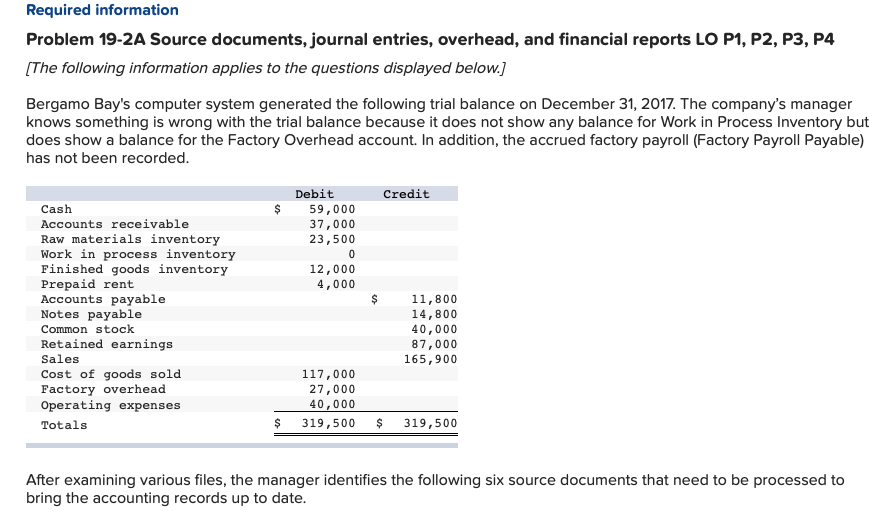

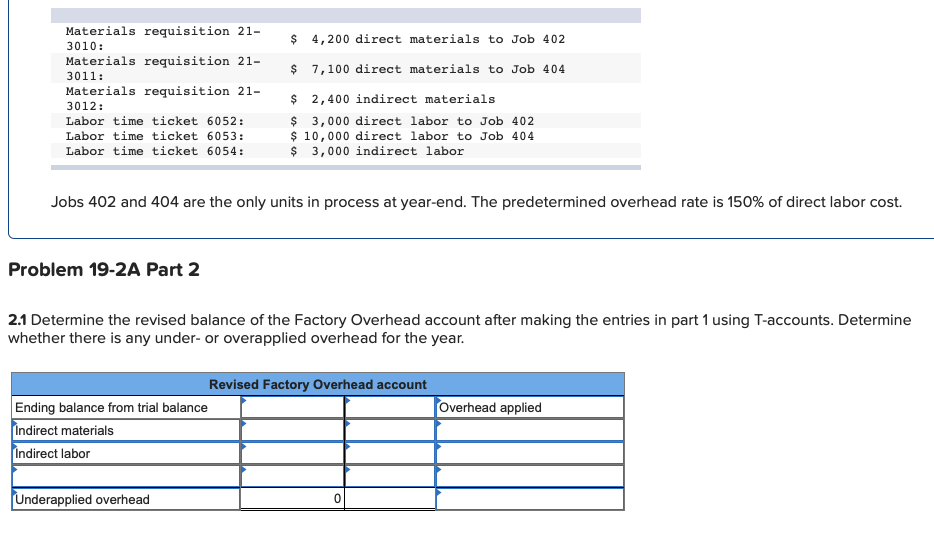

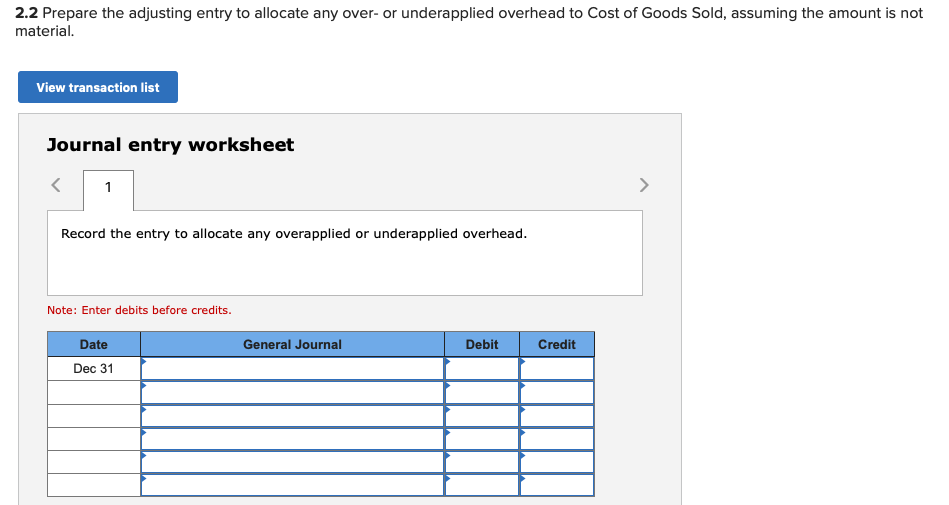

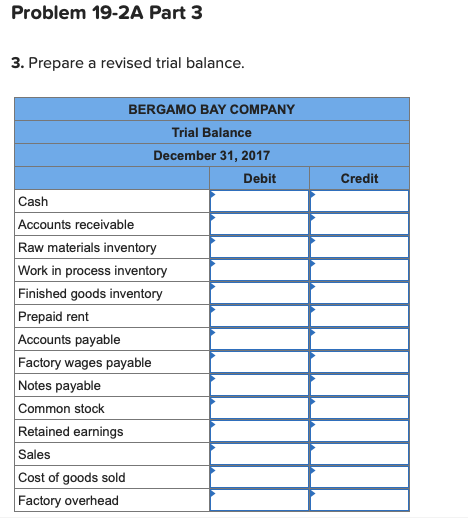

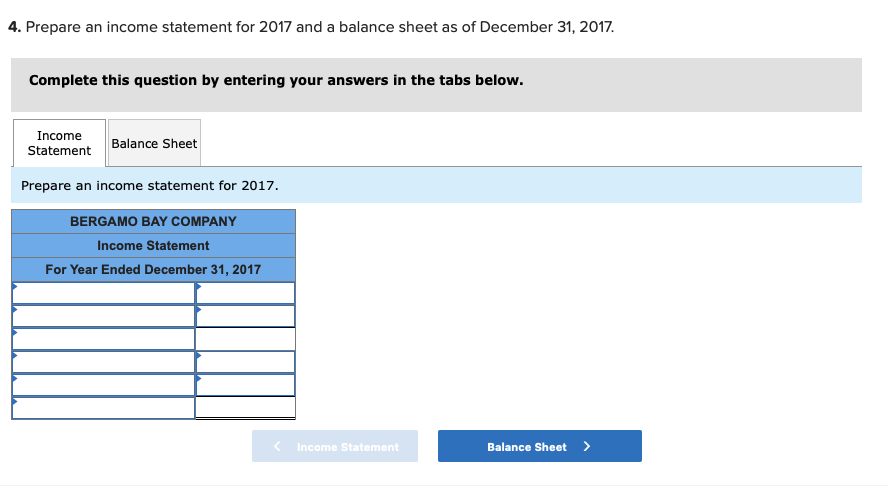

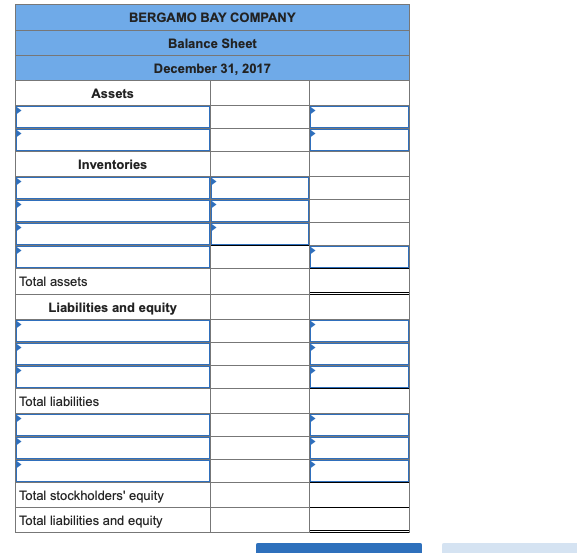

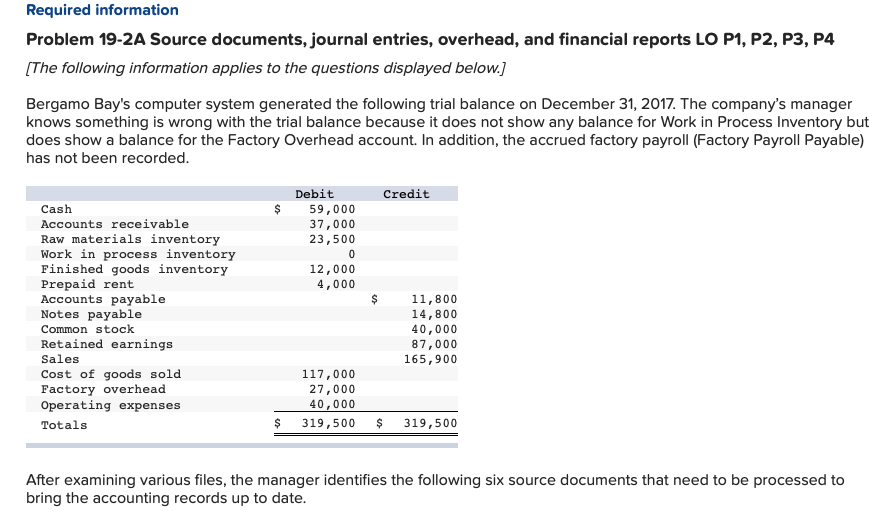

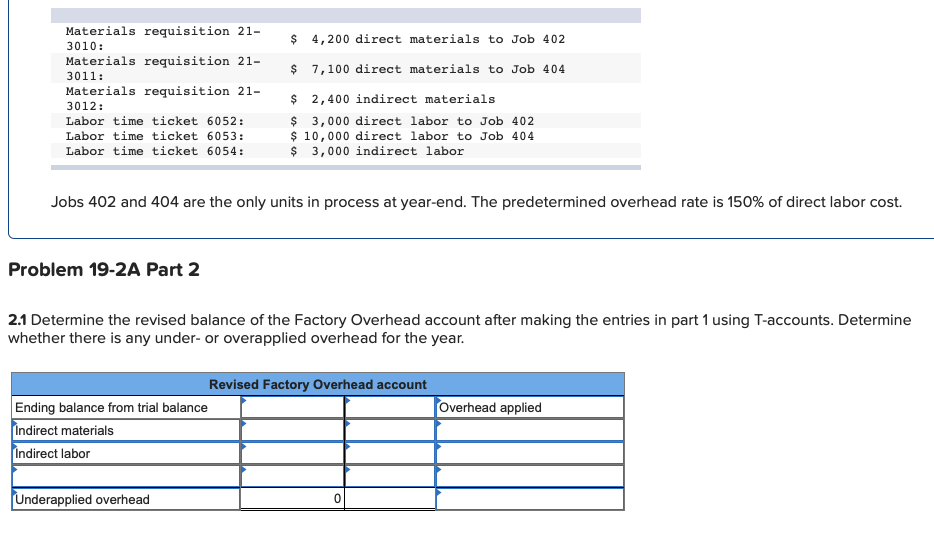

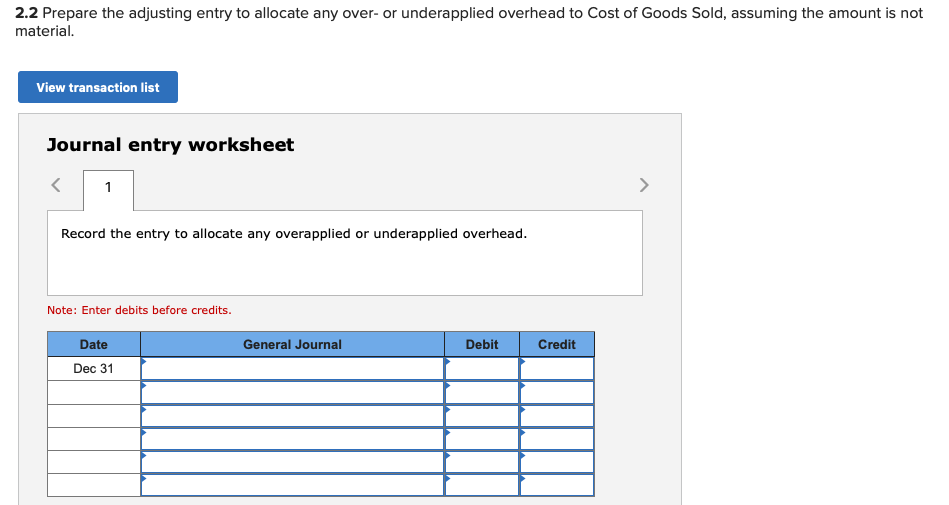

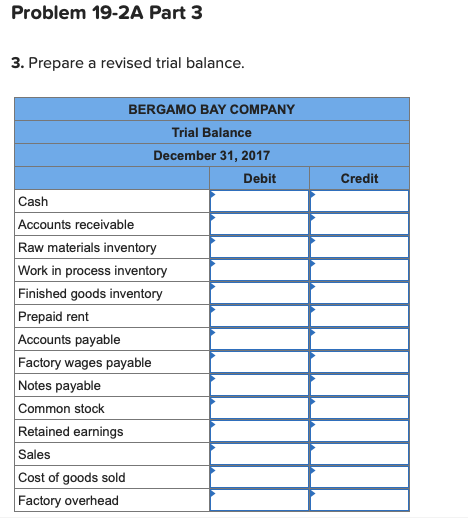

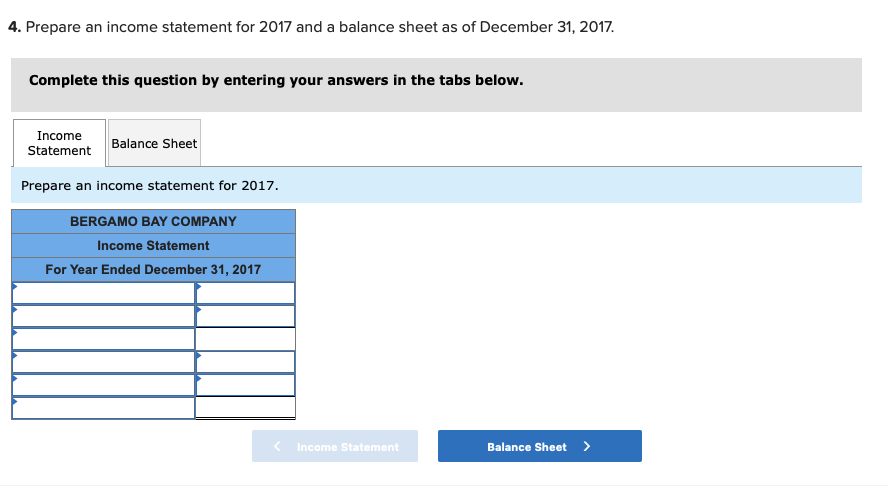

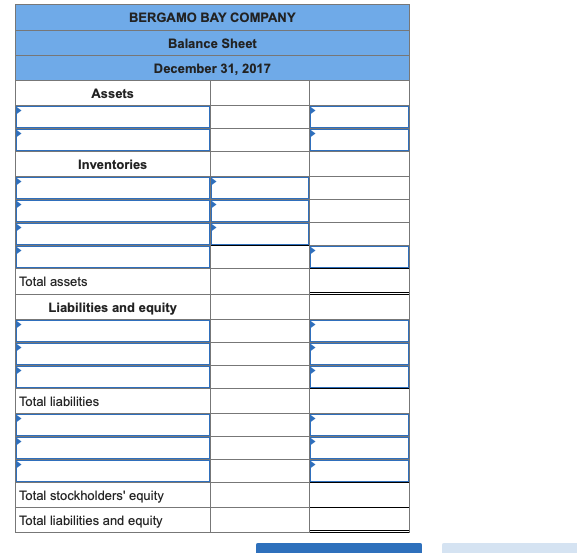

Required information Problem 19-2A Source documents, journal entries, overhead, and financial reports LO P1, P2, P3, P4 [The following information applies to the questions displayed below. Bergamo Bay's computer system generated the following trial balance on December 31, 2017. The company's manager knows something is wrong with the trial balance because it