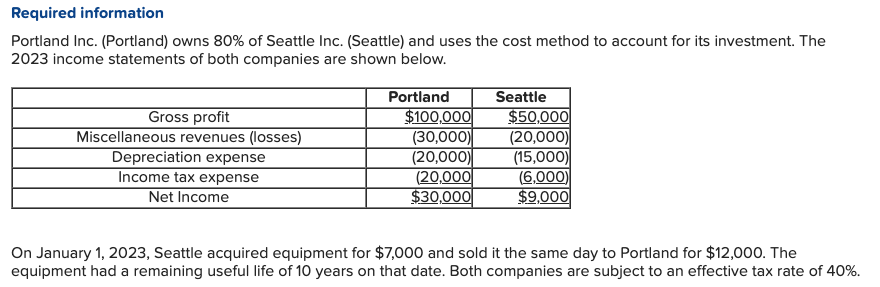

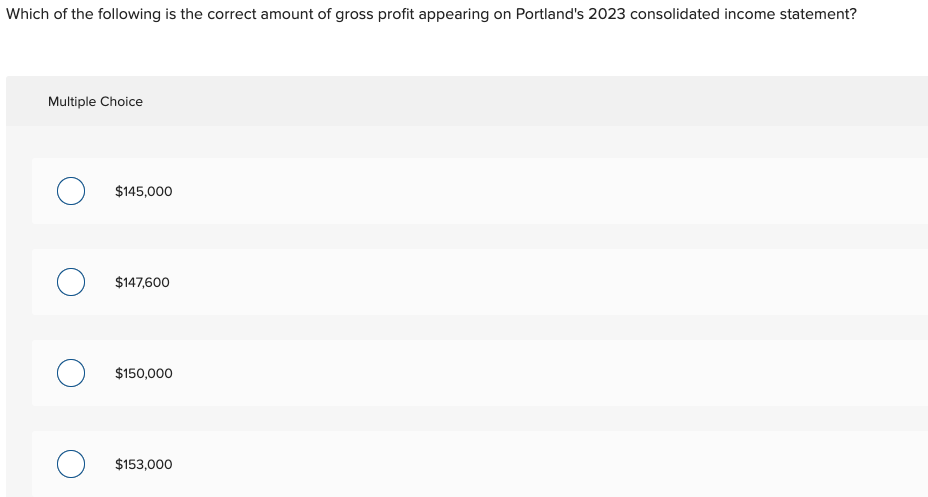

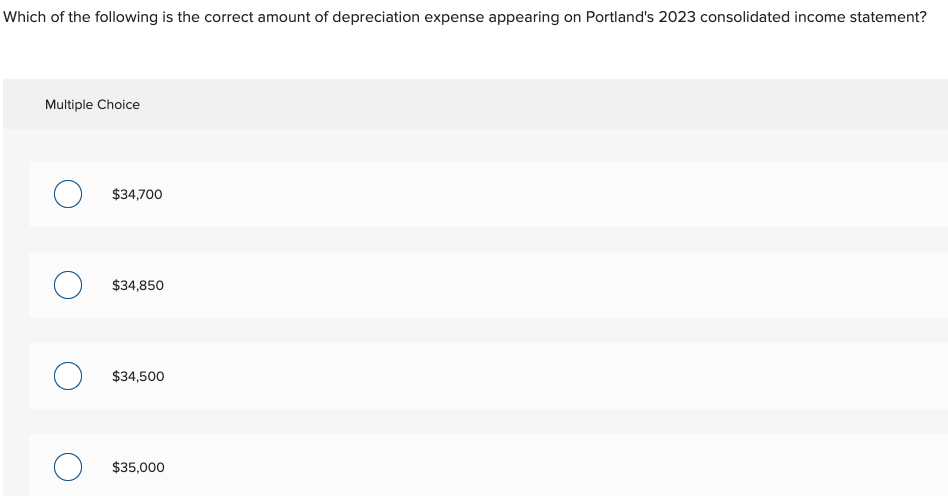

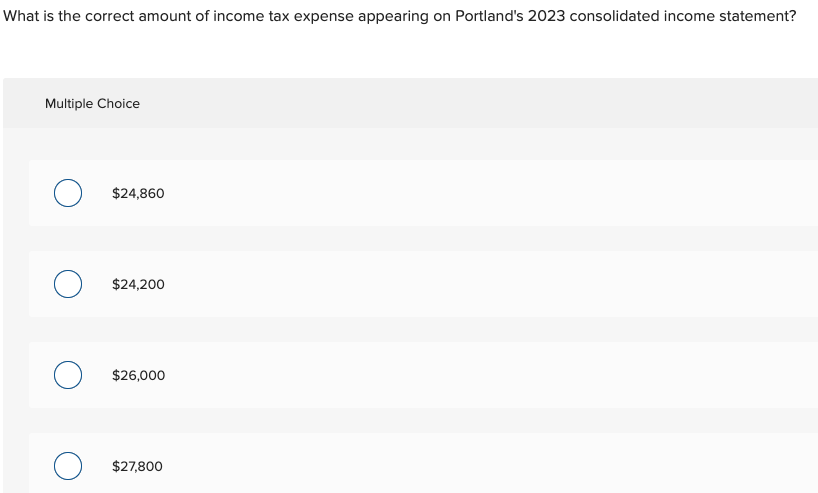

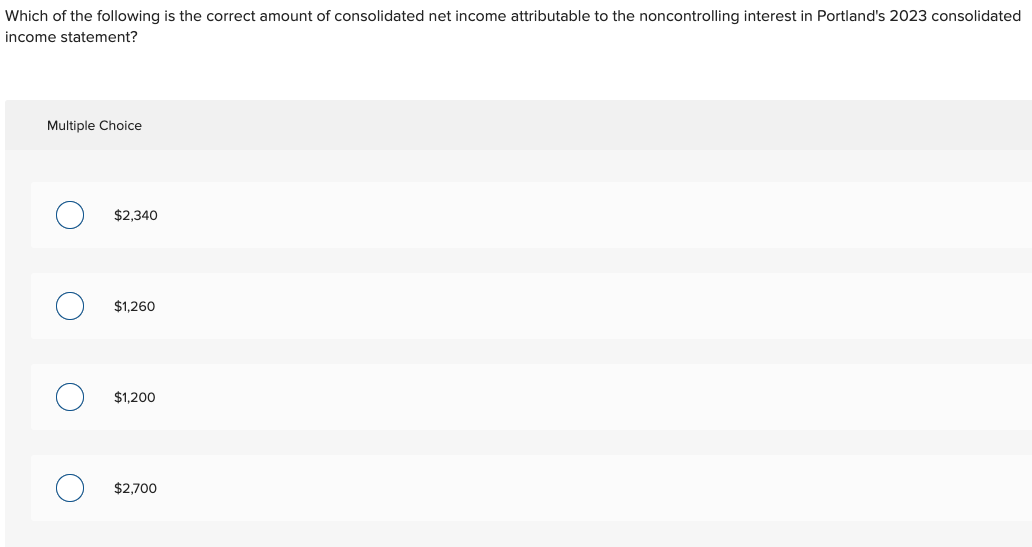

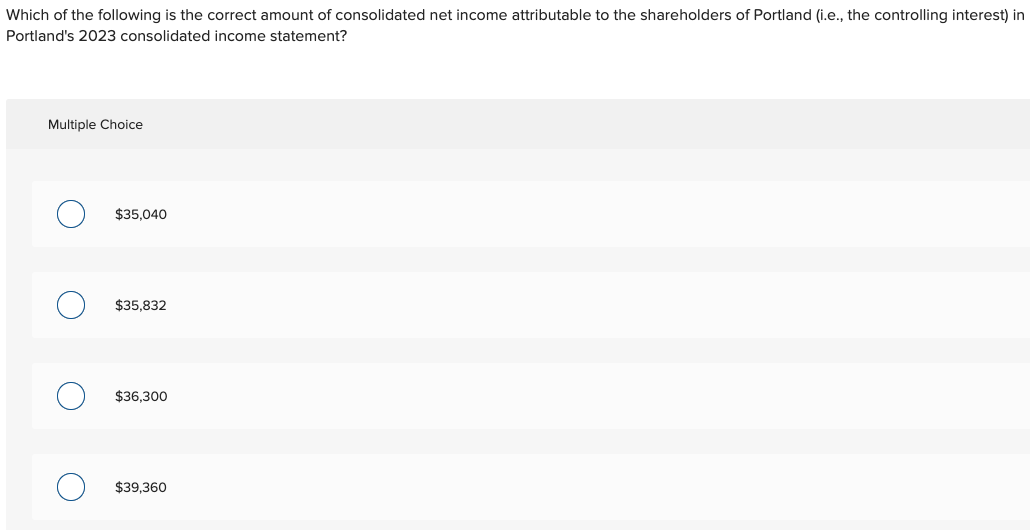

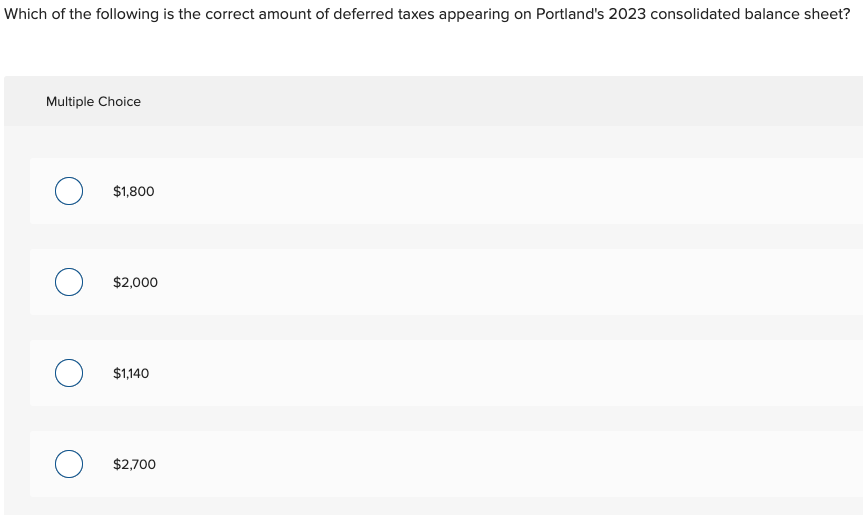

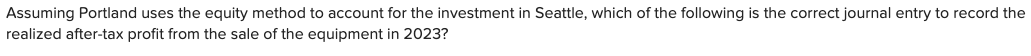

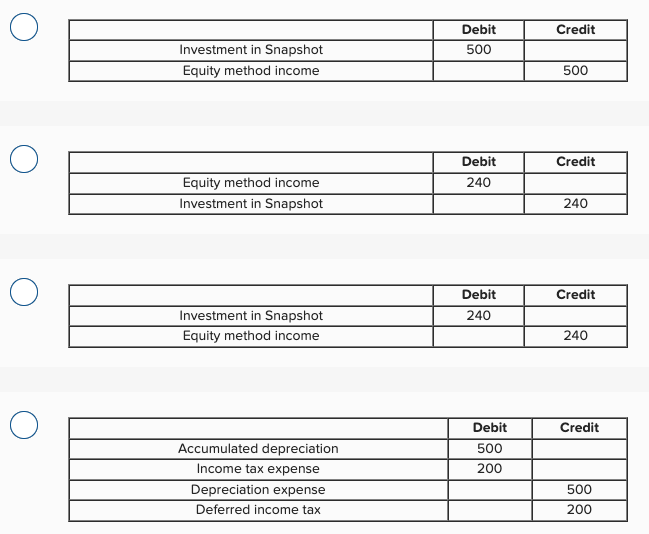

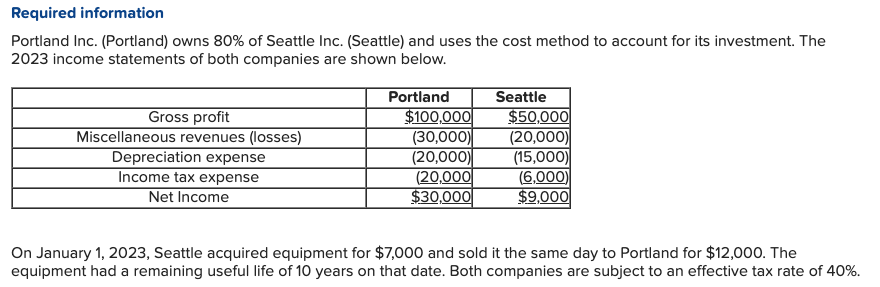

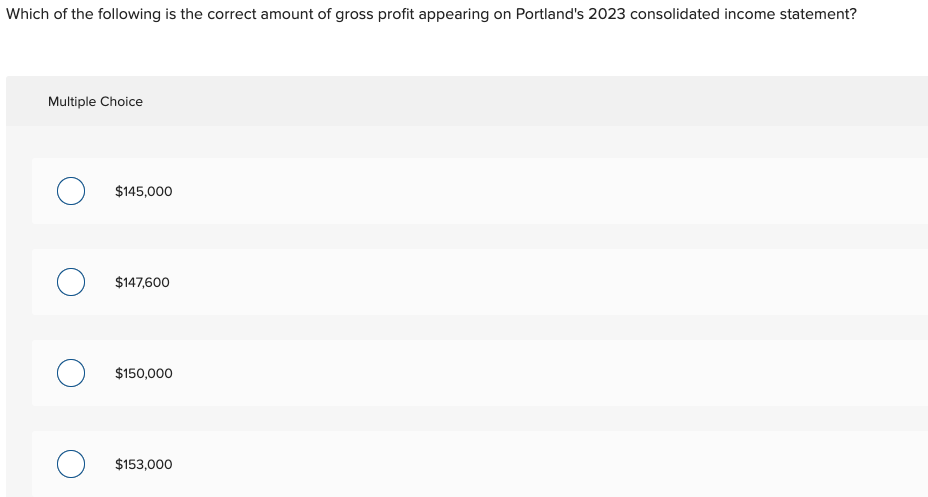

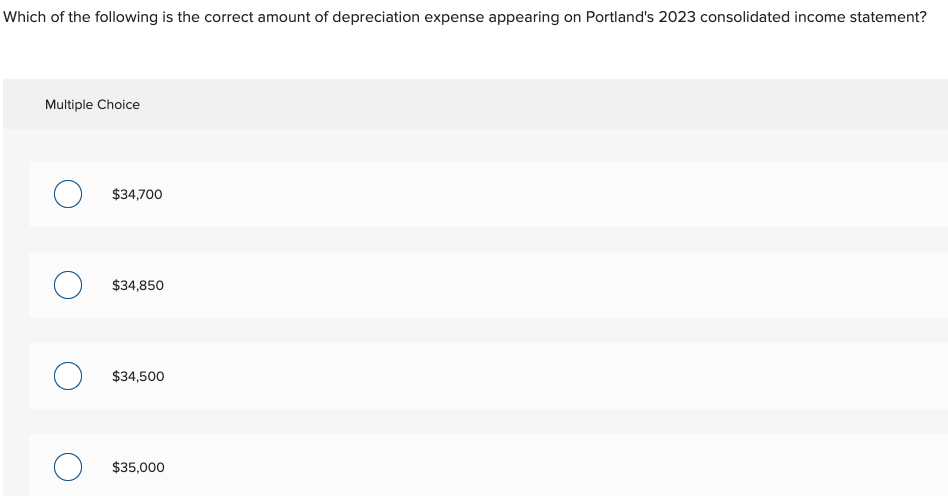

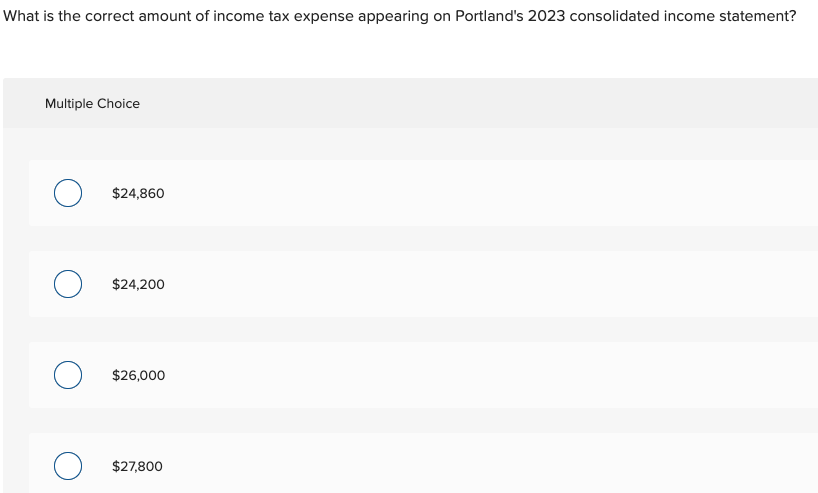

