Answered step by step

Verified Expert Solution

Question

1 Approved Answer

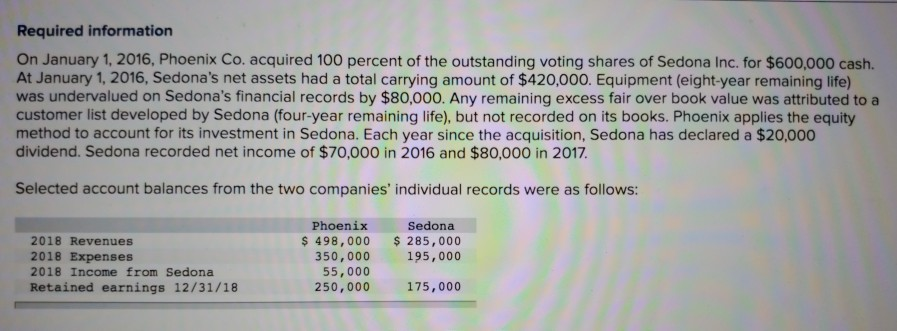

Required information On January 1, 2016, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc. for $600,000 cash. At January 1,

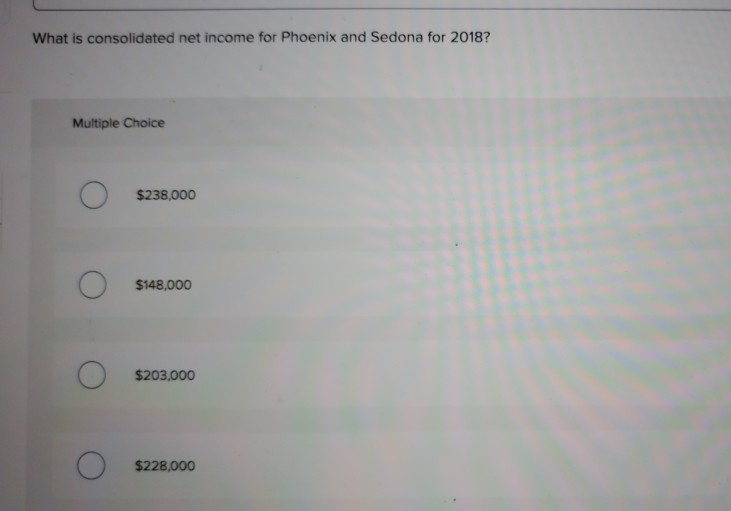

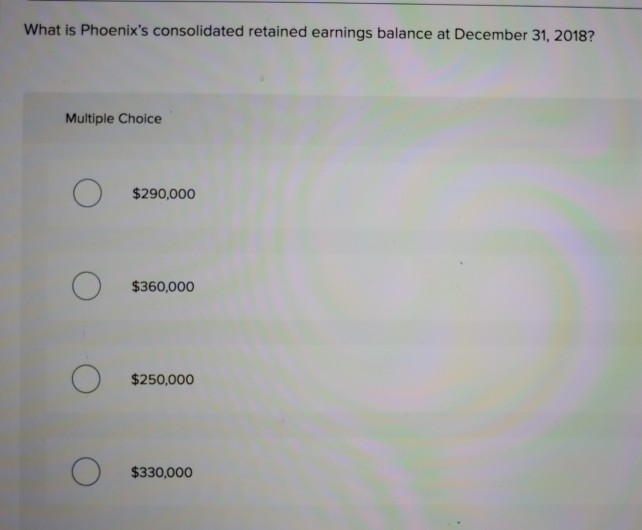

Required information On January 1, 2016, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc. for $600,000 cash. At January 1, 2016, Sedona's net assets had a total carrying amount of $420,000. Equipment (eight-year remaining life) was undervalued on Sedona's financial records by $80,000. Any remaining excess fair over book value was attributed to a customer list developed by Sedona (four-year remaining life), but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has declared a $20,000 dividend. Sedona recorded net income of $70,000 in 2016 and $80,000 in 2017 Selected account balances from the two companies' individual records were as follows: Phoenix Sedona $285,000 195,000 $ 498,000 2018 Revenues 2018 Expenses 2018 Income from Sedona Retained earnings 12/31/18 350,000 55,000 250,000 175,000 What is consolidated net income for Phoenix and Sedona for 2018? Multiple Choice $238,000 $148,000 $203,000 $228,000 What is Phoenix's consolidated retained earnings balance at December 31, 2018? Multiple Choice $290,000 $360,000 $250,000 $330,000 On its December 31, 2018, consolidated balance sheet, what amount should Phoenix report for Sedona's customer list? Multiple Choice $25,000 $20,000 $50,000 $10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started