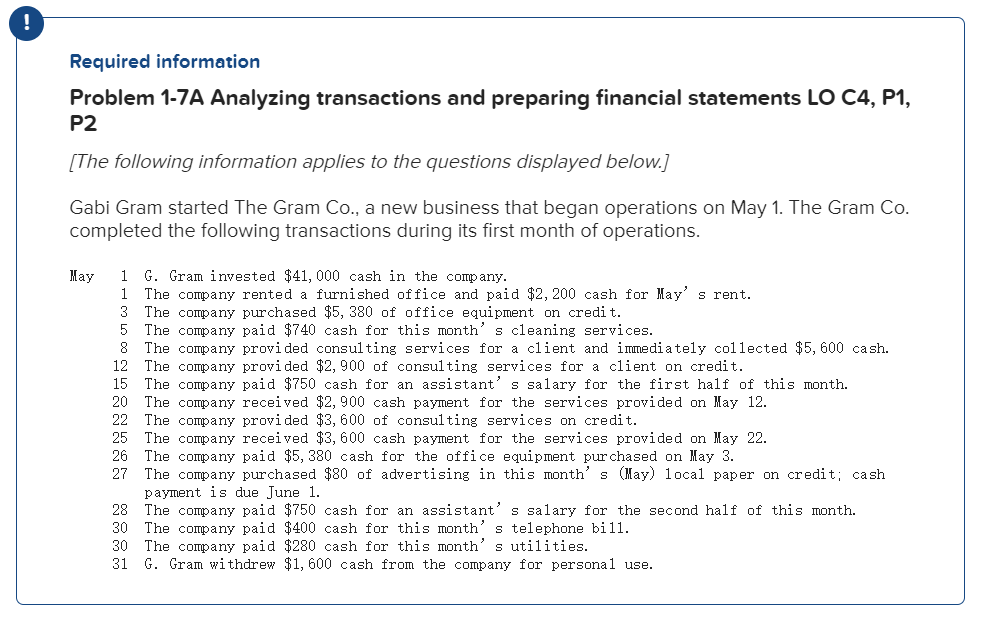

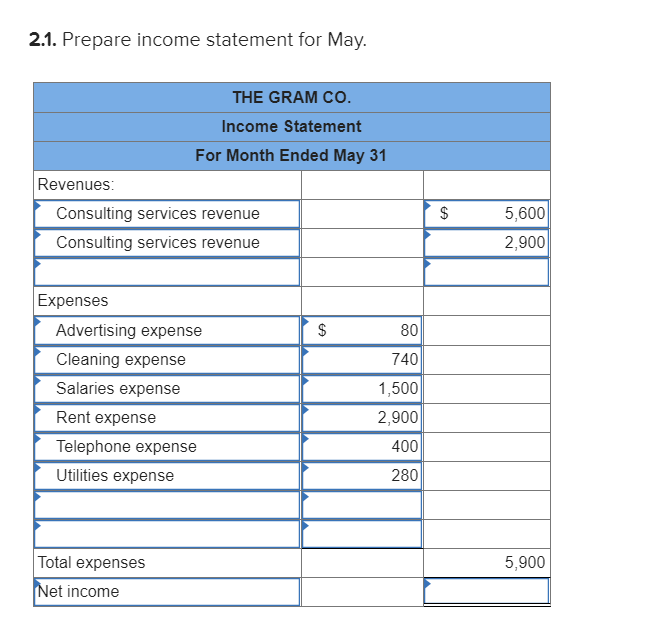

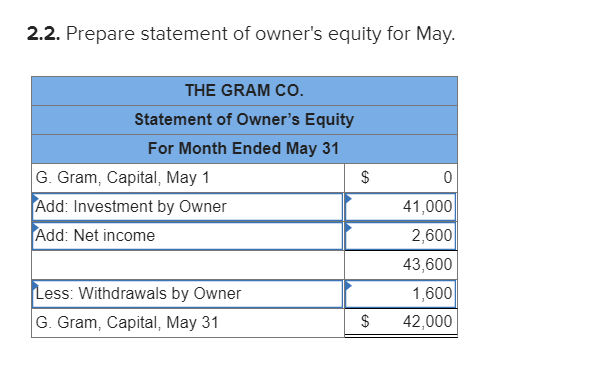

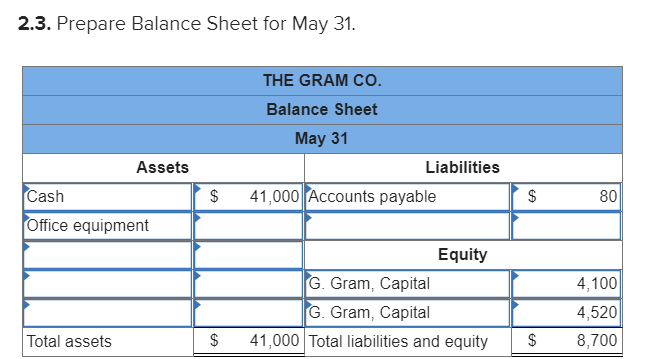

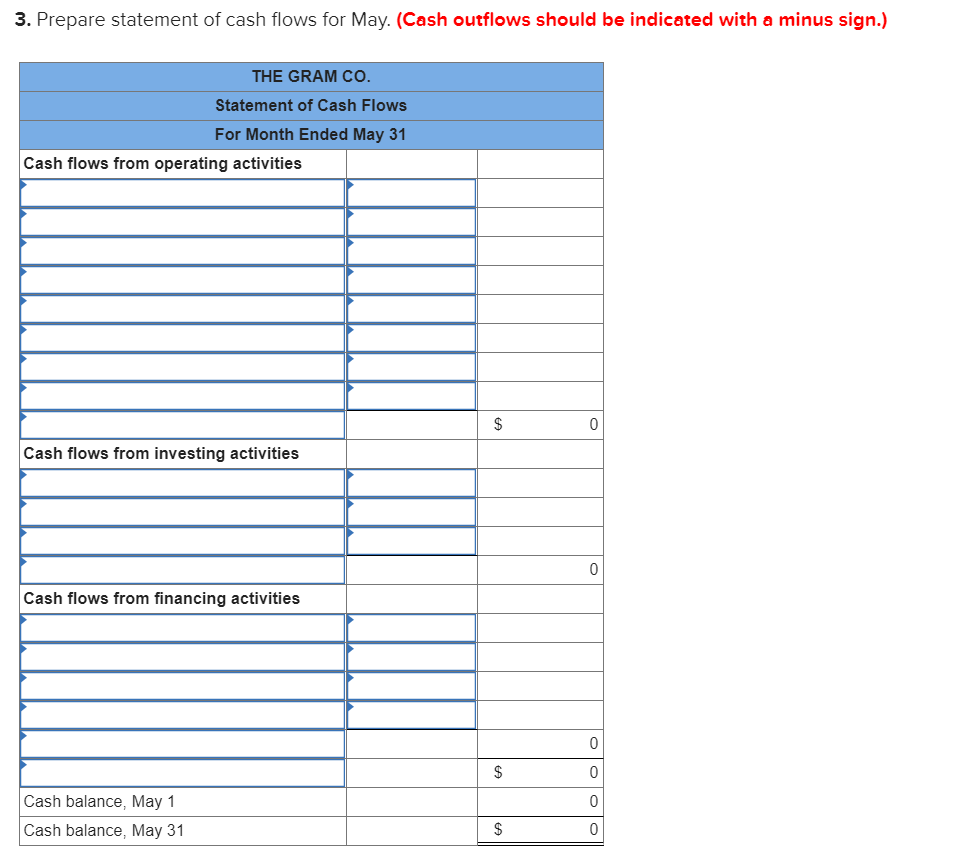

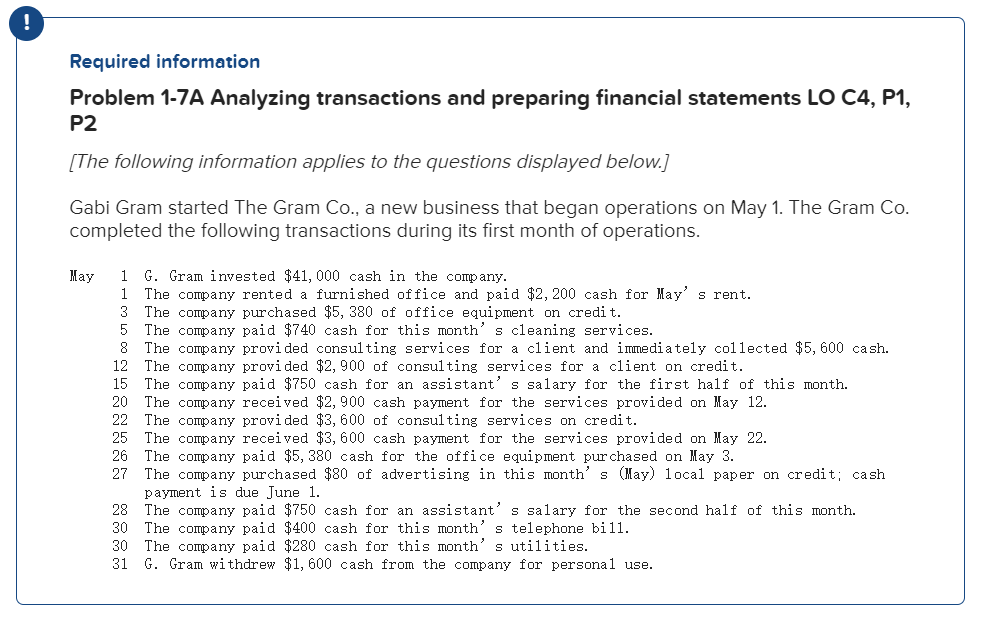

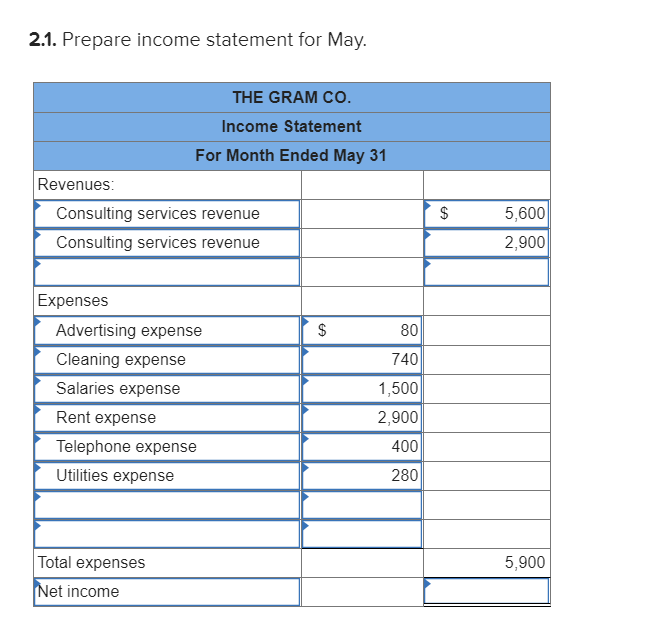

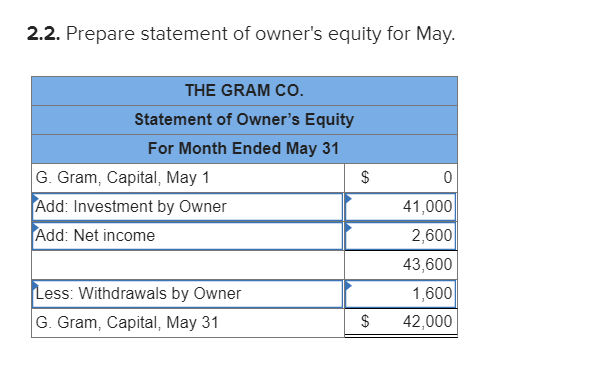

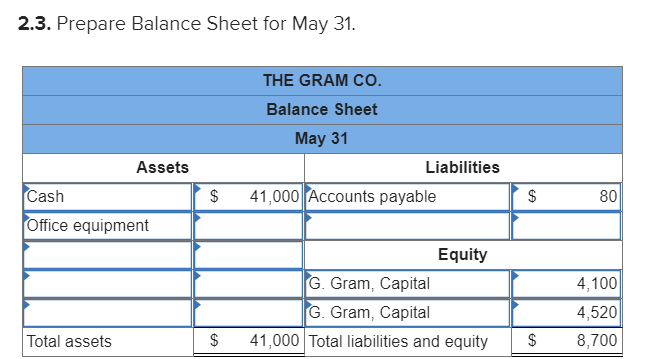

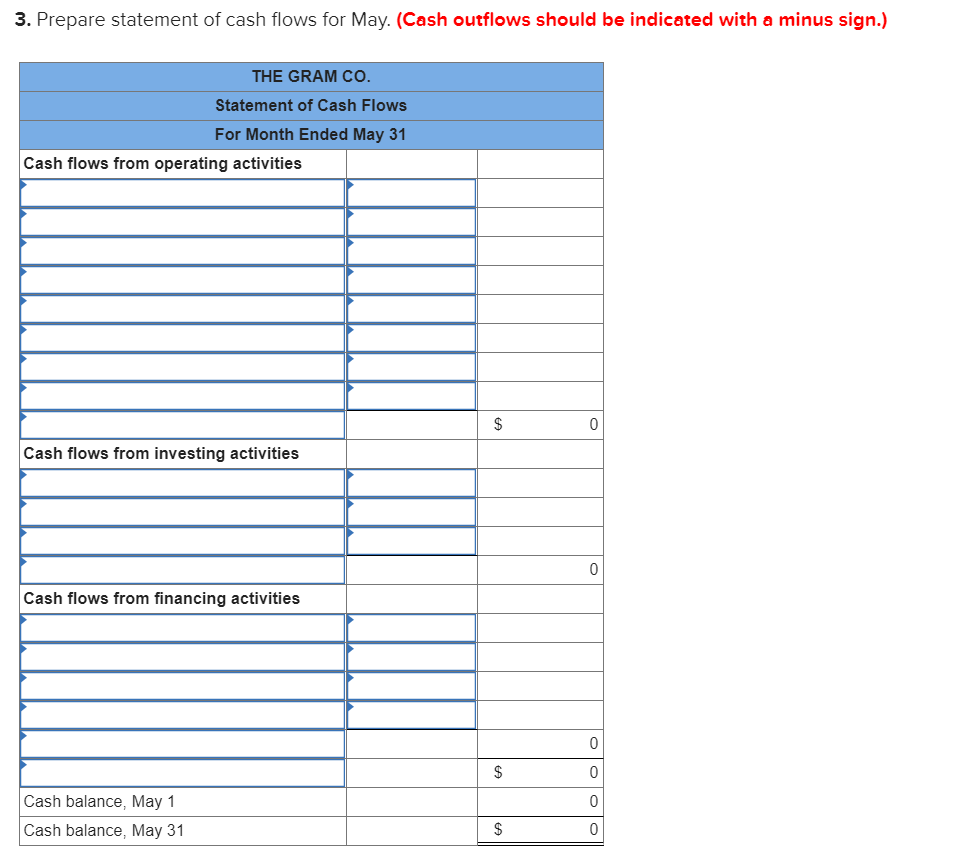

Required information Problem 1-7A Analyzing transactions and preparing financial statements LO C4, P1 P2 [The following information applies to the questions displayed below.] Gabi Gram started The Gram Co., a new business that began operations on May 1. The Gram Co. completed the following transactions during its first month of operations. G. Gram invested $41, 000 cash