Answered step by step

Verified Expert Solution

Question

1 Approved Answer

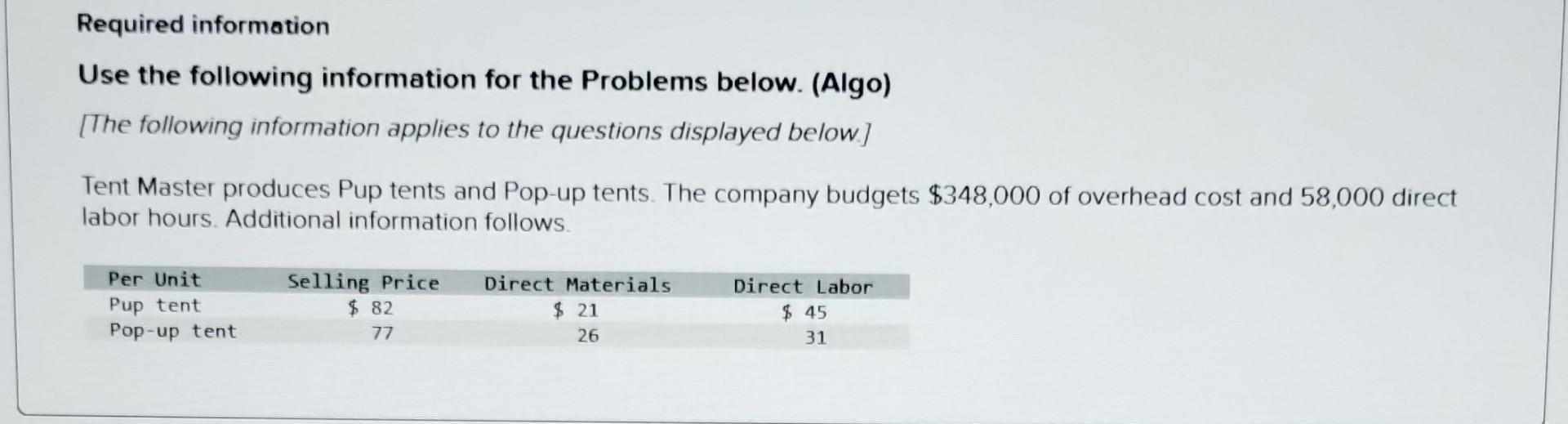

Required information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below ] Tent Master produces Pup

