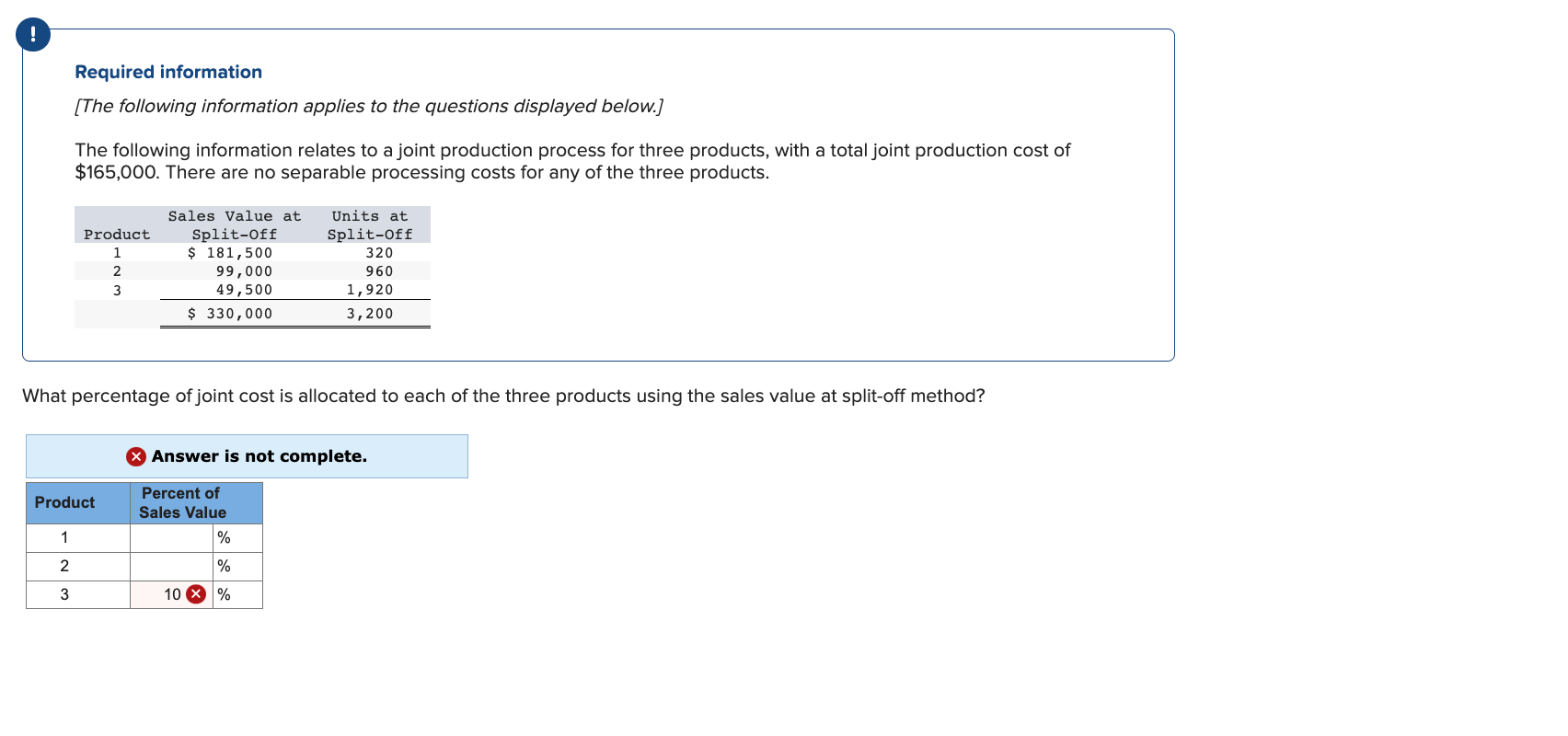

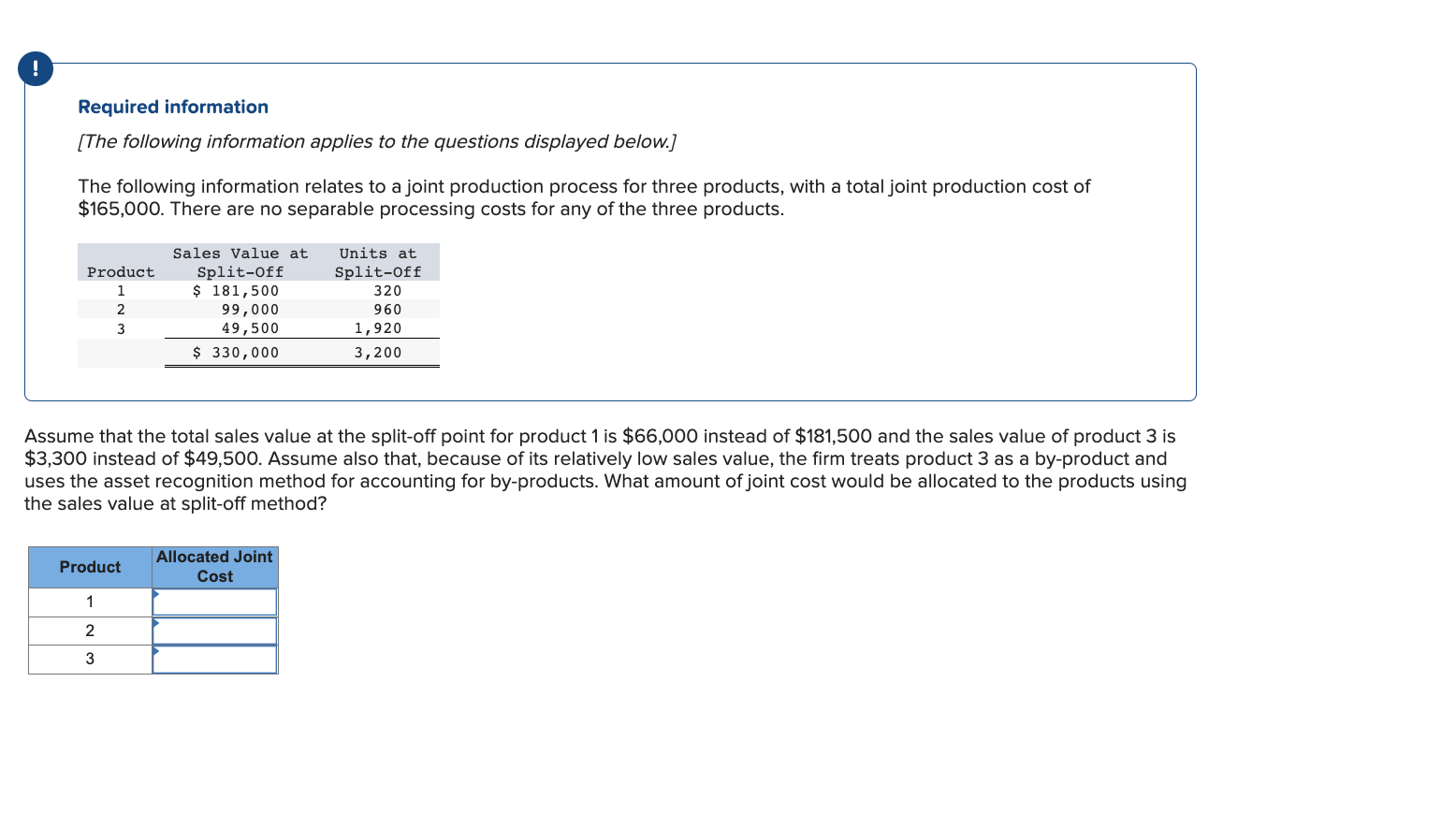

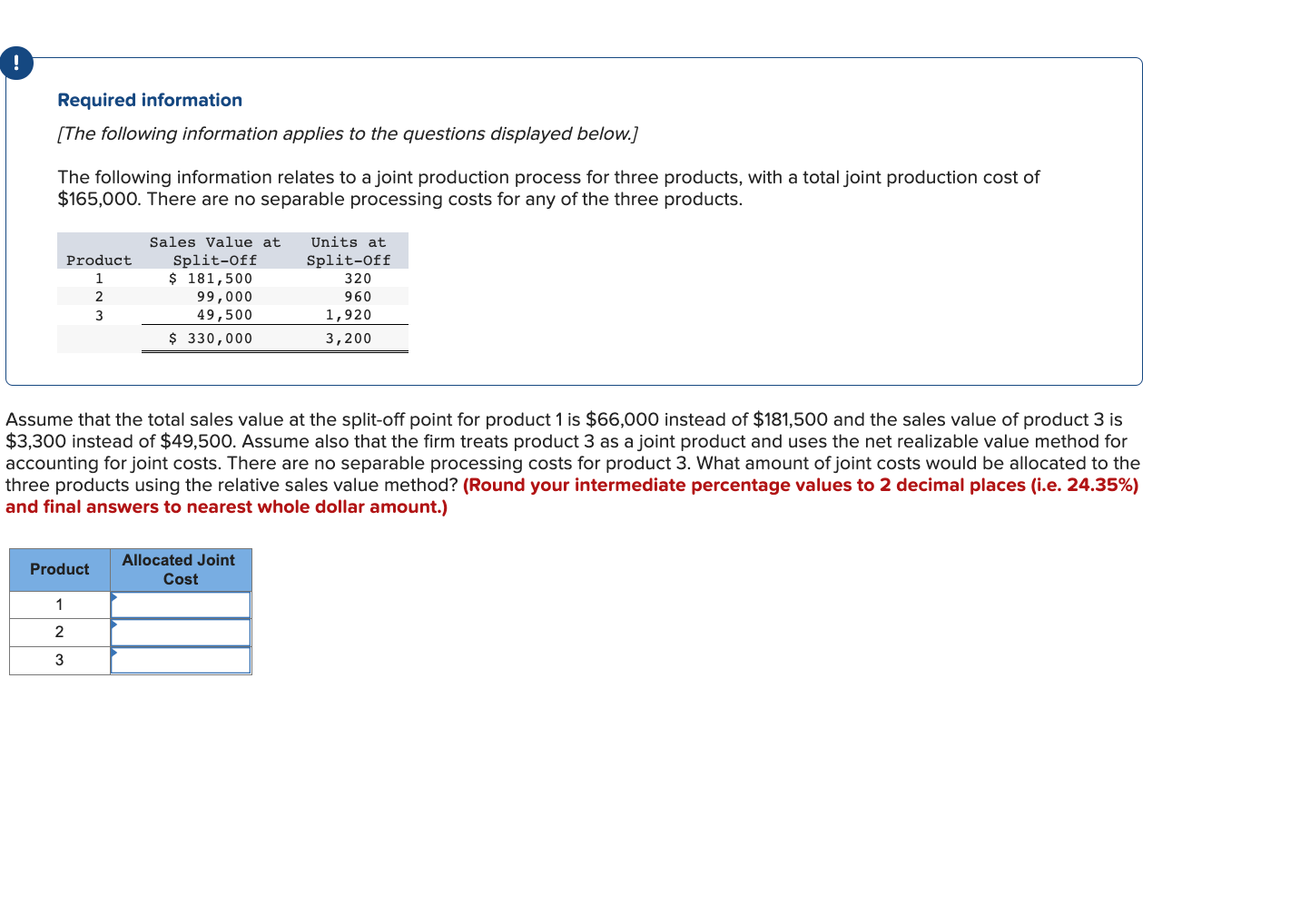

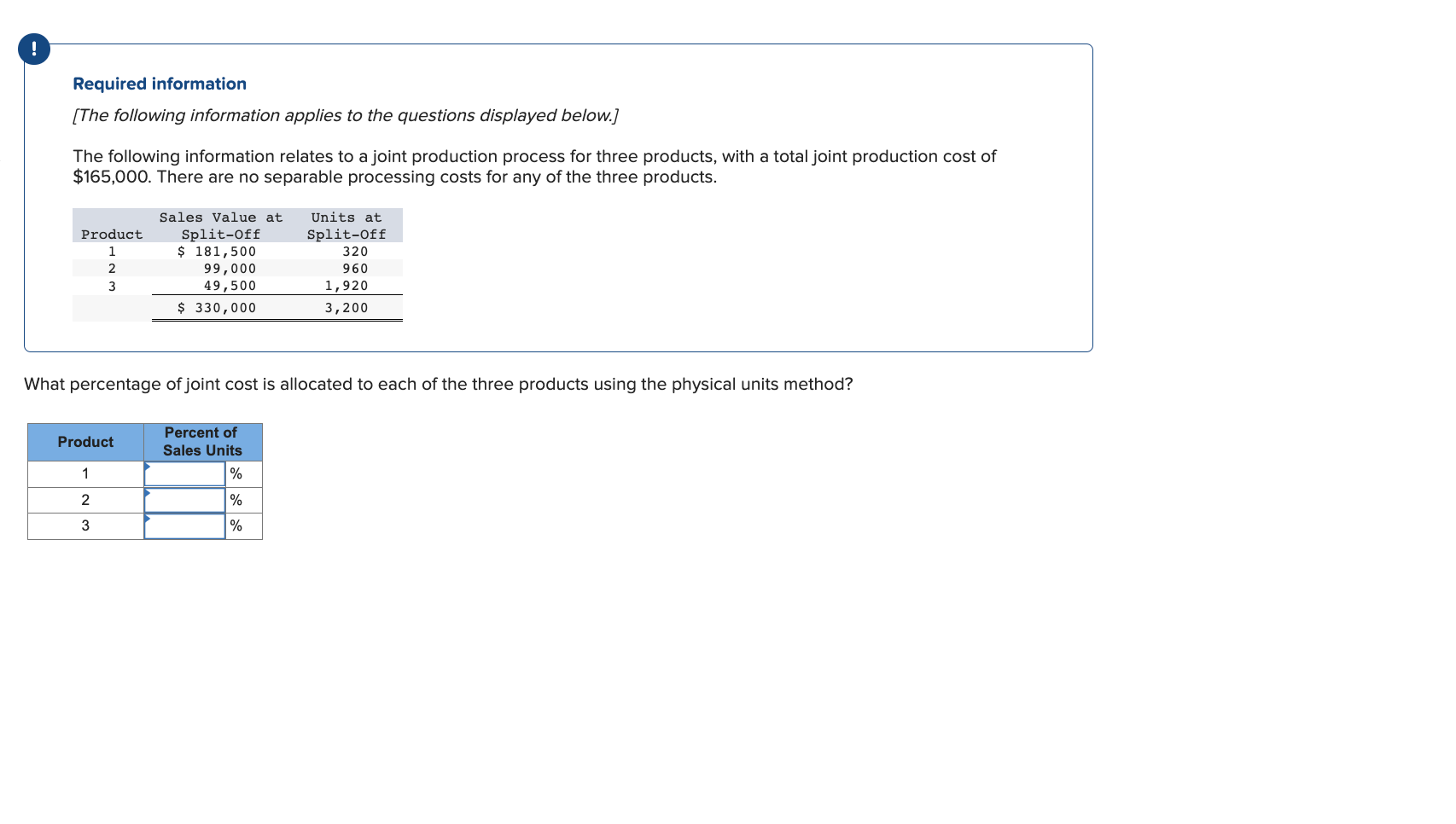

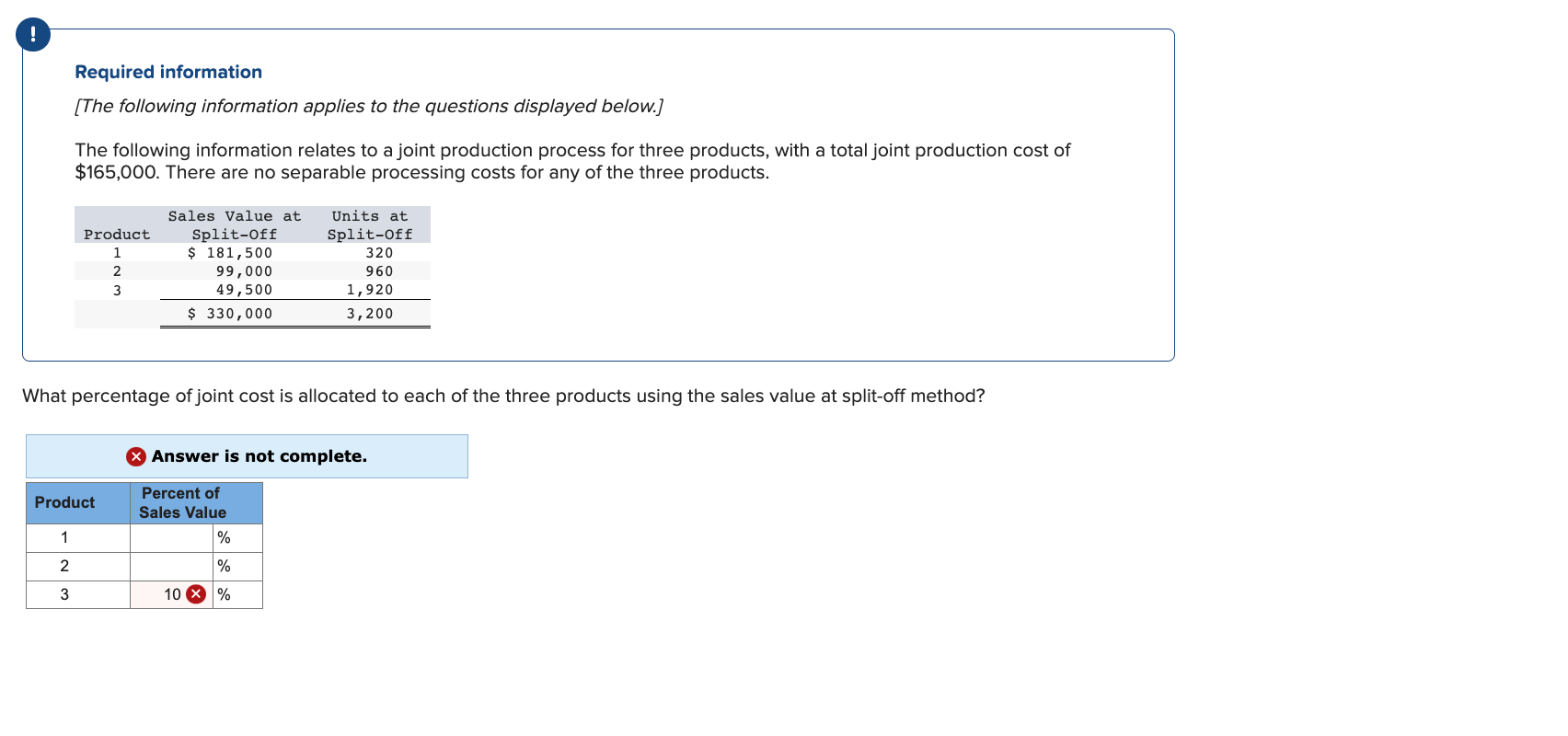

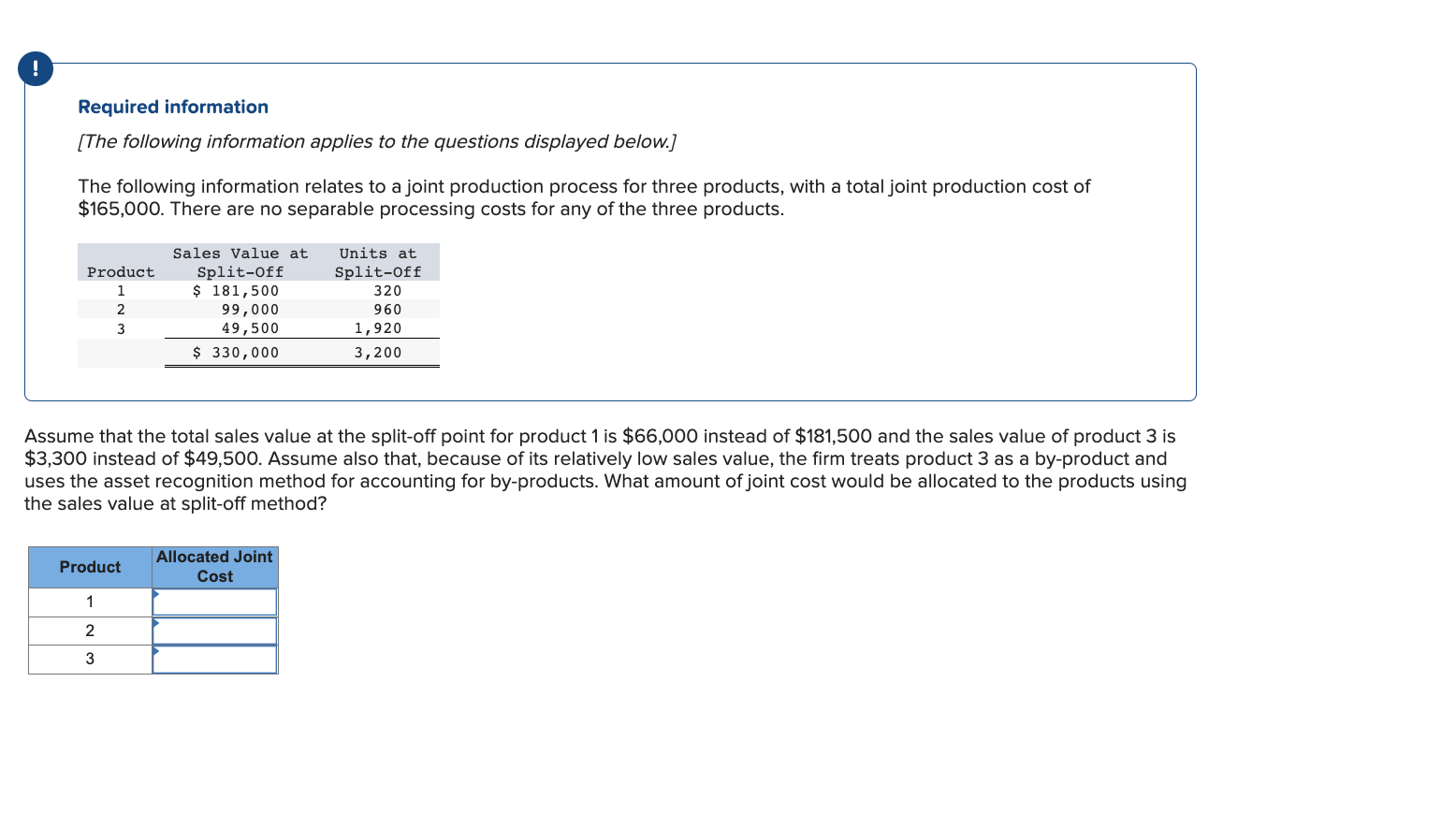

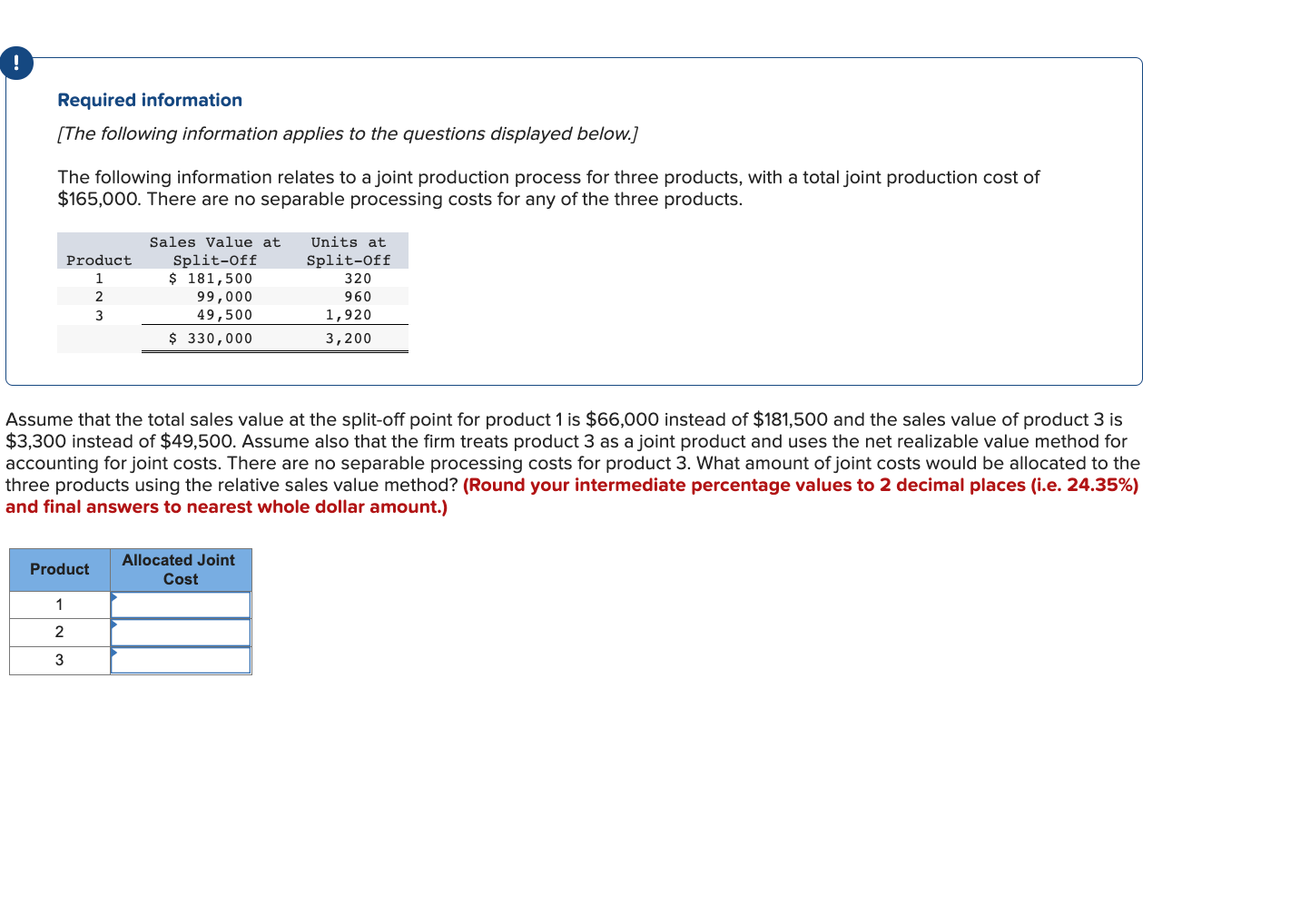

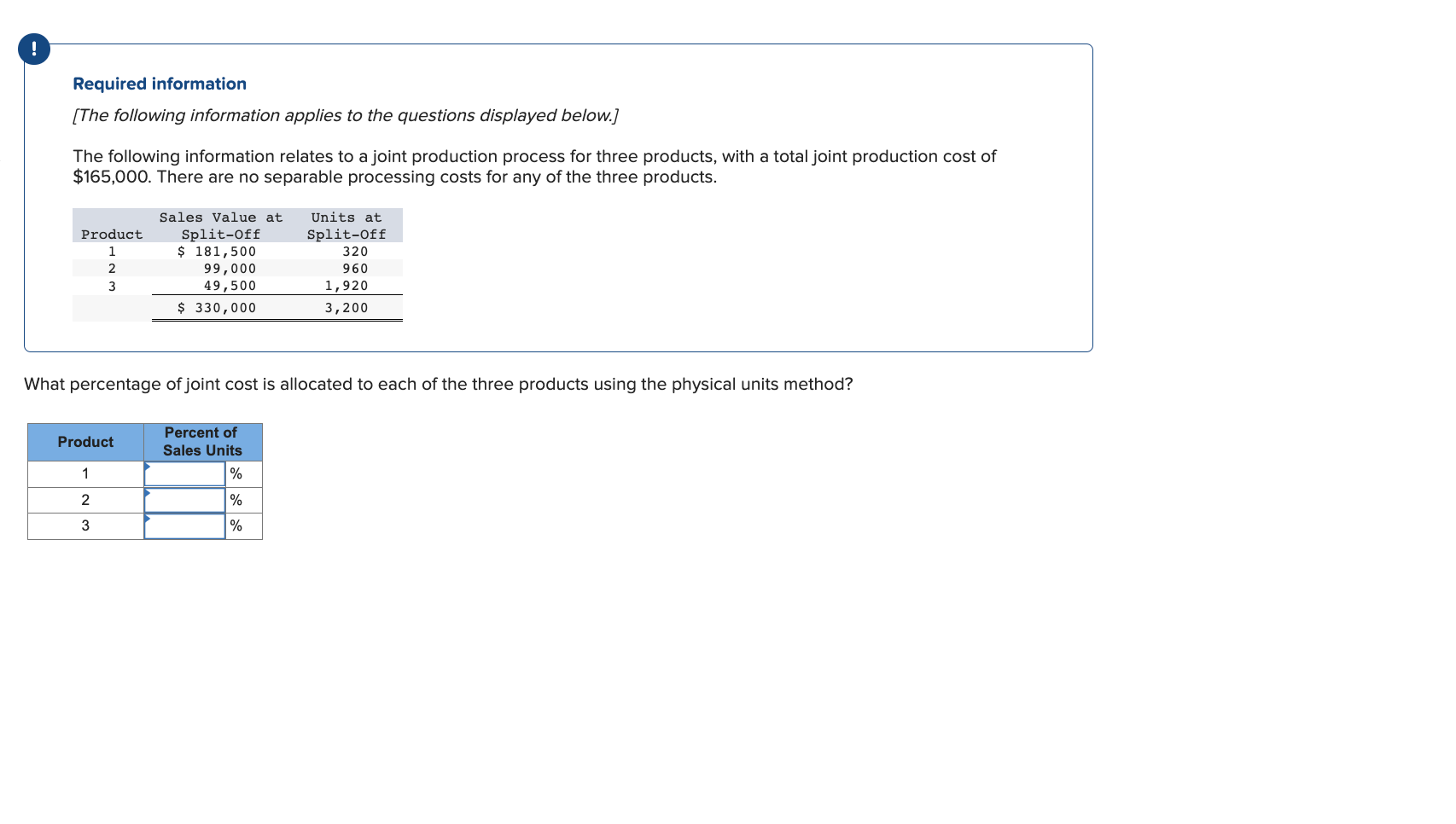

! Required information (The following information applies to the questions displayed