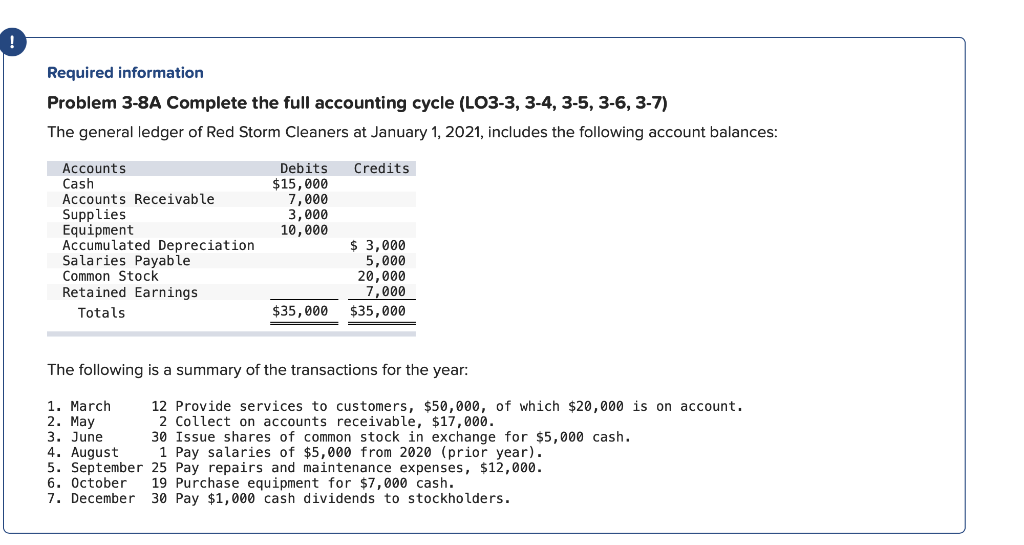

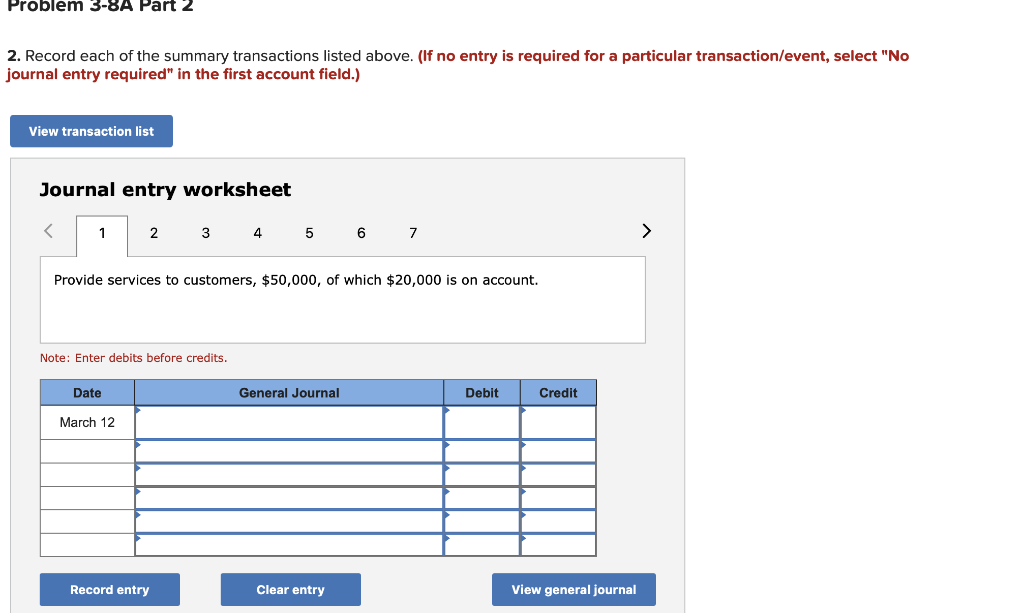

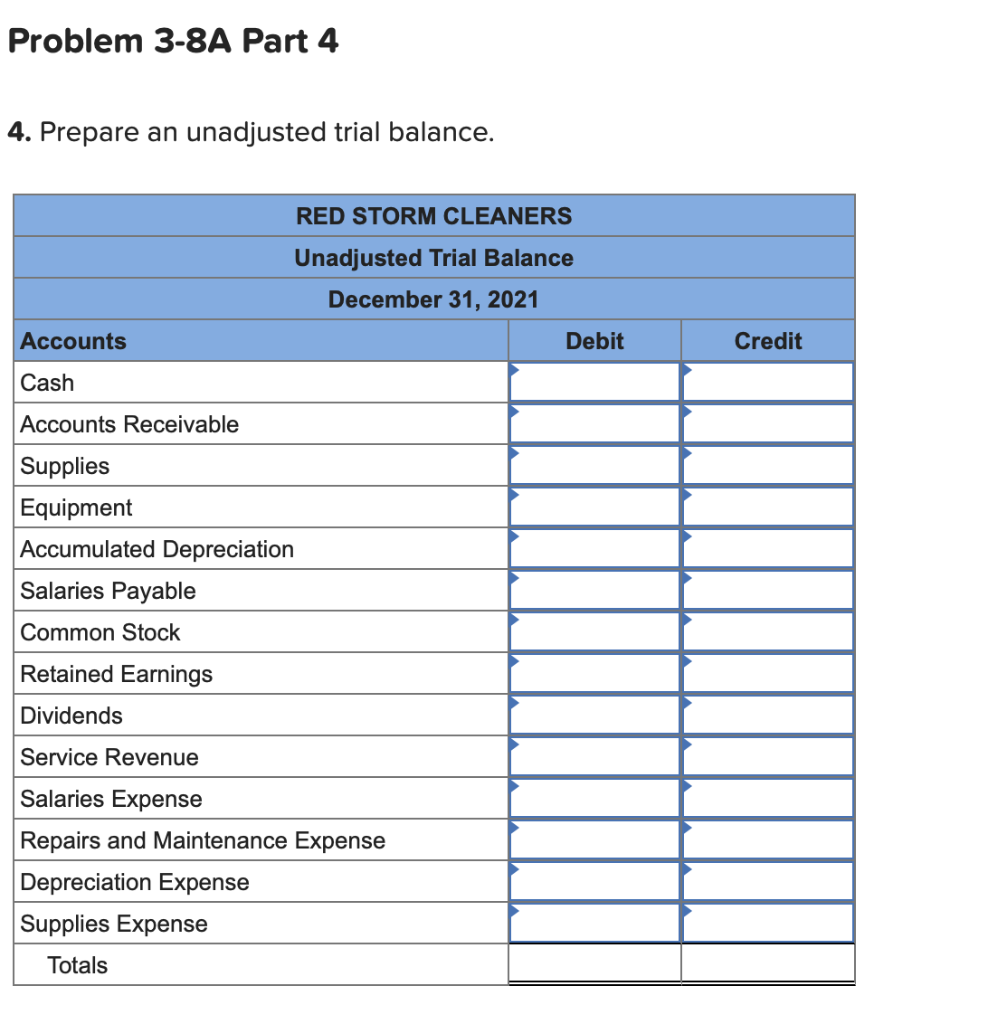

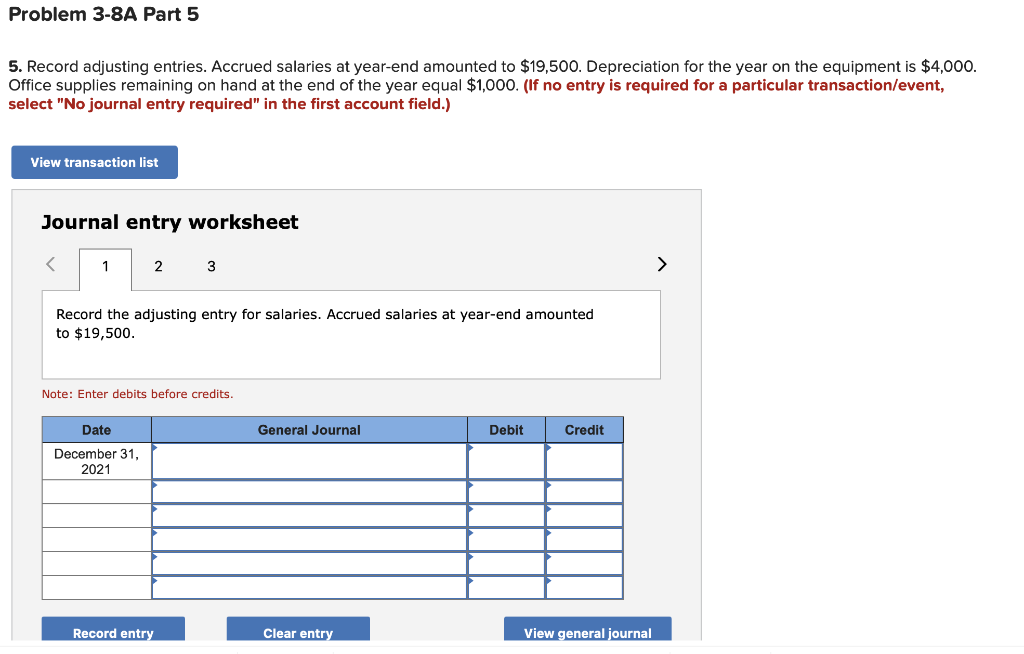

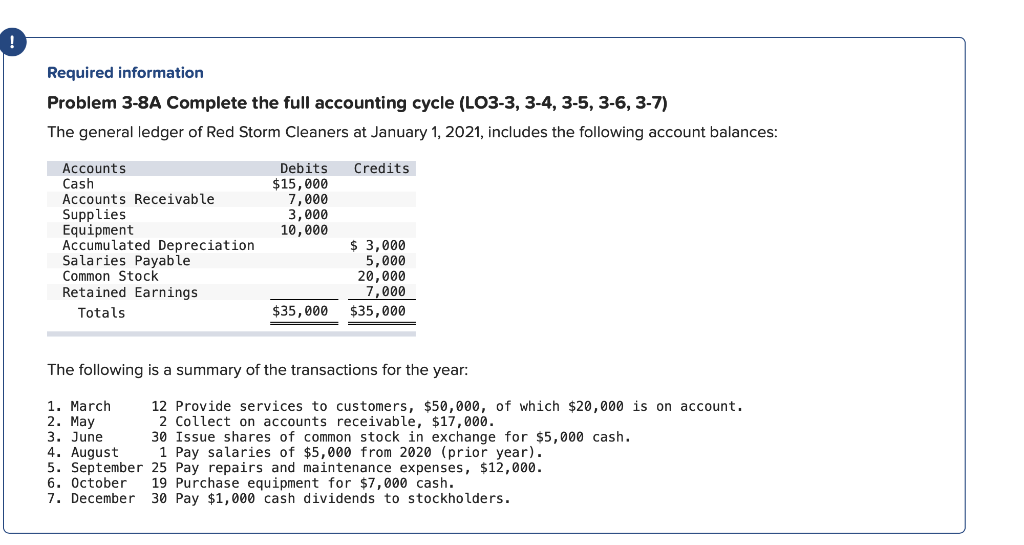

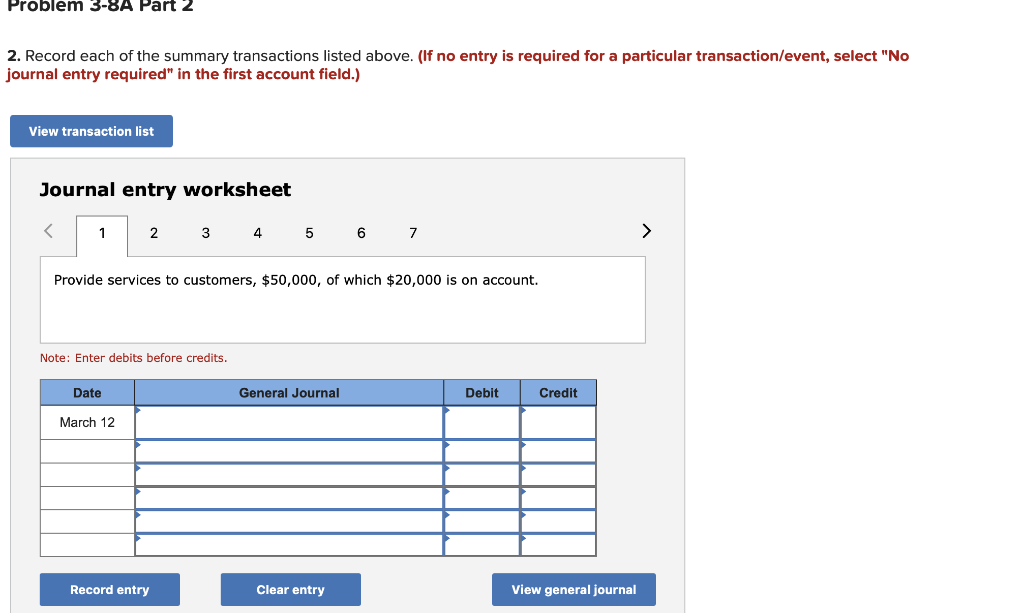

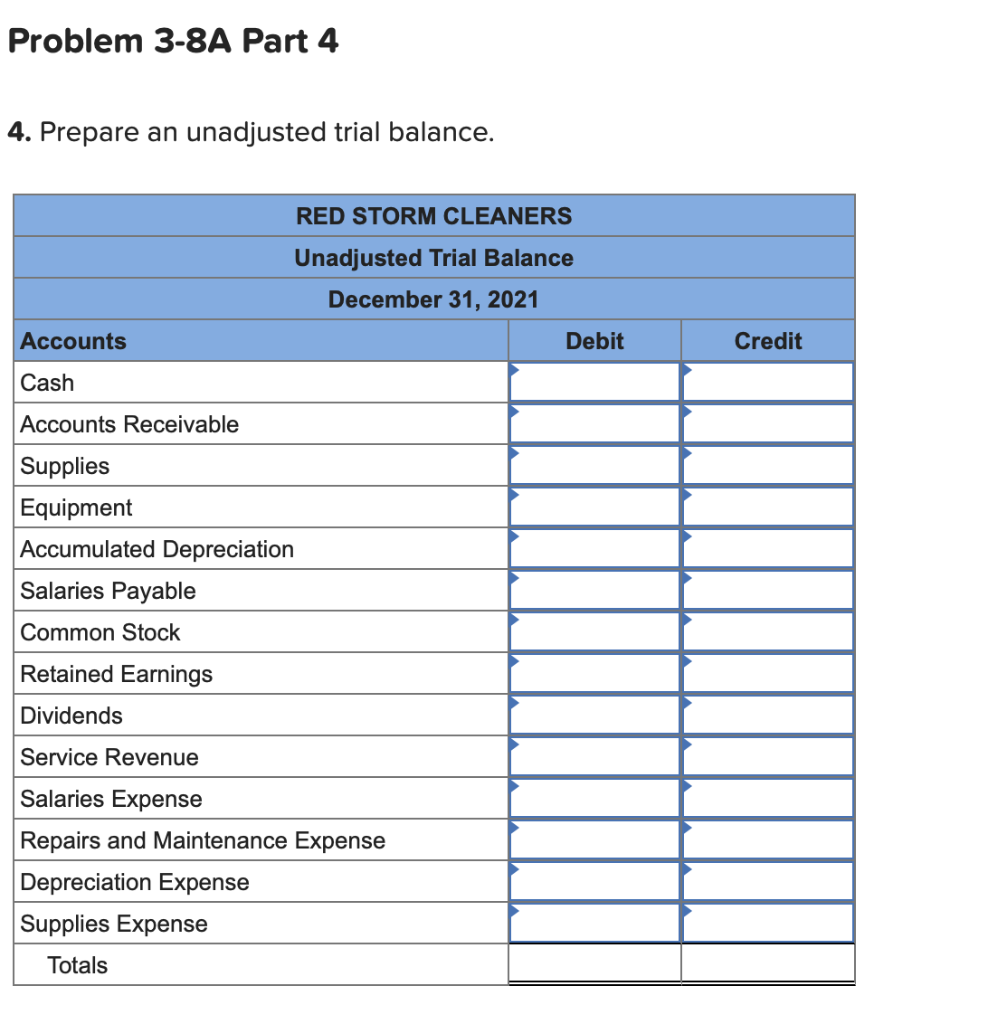

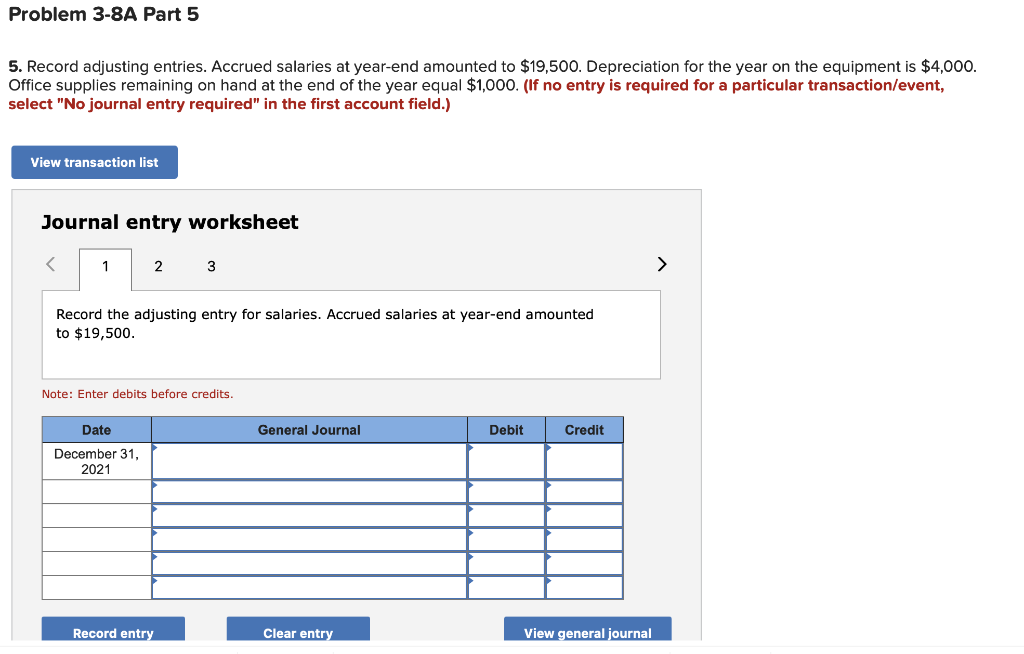

! Required information Problem 3-8A Complete the full accounting cycle (L03-3, 3-4, 3-5, 3-6, 3-7) The general ledger of Red Storm