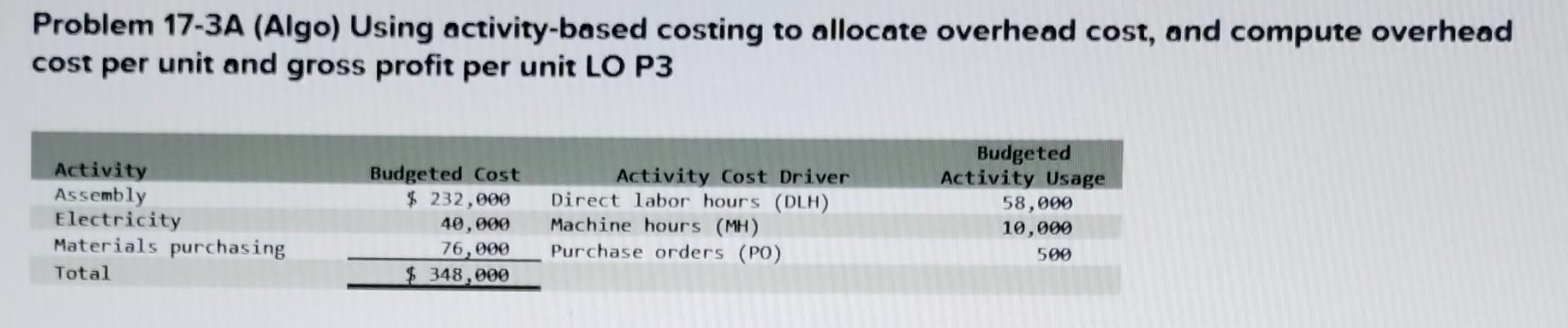

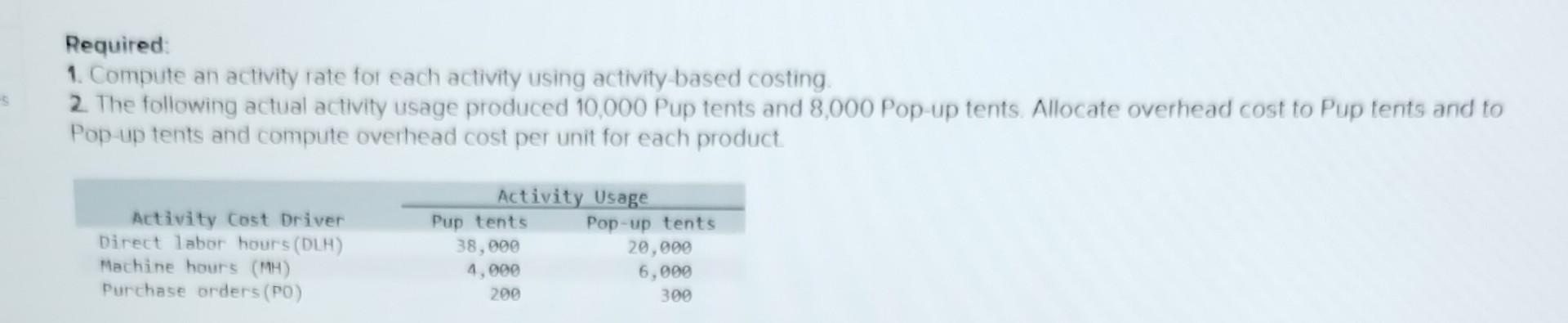

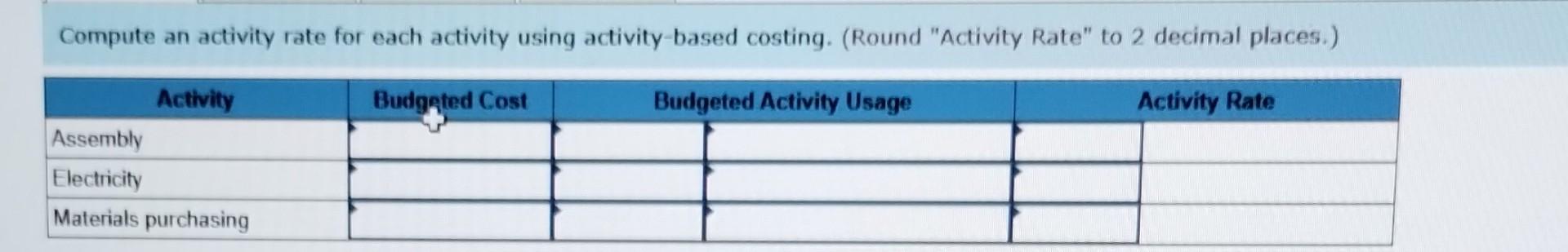

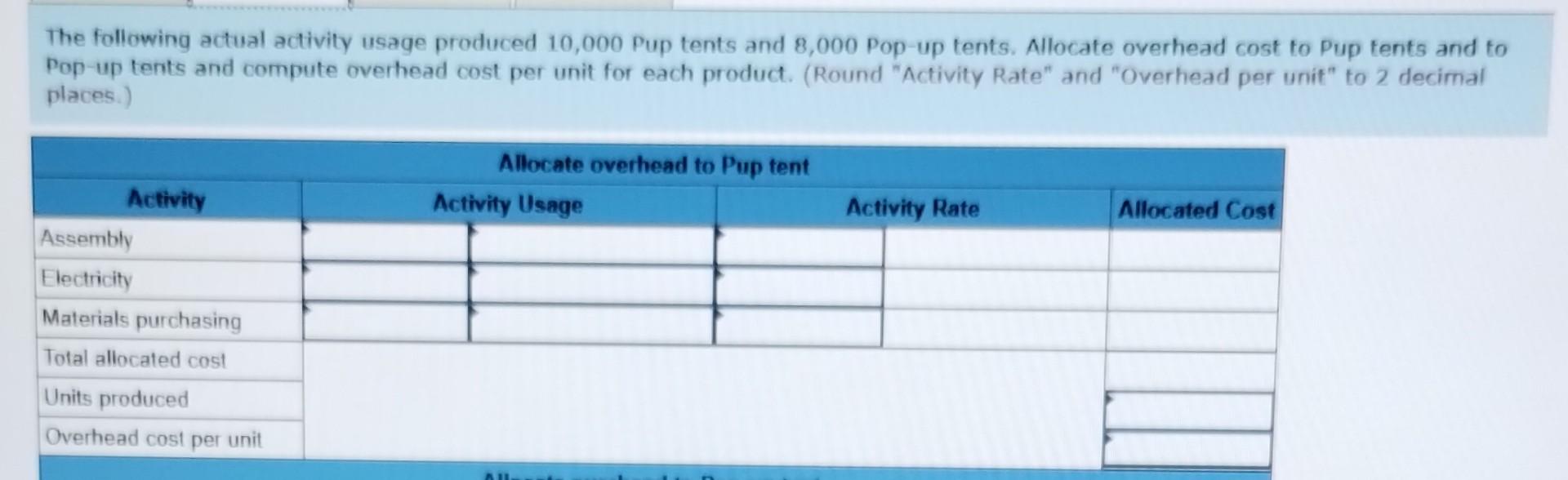

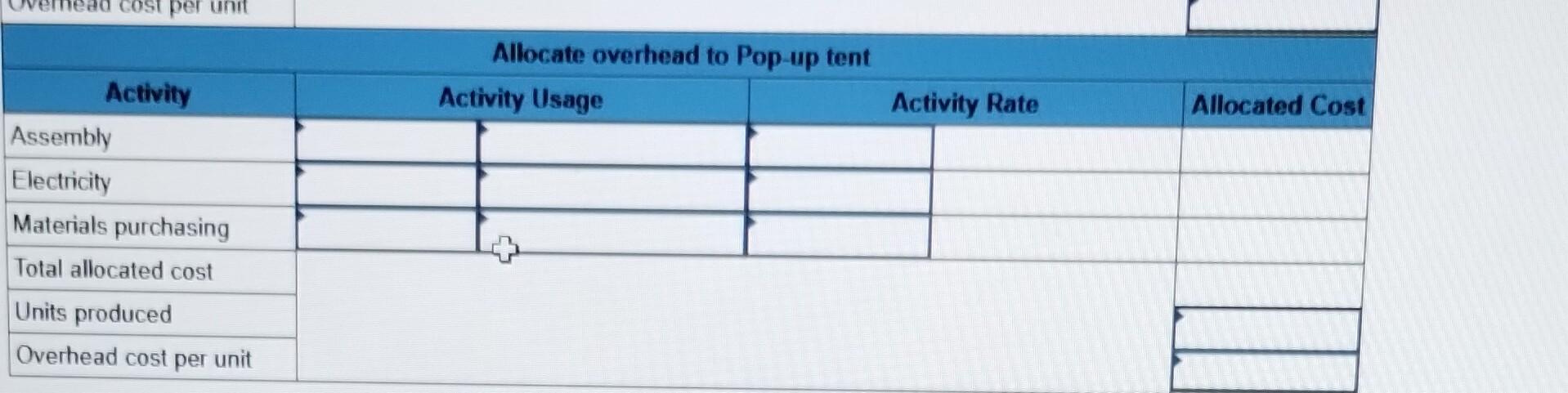

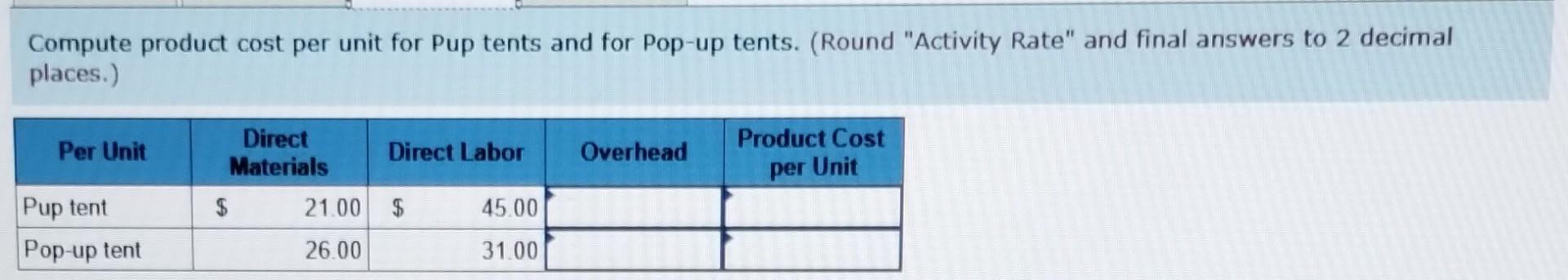

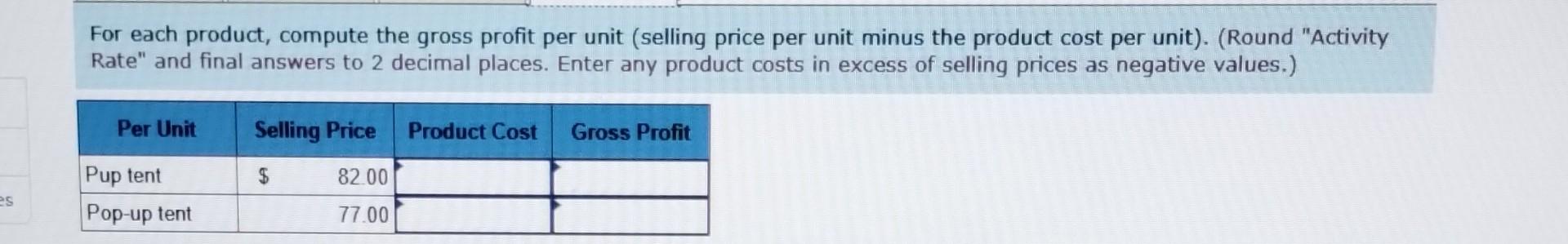

Required information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below ] Tent Master produces Pup tents and Pop-up tents. The company budgets $348,000 of overhead cost and 58,000 direct labor hours. Additional information follows. Problem 17-3A (Algo) Using activity-based costing to allocate overhead cost, and compute overhead cost per unit and gross profit per unit LO P3 Required: 1. Compute an activity rate for each activity using activity-based costing. 2. The following actual activity usage produced 10,000 Pup tents and 8,000 Pop-up tents. Allocate overhead cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product 3. Compute product cost per unit for Pup tents and for Pop-up tents. 4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). Compute an activity rate for each activity using activity-based costing. (Round "Activity Rate" to 2 decimal places.) The following actual activity usage produced 10,000 Pup tents and 8,000 Pop-up tents. Allocate overhead cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product. (Round "Activity Rate" and "Overhead per unit" to 2 decimal places.) \begin{tabular}{|l|l|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Activity } & \multicolumn{3}{|c|}{ Allocate overhead to Pop-up tent } \\ \hline Assembly & & & & & \\ \hline Electricity & & & & & \\ \hline Materials purchasing & & & & \\ \hline Total allocated cost & & & \\ \hline Units produced & & & \\ \hline Overhead cost per unit & & & \\ \hline \end{tabular} Compute product cost per unit for Pup tents and for Pop-up tents. (Round "Activity Rate" and final answers to 2 decimal places.) For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). (Round "Activity Rate" and final answers to 2 decimal places. Enter any product costs in excess of selling prices as negative values.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started