Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [ The following information applies to the questions displayed below. ] The beginning account balances for Terry's Auto Shop as of January 1

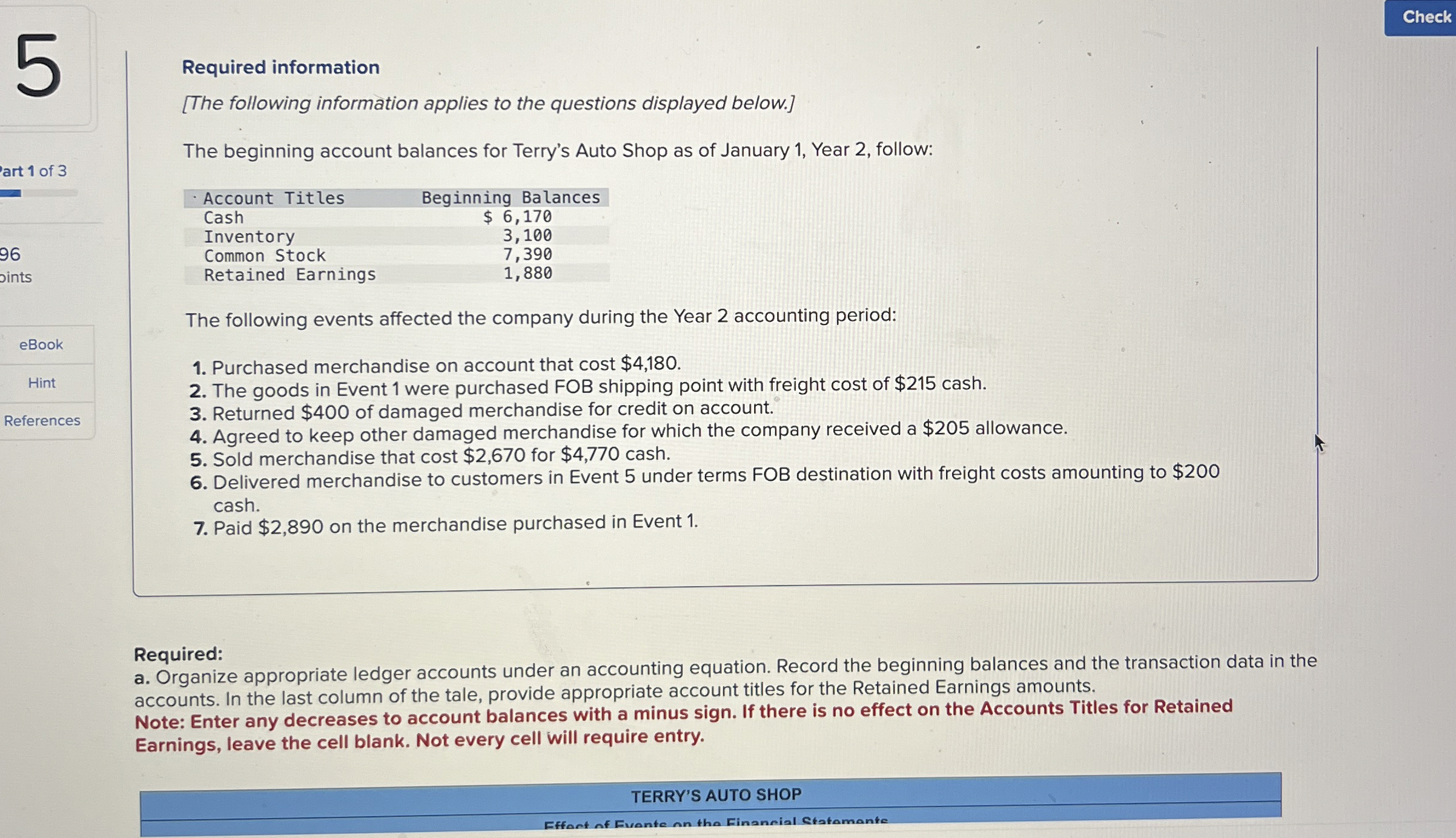

Required information

The following information applies to the questions displayed below.

The beginning account balances for Terry's Auto Shop as of January Year follow:

The following events affected the company during the Year accounting period:

Purchased merchandise on account that cost $

The goods in Event were purchased FOB shipping point with freight cost of $ cash.

Returned $ of damaged merchandise for credit on account.

Agreed to keep other damaged merchandise for which the company received a $ allowance.

Sold merchandise that cost $ for $ cash.

Delivered merchandise to customers in Event under terms FOB destination with freight costs amounting to $

cash.

Paid $ on the merchandise purchased in Event

Required:

a Organize appropriate ledger accounts under an accounting equation. Record the beginning balances and the transaction data in the

accounts. In the last column of the tale, provide appropriate account titles for the Retained Earnings amounts.

Note: Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained

Earnings, leave the cell blank. Not every cell will require entry.

Required:

a Organize appropriate ledger accounts under an accounting equation. Record the beginning balances and the transaction data in the

accounts. In the last column of the tale, provide appropriate account titles for the Retained Earnings amounts.

Note: Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained

Earnings, leave the cell blank. Not every cell will require entry.

Required information

The following information applies to the questions displayed below.

The beginning account balances for Terry's Auto Shop as of January Year follow:

The following events affected the company during the Year accounting period:

Purchased merchandise on account that cost $

The goods in Event were purchased FOB shipping point with freight cost of $ cash.

Returned $ of damaged merchandise for credit on account.

Agreed to keep other damaged merchandise for which the company received a $ allowance.

Sold merchandise that cost $ for $ cash.

Delivered merchandise to customers in Event under terms FOB destination with freight costs amounting to $

cash.

Paid $ on the merchandise purchased in Event

Required:

a Organize appropriate ledger accounts under an accounting equation. Record the beginning balances and the transaction data in the

accounts. In the last column of the tale, provide appropriate account titles for the Retained Earnings amounts.

Note: Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained

Earnings, leave the cell blank. Not every cell will require entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started