Answered step by step

Verified Expert Solution

Question

1 Approved Answer

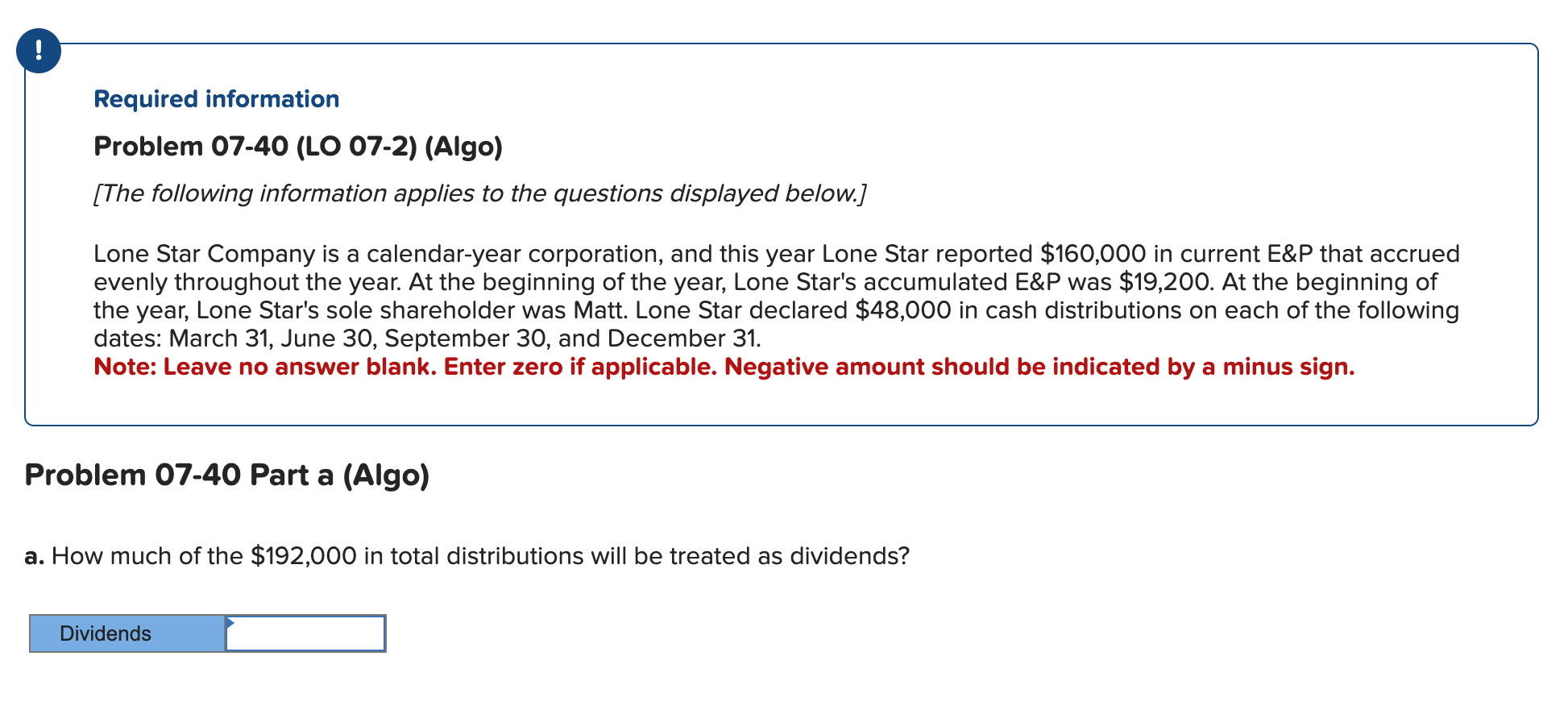

! Required information Problem 07-40 (LO 07-2) (Algo) [The following information applies to the questions displayed below.] Lone Star Company is a calendar-year corporation,

! Required information Problem 07-40 (LO 07-2) (Algo) [The following information applies to the questions displayed below.] Lone Star Company is a calendar-year corporation, and this year Lone Star reported $160,000 in current E&P that accrued evenly throughout the year. At the beginning of the year, Lone Star's accumulated E&P was $19,200. At the beginning of the year, Lone Star's sole shareholder was Matt. Lone Star declared $48,000 in cash distributions on each of the following dates: March 31, June 30, September 30, and December 31. Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Problem 07-40 Part a (Algo) a. How much of the $192,000 in total distributions will be treated as dividends? Dividends b. Suppose that Matt sold half of the shares to Chris on June 1st for $46,000. How much dividend income will Matt recognize this year? Dividend recognized c. If Matt's basis in the Lone Star shares was $7,240 at the beginning of the year, how much capital gain will he recognize on the sale and distributions from Lone Star? Capital gain recognized on the sale and distribution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem related to dividends capital gain and distributions lets go through each part ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started