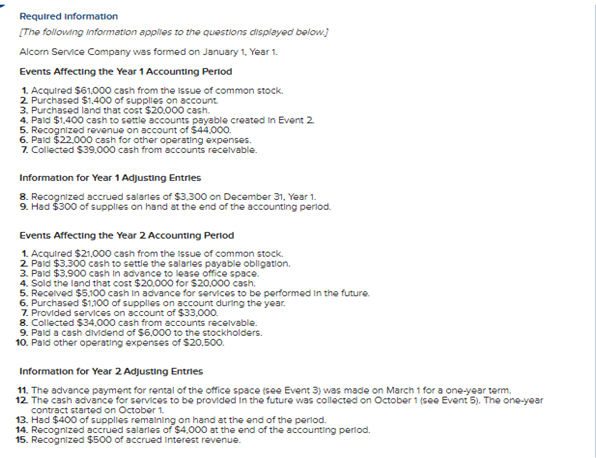

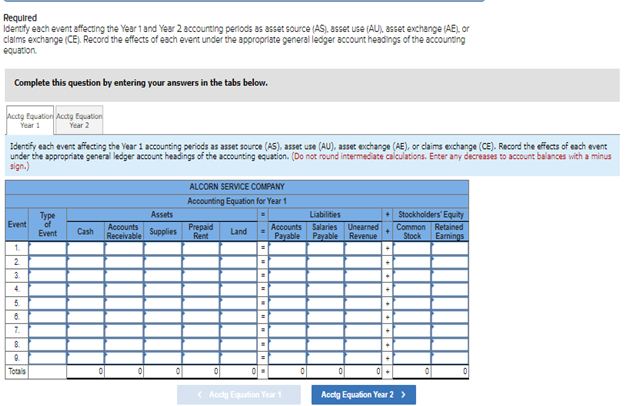

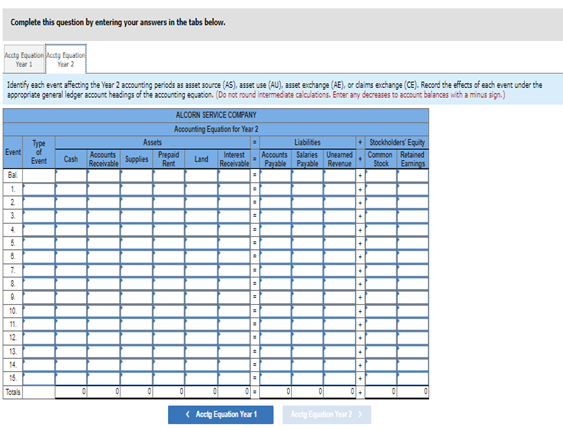

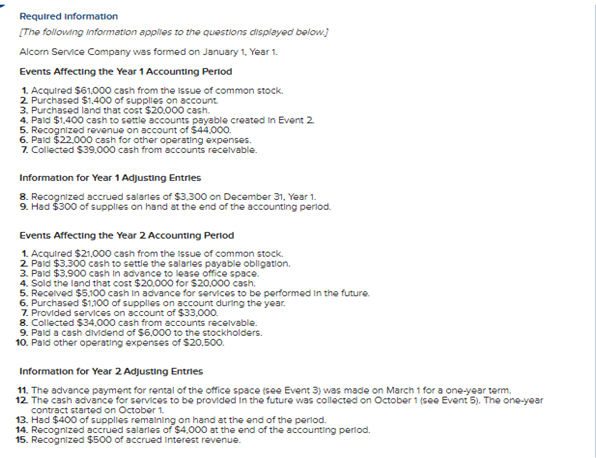

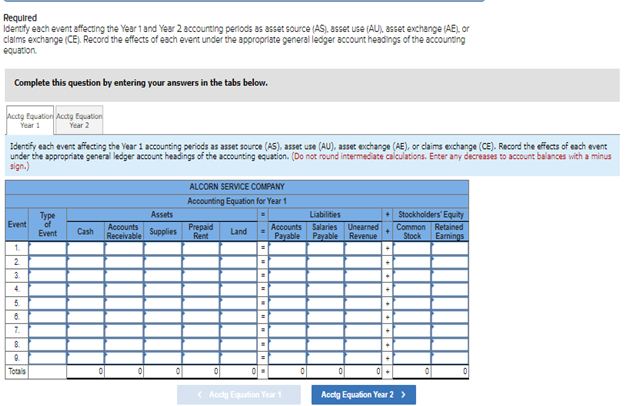

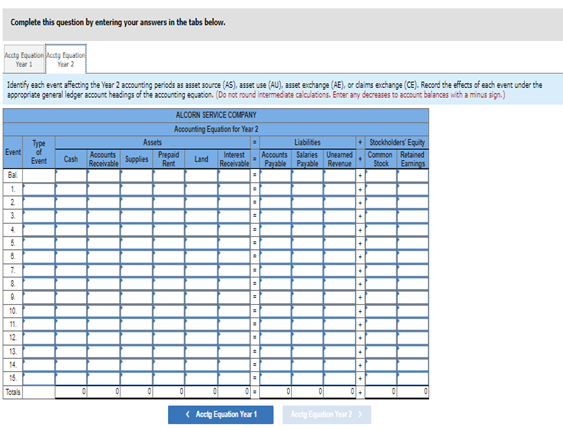

Required information [The following information appiles to the questions displayed below.] Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year 1 Accounting Perlod 1. Acquired $61,000 cash from the 16s se of common stock. 2 Purchased $1.400 of supplies on account 3. Purchased land that cost $20.000cash. 4. Paid $1,400 cash to settle accounts payable created in Event 2. 5. Recognized revenue on account of $44,000. 6. Pald $22,000 cash for other operating expenses. 7. Collected $39,000cash from accounts recelvable. Information for Year 1 Adjusting Entries 8. Recognized accrued salarles of $3,300 on December 31, Year 1. 9. Had $300 of supplies on hand at the end of the accounting period. Events Affecting the Year 2 Accounting Perlod 1. Acquired $21,000 cash from the issue of common stock. 2. Paid $3.300 cash to settle the salartes payable obligation. 3. Paid $3.900 cash in advance to lease office space. 4. Sold the land that cost $20.000 for $20.000cash. 5. Recelved $5.100 cash in advance for services to be performed in the future. 6. Purchased $1,100 of supplies on account during the year. 7. Provided services on account of $33,000. 8. Collected $34,000 cash from accounts recelvable. 9. Paid a cash divdend of $6,000 to the stockholders. 10. Paid other operating expenses of $20,500. Information for Year 2 Adjusting Entries 11. The advance payment for rental of the otfice space (see Event 3) was made on March 1 for a one-year term. 12. The cash advance for services to be provided in the future was collected on October 1 (see Event 5), The one-year contract started on October 1 . 13. Had $400 of supplies remalning on hand at the end of the period. 14. Recognized accrued salarles of $4,000 at the end of the accounting period. 15. Recognized $500 of accrued interest revenue. Required Identty each event affecting the Year 1 and Year 2 accourting periods as asset source (AS), asset use (AU), asset exchange (AE, or clamb exchange (CE). Record the effects of each event under the appropriate general ledger account headings of the accounting equation. Complete this question by entering your answers in the tabs below. Identif each event afficting the Year 1 accounting periods as asset source (AS), asset use (AU), asset exchange (AE), or daims exchange (CE). Record the effects of each event under the approptiste general ledger aceount hesdings of the accounting equasion. (Do not round intermediate cabulabions. Enter any decreases to actount balances with a minus sign.) Complete this question by entering your answers in the tabs below. Identiy each evers amesting the Year 2 accounting periods as asser sourse (AS), assen use (AU), asset exchange (AE), or clains exchange (CE). Aecord the efiecss of each event under the apsespriae geneal ledger account headings of the ascourting eq.ation (Do not round intemed are ca culations, Enter ary dectabes to accourt ba ances with a minus sign.) Required information [The following information appiles to the questions displayed below.] Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year 1 Accounting Perlod 1. Acquired $61,000 cash from the 16s se of common stock. 2 Purchased $1.400 of supplies on account 3. Purchased land that cost $20.000cash. 4. Paid $1,400 cash to settle accounts payable created in Event 2. 5. Recognized revenue on account of $44,000. 6. Pald $22,000 cash for other operating expenses. 7. Collected $39,000cash from accounts recelvable. Information for Year 1 Adjusting Entries 8. Recognized accrued salarles of $3,300 on December 31, Year 1. 9. Had $300 of supplies on hand at the end of the accounting period. Events Affecting the Year 2 Accounting Perlod 1. Acquired $21,000 cash from the issue of common stock. 2. Paid $3.300 cash to settle the salartes payable obligation. 3. Paid $3.900 cash in advance to lease office space. 4. Sold the land that cost $20.000 for $20.000cash. 5. Recelved $5.100 cash in advance for services to be performed in the future. 6. Purchased $1,100 of supplies on account during the year. 7. Provided services on account of $33,000. 8. Collected $34,000 cash from accounts recelvable. 9. Paid a cash divdend of $6,000 to the stockholders. 10. Paid other operating expenses of $20,500. Information for Year 2 Adjusting Entries 11. The advance payment for rental of the otfice space (see Event 3) was made on March 1 for a one-year term. 12. The cash advance for services to be provided in the future was collected on October 1 (see Event 5), The one-year contract started on October 1 . 13. Had $400 of supplies remalning on hand at the end of the period. 14. Recognized accrued salarles of $4,000 at the end of the accounting period. 15. Recognized $500 of accrued interest revenue. Required Identty each event affecting the Year 1 and Year 2 accourting periods as asset source (AS), asset use (AU), asset exchange (AE, or clamb exchange (CE). Record the effects of each event under the appropriate general ledger account headings of the accounting equation. Complete this question by entering your answers in the tabs below. Identif each event afficting the Year 1 accounting periods as asset source (AS), asset use (AU), asset exchange (AE), or daims exchange (CE). Record the effects of each event under the approptiste general ledger aceount hesdings of the accounting equasion. (Do not round intermediate cabulabions. Enter any decreases to actount balances with a minus sign.) Complete this question by entering your answers in the tabs below. Identiy each evers amesting the Year 2 accounting periods as asser sourse (AS), assen use (AU), asset exchange (AE), or clains exchange (CE). Aecord the efiecss of each event under the apsespriae geneal ledger account headings of the ascourting eq.ation (Do not round intemed are ca culations, Enter ary dectabes to accourt ba ances with a minus sign.)