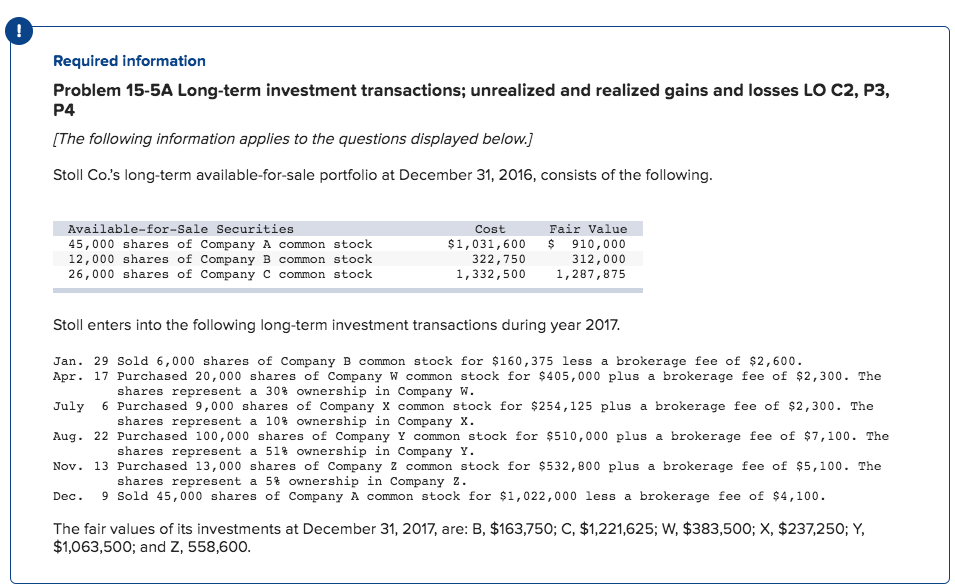

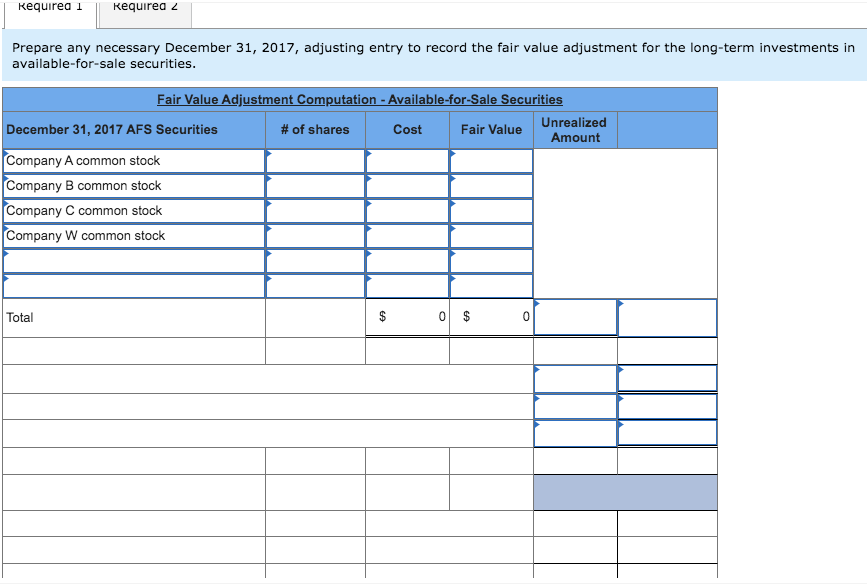

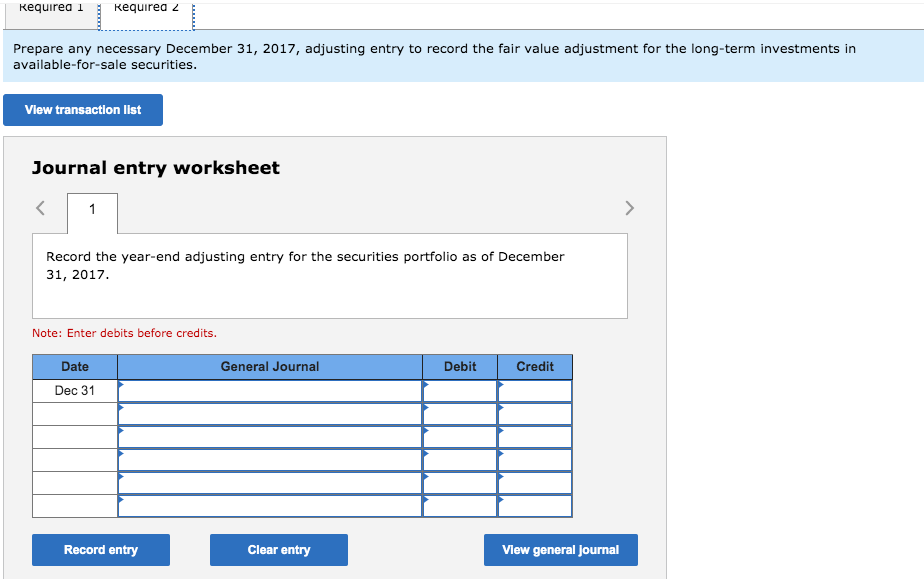

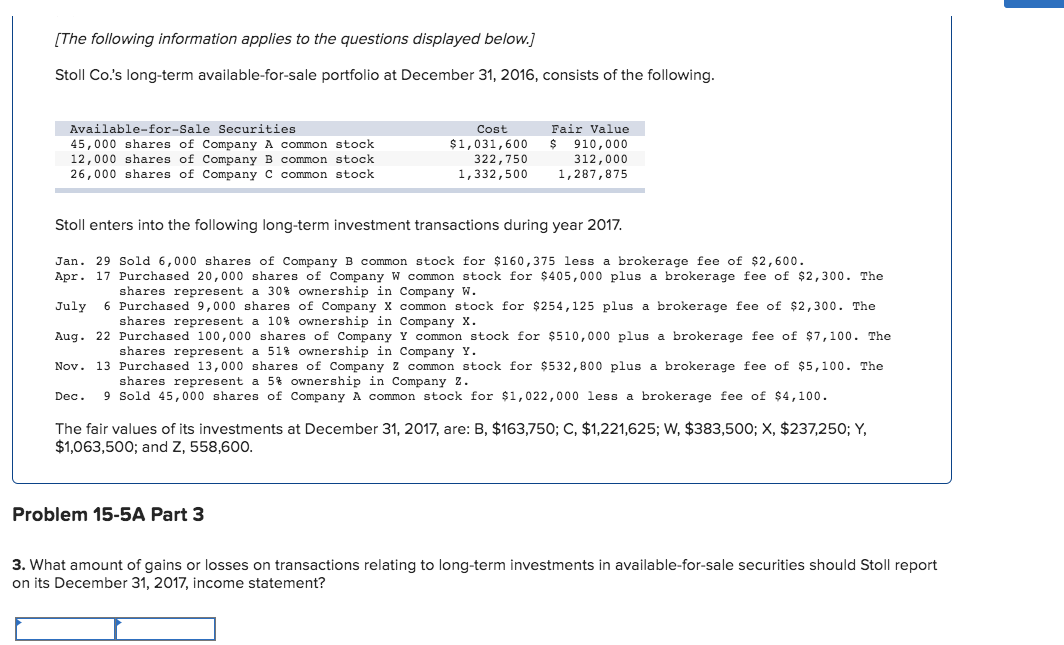

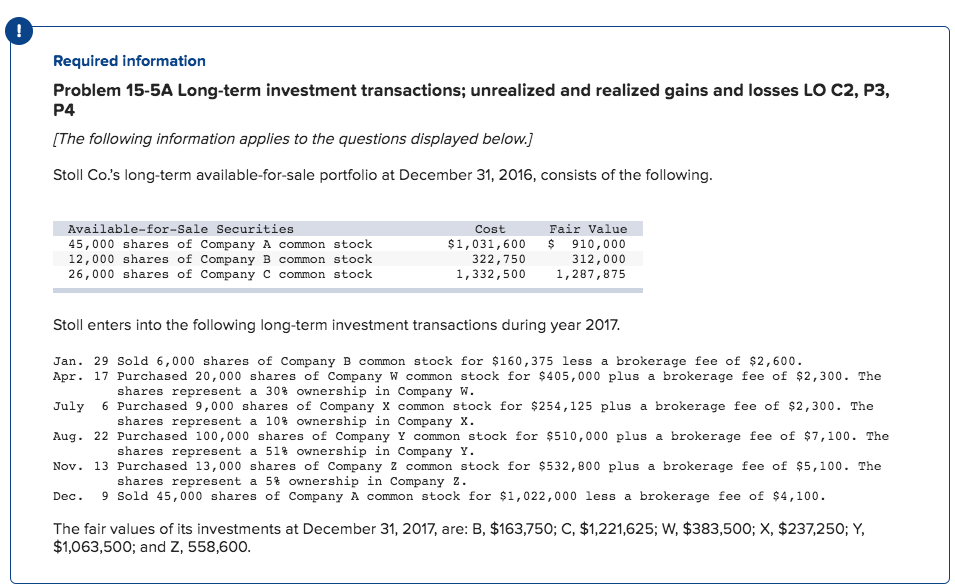

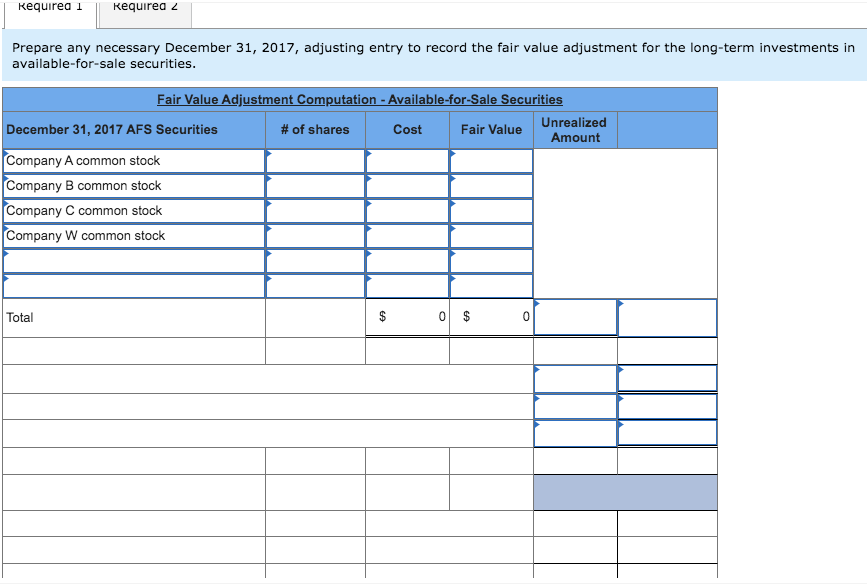

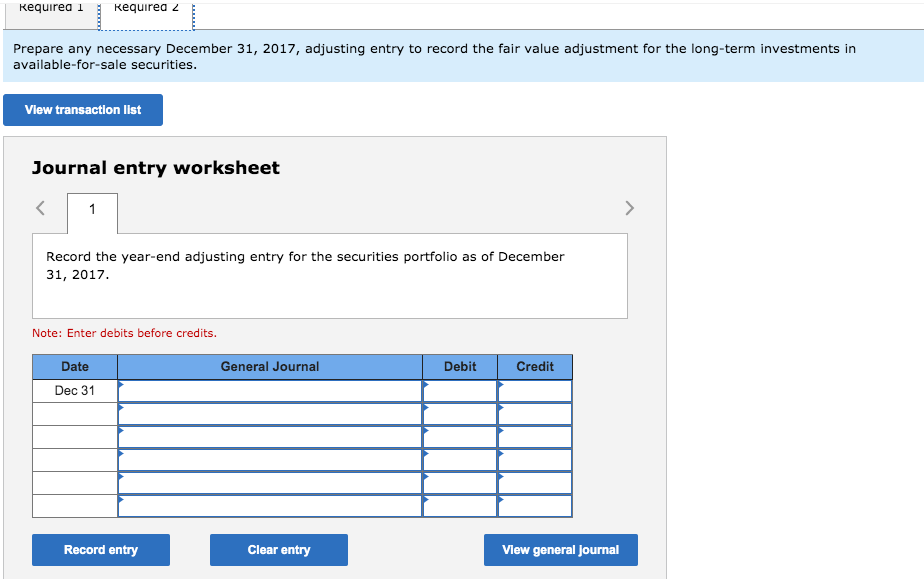

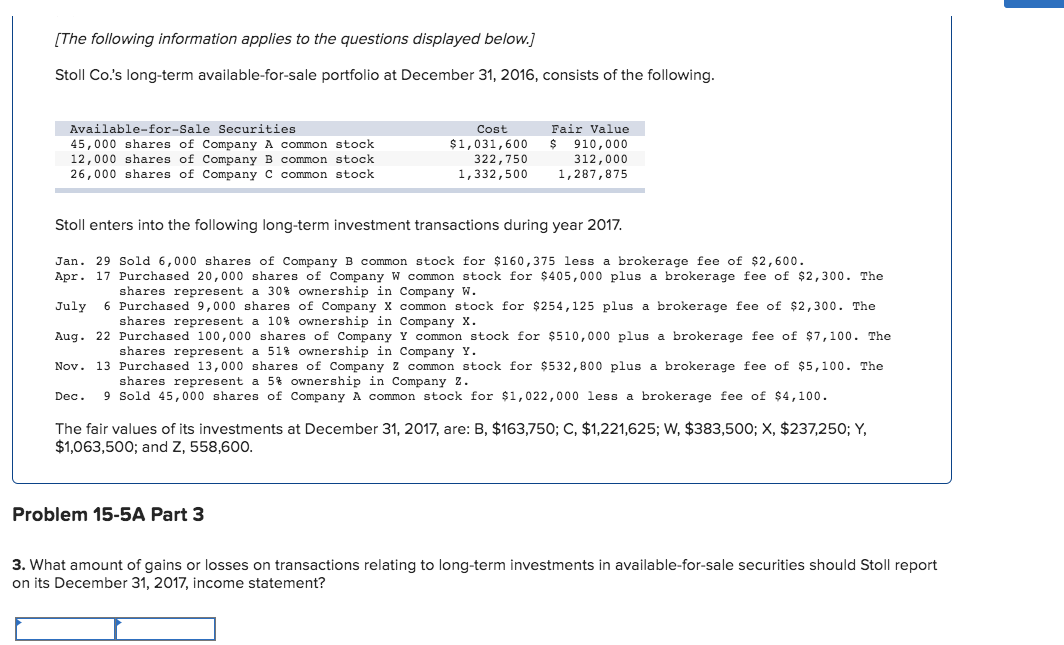

Required information Problem 15-5A Long-term investment transactions; unrealized and realized gains and losses LO C2, P3, P4 [The following information applies to the questions displayed below.) Stoll Co.'s long-term available-for-sale portfolio at December 31, 2016, consists of the following. Available-for-Sale Securities 45,000 shares of Company A common stock 12,000 shares of Company B common stock 26,000 shares of Company C common stock Cost $1,031,600 322,750 1,332,500 Fair Value $ 910,000 312,000 1,287,875 Stoll enters into the following long-term investment transactions during year 2017, Jan. 29 Sold 6,000 shares of Company B common stock for $160,375 less a brokerage fee of $2,600. Apr. 17 Purchased 