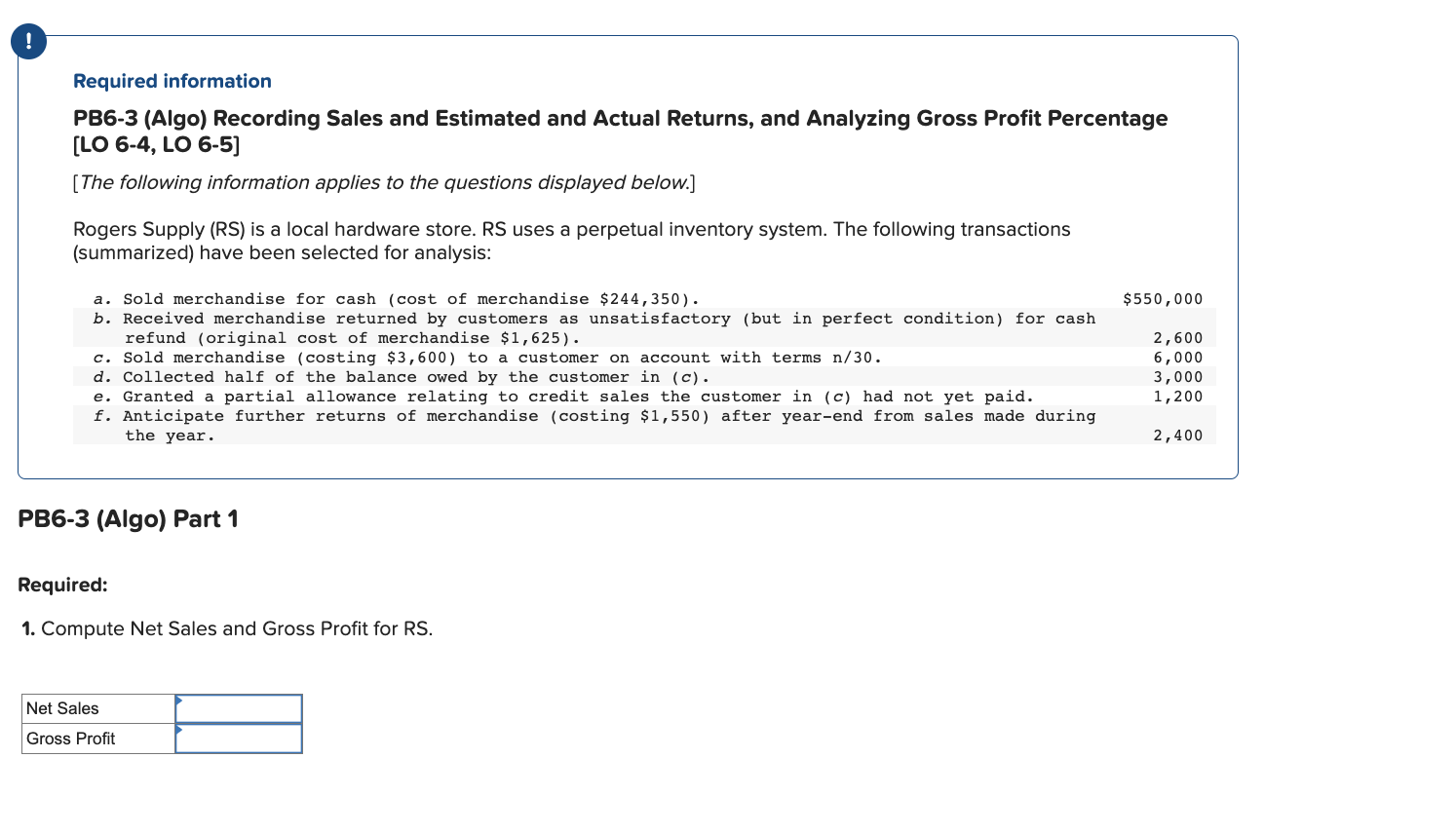

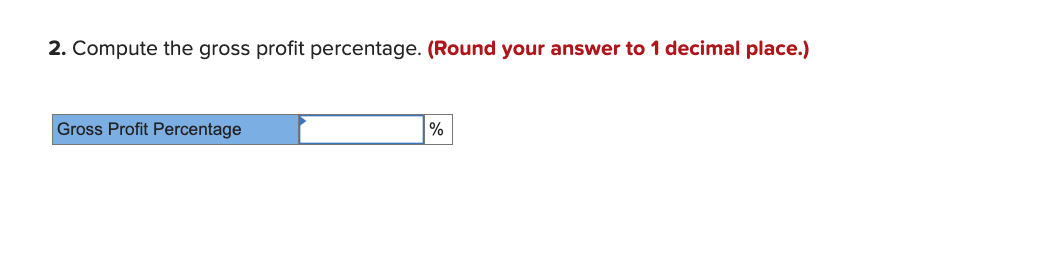

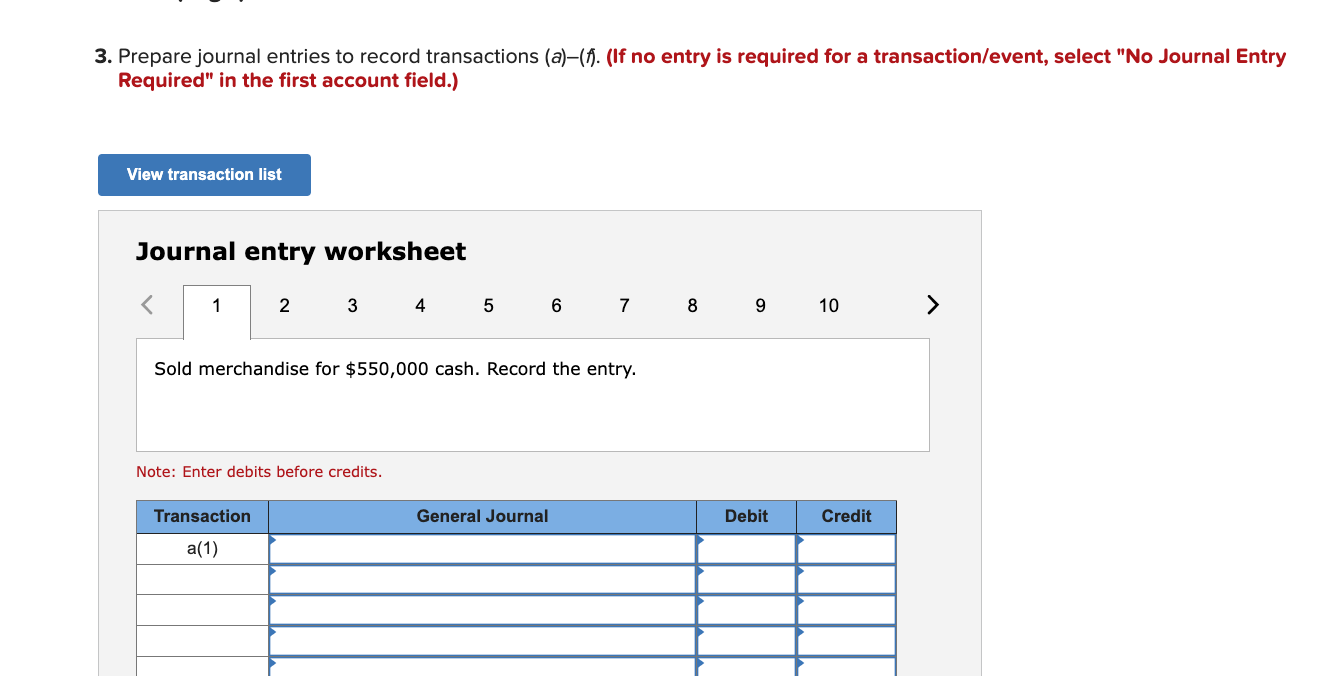

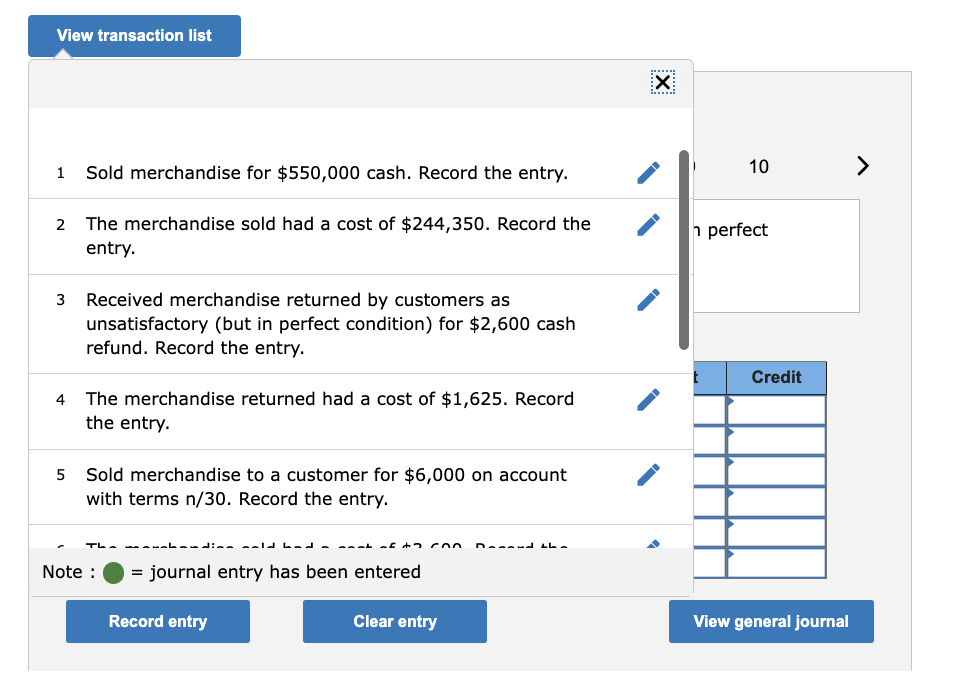

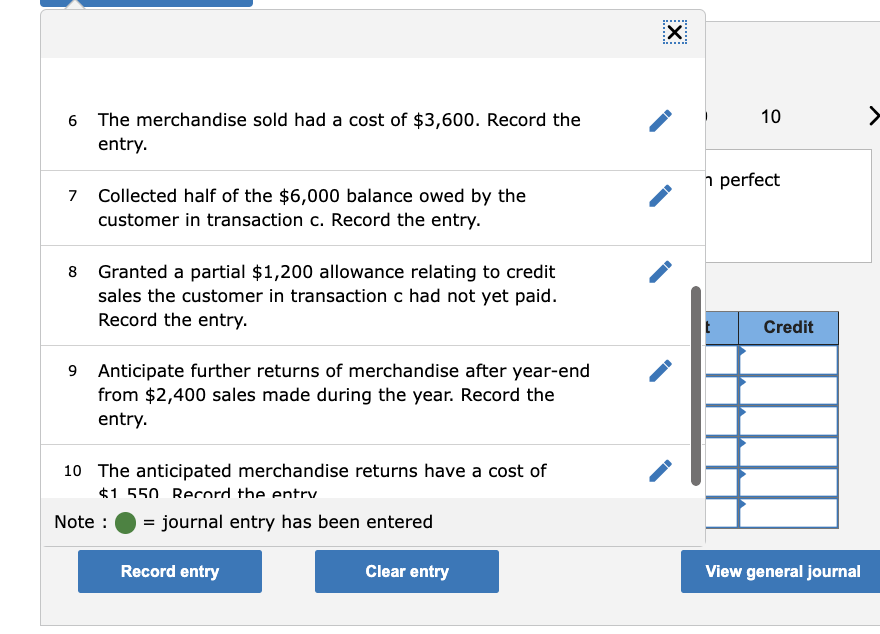

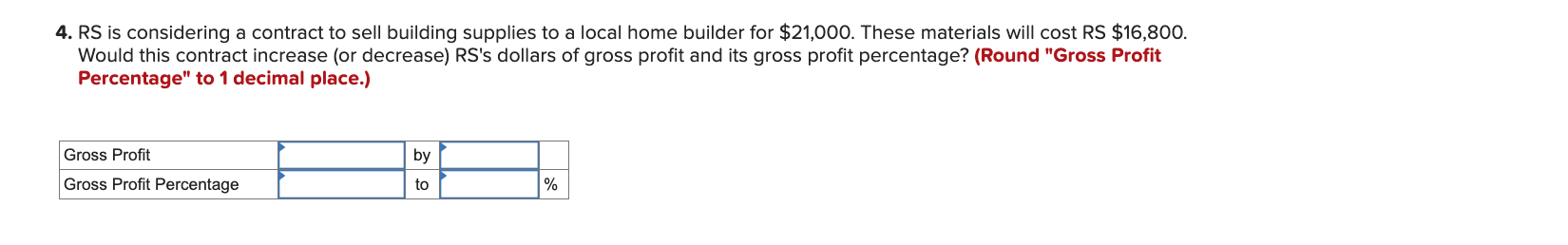

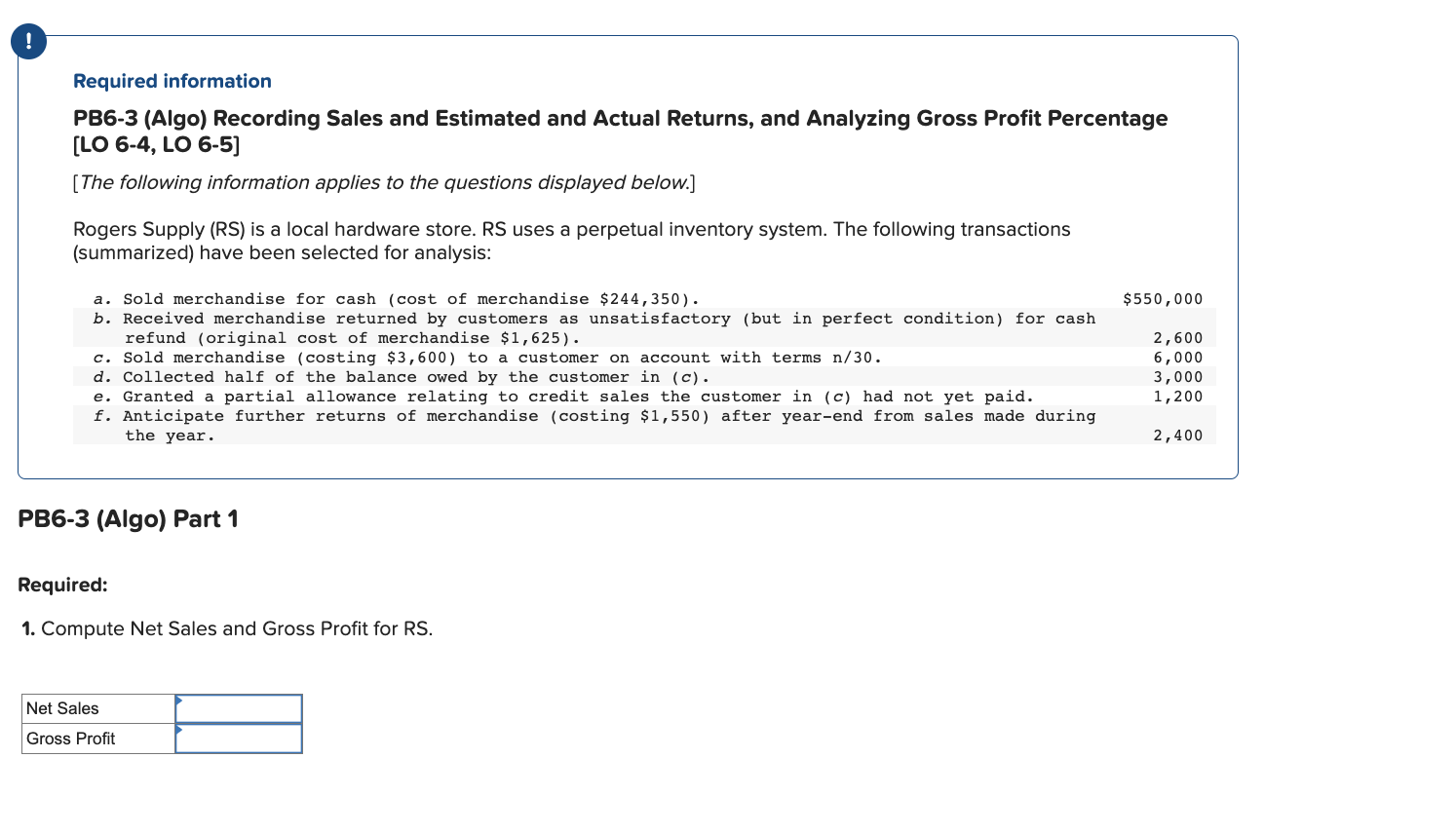

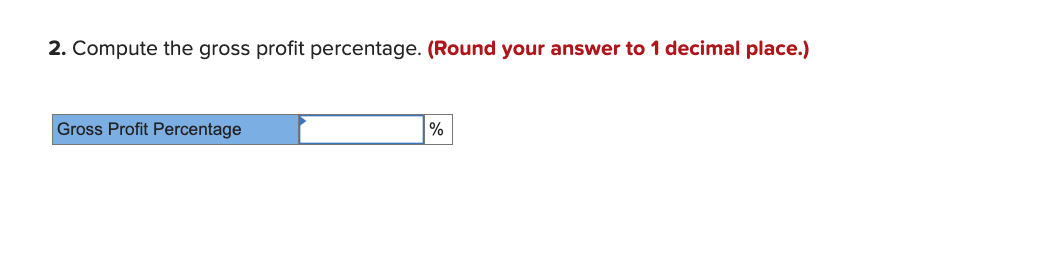

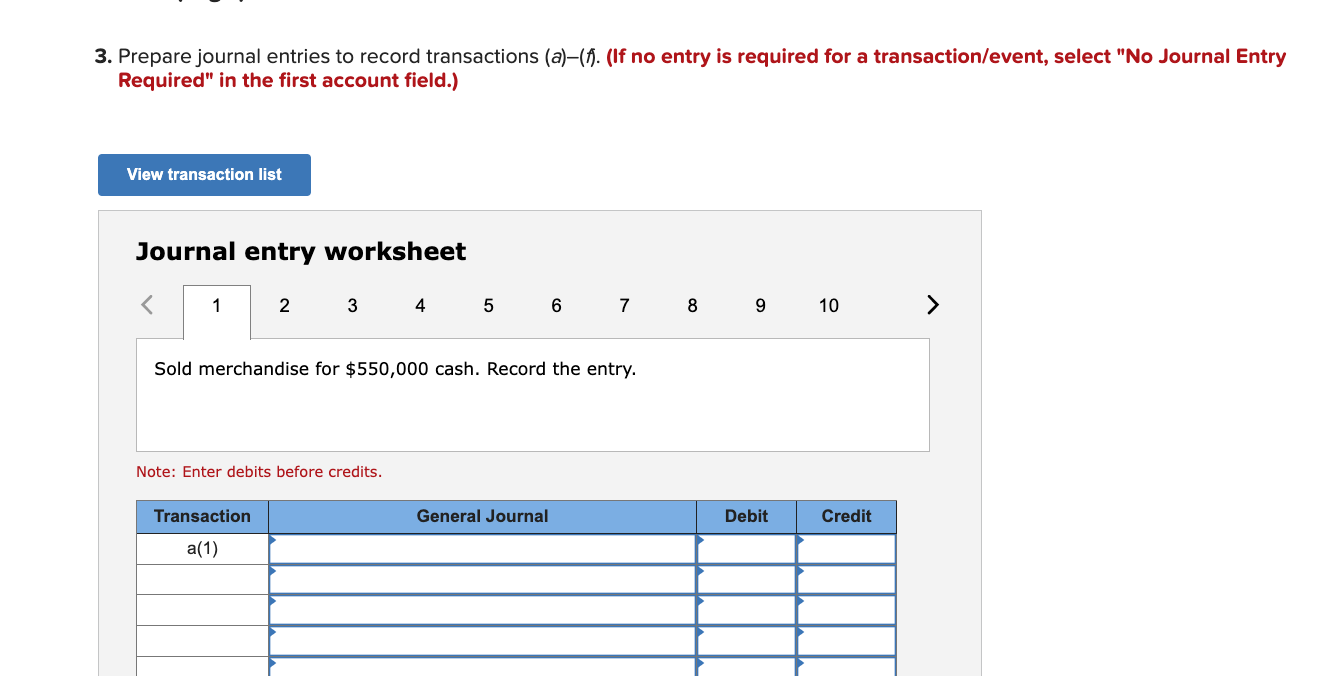

