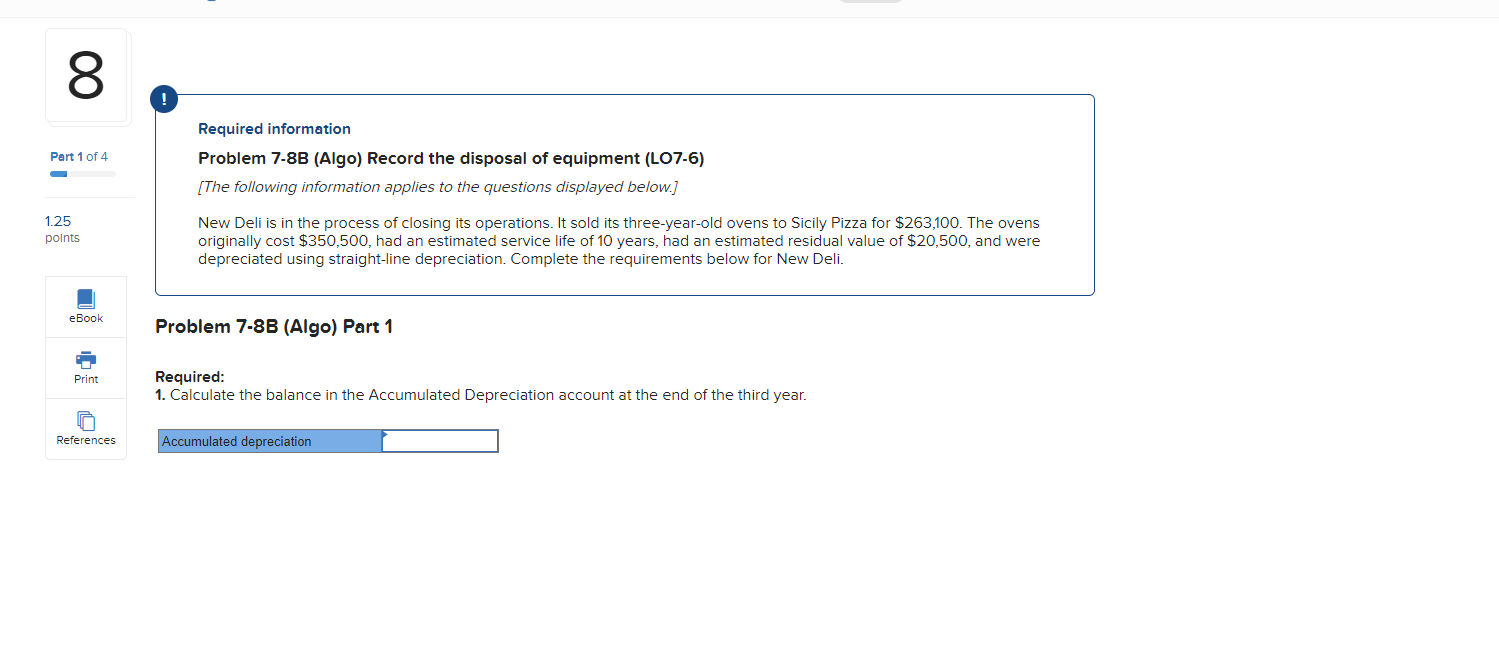

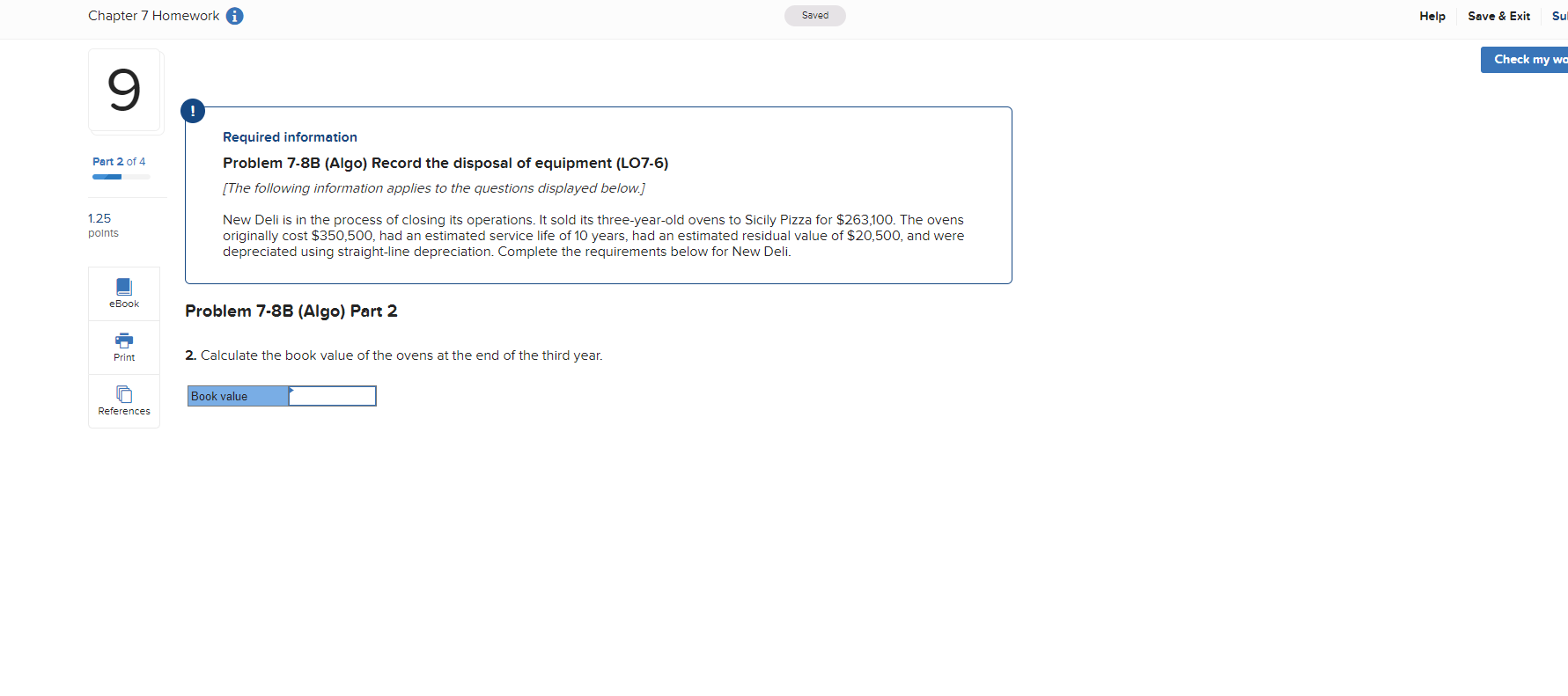

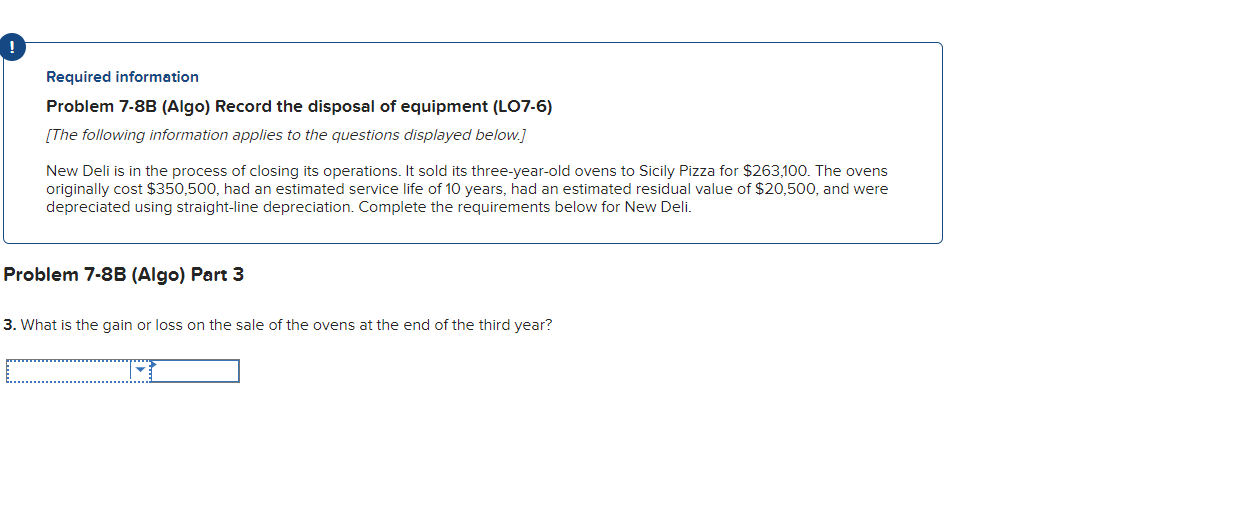

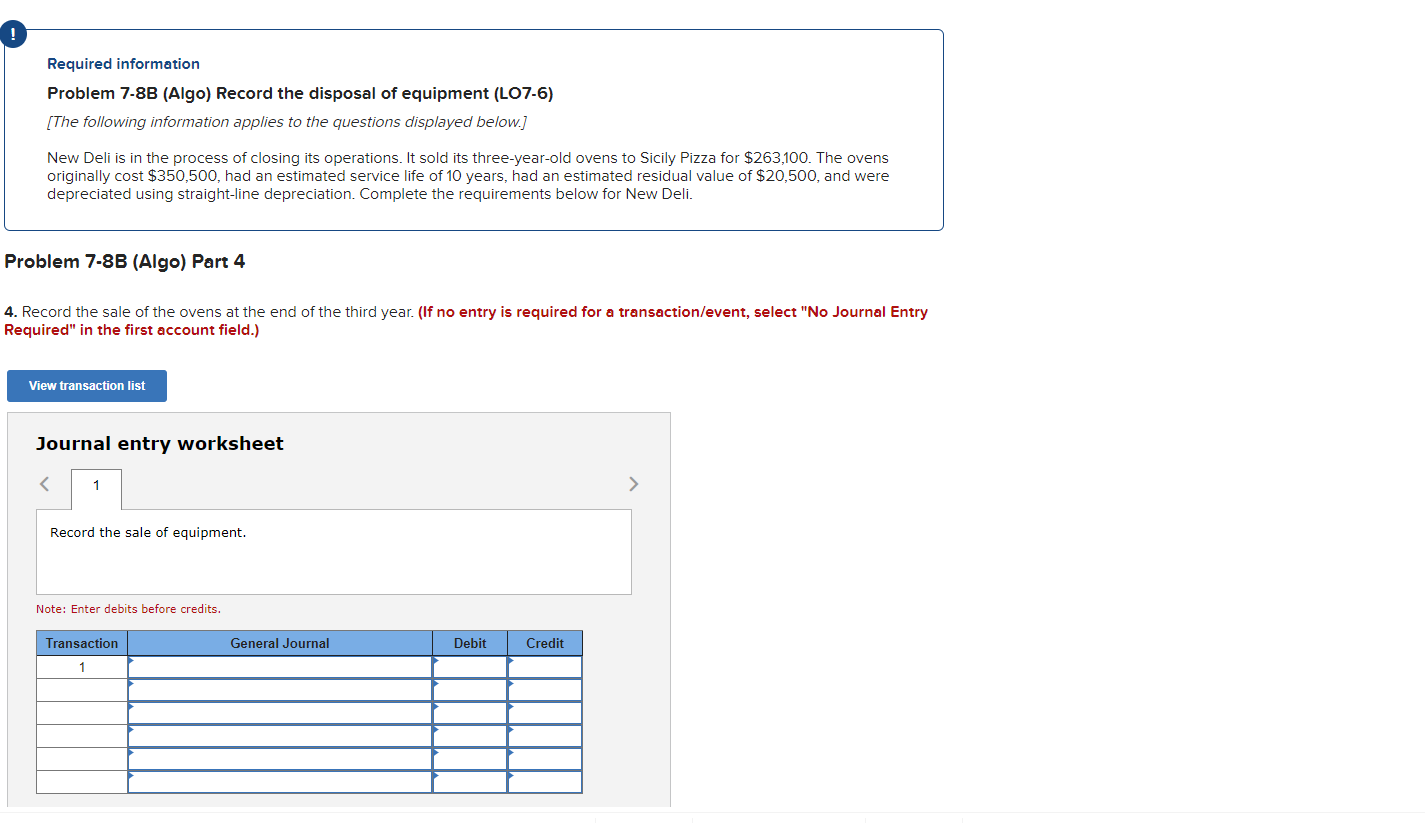

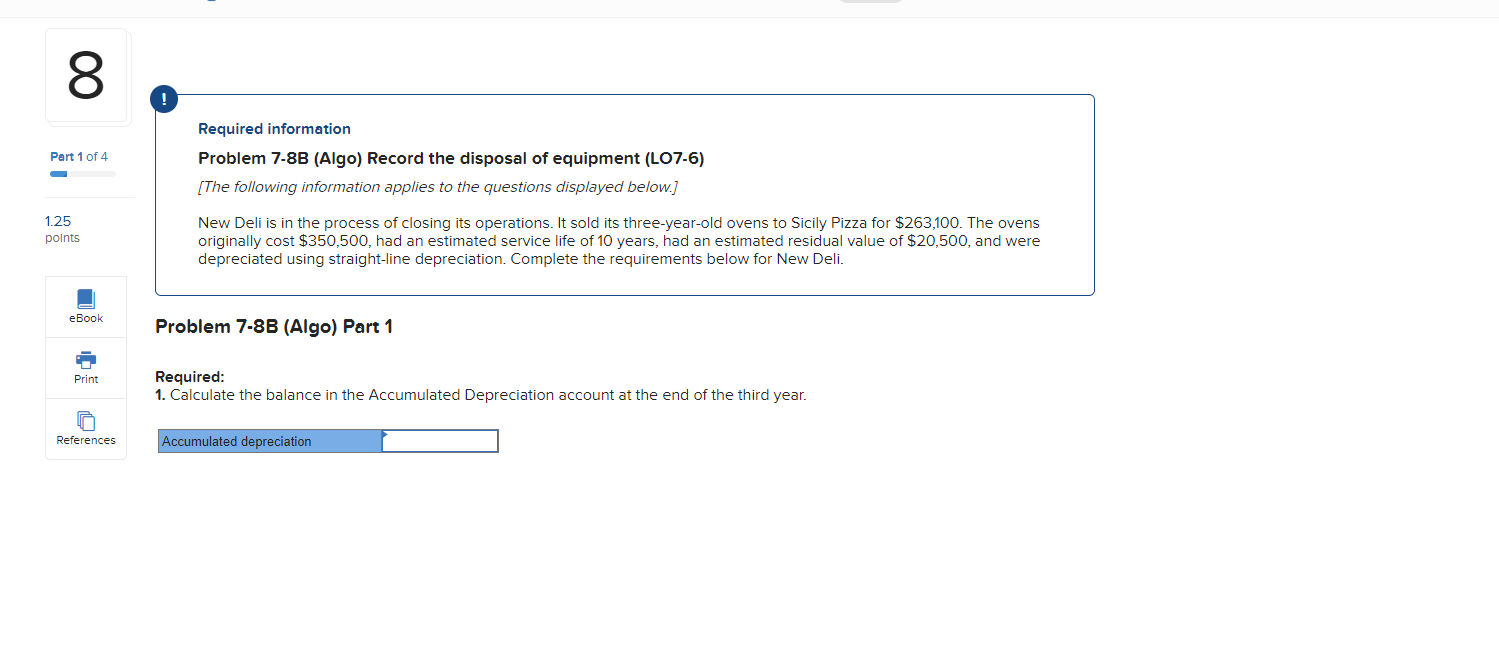

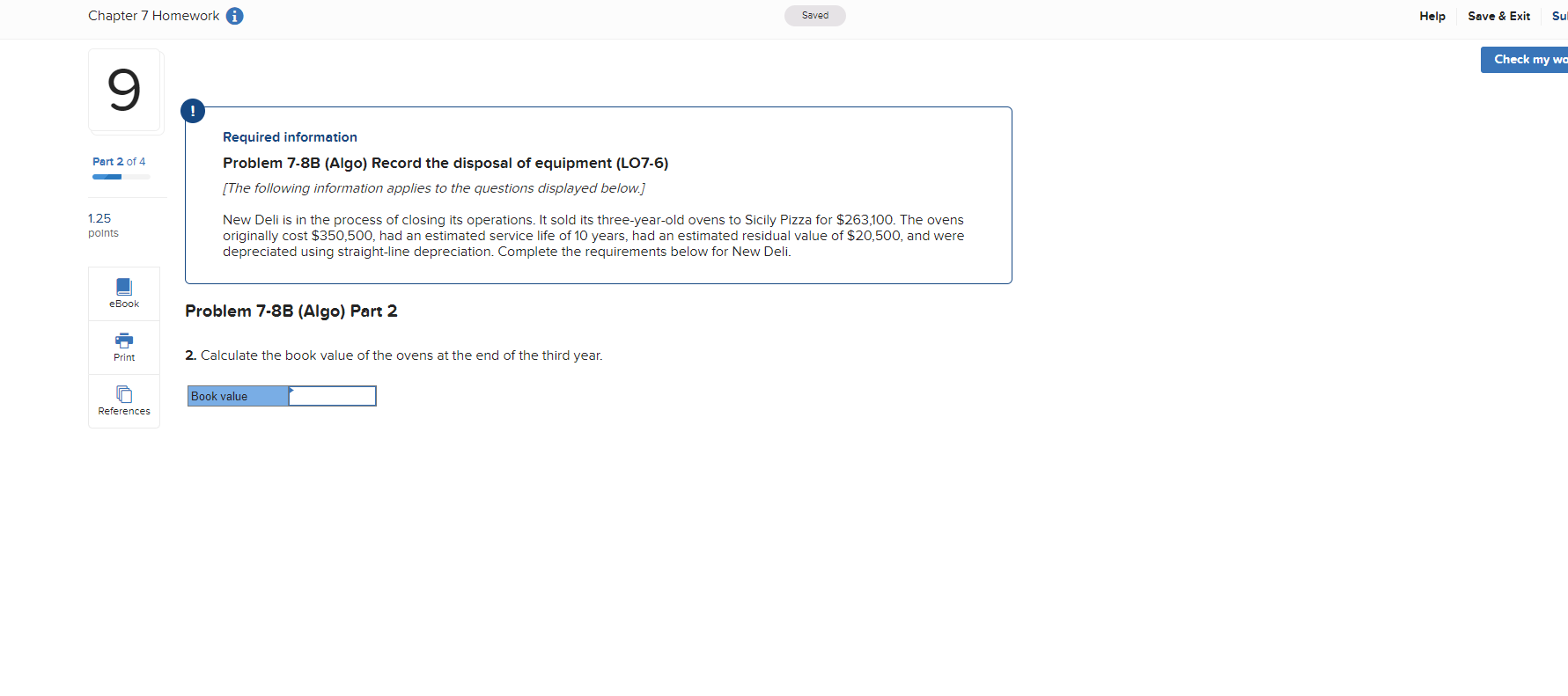

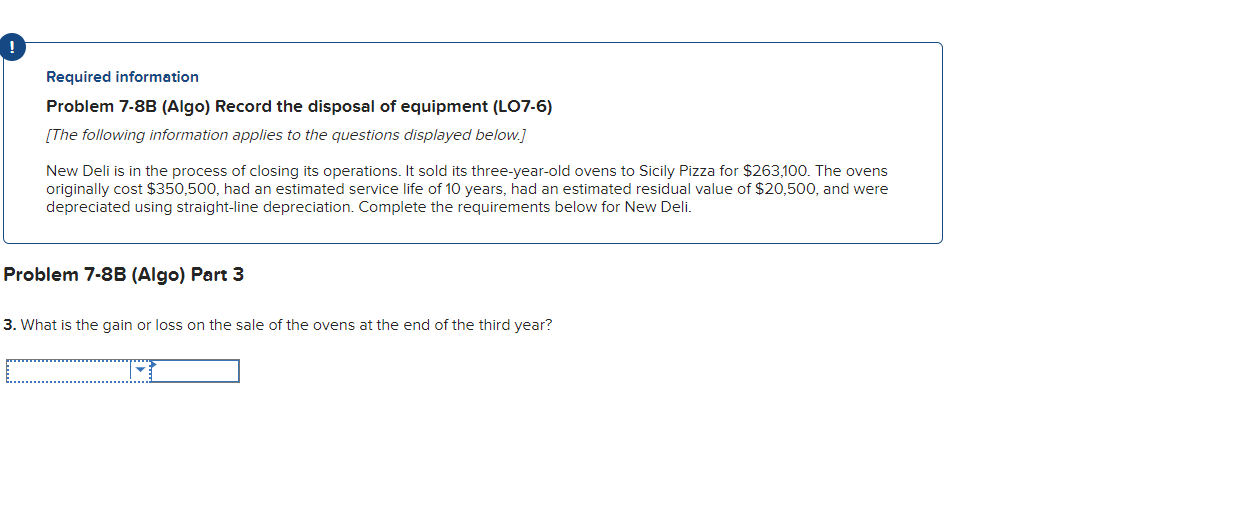

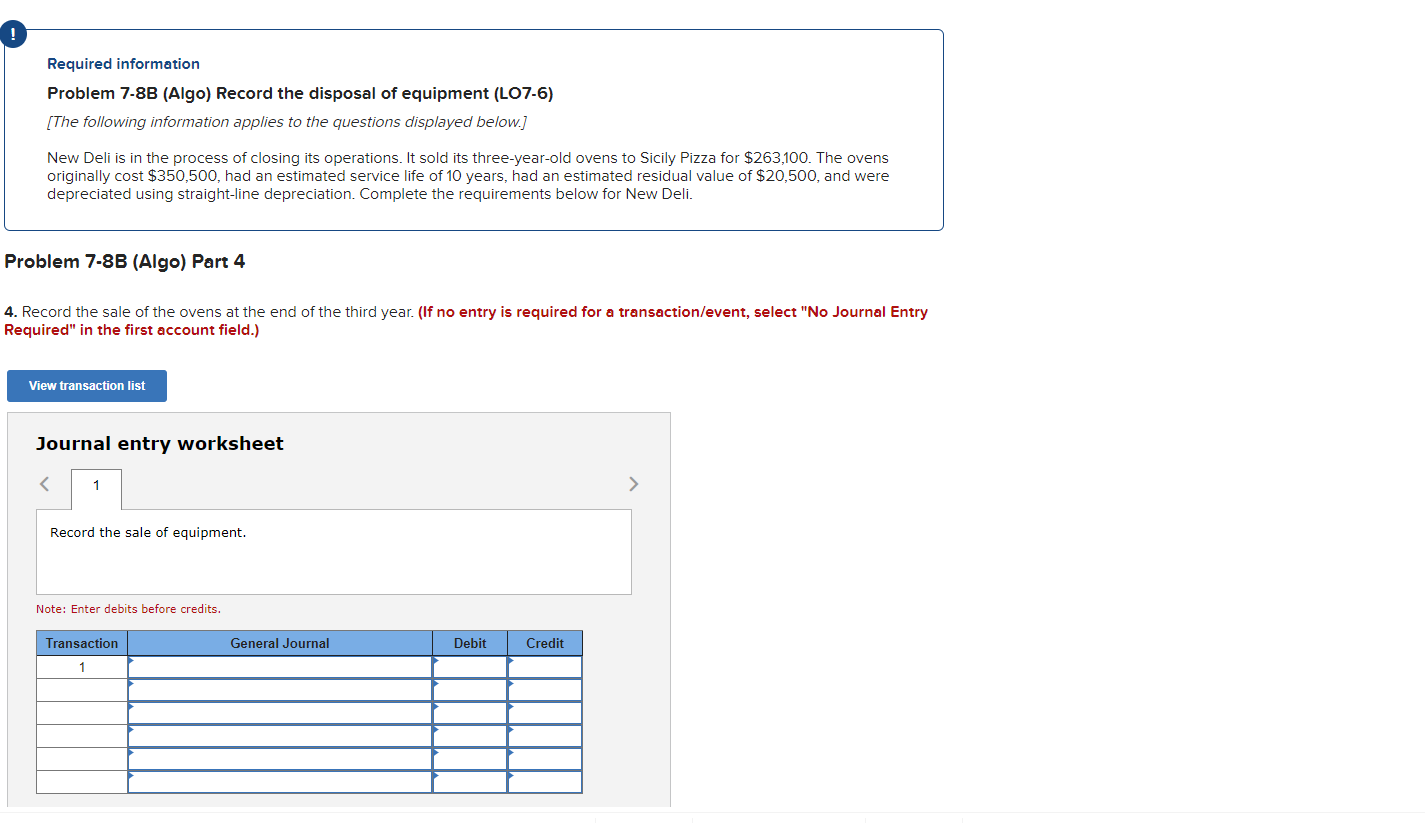

