Question

Required information Skip to question [The following information applies to the questions displayed below.] Gabi Gram started The Gram Company, a new business that began

Required information

Skip to question

[The following information applies to the questions displayed below.] Gabi Gram started The Gram Company, a new business that began operations on May 1. The Gram Company completed the following transactions during its first month of operations.

| May 1 | G. Gram invested $42,000 cash in the company in exchange for its common stock. |

|---|---|

| May 1 | The company rented a furnished office and paid $2,200 cash for Mays rent. |

| May 3 | The company purchased $1,900 of equipment on credit. |

| May 5 | The company paid $780 cash for this months cleaning services. |

| May 8 | The company provided consulting services for a client and immediately collected $5,800 cash. |

| May 12 | The company provided $2,900 of consulting services for a client on credit. |

| May 15 | The company paid $800 cash for an assistants salary for the first half of this month. |

| May 20 | The company received $2,900 cash payment for the services provided on May 12. |

| May 22 | The company provided $3,900 of consulting services on credit. |

| May 25 | The company received $3,900 cash payment for the services provided on May 22. |

| May 26 | The company paid $1,900 cash for the equipment purchased on May 3. |

| May 27 | The company purchased $80 of equipment on credit. |

| May 28 | The company paid $800 cash for an assistants salary for the second half of this month. |

| May 30 | The company paid $350 cash for this months telephone bill. |

| May 30 | The company paid $250 cash for this months utilities. |

| May 31 | The company paid $2,000 cash in dividends to the owner (sole shareholder). |

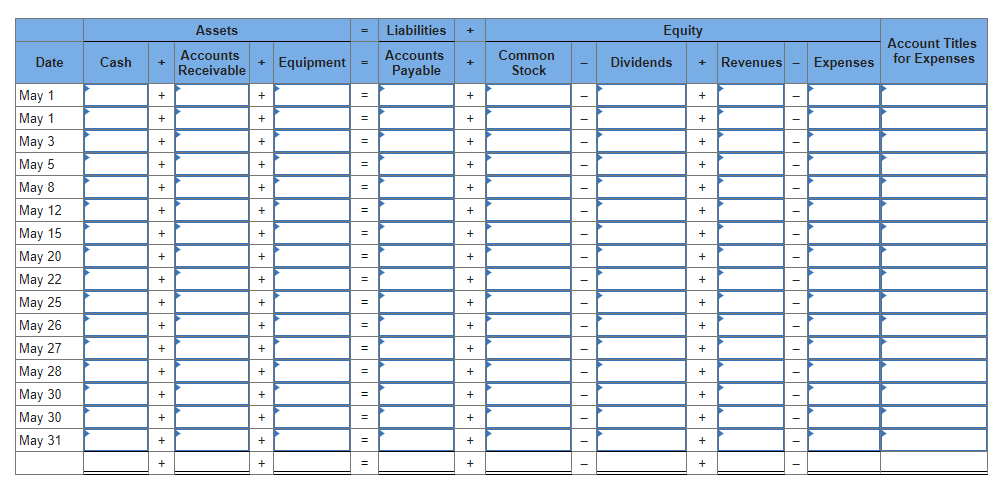

Required: 1. Enter the amount of each transaction on individual items of the accounting equation. (Enter the transactions in the given order. Enter reductions to account balances with a minus sign. Select "NA" for account titles if the transaction does not include an expense.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started