200 of services on account. 3. Provided $38,000 of services and received cash. 4. Collected $71,000 cash from accounts receivable. 5. Paid $40,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense account. Year 2: 1. Wrote off an uncollectible account for $660. 2. Provided $90,000 of services on account. 3. Provided $34,000 of services and collected cash. 4. Collected $83,000 cash from accounts receivable. 5. Paid $67,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible. Exercise 7-7A Part 6 b. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 1. (Statement of Cash Flows and Balance Sheet only: Items to be deducted must be indicated with a minus sign.) LEACH INC. Income Statement For the Year Ended December 31, Year 1 Operating expenses Total operating expenses 0 $ LEACH INC. Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 1 $ 0 0 Total stockholders' equity 0 LEACH INC. Balance Sheet As of December 31, Year 1 Assets 0 $ 0 Total assets Liabilities Stockholders' equity 0 Total stockholders' equity Total liabilities and stockholders' equity S 0 LEACH INC. Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flow from operating activities S 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash 0 Ending cash balance $ 0 c. What is the net realizable value of the accounts receivable at December 31, Year 1? Net realizable value