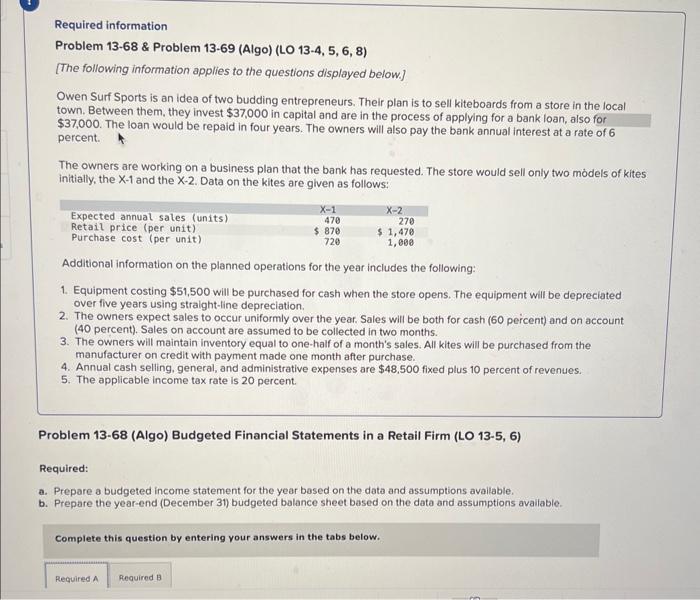

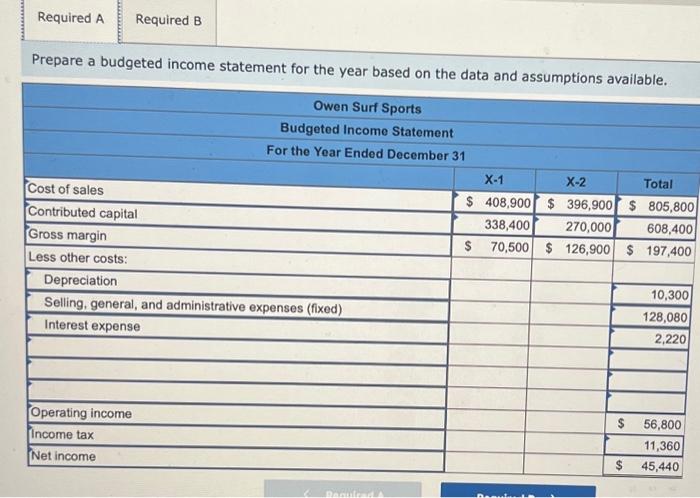

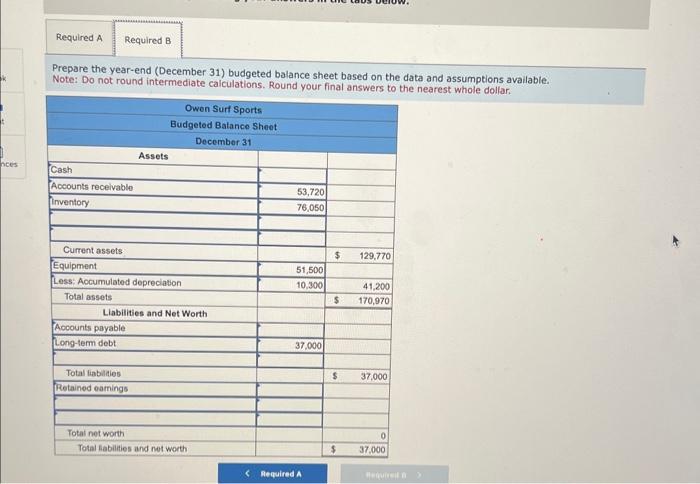

Required information Problem 13-68 \& Problem 13-69 (Algo) (LO 13-4, 5, 6, 8) [The following information applies to the questions displayed below.] Owen Surf Sports is an idea of two budding entrepreneurs. Their plan is to sell kiteboards from a store in the local town. Between them, they invest $37,000 in capital and are in the process of applying for a bank loan, also $37,000. The loan would be repaid in four years. The owners will also pay the bank annual interest at a rate of 6 percent. The owners are working on a business plan that the bank has requested. The store would sell only two moddels of kites initially, the X1 and the X2. Data on the kites are given as follows: Additional information on the planned operations for the year includes the following: 1. Equipment costing $51,500 will be purchased for cash when the store opens. The equipment will be depreciated over five years using straight-line depreciation. 2. The owners expect sales to occur uniformly over the year. Sales will be both for cash ( 60 percent) and on account ( 40 percent). Sales on account are assumed to be collected in two months. 3. The owners will maintain inventory equal to one-half of a month's sales. All kites will be purchased from the manufacturer on credit with payment made one month after purchase. 4. Annual cash selling, general, and administrative expenses are $48,500 fixed plus 10 percent of revenues. 5. The applicable income tax rate is 20 percent. Problem 13-68 (Algo) Budgeted Financial Statements in a Retail Firm (LO 13-5, 6) Required: a. Prepare a budgeted income statement for the year bosed on the data and assumptions avallable. b. Prepare the year-end (December 31) budgeted balance sheet based on the data and assumptions available. Complete this question by entering your answers in the tabs below. Prepare a budgeted income statement for the year based on the data and assumptions available. Prepare the year-end (December 31) budgeted balance sheet based on the data and assumptions available Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar