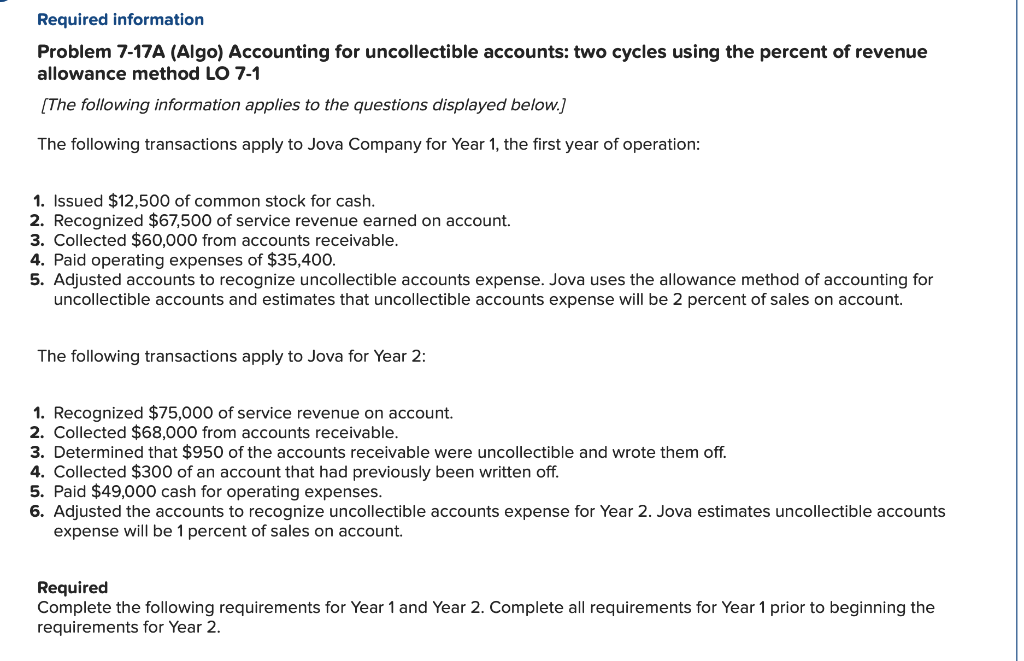

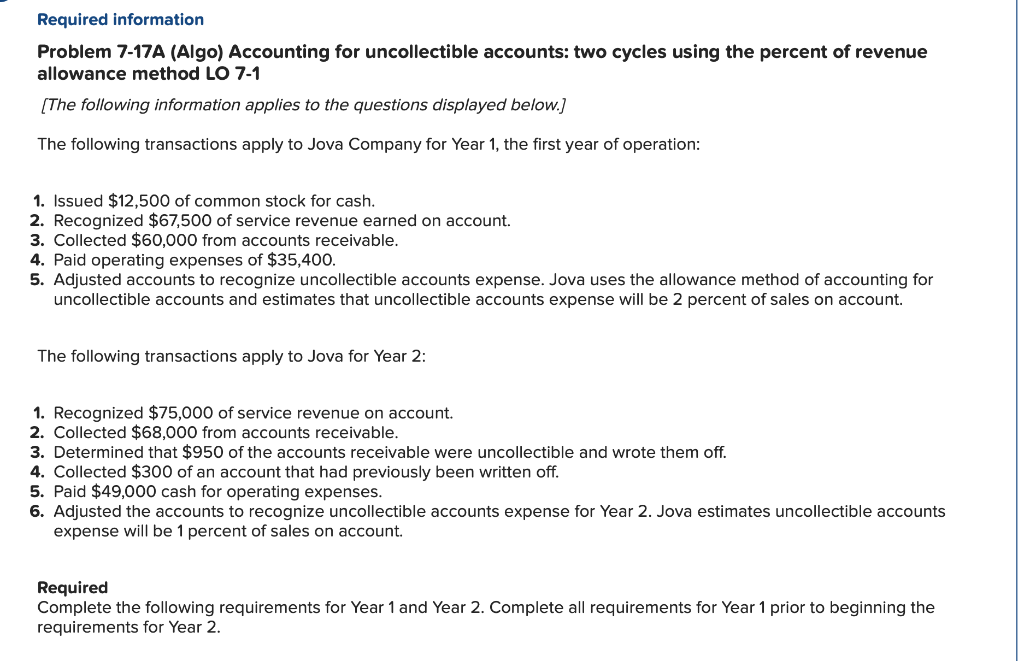

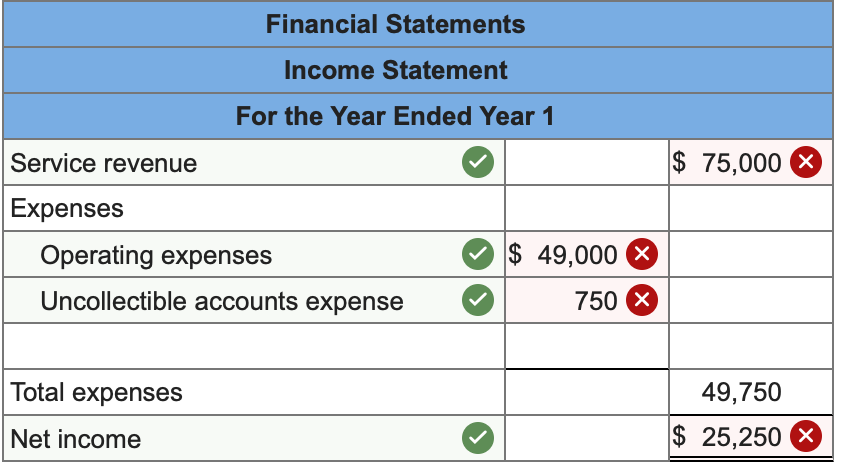

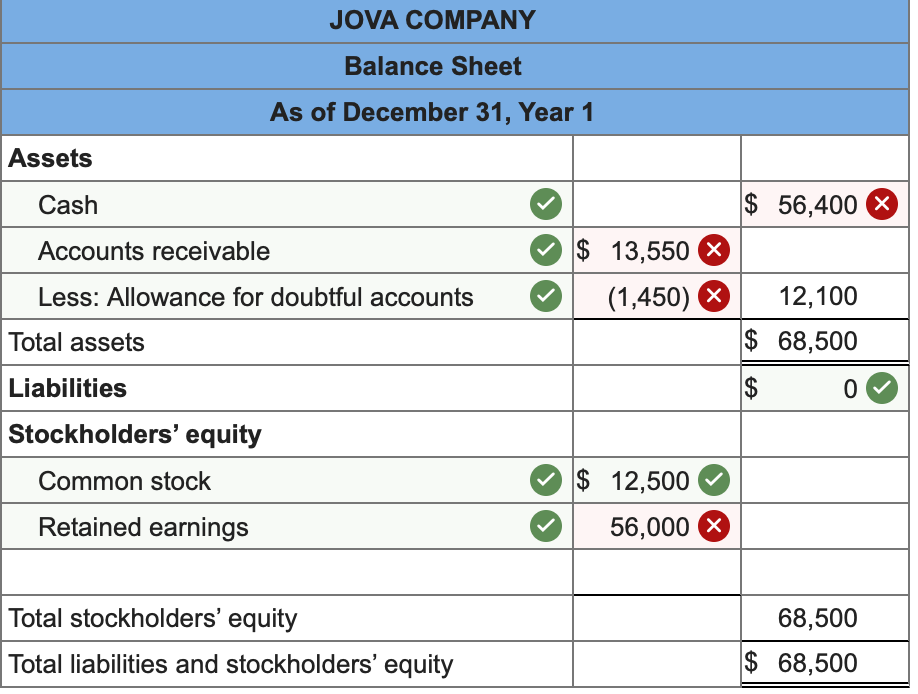

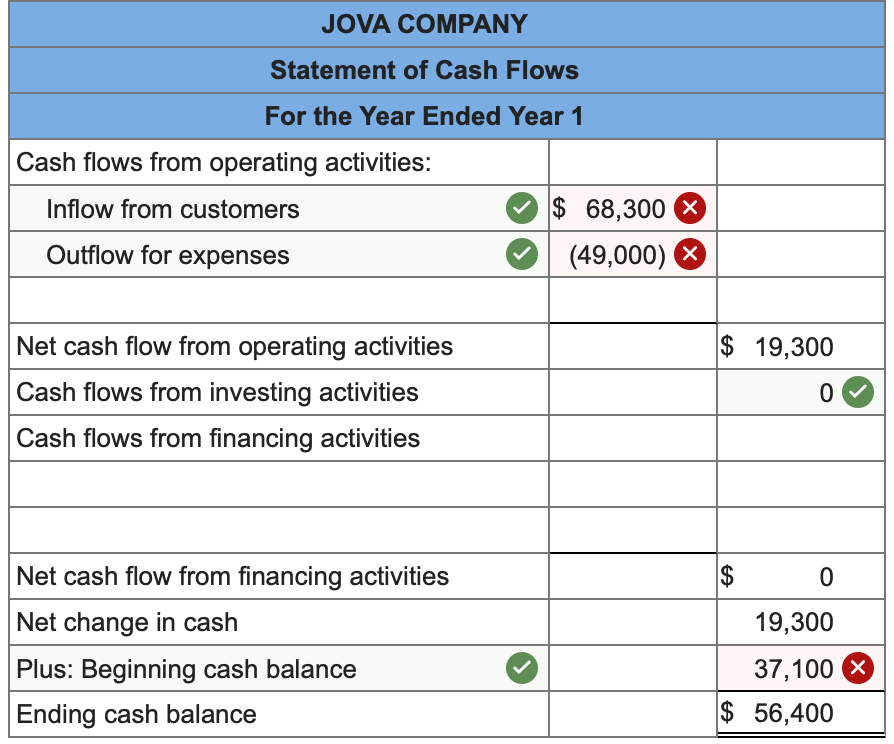

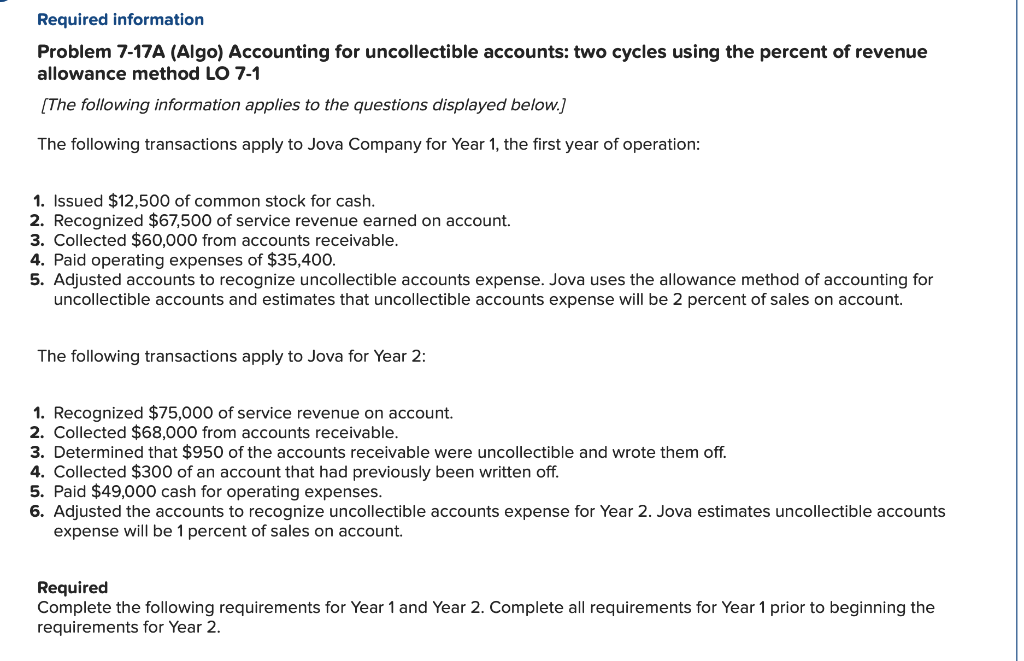

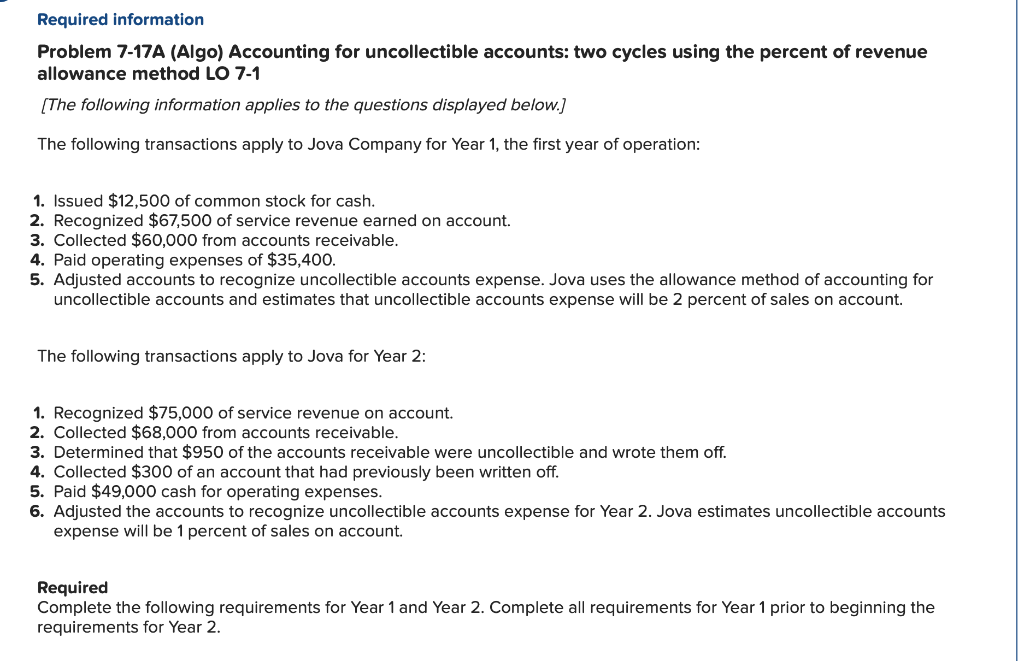

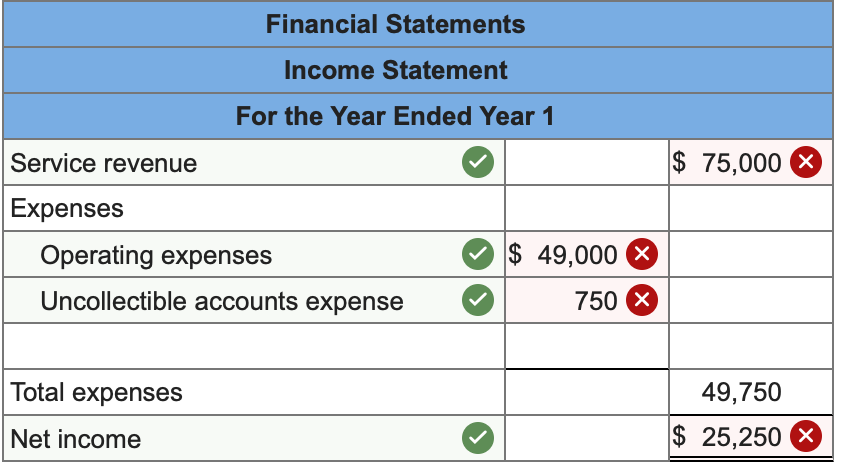

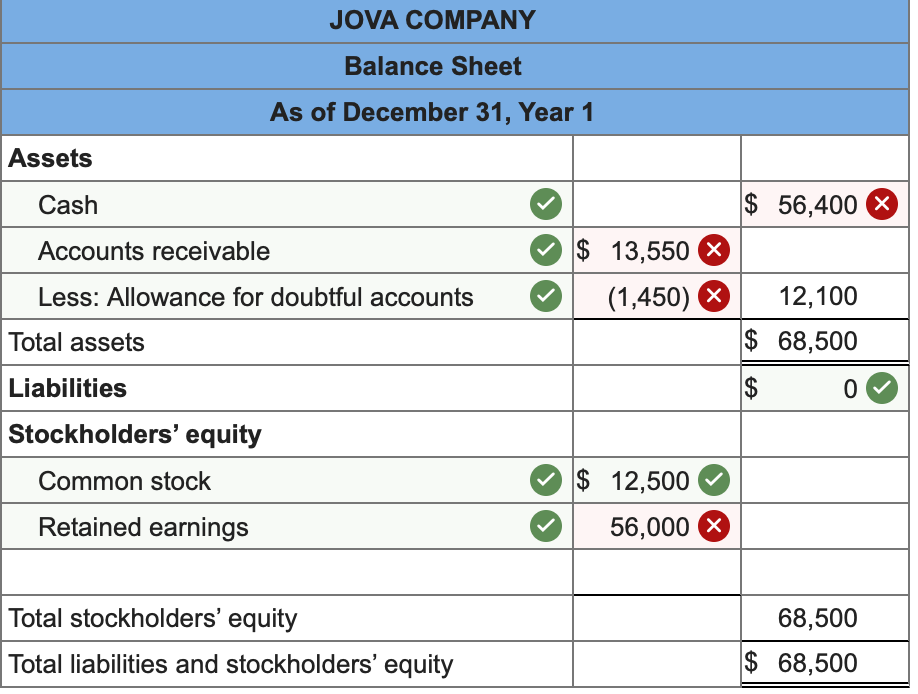

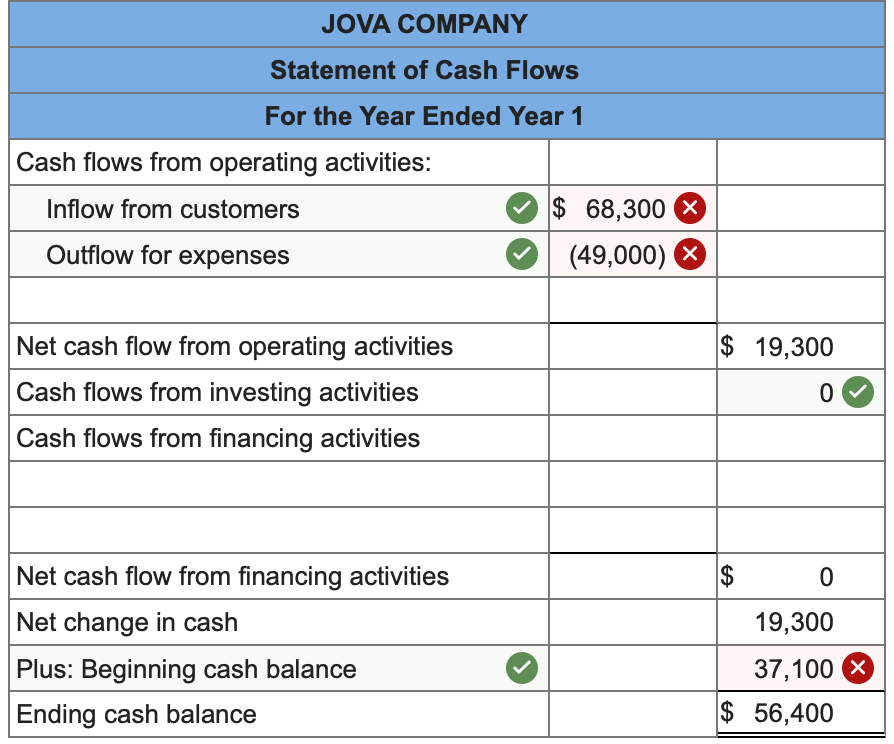

Required information Problem 7-17A (Algo) Accounting for uncollectible accounts: two cycles using the percent of revenue allowance method