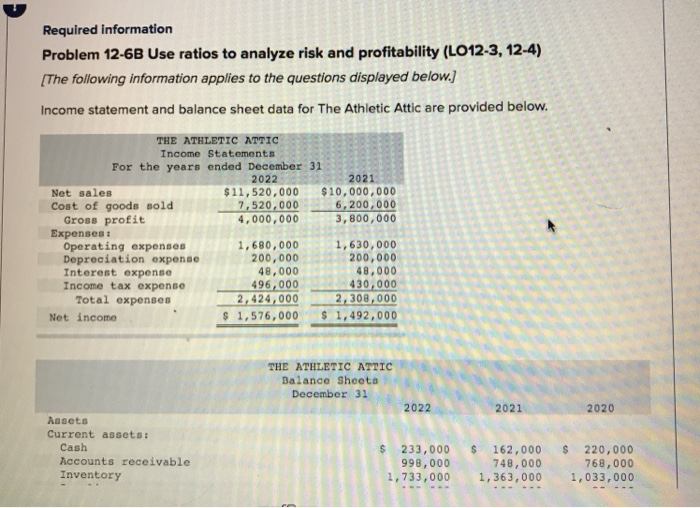

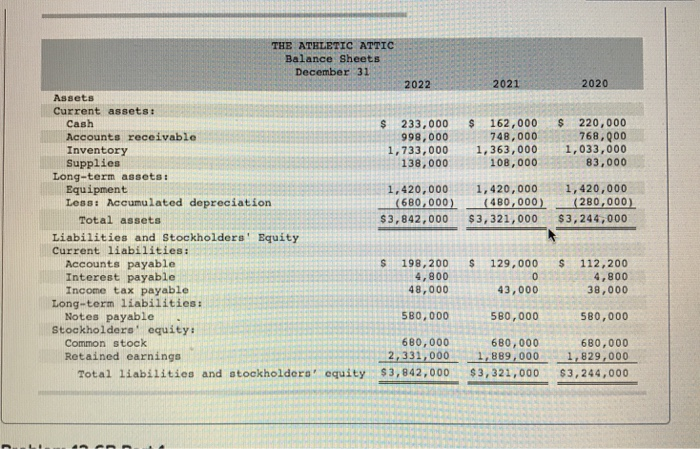

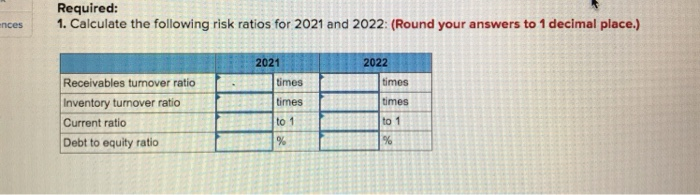

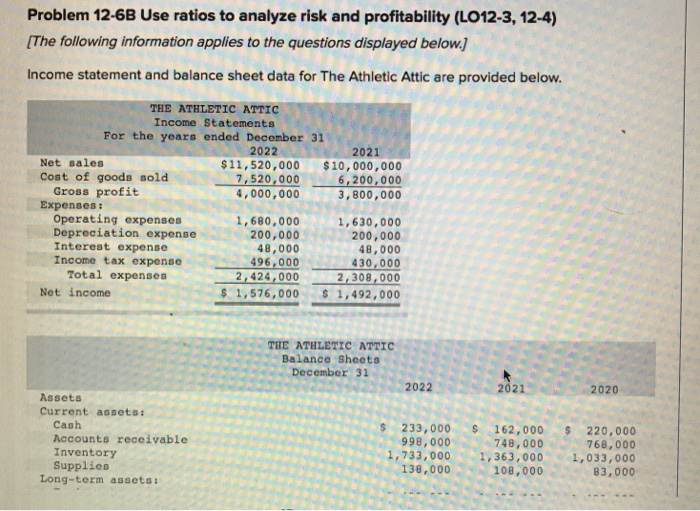

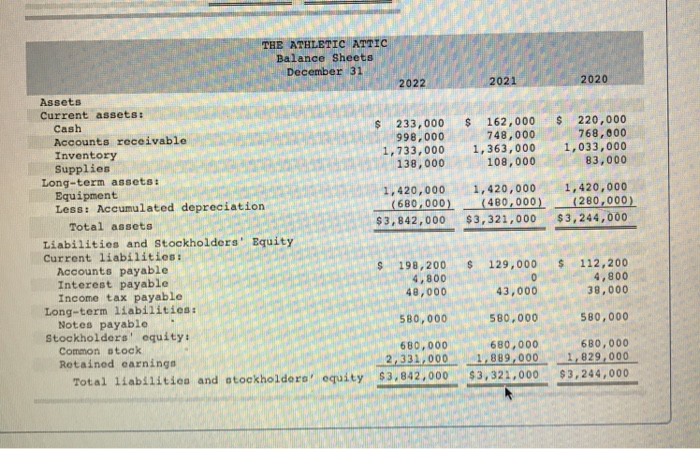

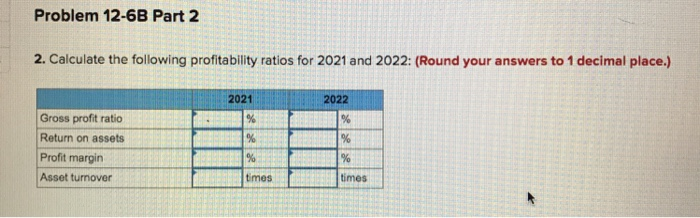

Required information Problem 12-6B Use ratios to analyze risk and profitability (L012-3, 12-4) The following information applies to the questions displayed below Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2021 2022 11,520,000 $10,000,000 6,200,000 3, 800,000 Net sales Cost of goods sold7,520,000 ,000,000 Gross profit Expenses 1,680,000 1,630,000 200,000 8,000 496,000430,000 Operating expense Depreciation expense Interest expense Income tax expense 200,000 48,000 2.424,000 2,308,00 Total expenses S1,576,000 1,492,000 Net income THE ATHLETIC ATTIC Balance Sheeto December 31 2022 2021 2020 Assets Current assets: Cash Accounts receivable Inventory 233,000 162,000 220,000 748,000 1,733,000 ,363,000 1, 033,000 768,000 998,000 THE ATELETIC ATTIC Balance Sheets December 31 2021 2022 2020 Assets Current assets: s 233,000 162,000 220,000 768,Q00 1,733,000 1,363,000 1,033,000 83,000 Cash Accounts receivable Inventory Supplies 748,000 998,000 108,000 138,000 Long-term assets: 1,420,000 1,420,000 1,420,000 (680,000) (480,000) (280,000) $3,842,000 3,321,000 $3,244,000 Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable S 198,200 129,000 112,200 4,800 38,000 4,800 48,000 580,000 680,000 43,000 580,000 680,000 Long-term liabilities: Notes payable 580,000 Stockholdere' equity: Common stock Retained earnings 680,000 2,331,0001,889,0001,829,000 Total liabilities and stockholdera' equity $3,842,000 $3,321,000 $3,244,000 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) nces 2022 2021 imesimes times to Receivables turnover ratic Inventory turnover ratio Current ratio Debt to equity ratio times to 1 Problem 12-6B Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below. Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2021 2022 Net sales Cost of goods sold 11, 520,000 $10,000,000 6,200,000 3, 800,000 7,520,000 4,000,000 Gross profit Expenses : Operating expenses Depreciation expense Interest expense Income tax expense 1,680,000 1,630,000 200,000 48,000 96,000430,000 424,0002,308,000 1,576,000 1,492,000 200,000 48,000 Total expenses 2, Net income THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 Assets Current assets: Cash Accounts receivable Inventory Supplies $233,000 162,000 $ 220,000 768,000 1,733,000 1,363,000 1,033,000 83,000 998,000 748,000 138,000 108,000 Long-term assets THE ATHLETIC ATTIc Balance Sheets December 31 202 2020 2022 Assets Current assets: 220,000 768,000 s 233,000 162,000 748,000 Cash Accounts receivable Inventory Supplies 998,000 1,733,000 1,363,000 1,033,000 83,000 1,420,000 1,420,000 1,420,000 $3,842,000 $3,321,000 $3,244,000 138,000108,000 Long-term assets: Equipment Less: Accumulated depreciation (480,000)(280,000) (680,000) Total assets Liabilities and Stockholders Equity Current liabilities: s 198,200 129,000 112,200 4,800 Accounts payable Interest payable Income tax payable 4,800 48,000 38,000 43,000 Long-term liabilities: 580,000 580000580,000 Notes payable Stockholders equity: 680,000 2 331,000 1,889,000 829 000 nd atockholdera equity $3,842,000 $3,321,000 $3,244,000 680,000 680,000 Common stock Retained earninga Total lLabilitien Problem 12-6B Part 2 2. Calculate the following profitability ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 Gross profit ratio Return on assets Profit margin Asset turnover times times