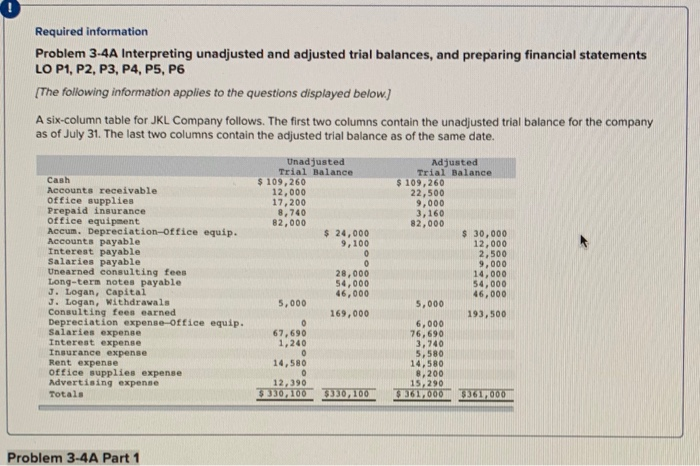

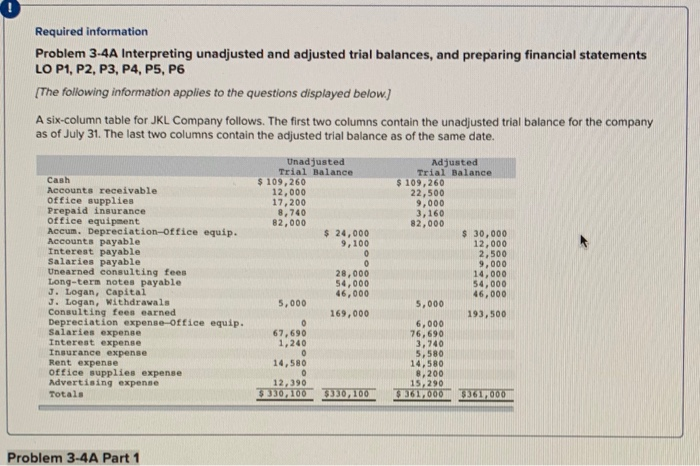

Required information Problem 3-4A Interpreting unadjusted and adjusted trial balances, and preparing financial statements LO P1, P2, P3, P4, P5, P6 (The following information applies to the questions displayed below.) A six-column table for JKL Company follows. The first two columns contain the unadjusted trial balance for the company as of July 31. The last two columns contain the adjusted trial balance as of the same date. Unadjusted Adjusted Trial Balance Trial Balance Cash $ 109,260 $ 109,260 Accounts receivable 12,000 22,500 Office supplies 17,200 9,000 Prepaid insurance 8,740 3,160 office equipment 82,000 82,000 Accum. Depreciation office equip. $ 24,000 $ 30,000 Accounts payable 9,100 12,000 Interest payable 0 2,500 Salaries payable 0 9,000 Unearned consulting fees 28,000 14,000 Long-term notes payable 54,000 54,000 J. Logan, Capital 46,000 46,000 J. Logan, withdrawals 5,000 5,000 Consulting fees earned 169,000 193,500 Depreciation expense-office equip. 6,000 Salaries expense 67,690 76,690 Interest expense 1,240 3,740 Insurance expense 5,580 Rent expense 14,580 14,580 office supplies expense 8,200 Advertising expense 12,390 15,290 Totals $30, 100 $330,100 $361,000 3361,000 0 0 0 Problem 3-4A Part 1 Required information Problem 3-4A Interpreting unadjusted and adjusted trial balances, and preparing financial statements LO P1, P2, P3, P4, P5, P6 (The following information applies to the questions displayed below.) A six-column table for JKL Company follows. The first two columns contain the unadjusted trial balance for the company as of July 31. The last two columns contain the adjusted trial balance as of the same date. Unadjusted Adjusted Trial Balance Trial Balance Cash $ 109,260 $ 109,260 Accounts receivable 12,000 22,500 Office supplies 17,200 9,000 Prepaid insurance 8,740 3,160 office equipment 82,000 82,000 Accum. Depreciation office equip. $ 24,000 $ 30,000 Accounts payable 9,100 12,000 Interest payable 0 2,500 Salaries payable 0 9,000 Unearned consulting fees 28,000 14,000 Long-term notes payable 54,000 54,000 J. Logan, Capital 46,000 46,000 J. Logan, withdrawals 5,000 5,000 Consulting fees earned 169,000 193,500 Depreciation expense-office equip. 6,000 Salaries expense 67,690 76,690 Interest expense 1,240 3,740 Insurance expense 5,580 Rent expense 14,580 14,580 office supplies expense 8,200 Advertising expense 12,390 15,290 Totals $30, 100 $330,100 $361,000 3361,000 0 0 0 Problem 3-4A