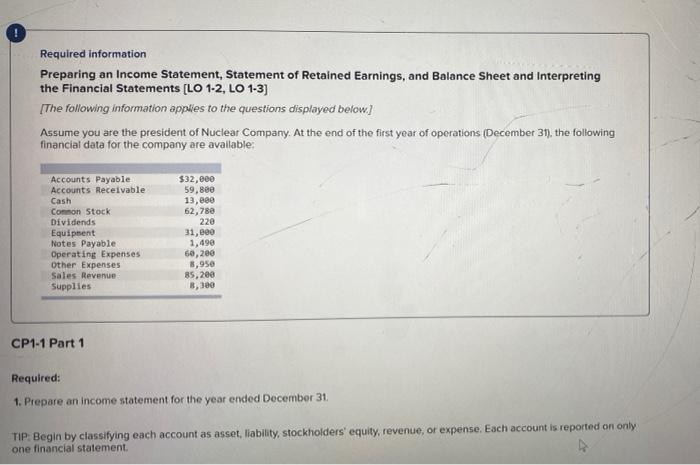

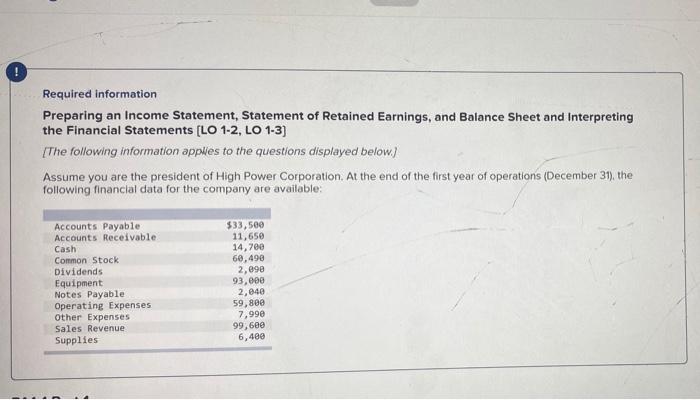

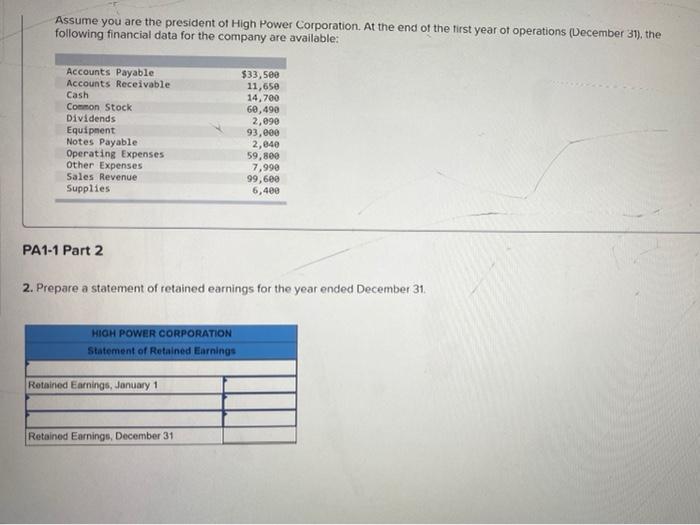

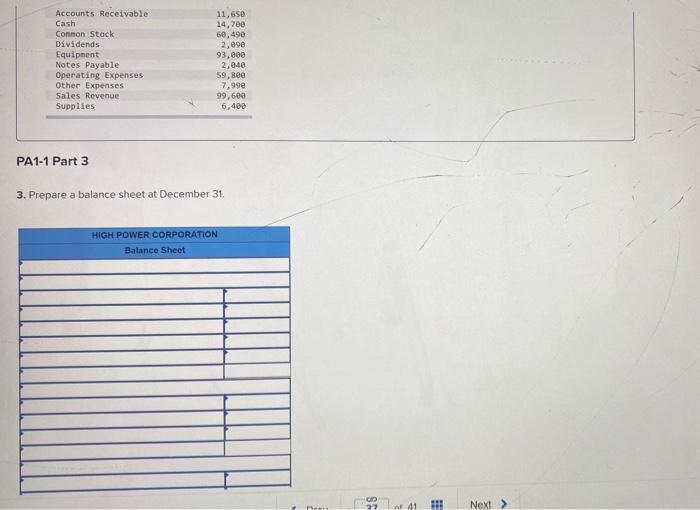

Required Information Preparing an Income Statement, Statement of Retained Earnings, and Balance Sheet and interpreting the Financial Statements [LO 1-2, LO 1-3] [The following information applies to the questions displayed below.) Assume you are the president of Nuclear Company. At the end of the first year of operations (December 31), the following financial data for the company are available: Accounts Payable Accounts Receivable Cash Common Stock Dividends Equipent Notes Payable Operating Expenses Other Expenses Sales Revenue Supplies $32,000 59,800 13,880 62,780 220 31,000 1,490 60,200 8,950 85,200 B, 300 CP1-1 Part 1 Required: 1. Prepare an income statement for the year ended December 31 TIP: Begin by classifying each account as asset, liability, stockholders' equity, revenue, or expense. Each account is reported on only one financial statement CP1-1 Part 1 Required: 1. Prepare an income statement for the year ended December 31. TIP: Begin by classifying each account as asset, liability, stockholders equity, revenue, or expense. Each account is reported on only one financial statement NUCLEAR COMPANY Income Statement Required information Preparing an Income Statement, Statement of Retained Earnings, and Balance Sheet and Interpreting the Financial Statements [LO 1-2, LO 1-3) The following information applies to the questions displayed below.) Assume you are the president of High Power Corporation. At the end of the first year of operations (December 31), the following financial data for the company are available: Accounts Payable Accounts Receivable Cash Common Stock Dividends Equipment Notes Payable Operating Expenses Other Expenses Sales Revenue Supplies $33,500 11,650 14,700 68,490 2,098 93,000 2,040 59,800 7,990 99,600 6,480 Supplies 6,400 PA1-1 Part 1 Required: 1. Prepare an income statement for the year ended December 31. HIGH POWER CORPORATION Income Statement 0 0 Assume you are the president of High Power Corporation. At the end of the first year of operations (December 31), the following financial data for the company are available: Accounts Payable Accounts Receivable Cash Common Stock Dividends Equipment Notes Payable Operating Expenses Other Expenses Sales Revenue Supplies $33,500 11,650 14,700 60, 490 2,090 93,000 2,840 59,800 7,990 99,600 6,400 PA1-1 Part 2 2. Prepare a statement of retained earnings for the year ended December 31 HIGH POWER CORPORATION Statement of Retained Earnings Retained Earnings, January 1 Retained Earnings, December 31 Accounts Receivable Cash Connon Stock Dividends Equipment Notes Payable Operating Expenses Other Expenses Sales Revenue Supplies 11,650 14,200 60, 490 2,098 93,000 2,040 59,800 7,990 99,600 6,400 PA1-1 Part 3 3. Prepare a balance sheet at December 31 HIGH POWER CORPORATION Balance Sheet SA 1 Next >