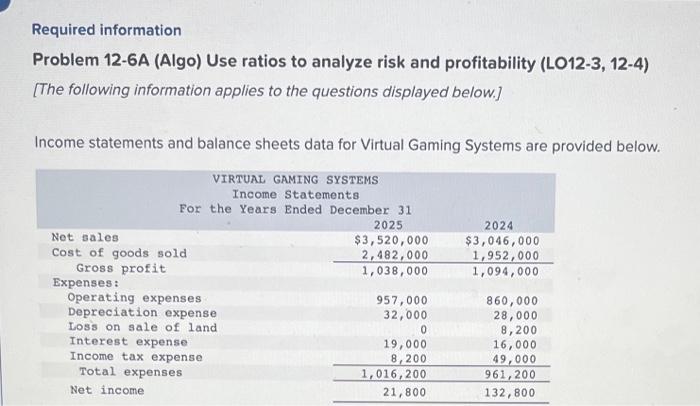

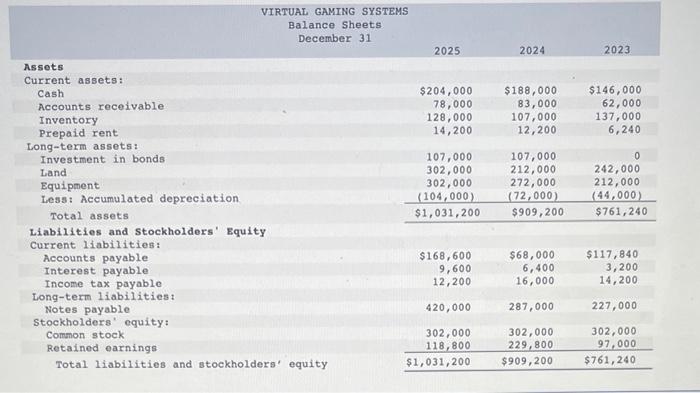

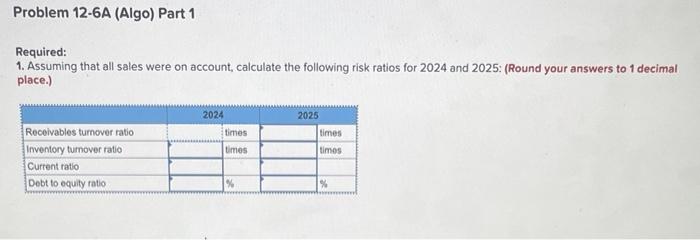

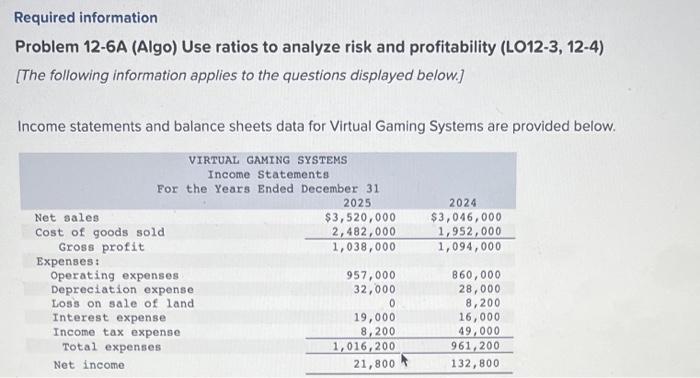

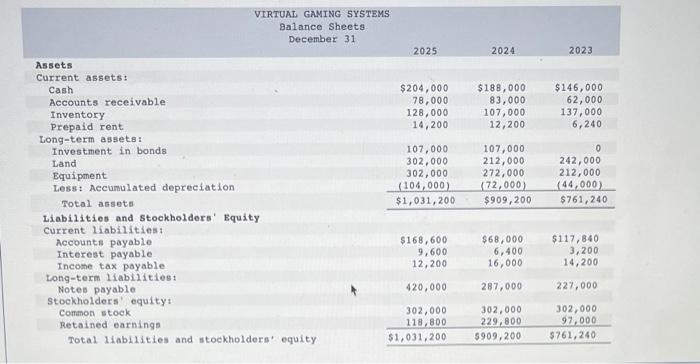

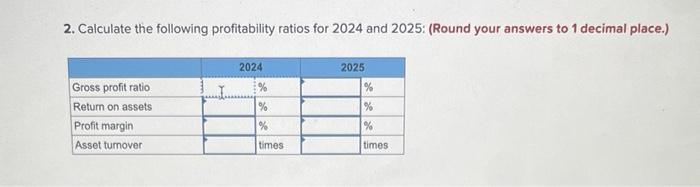

Required information Problem 12-6A (Algo) Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.] Income statements and balance sheets data for Virtual Gaming Systems are provided below. VIRTUAL GAMING SYSTEMS Balance Sheets December 31 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent 202520242023 Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' gquity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities : Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity \begin{tabular}{ccc} 107,000 & 107,000 & 0 \\ 302,000 & 212,000 & 242,000 \\ 302,000 & 272,000 & 212,000 \\ (104,000) & (72,000) & (44,000) \\ \hline$1,031,200 & $909,200 & $761,240 \\ \hline \end{tabular} $204,00078,000128,00014,200$188,00083,000107,00012,200$146,00062,000137,0006,240 Required: 1. Assuming that all sales were on account, calculate the following risk ratios for 2024 and 2025: (Round your answers to 1 decimal place.) Required information Problem 12-6A (Algo) Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.] Income statements and balance sheets data for Virtual Gaming Systems are provided below. VIRTUAL GAMING SYSTEMS Balance Sheets. December 31 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent 20252024 Long-term assets: Investment in bonds Land Equipment Lesst Accunulated depreciation Total assets Liabilities and stockholders' Equity Current liabilities Accounts payable Interest payable Incose tax payable rong-term 11abl11t1esi Notes payable Stockholders' equity Contmon stock Retained earnings Total Iiabilities and stockholders' equity \begin{tabular}{ccc} (104,000) & (72,000) & (44,000) \\ \hline$1,031,200 & $909,200 & $761,240 \\ \hline \end{tabular} \begin{tabular}{rrr} $168,600 & $68,000 & $117,840 \\ 9,600 & 6,400 & 3,200 \\ 12,200 & 16,000 & 14,200 \\ 420,000 & 287,000 & 227,000 \\ 302,000 & 302,000 & 302,000 \\ 118,800 & 229,800 & 97,000 \\ \hline$1,031,200 & $909,200 & $761,240 \\ \hline \end{tabular} 2. Calculate the following profitability ratios for 2024 and 2025: (Round your answers to 1 decimal place.)