Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Problem 15-2A (Algo) Recording, adjusting, and reporting available-for-sale debt securities LO P3 [The following information applies to the questions displayed below.] Mead Incorporated

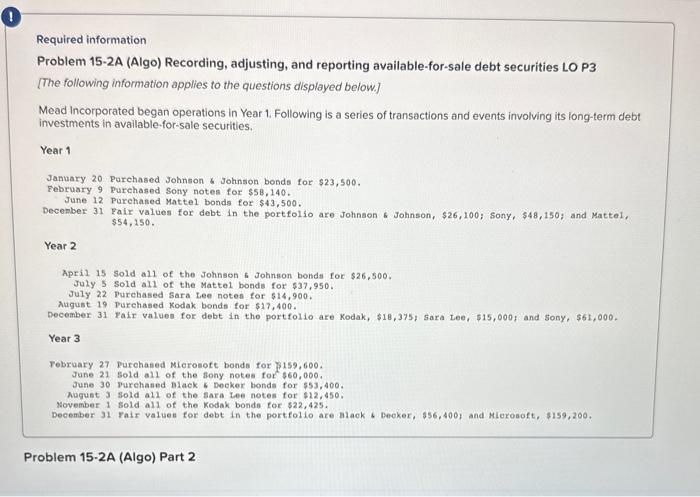

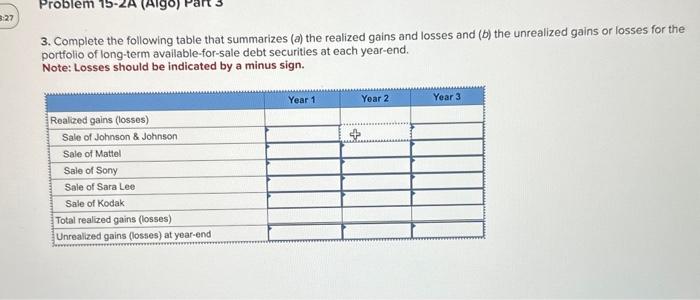

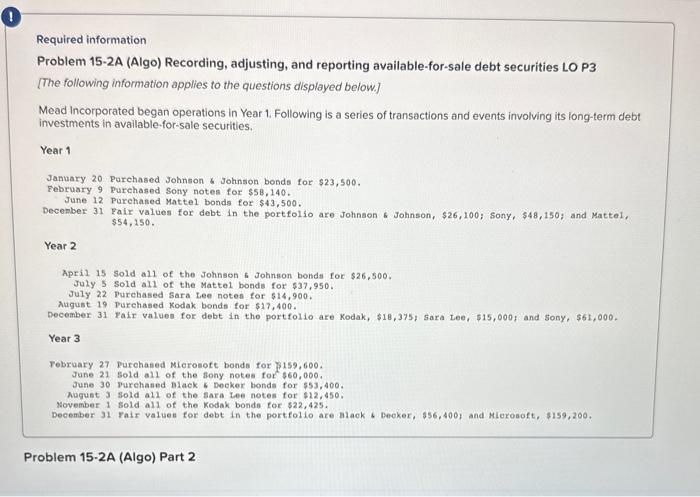

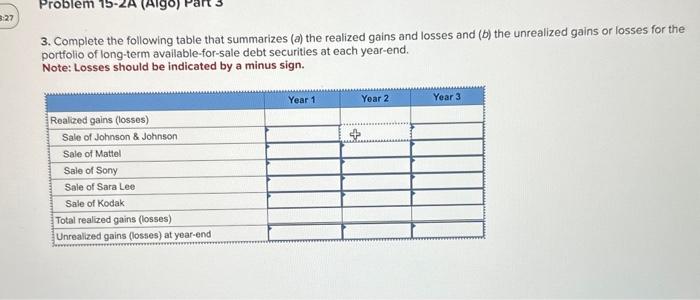

Required information Problem 15-2A (Algo) Recording, adjusting, and reporting available-for-sale debt securities LO P3 [The following information applies to the questions displayed below.] Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purehased Johnson \& Johnson bonds for $23,500. February 9 purchased sony notes for $5B,140. June 12 Purehased Mattel bonds for $43,500. December 31 Fair values for debt in the portfolio are Johnson \& Johnson, $26,100; sony, $48,150; and Mattel, $54,150. Year 2 April 15 sold all of the Johnsen 6 Johnson bonds for $26,500. July 5 sold all of the Mattel bonds for $37,950. July 22 Purchased Sara Lee noten for 514,900 . August 19 Purehased Kodak bonds for $17,400. December 31 Fair values for debt in the portfolio are Kodak, $18,375; sara Lee, $15,000; and 500y,$51,000. Year 3 Tebruary 27 Purchased Micronoft bond for $159,600. June 21 sold all of the fony notes for $60,000. June 30 Purehased Black \& Deoker bonda for $53,400. Aagunt 3 sold al1 of the sara Lee notes for $12,450. November 1 sold al1 of the Kodak bondn for $22,425. December 31 Fair valuen for debt in the portfolio are Black \& Beker, $56,400 ) and Mieroooft, $159,200. Problem 15-2A (Algo) Part 2 3. Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end. Note: Losses should be indicated by a minus sign

Required information Problem 15-2A (Algo) Recording, adjusting, and reporting available-for-sale debt securities LO P3 [The following information applies to the questions displayed below.] Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purehased Johnson \& Johnson bonds for $23,500. February 9 purchased sony notes for $5B,140. June 12 Purehased Mattel bonds for $43,500. December 31 Fair values for debt in the portfolio are Johnson \& Johnson, $26,100; sony, $48,150; and Mattel, $54,150. Year 2 April 15 sold all of the Johnsen 6 Johnson bonds for $26,500. July 5 sold all of the Mattel bonds for $37,950. July 22 Purchased Sara Lee noten for 514,900 . August 19 Purehased Kodak bonds for $17,400. December 31 Fair values for debt in the portfolio are Kodak, $18,375; sara Lee, $15,000; and 500y,$51,000. Year 3 Tebruary 27 Purchased Micronoft bond for $159,600. June 21 sold all of the fony notes for $60,000. June 30 Purehased Black \& Deoker bonda for $53,400. Aagunt 3 sold al1 of the sara Lee notes for $12,450. November 1 sold al1 of the Kodak bondn for $22,425. December 31 Fair valuen for debt in the portfolio are Black \& Beker, $56,400 ) and Mieroooft, $159,200. Problem 15-2A (Algo) Part 2 3. Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end. Note: Losses should be indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started