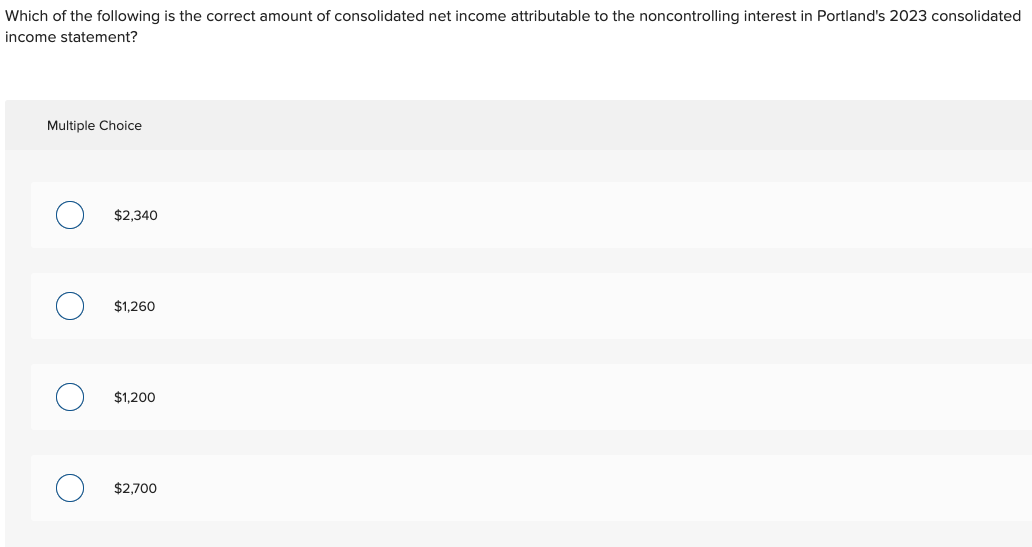

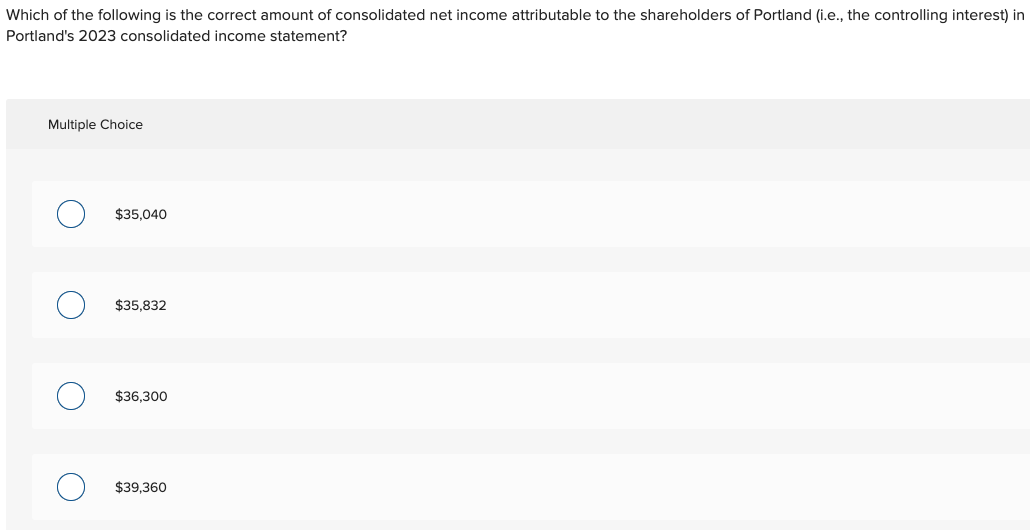

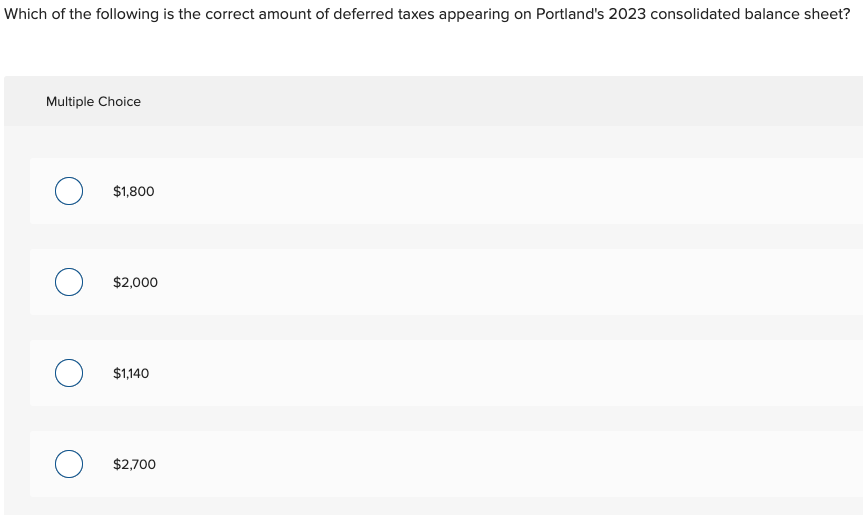

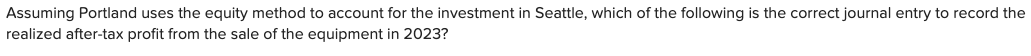

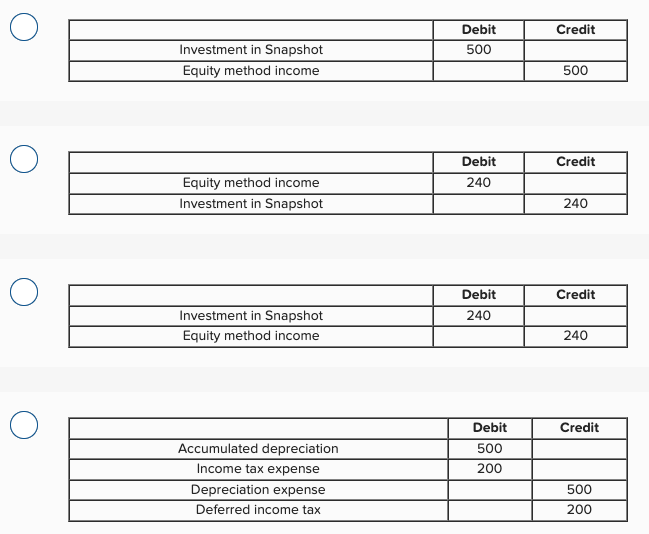

Required information Portland Inc. (Portland) owns 80% of Seattle Inc. (Seattle) and uses the cost method to account for its investment. The 2023 income statements of both companies are shown below. On January 1, 2023, Seattle acquired equipment for $7,000 and sold it the same day to Portland for $12,000. The equipment