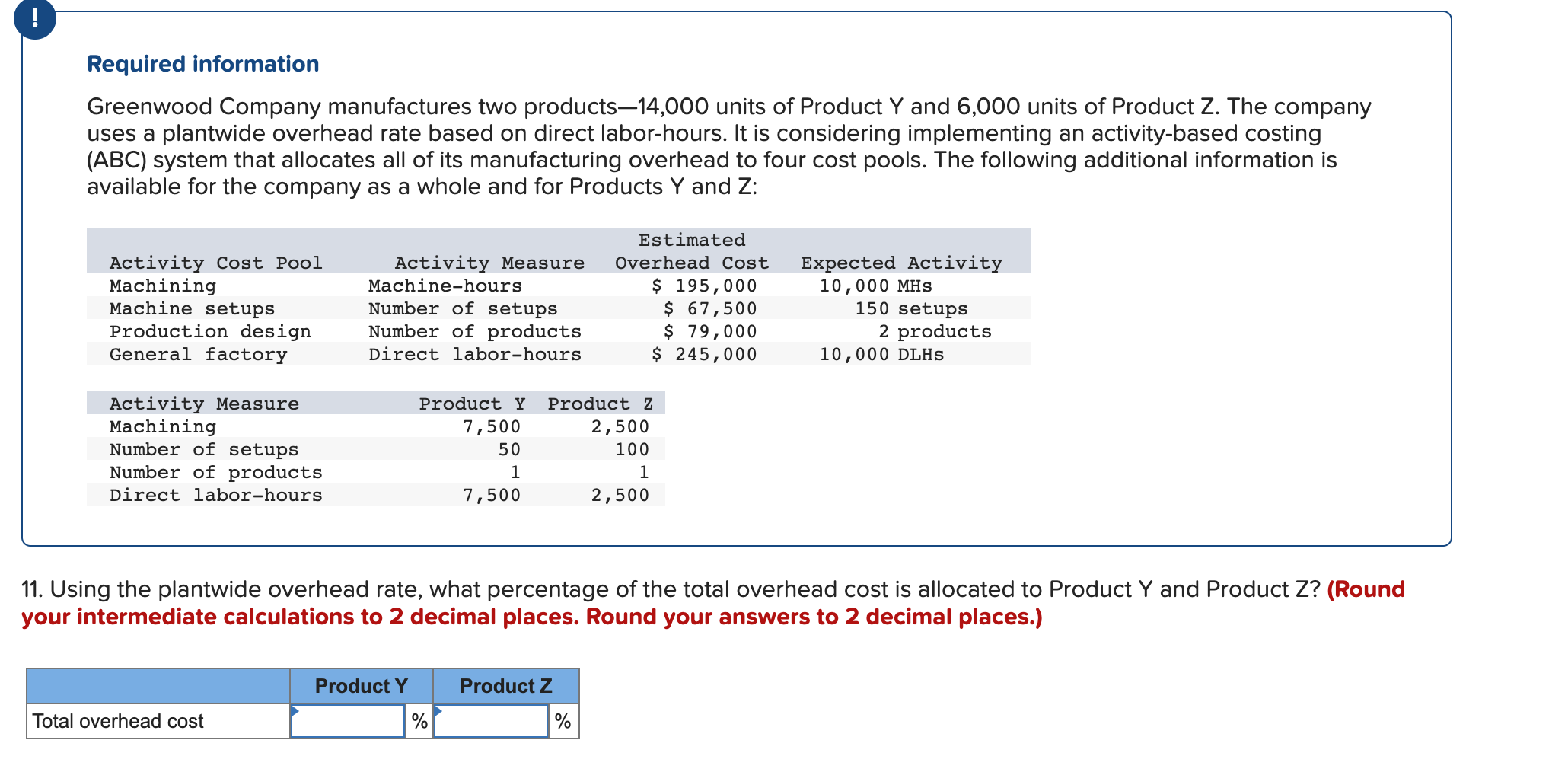

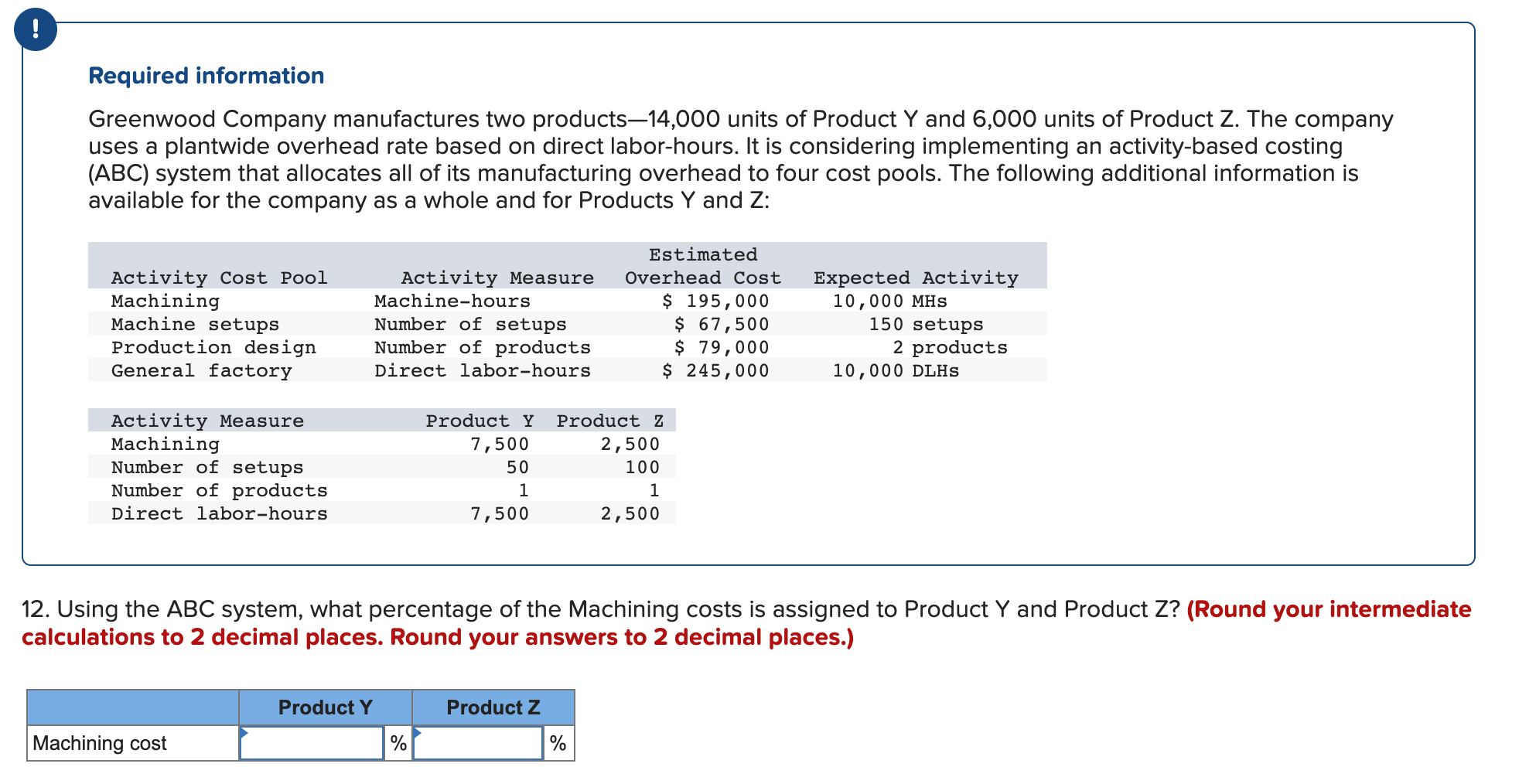

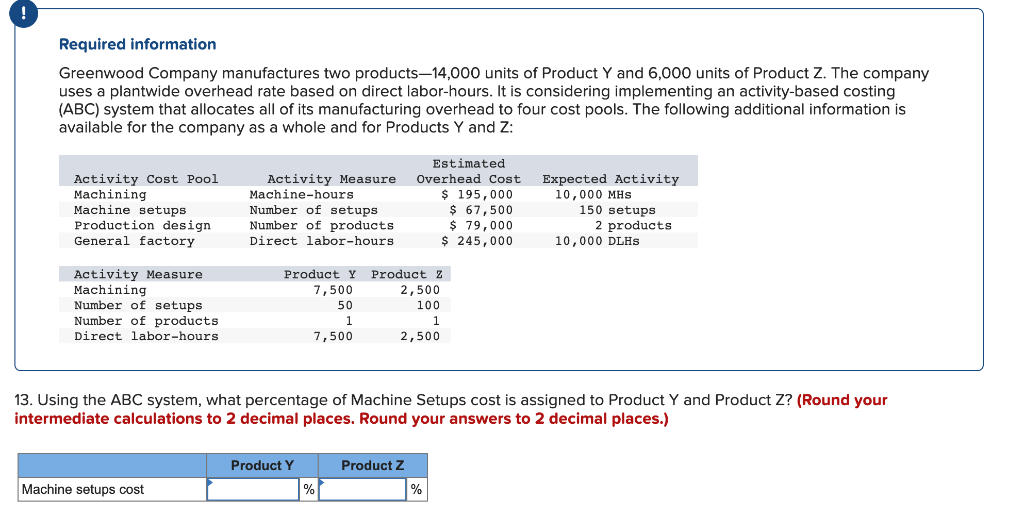

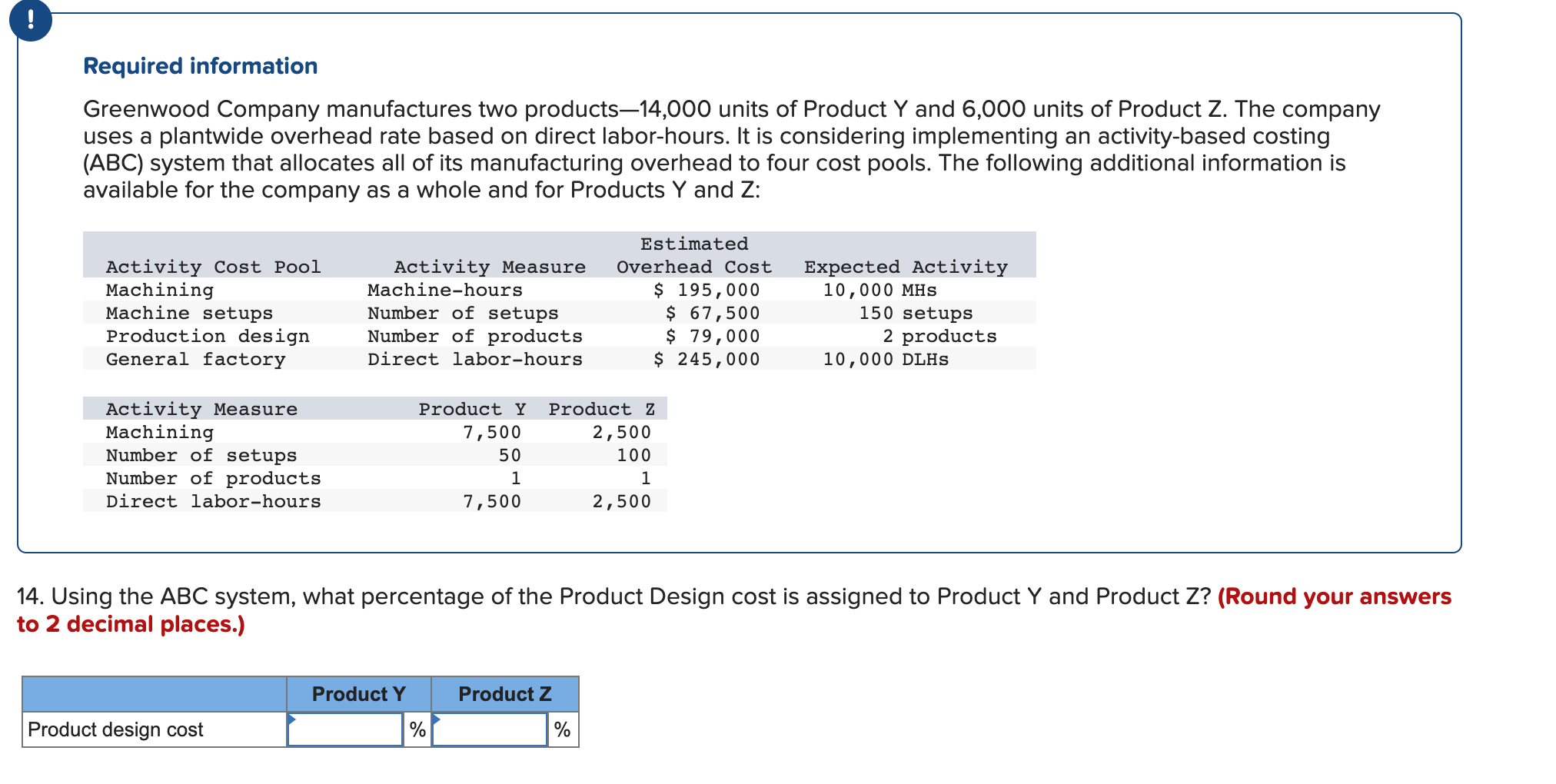

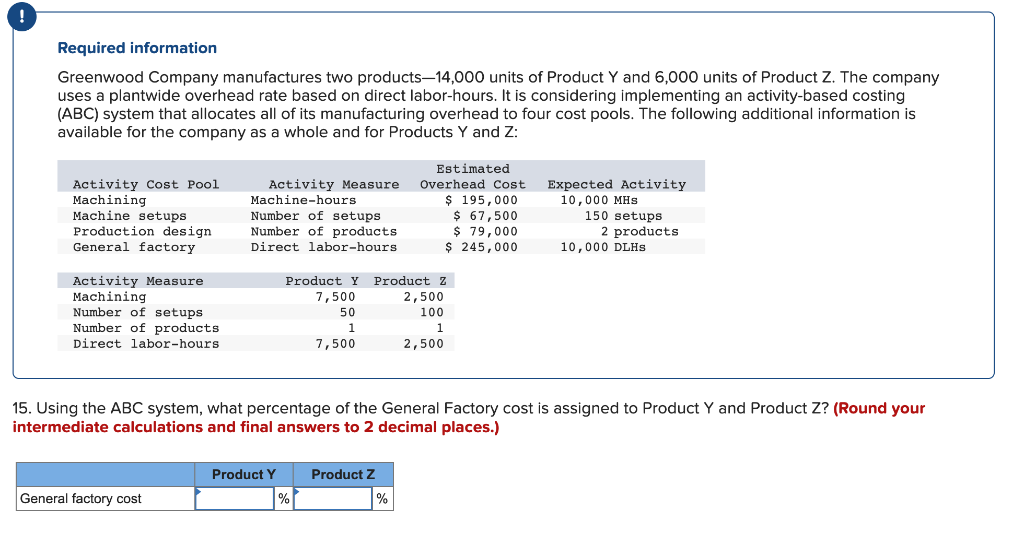

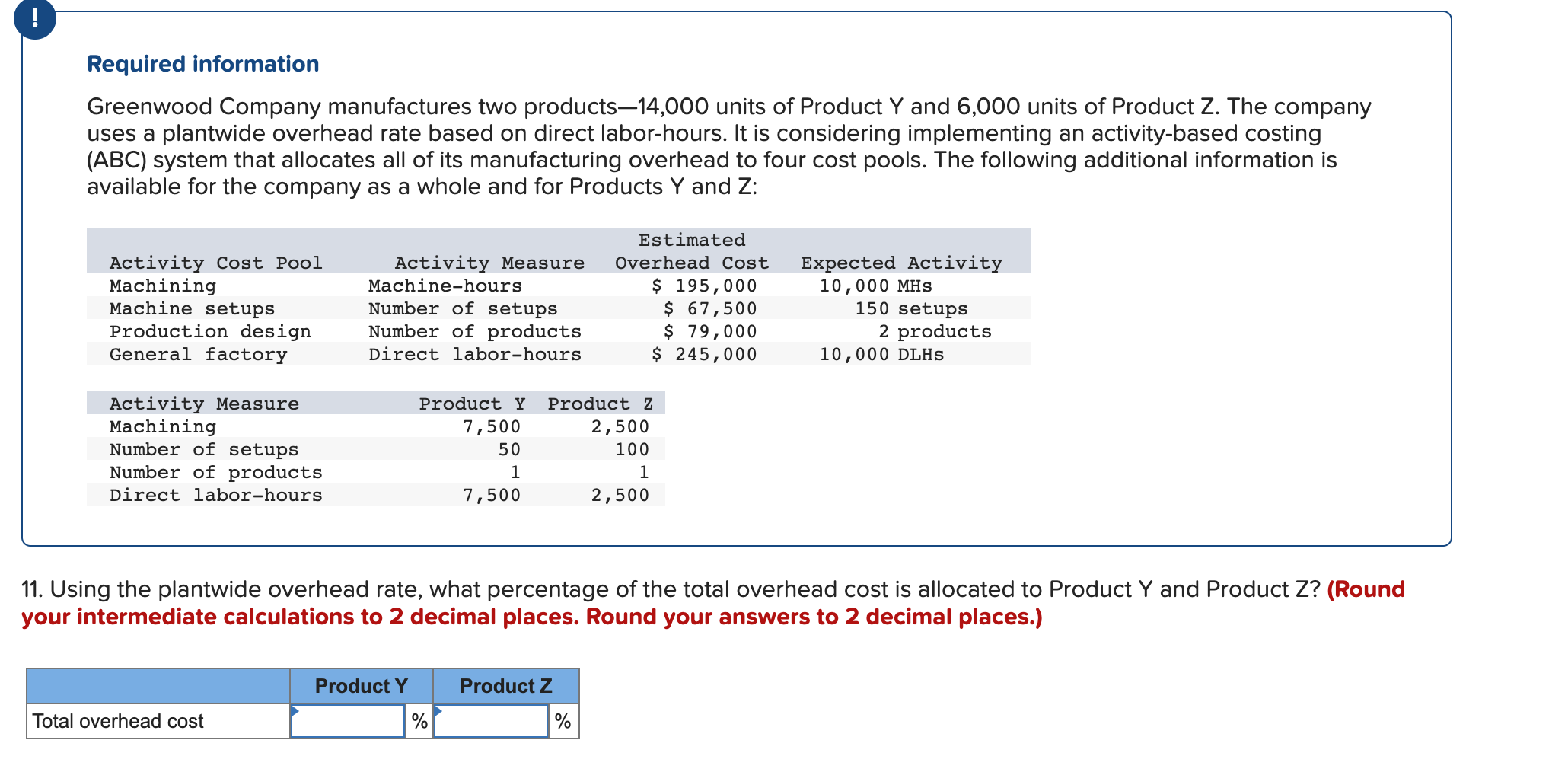