in the comp any. The company rented a furnished office and paid $2, 200 cash for May s rent The company purchased $5, 380 of office equipment on credit. The company paid $740 cash for this month' s cleaning services. The company provi ded consulting services for a client and immediately collected $5, 600 cash. The company provided $2, 900 of consulting services for a client on credit The company paid $750 cash for an assistant' s salary for the first half of this month The company received $2, 900 cash payment for the services provided on ay 12. The company provided $3, 600 of consulting services on credit. The company received $3, 600 cash payment for the services provided on May 22. The company paid $5, 380 cash for the office equipment purchased on May 3. 27 The company purchased $80 of advertising in this month' s (May 1ocal paper on credit; cash payment is due June 1. 28 y 1 1 3 5 12 15 20 22 25 26 The company paid $750 cash for an assistant' s salary for the second half of this month The company paid $400 cash for this month' s telephone bil1 The company paid $280 cash for this month' s uti1ities. G. Gram withdrew $1, 600 cash from the company for personal use. 30 30 31 2.1. Prepare income statement for May. THE GRAM CO. Income Statement For Month Ended May 31 Revenues: 5,600 Consulting services revenue 2,900 Consulting services revenue Expenses Advertising expense 80 Cleaning expense 740 Salaries expense 1,500 Rent expense 2,900 400 Telephone expense Utilities expense 280 Total expenses 5,900 Net income 2.2. Prepare statement of owner's equity for May. THE GRAM CO. Statement of Owner's Equity For Month Ended May 31 G. Gram, Capital, May 1 0 Add: Investment by Owner 41,000 Add: Net income 2,600 43,600 Less: Withdrawals by Owner 1,600 G. Gram, Capital, May 31 42,000 2.3. Prepare Balance Sheet for May 31. THE GRAM CO. Balance Sheet May 31 Assets Liabilities Cash 41,000 Accounts payable $ 80 Office equipment Equity G. Gram, Capital 4,100 G. Gram, Capital 4,520 41,000 Total liabilities and equity Total assets $ $ 8,700 3. Prepare statement of cash flows for May. (Cash outflows should be indicated with a minus sign.) THE GRAM Co. Statement of Cash Flows For Month Ended May 31 Cash flows from operating activities 0 Cash flows from investing activities 0 Cash flows from financing activities 0 0 Cash balance, May 1 0 Cash balance, May 31 0