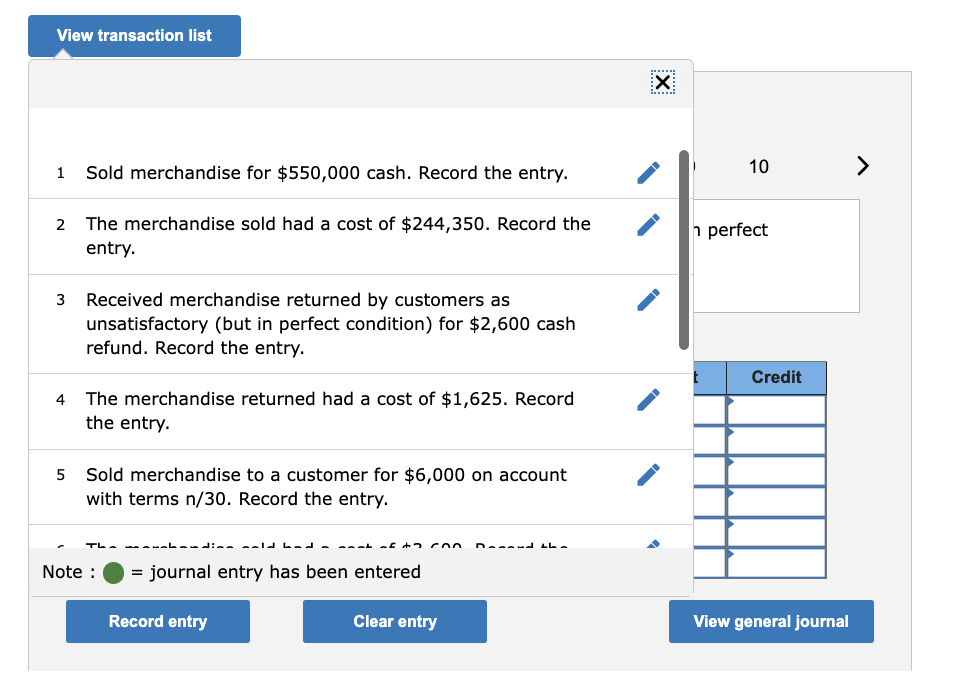

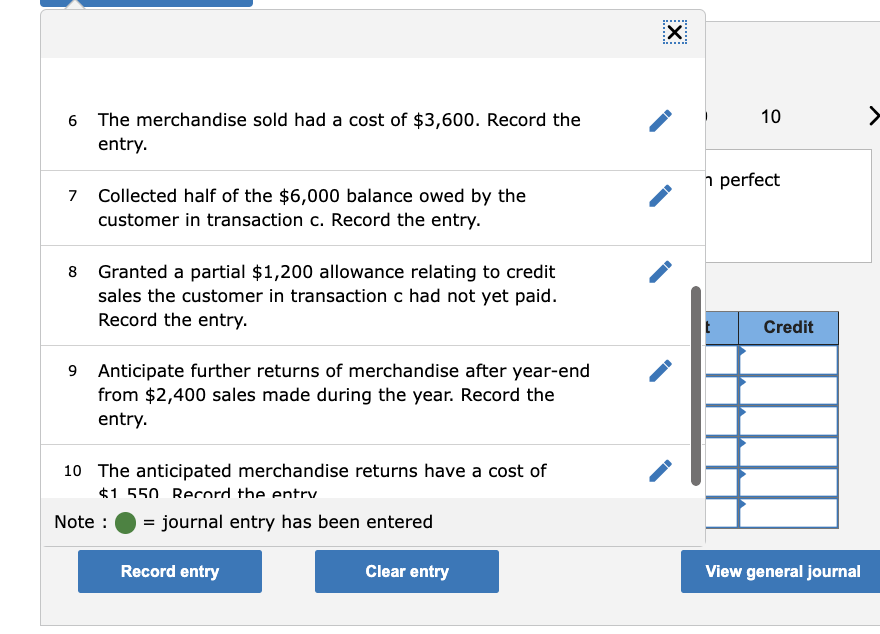

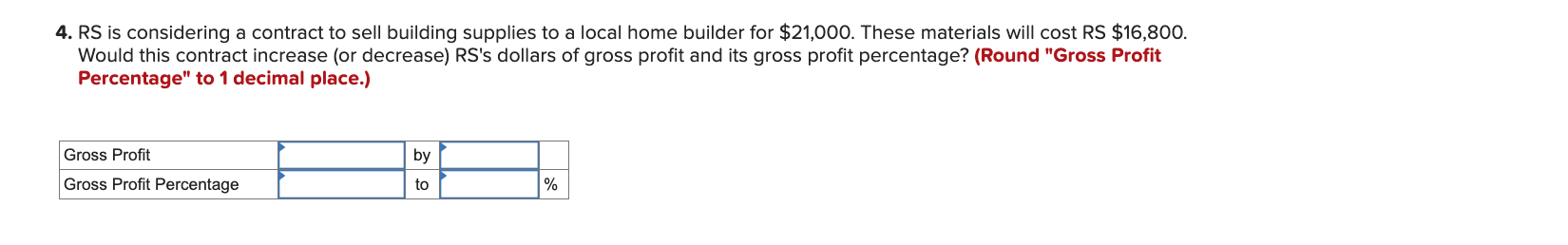

Required information PB6-3 (Algo) Recording Sales and Estimated and Actual Returns, and Analyzing Gross Profit Percentage [LO 6-4, LO 6-5] [The following information applies to the questions displayed below.] Rogers Supply (RS) is a local hardware store. RS uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $244,350 ). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash $550,000 refund (original cost of merchandise $1,625 ). c. Sold merchandise (costing $3,600 ) to a customer on account with terms n/30. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. 1,200 f. Anticipate further returns of merchandise (costing $1,550 ) after year-end from sales made during the year. 2,400 PB6-3 (Algo) Part 1 Required: 1. Compute Net Sales and Gross Profit for RS. 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) 3. Prepare journal entries to record transactions (a)-( f ). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet VUIC. LIICI CHIS CIVIC . 1 Sold merchandise for $550,000 cash. Record the entry. 2 The merchandise sold had a cost of $244,350. Record the entry. 3 Received merchandise returned by customers as unsatisfactory (but in perfect condition) for $2,600 cash refund. Record the entry. 4 The merchandise returned had a cost of $1,625. Record the entry. 5 Sold merchandise to a customer for $6,000 on account with terms n/30. Record the entry. Note: = journal entry has been entered 6 The merchandise sold had a cost of $3,600. Record the entry. 7 Collected half of the $6,000 balance owed by the customer in transaction c. Record the entry. 8 Granted a partial $1,200 allowance relating to credit sales the customer in transaction c had not yet paid. Record the entry. 9 Anticipate further returns of merchandise after year-end from $2,400 sales made during the year. Record the entry. 10 The anticipated merchandise returns have a cost of $155 Rernrd the entrv Note : = journal entry has been entered 4. RS is considering a contract to sell building supplies to a local home builder for $21,000. These materials will cost RS $16,800. Would this contract increase (or decrease) RS's dollars of gross profit and its gross profit percentage? (Round "Gross Profit Percentage" to 1 decimal place.)