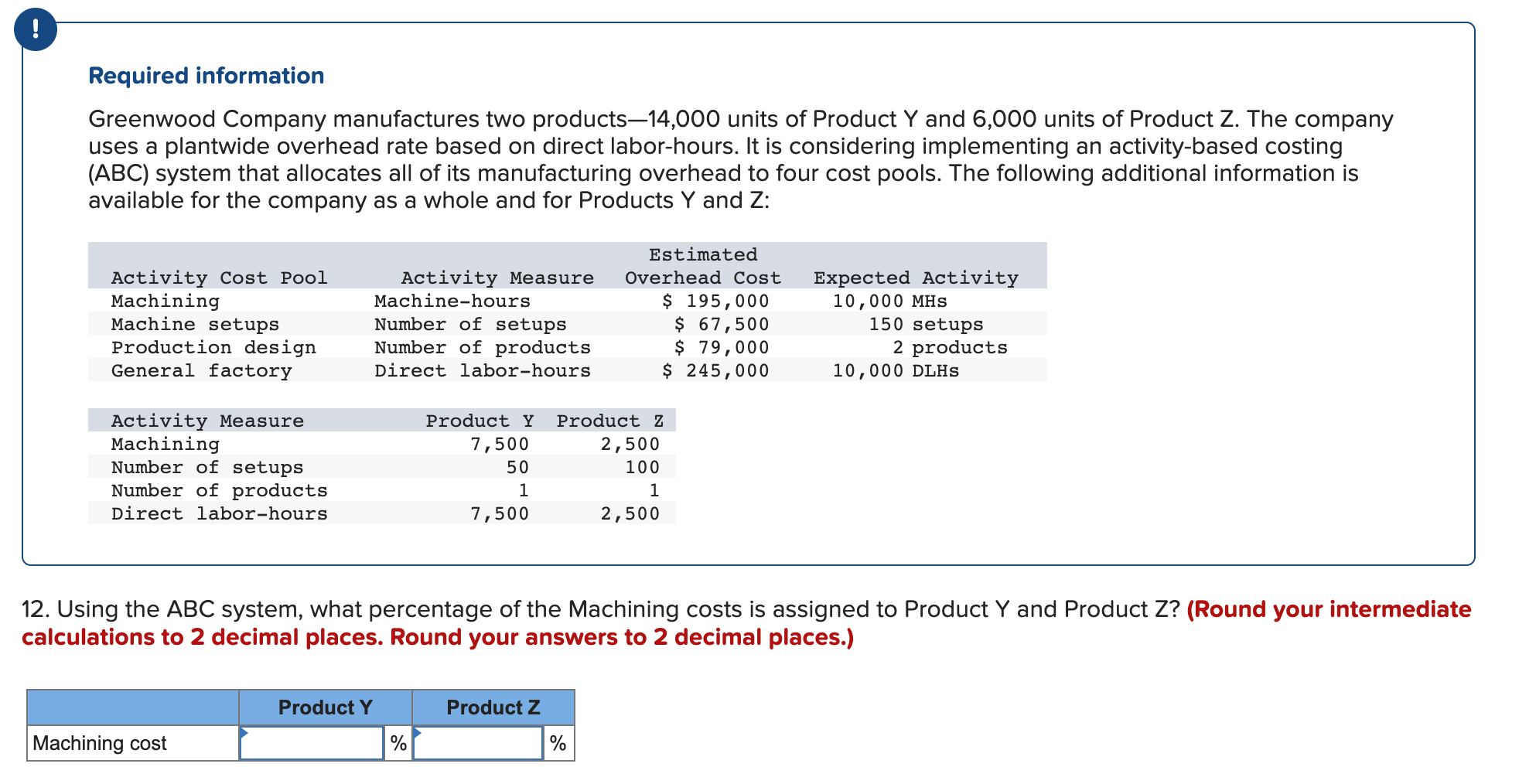

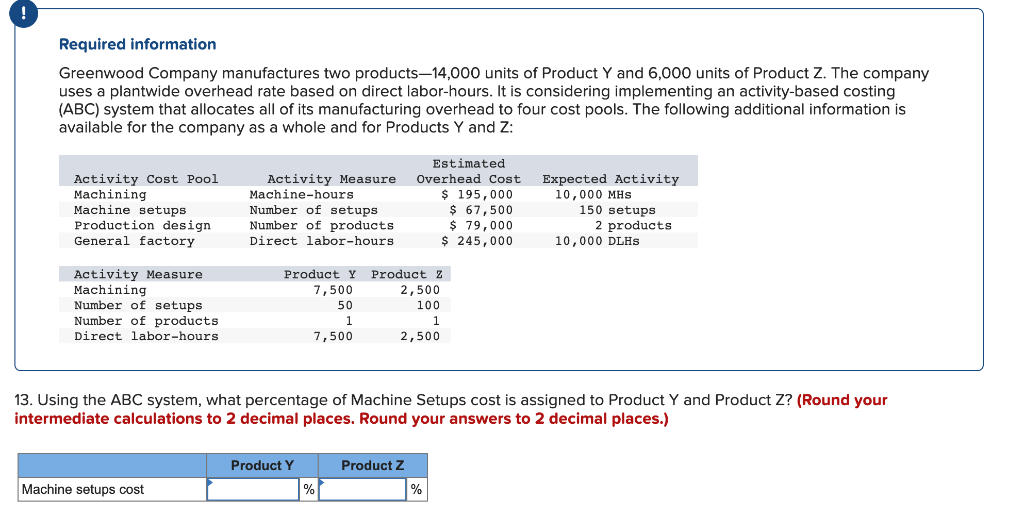

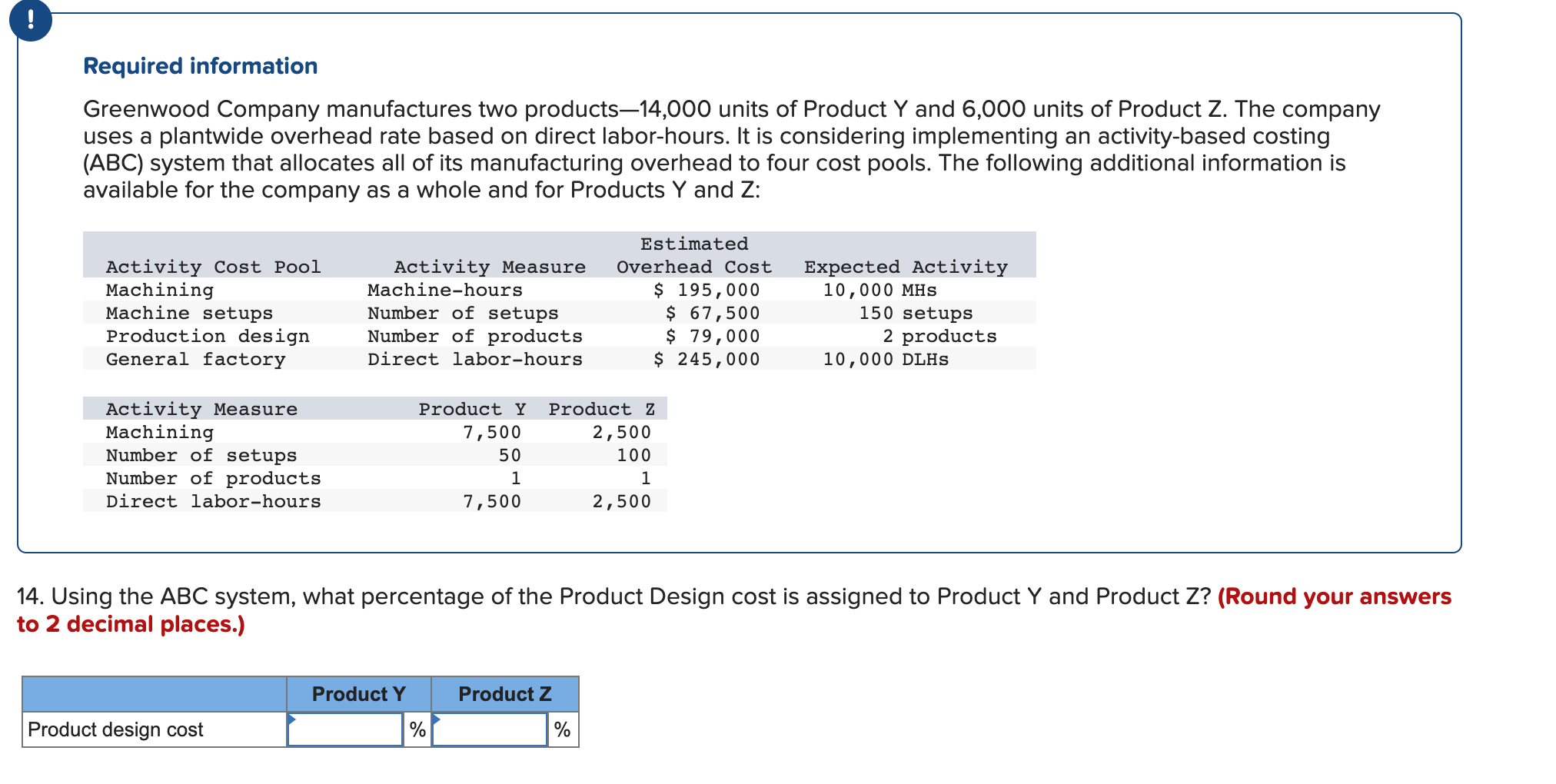

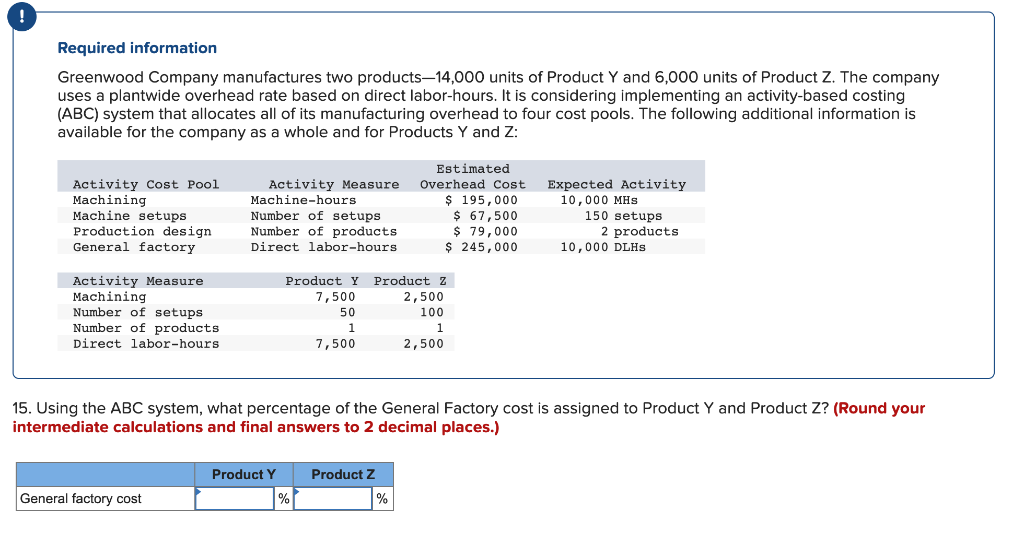

Required information Greenwood Company manufactures two products-14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y and Product Z ? (Round ur intermediate calculations to 2 decimal places. Round your answers to 2 decimal places.) Required information Greenwood Company manufactures two products-14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : 2. Using the ABC system, what percentage of the Machining costs is assigned to Product Y and Product Z ? (Round your intermediate :alculations to 2 decimal places. Round your answers to 2 decimal places.) Required information Greenwood Company manufactures two products-14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : 13. Using the ABC system, what percentage of Machine Setups cost is assigned to Product Y and Product Z? (Round your intermediate calculations to 2 decimal places. Round your answers to 2 decimal places.) Required information Greenwood Company manufactures two products-14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : 4. Using the ABC system, what percentage of the Product Design cost is assigned to Product Y and Product Z ? (Round your answers - 2 decimal places.) Required information Greenwood Company manufactures two products-14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : 5. Using the ABC system, what percentage of the General Factory cost is assigned to Product Y and Product Z ? (Round your itermediate calculations and final answers to 2 decimal places.)