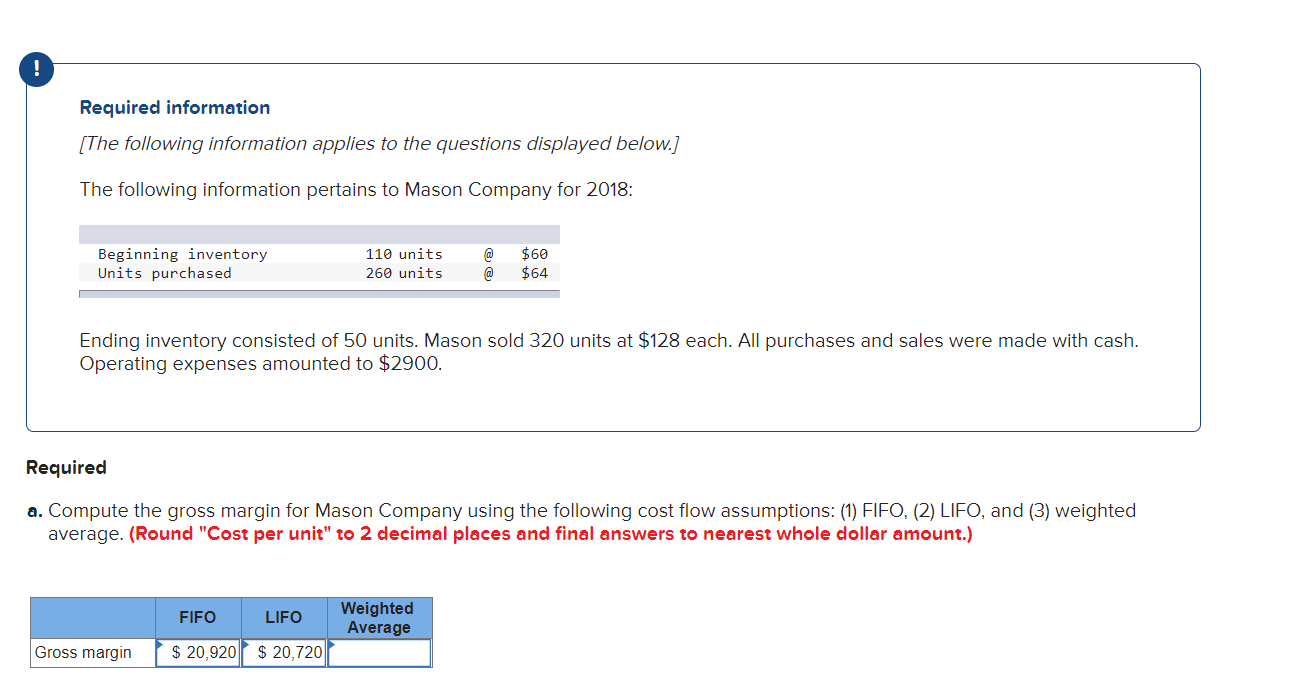

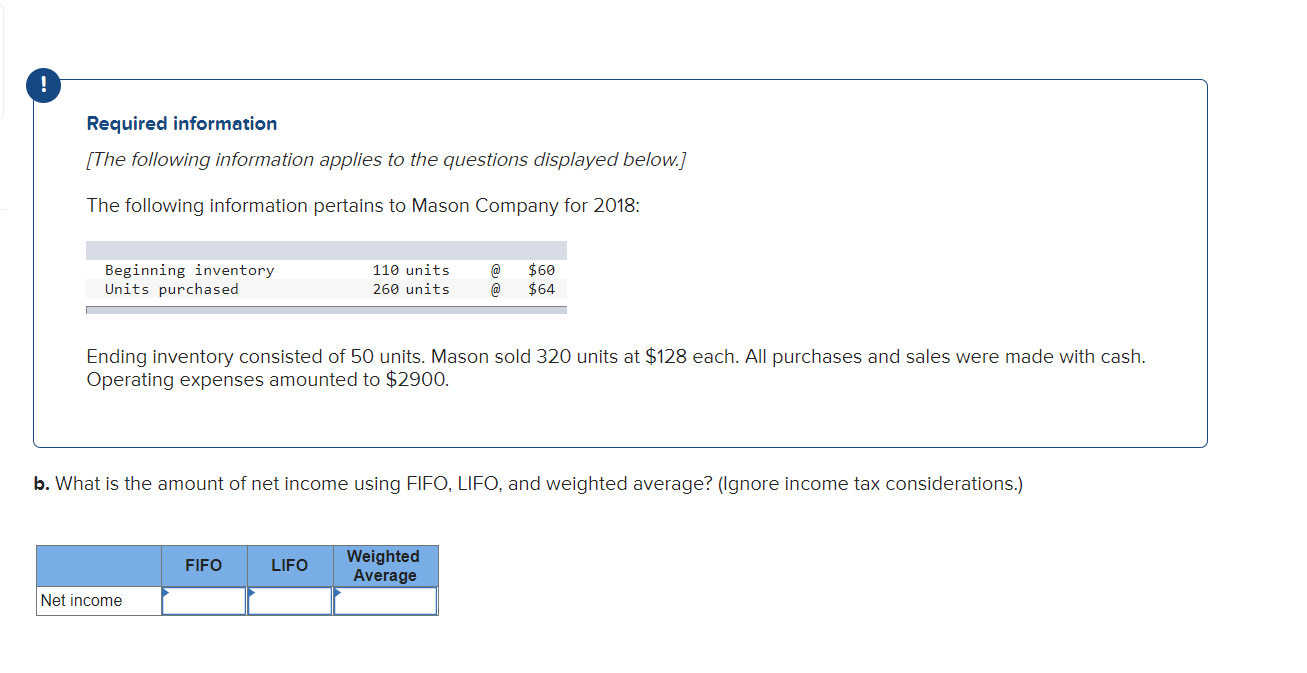

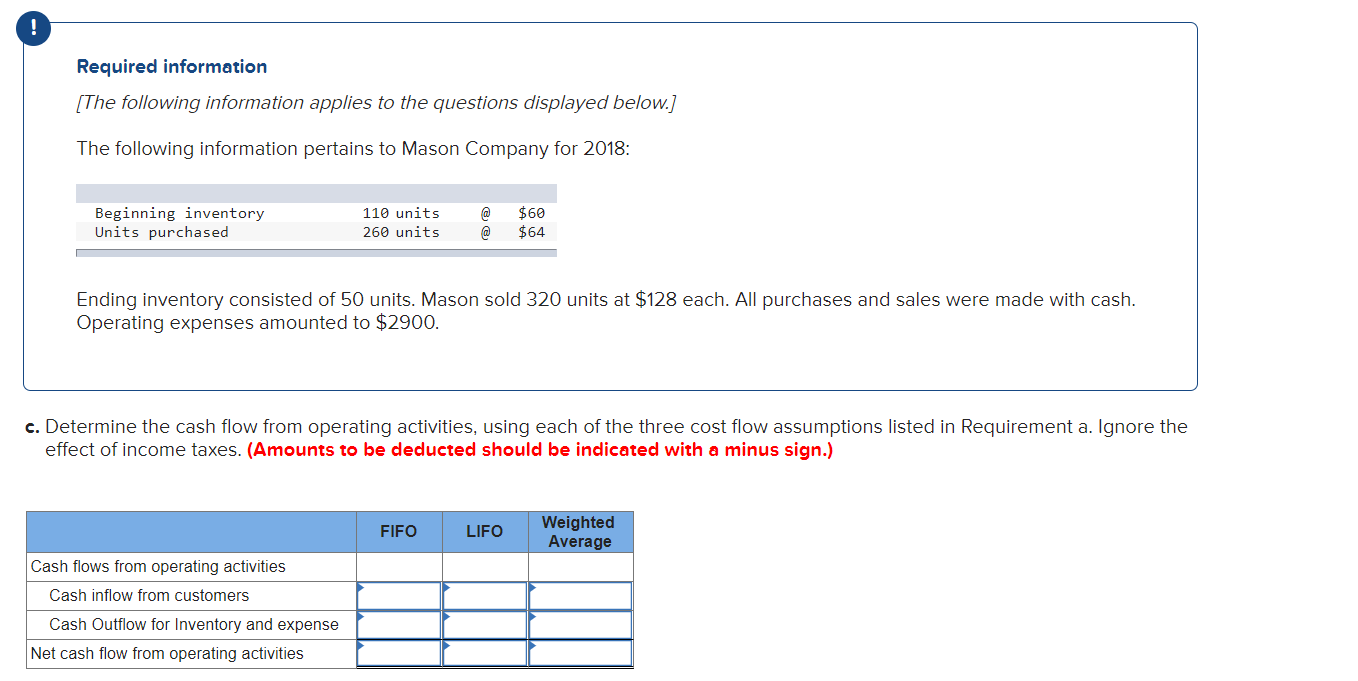

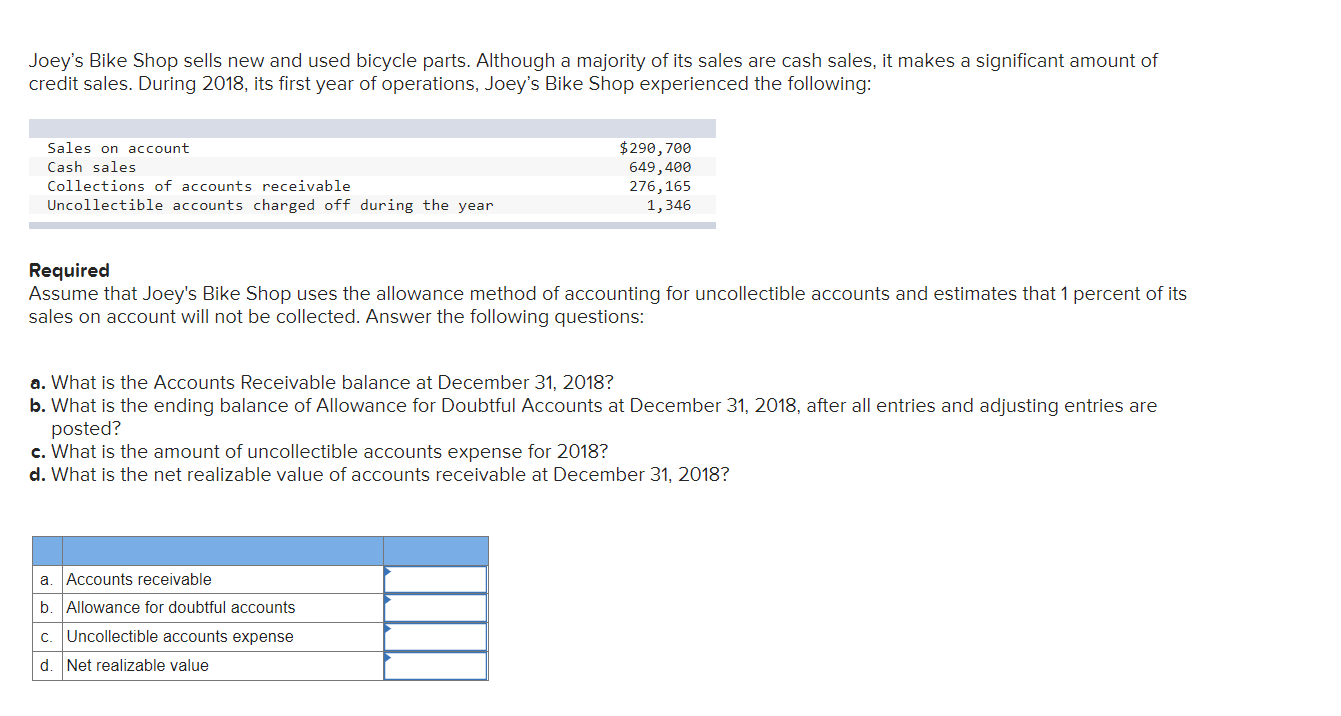

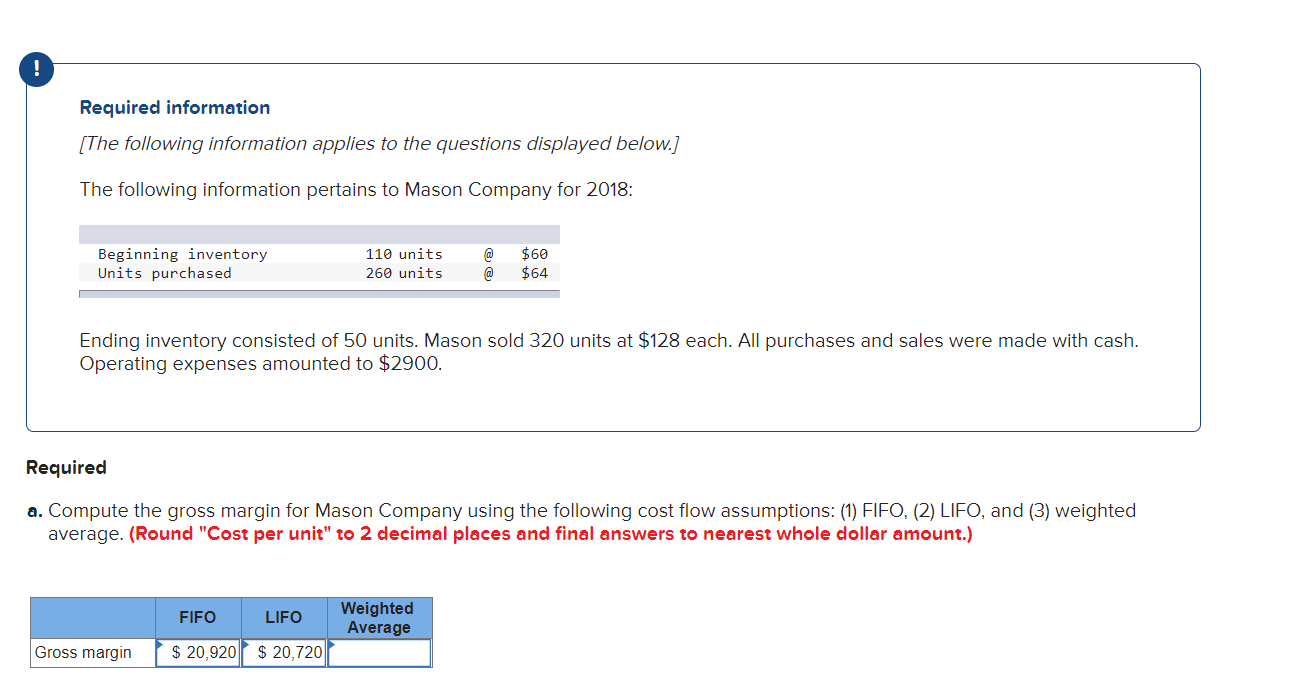

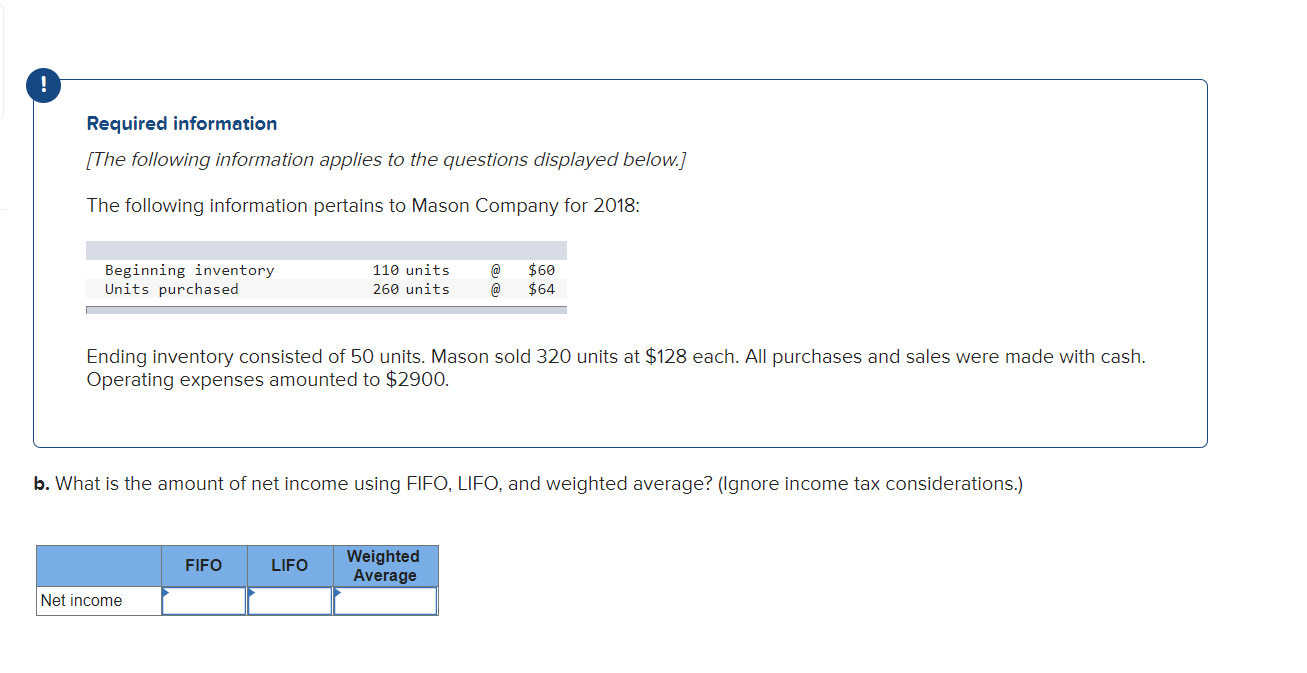

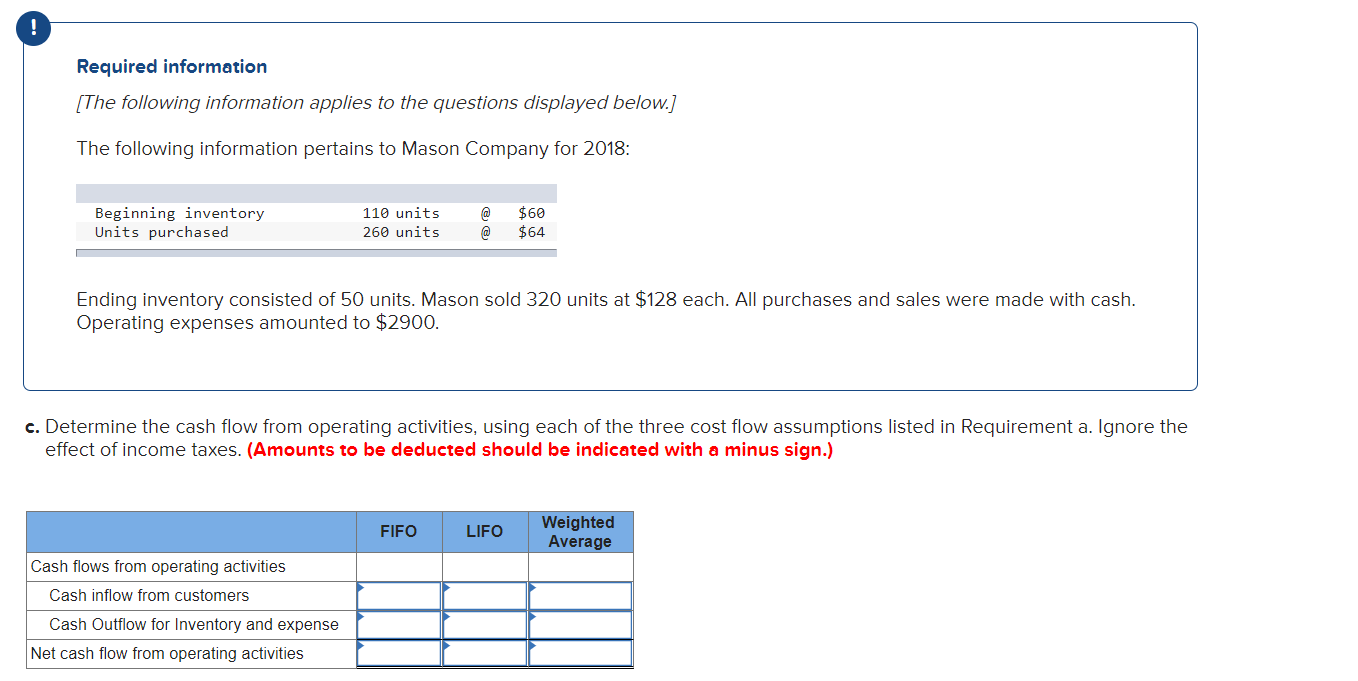

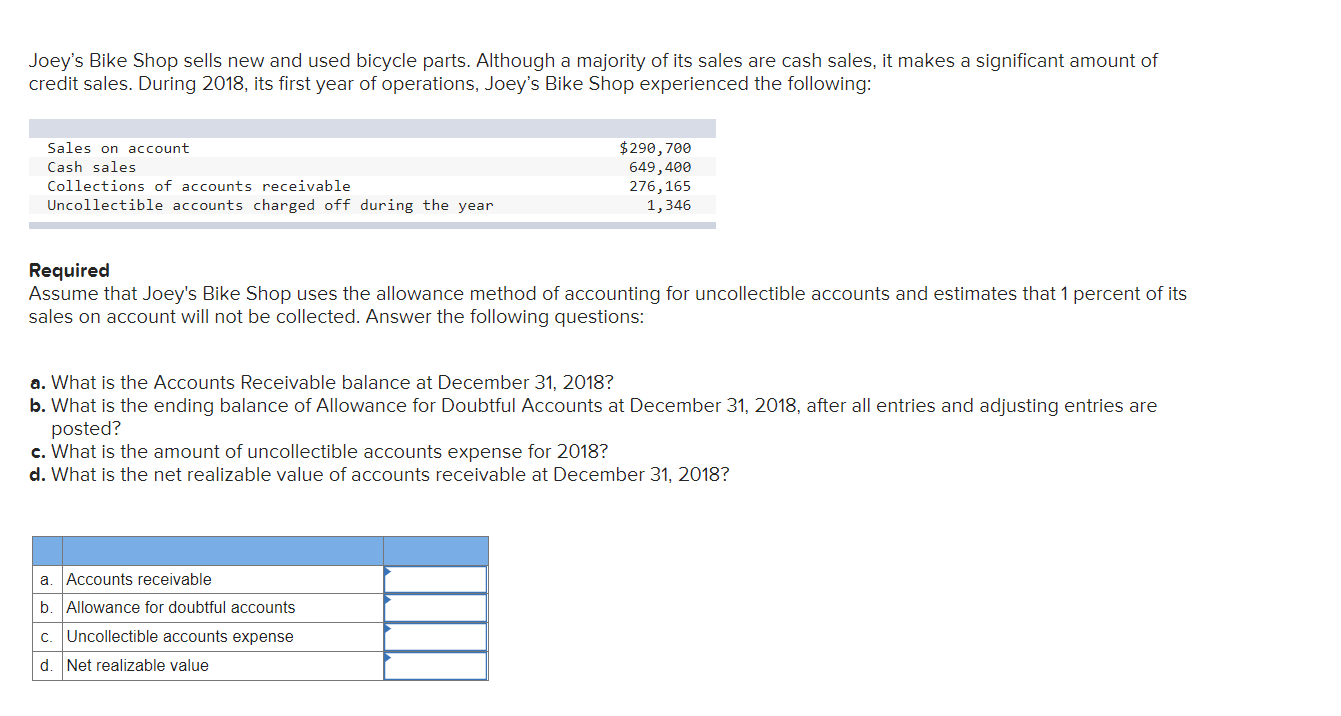

! Required information (The following information applies to the questions displayed below.) The following information pertains to Mason Company for 2018: $60 Beginning inventory Units purchased 110 units 260 units @ @ $64 