below.] The following information relates to a joint production process for three products, with a total joint production cost of $165,000. There are no separable processing costs for any of the three products. Product 1 2 Sales Value at Split-Off $ 181,500 99,000 49,500 $ 330,000 Units at Split-off 320 960 1,920 3,200 3 What percentage of joint cost is allocated to each of the three products using the sales value at split-off method? X Answer is not complete. Product Percent of Sales Value % 1 2 % 3 10 X % ! Required information [The following information applies to the questions displayed below.) The following information relates to a joint production process for three products, with a total joint production cost of $165,000. There are no separable processing costs for any of the three products. Product 1 2 3 Sales Value at Split-Off $ 181,500 99,000 49,500 $ 330,000 Units at Split-Off 320 960 1,920 3,200 Assume that the total sales value at the split-off point for product 1 is $66,000 instead of $181,500 and the sales value of product 3 is $3,300 instead of $49,500. Assume also that, because of its relatively low sales value, the firm treats product 3 as a by-product and uses the asset recognition method for accounting for by-products. What amount of joint cost would be allocated to the products using the sales value at split-off method? Product Allocated Joint Cost 1 2 3 Required information (The following information applies to the questions displayed below.] The following information relates to a joint production process for three products, with a total joint production cost of $165,000. There are no separable processing costs for any of the three products. Product 1 2 3 Sales Value at Split-Off $ 181,500 99,000 49,500 $ 330,000 Units at Split-Off 320 960 1,920 3,200 Assume that the tota value at the split-off point for product 1 is $66, instead of $181,500 and the sales value of product 3 is $3,300 instead of $49,500. Assume also that the firm treats product 3 as a joint product and uses the net realizable value method for accounting for joint costs. There are no separable processing costs for product 3. What amount of joint costs would be allocated to the three products using the relative sales value method? (Round your intermediate percentage values to 2 decimal places (i.e. 24.35%) and final answers to nearest whole dollar amount.) Product Allocated Joint Cost 1 2 3 Required information [The following information applies to the questions displayed below.) The following information relates to a joint production process for three products, with a total joint production cost of $165,000. There are no separable processing costs for any of the three products. Product 1 2 3 Sales Value at Split-Off $ 181,500 99,000 49,500 $ 330,000 Units at Split-Off 320 960 1,920 3,200 What percentage of joint cost is allocated to each of the three products using the physical units method? Product Percent of Sales Units % 1 2 % 3 %