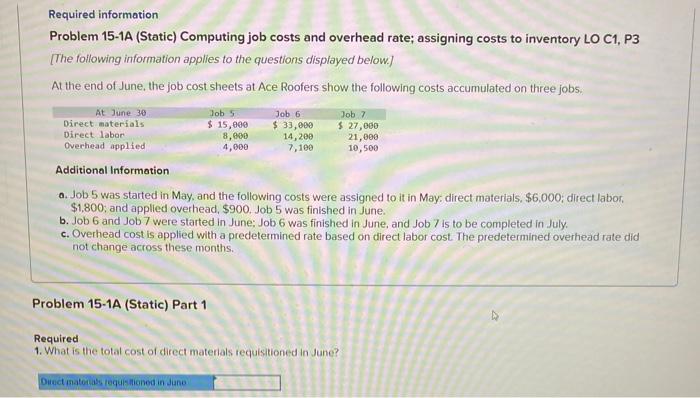

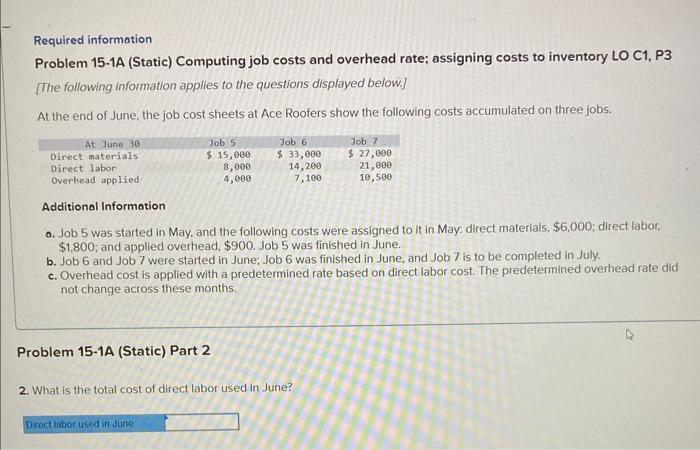

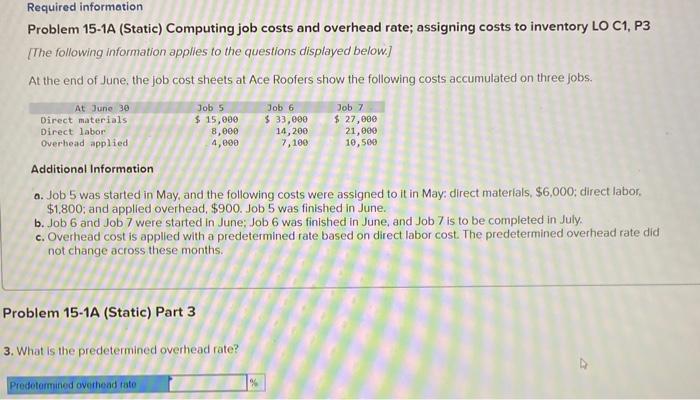

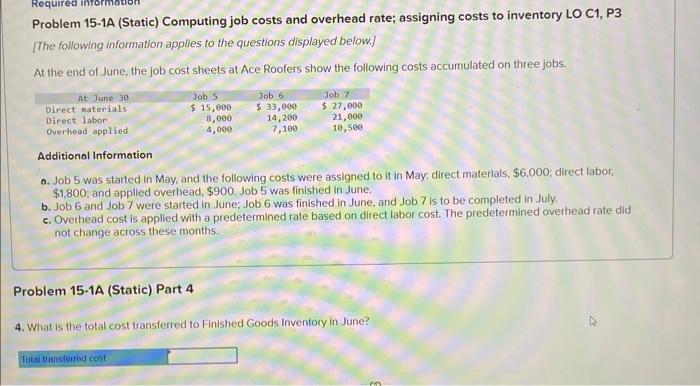

Required information Problem 15-1A (Static) Computing job costs and overhead rate; assigning costs to inventory LO C1, P3 [The following information applies to the questions displayed below] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. Additional Information a. Job 5 was started in May, and the following costs were assigned to it in May. direct materials, $6,000; direct labor, $1,800; and applied overhead, $900, Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. Problem 15-1A (Static) Part 1 Required 1. What is the total cost of direct materials requistioned in June? Required information Problem 15-1A (Static) Computing job costs and overhead rate; assigning costs to inventory LO C1, P3 [The following information applies to the questions displayed below.] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. Additional Information o. Job 5 was started in May, and the following costs were assigned to it in May. direct materials, $6,000; direct labor: $1,800 : and applied overhead, $900. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. Problem 15-1A (Static) Part 2 2. What is the total cost of direct labor used in June? Problem 15-1A (Static) Computing job costs and overhead rate; assigning costs to inventory LO C1, P3 [The following information applies to the questions displayed below.] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. Additional Information a. Job 5 was started in May, and the following costs were assigned to it in May; direct materlals, $6,000; direct labor. $1,800; and applied overhead, $900. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. Problem 15-1A (Static) Part 3 3. What is the predetermined overhead rate? Problem 15-1A (Static) Computing job costs and overhead rate; assigning costs to inventory LO C1, P3 [The following information applies to the questions displayed below.] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. Additional Information 0. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $6,000; direct labor, $1,800; and applied overhead, $900. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. Problem 15-1A (Static) Part 4 4. What is the total cost transferred to Finished Goods Inventory in June