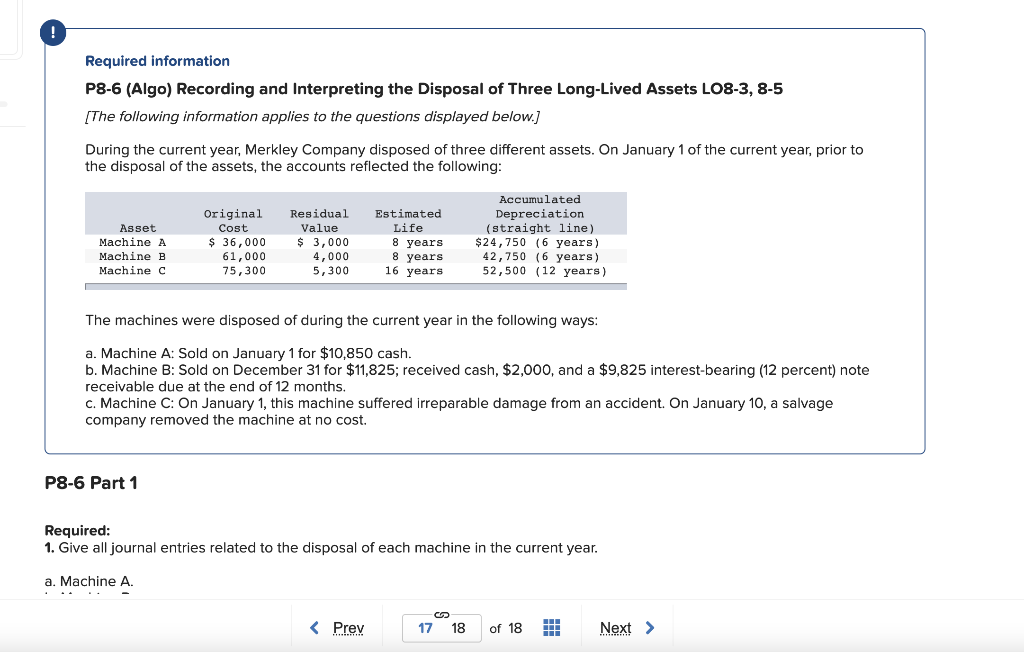

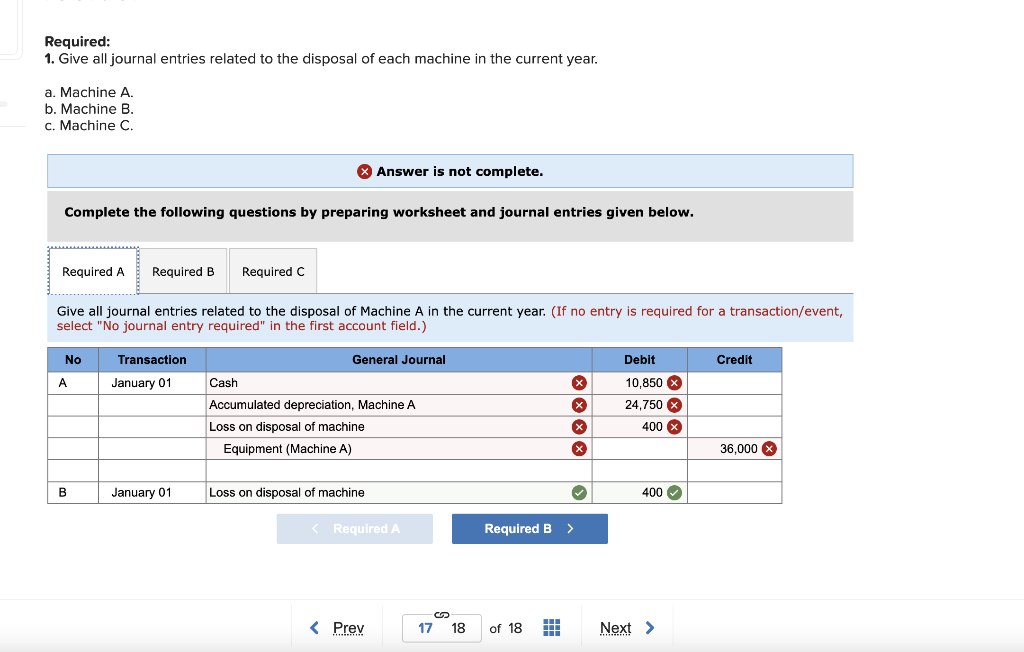

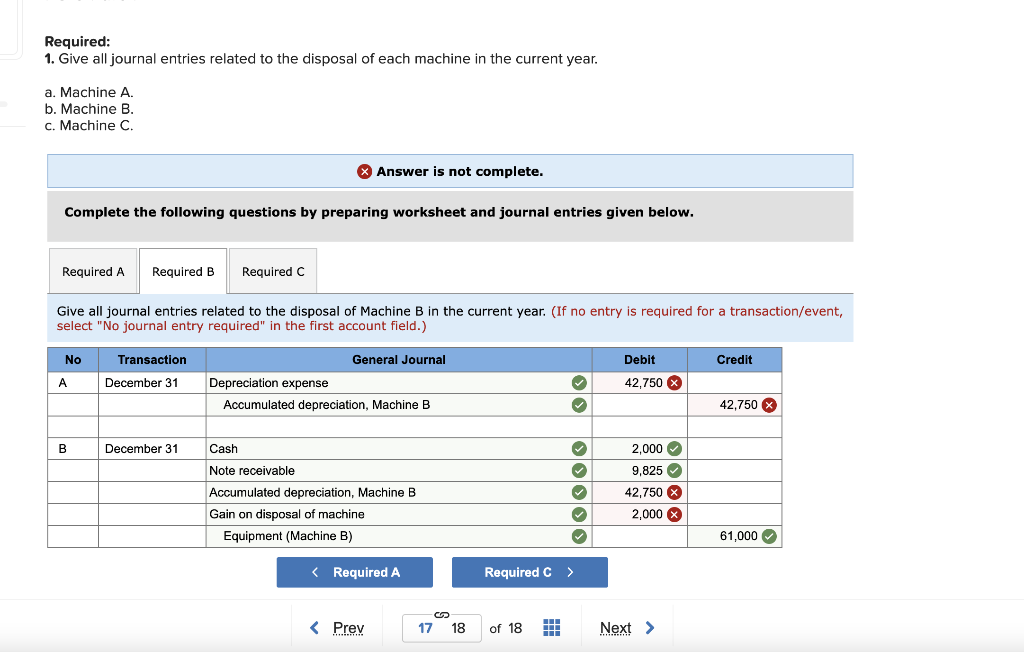

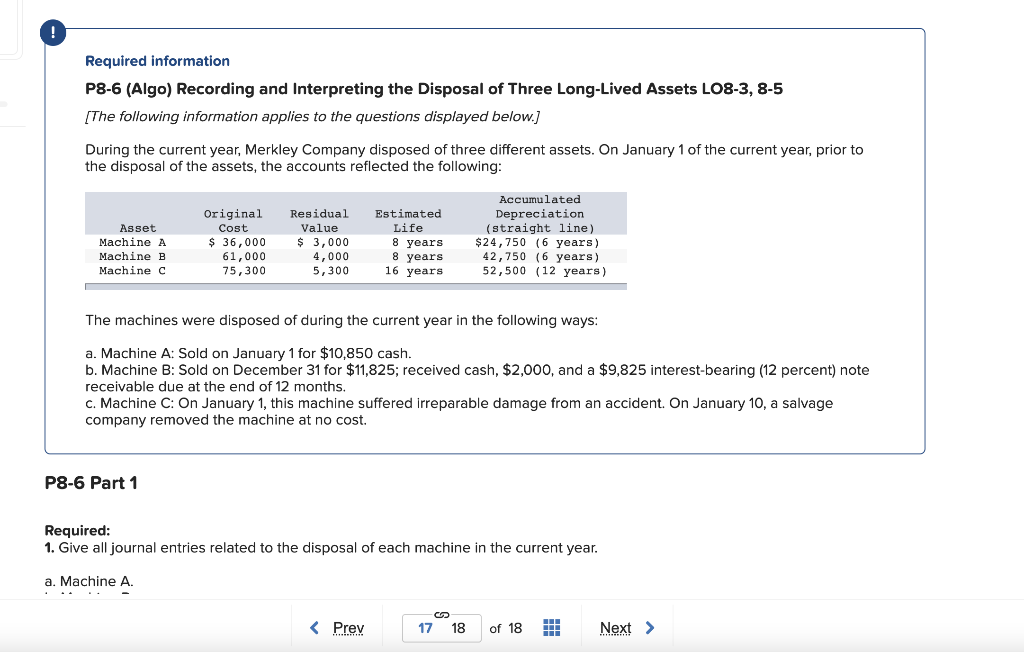

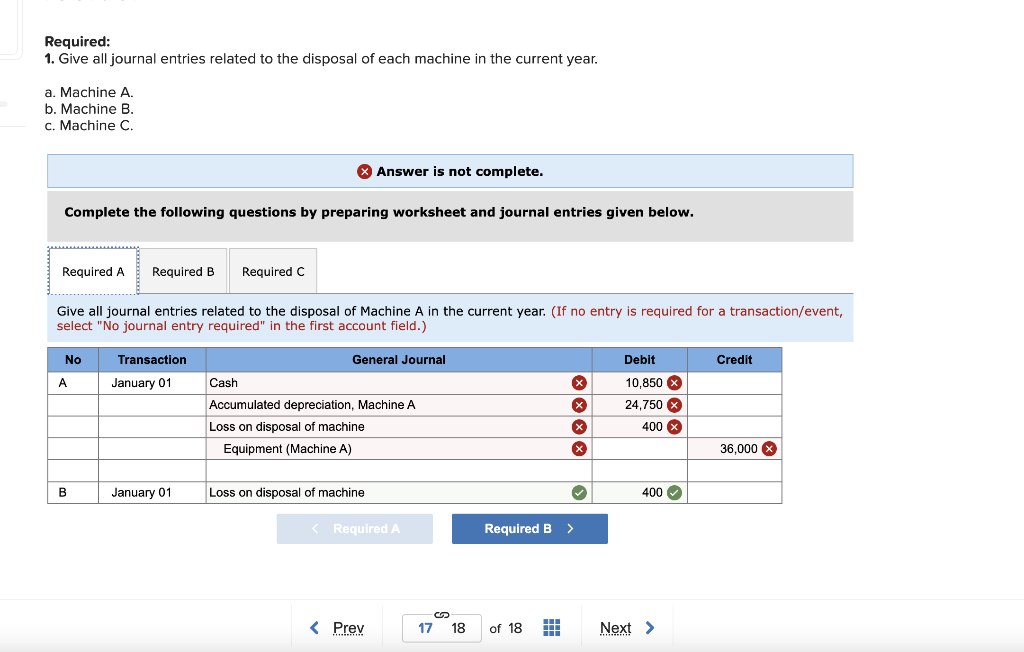

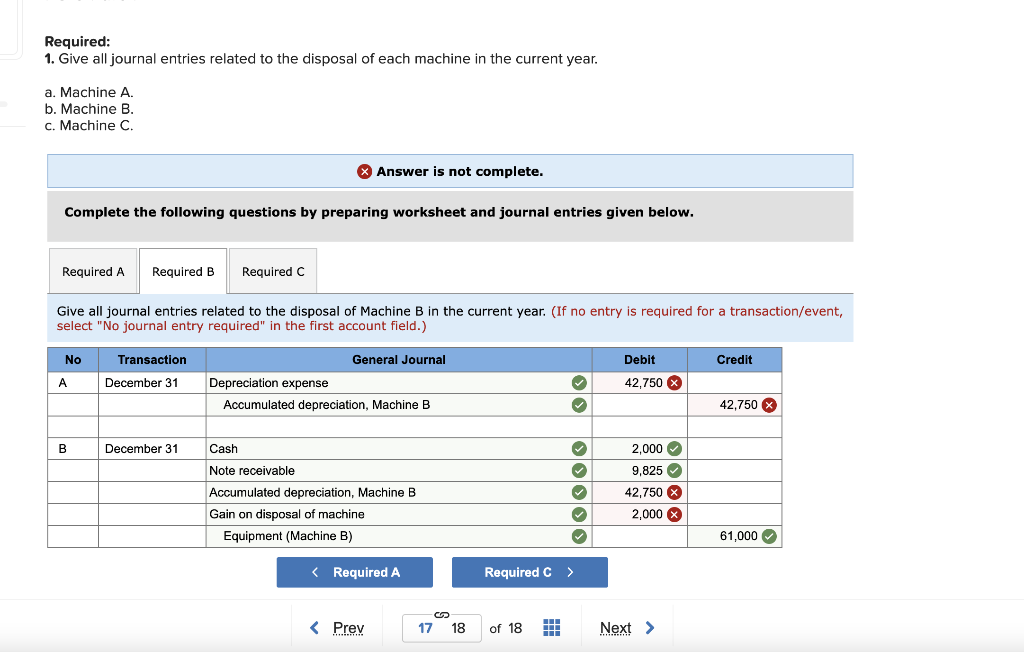

Required information P8-6 (Algo) Recording and Interpreting the Disposal of Three Long-Lived Assets LO8-3, 8-5 [The following information applies to the questions displayed below.) During the current year, Merkley Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: Asset Machine A Machine B Machine C Original Cost $ 36,000 61,000 75,300 Residual Value $ 3,000 4,000 5,300 Estimated Life 8 years 8 years 16 years Accumulated Depreciation (straight line) $24,750 (6 years) 42,750 (6 years) 52,500 (12 years) The machines were disposed of during the current year in the following ways: a. Machine A: