Answered step by step

Verified Expert Solution

Question

1 Approved Answer

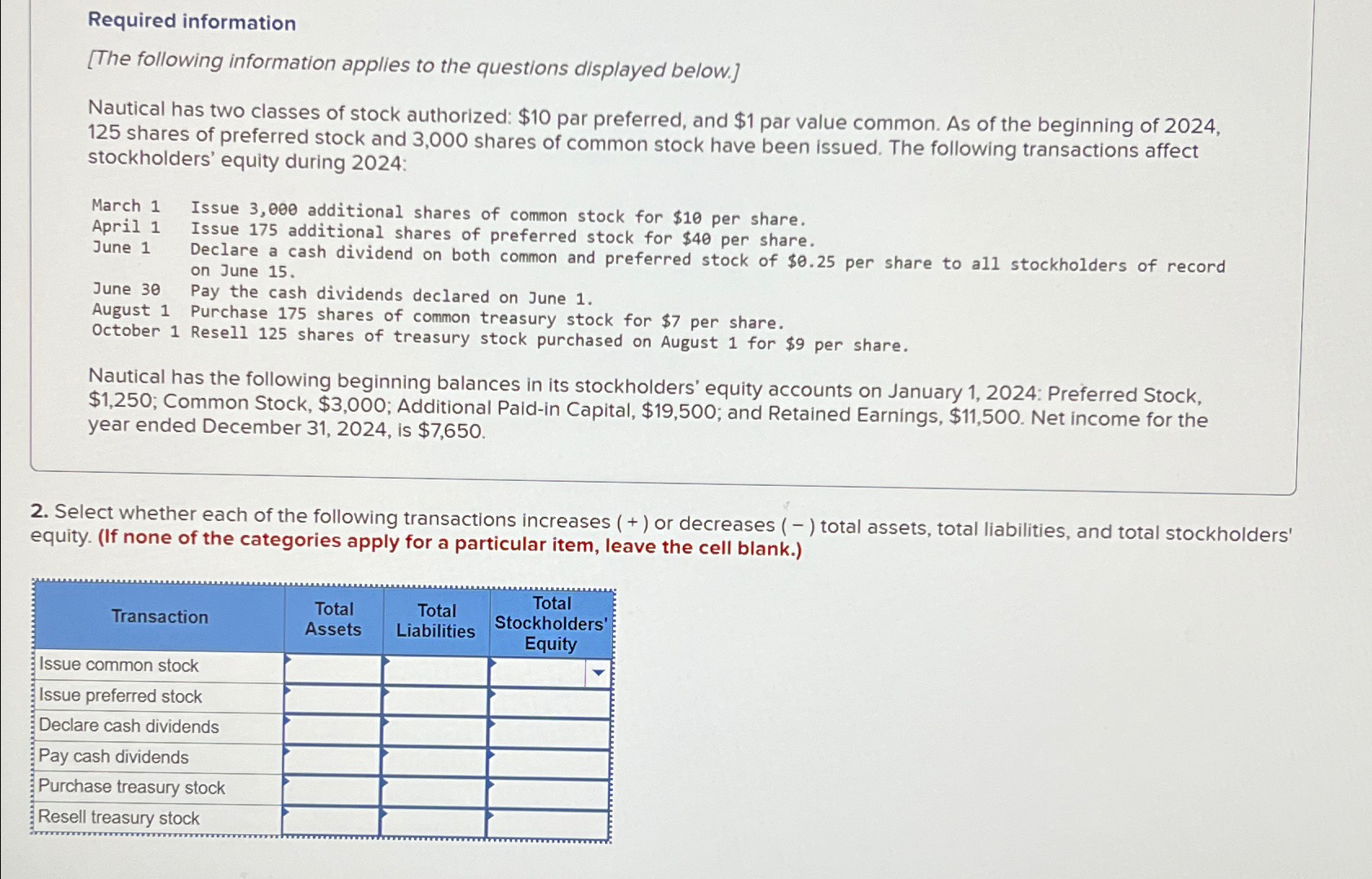

Required information [ The following information applies to the questions displayed below. ] Nautical has two classes of stock authorized: $ 1 0 par preferred,

Required information

The following information applies to the questions displayed below.

Nautical has two classes of stock authorized: $ par preferred, and $ par value common. As of the beginning of shares of preferred stock and shares of common stock have been issued. The following transactions affect stockholders' equity during :

March Issue additional shares of common stock for $ per share.

April Issue additional shares of preferred stock for $ per share.

June Declare a cash dividend on both common and preferred stock of $ per share to all stockholders of record on June

June Pay the cash dividends declared on June

August Purchase shares of common treasury stock for $ per share.

October Resell shares of treasury stock purchased on August for $ per share.

Nautical has the following beginning balances in its stockholders' equity accounts on January : Preferred Stock, $; Common Stock, $; Additional Paidin Capital, $; and Retained Earnings, $ Net income for the year ended December is $

Select whether each of the following transactions increases or decreases total assets, total liabilities, and total stockholders' equity. If none of the categories apply for a particular item, leave the cell blank.

tableTransactiontableTotalAssetstableTotalLiabilitiestableTotalStockholdersEquityIssue common stock,,,Issue preferred stock,,,Peclare cash dividends,,,Purchase dividends,,,Resell treasury stock,,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started