LO 7-1 (The following information applies to the questions displayed below. The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $12,500 of common stock for cash. 2. Recognized $67,500 of service revenue earned on account. 3. Collected $60,000 from accounts receivable. 4. Paid operating expenses of $35,400. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $75,000 of service revenue on account. 2. Collected $68,000 from accounts receivable. 3. Determined that $950 of the accounts receivable were uncollectible and wrote them off. 4. Collected $300 of an account that had previously been written off. 5. Paid $49,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1 percent of sales on account. Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. Required information Problem 7-17A (Algo) Accounting for uncollectible accounts: two cycles using the percent of revenue allowance method LO 7-1 (The following information applies to the questions displayed below. The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $12,500 of common stock for cash. 2. Recognized $67,500 of service revenue earned on account. 3. Collected $60,000 from accounts receivable. 4. Paid operating expenses of $35,400. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $75,000 of service revenue on account. 2. Collected $68,000 from accounts receivable. 3. Determined that $950 of the accounts receivable were uncollectible and wrote them off. 4. Collected $300 of an account that had previously been written off. 5. Paid $49,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1 percent of sales on account. Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. Financial Statements Income Statement For the Year Ended Year 1 Service revenue $ 75,000 X Expenses Operating expenses Uncollectible accounts expense $ 49,000 X 750 x Total expenses 49,750 $ 25,250 X Net income JOVA COMPANY Balance Sheet As of December 31, Year 1 Assets Cash Accounts receivable Less: Allowance for doubtful accounts $ 56,400 X $ 13,550 X (1,450) X 12,100 $ 68,500 $ 0 Total assets Liabilities Stockholders' equity Common stock $ 12,500 56,000 X Retained earnings 68,500 Total stockholders' equity Total liabilities and stockholders' equity $ 68,500