Cleaners at January 1, 2021, includes the following account balances: Credits Debits $15,000 7,000 3,000 10,000 Accounts Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Salaries Payable Common Stock Retained Earnings Totals $ 3,000 5,000 20,000 7,000 $35,000 $35,000 The following is a summary of the transactions for the year: 1. March 12 Provide services to customers, $50,000, of which $20,000 is on account. 2. May 2 Collect on accounts receivable, $17,000. 3. June 30 Issue shares of common stock in exchange for $5,000 cash. 4. August 1 Pay salaries of $5,000 from 2020 (prior year). 5. September 25 Pay repairs and maintenance expenses, $12,000. 6. October 19 Purchase equipment for $7,000 cash. 7. December 30 Pay $1,000 cash dividends to stockholders. Problem 3-8A Part 2 2. Record each of the summary transactions listed above. (If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Provide services to customers, $50,000, of which $20,000 is on account. Note: Enter debits before credits. Date General Journal Debit Credit March 12 Record entry Clear entry View general journal Problem 3-8A Part 4 4. Prepare an unadjusted trial balance. RED STORM CLEANERS Unadjusted Trial Balance December 31, 2021 Debit Accounts Credit Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Salaries Payable Common Stock Retained Earnings Dividends Service Revenue Salaries Expense Repairs and Maintenance Expense Depreciation Expense Supplies Expense Totals Problem 3-8A Part 5 5. Record adjusting entries. Accrued salaries at year-end amounted to $19,500. Depreciation for the year on the equipment is $4,000. Office supplies remaining on hand at the end of the year equal $1,000. (If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for salaries. Accrued salaries at year-end amounted to $19,500. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general journal