20,000 shares of Company W common stock for $405,000 plus a brokerage fee of $2,300. The shares represent a 30% ownership in Company w. July 6 Purchased 9,000 shares of Company X common stock for $254,125 plus a brokerage fee of $2,300. The shares represent a 10% ownership in Company X. Aug. 22 Purchased 100,000 shares of Company Y common stock for $510,000 plus a brokerage fee of $7,100. The shares represent a 51% ownership in Company Y. Nov. 13 Purchased 13,000 shares of Company 2 common stock for $532,800 plus a brokerage fee of $5,100. The shares represent a 5% ownership in Company z. Dec. 9 Sold 45,000 shares of Company A common stock for $1,022,000 less a brokerage fee of $4,100. The fair values of its investments at December 31, 2017, are: B, $163,750; C, $1,221,625; W, $383,500; X, $237,250; Y, $1,063,500; and Z, 558,600. Requirea 1 Requirea 2 Prepare any necessary December 31, 2017, adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. Fair Value Adjustment Computation - Available-for-Sale Securities December 31, 2017 AFS Securities # of shares Unrealized Cost Fair Value Amount Company A common stock Company B common stock Company C common stock Company W common stock Total $ 0 $ 0 Requirea 1 Requirea 2 Prepare any necessary December 31, 2017, adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. View transaction list Journal entry worksheet 1 Record the year-end adjusting entry for the securities portfolio as of December 31, 2017. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Record entry Clear entry View general Journal [The following information applies to the questions displayed below.) Stoll Co.'s long-term available-for-sale portfolio at December 31, 2016, consists of the following. Available-for-Sale Securities 45,000 shares of Company A common stock 12,000 shares of Company B common stock 26,000 shares of Company C common stock Cost $1,031,600 322,750 1,332,500 Fair Value $ 910,000 312,000 1,287,875 Stoll enters into the following long-term investment transactions during year 2017. Jan. 29 Sold 6,000 shares of Company B common stock for $160,375 less a brokerage fee of $2,600. Apr. 17 Purchased 20,000 shares of Company W common stock for $405,000 plus a brokerage fee of $2,300. The shares represent a 30% ownership in Company w. July 6 Purchased 9,000 shares of Company X common stock for $254,125 plus a brokerage fee of $2,300. The shares represent a 10% ownership in Company X. Aug. 22 Purchased 100,000 shares of Company Y common stock for $510,000 plus a brokerage fee of $7,100. The shares represent a 51% ownership in Company Y. Nov. 13 Purchased 13,000 shares of Company 2 common stock for $532,800 plus a brokerage fee of $5,100. The shares represent a 5% ownership in Company 2. Dec. 9 Sold 45,000 shares of Company A common stock for $1,022,000 less a brokerage fee of $4,100. The fair values of its investments at December 31, 2017, are: B, $163,750; C, $1,221,625; W, $383,500; X, $237,250; Y, $1,063,500; and Z, 558,600. Problem 15-5A Part 3 3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale securities should Stoll report on its December 31, 2017, income statement