does not show any balance for Work in Process Inventory but does show a balance for the Factory Overhead account. In addition, the accrued factory payroll (Factory Payroll Payable) has not been recorded Debit Credit Cash Accounts receivable Raw materials inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings Sales Cost of goods sold Factory overhead Operating expenses Totals $59,000 37,000 23,500 12,000 4,000 11,800 14,800 40,000 87,000 165,900 117,000 27,000 40,000 $319,500 319,500 After examining various files, the manager identifies the following six source documents that need to be processed to bring the accounting records up to date Materials requisition 21- 3010: Materials requisition 21-s 7,100 direct 3011: Materials requisition 21- 3012: Labor time ticket 6052: Labor time ticket 6053: Labor time ticket 6054 $ 4,200 direct materials to Job 402 materials to Job 404 $ 2,400 indirect materials $ 3,000 direct labor to Job 402 10,000 direct labor to Job 404 $ 3,000 indirect labor Jobs 402 and 404 are the only units in process at year-end. The predetermined overhead rate is 150% of direct labor cost. Problem 19-2A Part 2 2.1 Determine the revised balance of the Factory Overhead account after making the entries in part 1 using T-accounts. Determine whether there is any under- or overapplied overhead for the year Revised Factory Overhead account Overhead applied Ending balance from trial balance Indirect materials Indirect labor Underapplied overhead 2.2 Prepare the adjusting entry to allocate any over-or underapplied overhead to Cost of Goods Sold, assuming the amount is not material View transaction list Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead Note: Enter debits before credits. Date General Journal Credit Debit Dec 31 Problem 19-2A Part 3 3. Prepare a revised trial balance BERGAMO BAY COMPANY Trial Balance December 31, 2017 Debit Credit Cash Accounts receivable Raw materials inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Factory wages payable Notes payable Common stock Retained earnings Sales Cost of goods sold Factory overhead 4. Prepare an income statement for 2017 and a balance sheet as of December 31, 2017. Complete this question by entering your answers in the tabs below. Income StatementBalance Sheet Prepare an income statement for 2017. BERGAMO BAY COMPANY Income Statement For Year Ended December 31, 2017 Balance Sheet > Income Statement BERGAMO BAY COMPANY Balance Sheet December 31, 2017 Assets Inventories Total assets Liabilities and equity Total liabilities Total stockholders' equity Total liabilities and equity