Ending inventory consisted of 50 units. Mason sold 320 units at $128 each. All purchases and sales were made with cash. Operating expenses amounted to $2900. Required a. Compute the gross margin for Mason Company using the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. (Round "Cost per unit" to 2 decimal places and final answers to nearest whole dollar amount.) FIFO LIFO Weighted Average Gross margin $ 20,920 $ 20,720 Required information [The following information applies to the questions displayed below.) The following information pertains to Mason Company for 2018: Beginning inventory Units purchased 110 units 260 units @ @ $60 $64 Ending inventory consisted of 50 units. Mason sold 320 units at $128 each. All purchases and sales were made with cash. Operating expenses amounted to $2900. b. What is the amount of net income using FIFO, LIFO, and weighted average? (Ignore income tax considerations.) FIFO LIFO Weighted Average Net income ! Required information [The following information applies to the questions displayed below.) The following information pertains to Mason Company for 2018: @ Beginning inventory Units purchased 110 units 260 units $60 $64 Ending inventory consisted of 50 units. Mason sold 320 units at $128 each. All purchases and sales were made with cash. Operating expenses amounted to $2900. c. Determine the cash flow from operating activities, using each of the three cost flow assumptions listed in Requirement a. Ignore the effect of income taxes. (Amounts to be deducted should be indicated with a minus sign.) FIFO LIFO Weighted Average Cash flows from operating activities Cash inflow from customers Cash Outflow for Inventory and expense Net cash flow from operating activities Joey's Bike Shop sells new and used bicycle parts. Although a majority of its sales are cash sales, it makes a significant amount of credit sales. During 2018, its first year of operations, Joey's Bike Shop experienced the following: Sales on account Cash sales Collections of accounts receivable Uncollectible accounts charged off during the year $290, 700 649,400 276,165 1,346 Required Assume that Joey's Bike Shop uses the allowance method of accounting for uncollectible accounts and estimates that 1 percent of its sales on account will not be collected. Answer the following questions: a. What is the Accounts Receivable balance at December 31, 2018? b. What is the ending balance of Allowance for Doubtful Accounts at December 31, 2018, after all entries and adjusting entries are posted? c. What is the amount of uncollectible accounts expense for 2018? d. What is the net realizable value of accounts receivable at December 31, 2018? a. Accounts receivable b Allowance for doubtful accounts c. Uncollectible accounts expense d. Net realizable value