had a remaining useful life of 10 years on that date. Both companies are subject to an effective tax rate of 40% Which of the following is the correct amount of gross profit appearing on Portland's 2023 consolidated income statement? Multiple Choice $145,000 $147,600 $150,000 $153,000 Which of the following is the correct amount of depreciation expense appearing on Portland's 2023 consolidated income statement? Multiple Choice $34,700 $34,850 $34,500 $35,000 What is the correct amount of income tax expense appearing on Portland's 2023 consolidated income statement? Multiple Choice $24,860 $24,200 $26,000 $27,800 Which of the following is the correct amount of consolidated net income attributable to the noncontrolling interest in Portland's 2023 consolidated income statement? Multiple Choice $2,340 $1,260 $1,200 $2,700 Which of the following is the correct amount of consolidated net income attributable to the shareholders of Portland (i.e., the controlling interest) in Portland's 2023 consolidated income statement? Multiple Choice $35,040 $35,832 $36,300 $39,360 Which of the following is the correct amount of deferred taxes appearing on Portland's 2023 consolidated balance sheet? Multiple Choice $1,800 $2,000 $1,140 $2,700 Assuming Portland uses the equity method to account for the investment in Seattle, which of the following is the correct journal entry to record the realized after-tax profit from the sale of the equipment in 2023 ? \begin{tabular}{|c|c|c|} \hline & Debit & Credit \\ \hline Investment in Snapshot & 500 & \\ \hline Equity method income & & 500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline & Debit & Credit \\ \hline Equity method income & 240 & \\ \hline Investment in Snapshot & & 240 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline & Debit & Credit \\ \hline Investment in Snapshot & 240 & \\ \hline Equity method income & & 240 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline & Debit & Credit \\ \hline Accumulated depreciation & 500 & \\ \hline Income tax expense & 200 & \\ \hline Depreciation expense & & 500 \\ \hline Deferred income tax & & 200 \\ \hline \end{tabular}