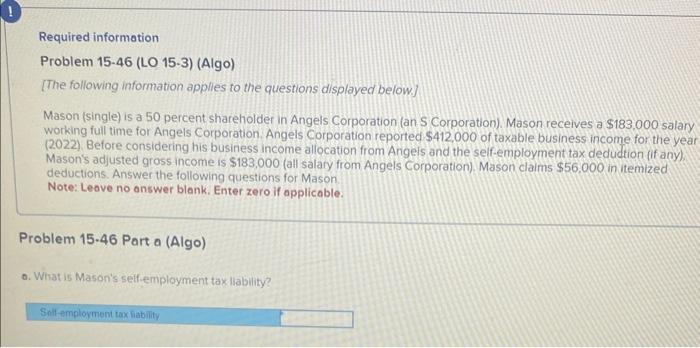

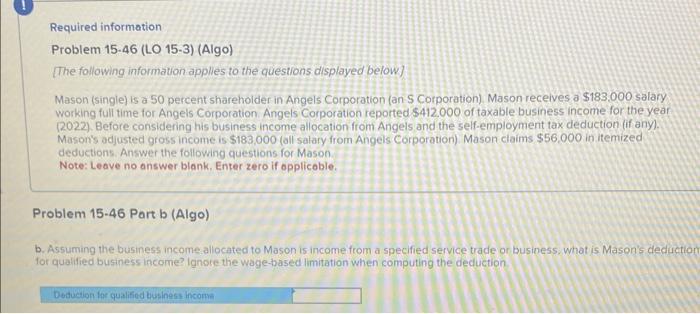

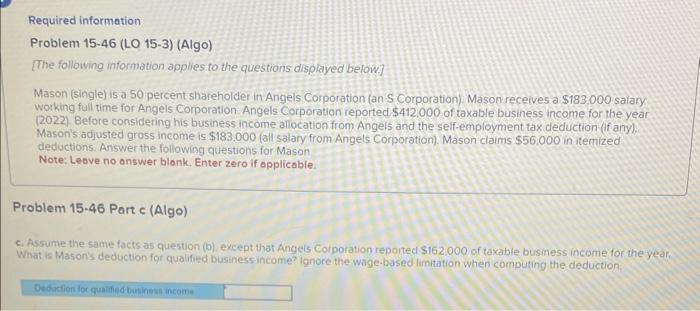

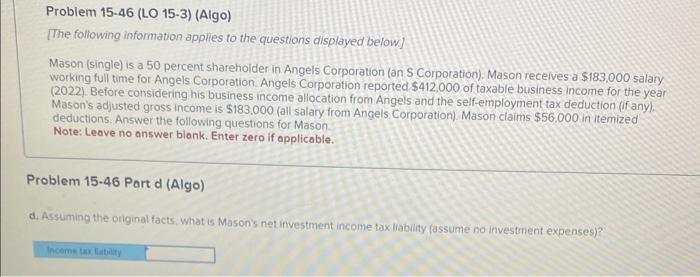

Required information Problem 15-46 (LO 15.3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $183,000 salary working full time for Angels Corporation. Angels Corporation reported $412,000 of taxable business income for the year (2022). Before considering his business income allocation from Angels and the self-employment tax dedudtion (if any), Mason's adjusted gross income is $183,000 (all salary from Angels Corporation). Mason claims $56.000 in itemized deductions. Answer the following questions for Mason. Note: Leave no answer blank. Enter zero if applicable. Problem 15.46 Part a (Algo) o. What is Mason's seif-employment tax liability? Required information Problem 15.46 (LO 15-3) (Algo) [The following information applies to the questions displayed below] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation) Mason receives a \$183.000 salary working full time for Angels Corporation. Angels Corporation reported $412.000 of taxable business income for the year (2022). Before considering his business income allocation from Angels and the self-employment tax deduction (if any). Mason's adjusted gross income is $183,000 (all salary from Angels Corporation) Mason ciaims $56.000 in itemized deductions. Answer the following questions for Mason. Note: Leave no answer blank. Enter zero if opplicoble. Problem 15-46 Part b (Algo) b. Assuming the business income allocated to Mason is income from a specified service trade or business. what is Mason's dedactio for qualified business income? Ignore the wage-based limitation when computing the deduction Required information Problem 15-46 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation) Mason recerves a $183,000 salary working full time for Angels Corporation. Angels Corporation reported $412,000 of taxable business income for the yeai (2022). Before considering his business income allocation from Angels and the self-employment tax deduction (if any). Mason's adjusted gross income is $183.000 (all salary from Angels Corporation) Mason claims $56.000 in itemized deductions. Answer the following questions for Mason Note: Leave no answer blank, Enter zero if applicable. Problem 15.46 Part c (Algo) c. Assume the same facts as question (b), except that Angels Corporation reported $162.000 of taxable business income for the year. What is Mason's deduction for qualified business income? lanore the wage-based limitation when computing the deduction, Problem 15.46 (LO 15-3) (Algo) [The following information applies to the questions displayed below] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason recelves a $183,000 salary working full time for Angels Corporation. Angels Corporation reported $412,000 of taxable business income for the year (2022). Before considering his business income allocation from Angels and the self-employment tax deduction (if any). Mason's adjusted gross income is $183,000 (all salary from Angels Corporation). Mason claims $56.000 in itemized deductions. Answer the following questions for Mason. Note: Leave no answer blank. Enter zero if applicable. Problem 15.46 Part d (Algo) d. Assuming the onginal facts, what is Mason's net investment income tax llablity (assume no investment expenses)