Sold on January 1 for $10,850 cash. b. Machine B: Sold on December 31 for $11,825; received cash, $2,000, and a $9,825 interest-bearing (12 percent) note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage company removed the machine at no cost. P8-6 Part 1 Required: 1. Give all journal entries related to the disposal of each machine in the current year. a. Machine A. Required: 1. Give all journal entries related to the disposal of each machine in the current year. a. Machine A. b. Machine B c. Machine C. > Answer is not complete. Complete the following questions by preparing worksheet and journal entries given below. Required A Required B Required Give all journal entries related to the disposal of Machine A in the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction General Journal Debit Credit A January 01 Cash X x Accumulated depreciation, Machine A Loss on disposal of machine Equipment (Machine A) 10,850 X 24,750 X 400 X x X 36,000 X B January 01 Loss on disposal of machine 400 Required: 1. Give all journal entries related to the disposal of each machine in the current year. a. Machine A. b. Machine B. c. Machine C. > Answer is not complete. Complete the following questions by preparing worksheet and journal entries given below. Required A Required B Required C Give all journal entries related to the disposal of Machine B in the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Debit Credit Transaction December 31 A General Journal Depreciation expense Accumulated depreciation, Machine B 42,750 X 42,750 X B December 31 Cash Note receivable Accumulated depreciation, Machine B Gain on disposal of machine Equipment (Machine B) OOOOO 2,000 9,825 42,750 2,000 X 61,000