Required information Problem 7-8B (Algo) Record the disposal of equipment (LO7-6) [The following information applies to the questions displayed below.] New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $263,100. The ovens originally cost $350,500, had an estimated service life of 10 years, had an estimated residual value of $20,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. Problem 7-8B (Algo) Part 1 Required: 1. Calculate the balance in the Accumulated Depreciation account at the end of the third year. Required information Problem 7-8B (Algo) Record the disposal of equipment (LO7-6) [The following information applies to the questions displayed below.] New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $263,100. The ovens originally cost $350,500, had an estimated service life of 10 years, had an estimated residual value of $20,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. Problem 7-8B (Algo) Part 2 2. Calculate the book value of the ovens at the end of the third year. Required information Problem 7-8B (Algo) Record the disposal of equipment (LO7-6) [The following information applies to the questions displayed below.] New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $263,100. The ovens originally cost $350,500, had an estimated service life of 10 years, had an estimated residual value of $20,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. Problem 7-8B (Algo) Part 3 3. What is the gain or loss on the sale of the ovens at the end of the third year? Required information Problem 7-8B (Algo) Record the disposal of equipment (LO7-6) [The following information applies to the questions displayed below.] New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $263,100. The ovens originally cost $350,500, had an estimated service life of 10 years, had an estimated residual value of $20,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. Problem 7-8B (Algo) Part 4 Record the sale of the ovens at the end of the third year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Note: tnter debits betore credits