Question

Required information Skip to question [The following information applies to the questions displayed below.] Gerald Utsey earned $47,500 in 2021 for a company in Kentucky.

Required information

Skip to question

[The following information applies to the questions displayed below.]

Gerald Utsey earned $47,500 in 2021 for a company in Kentucky. He is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2021 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in Appendix D. Manual payroll system is used and Box 2 is not checked.

Required:

How to calulate employer social, medicare, FUTA and SUTA tax???

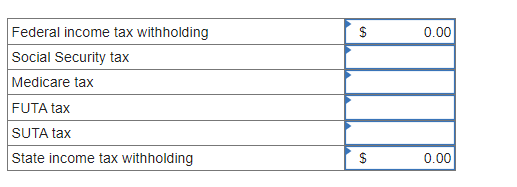

Compute the employers share of the taxes. (Do not round intermediate calculation. Round your final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started