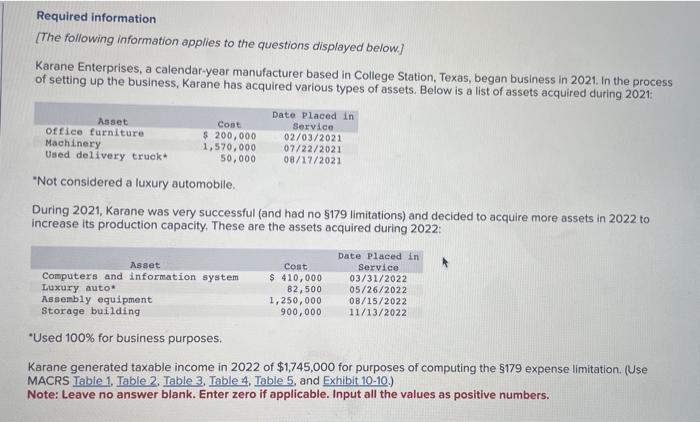

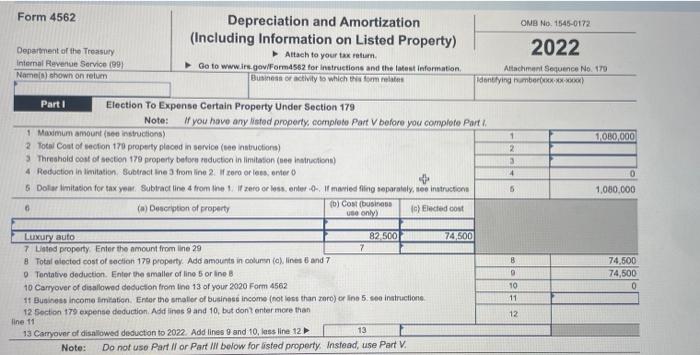

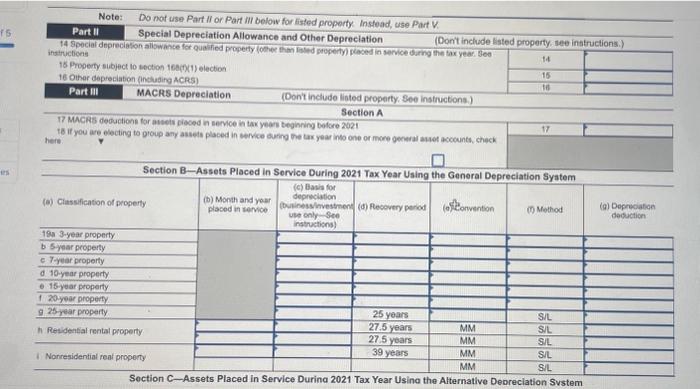

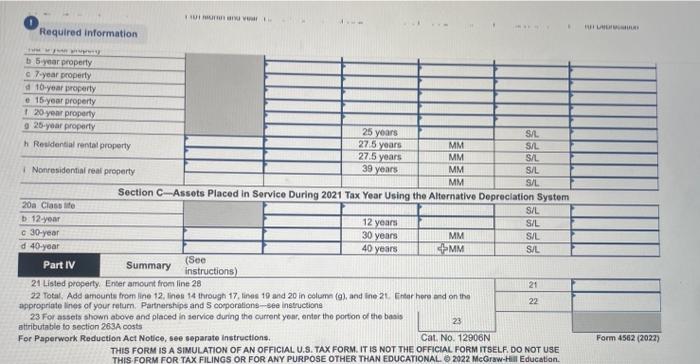

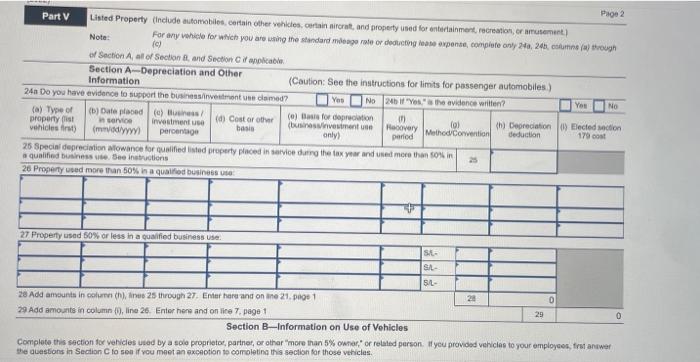

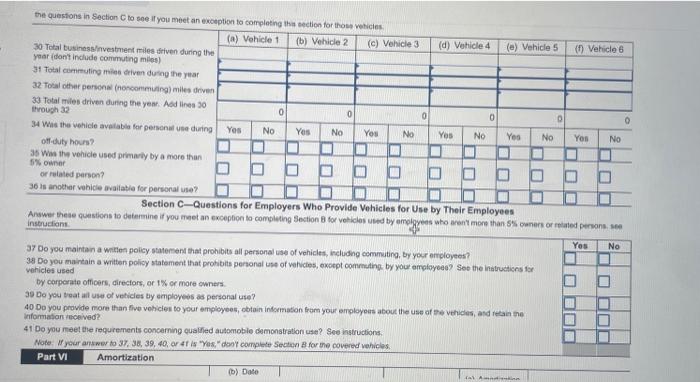

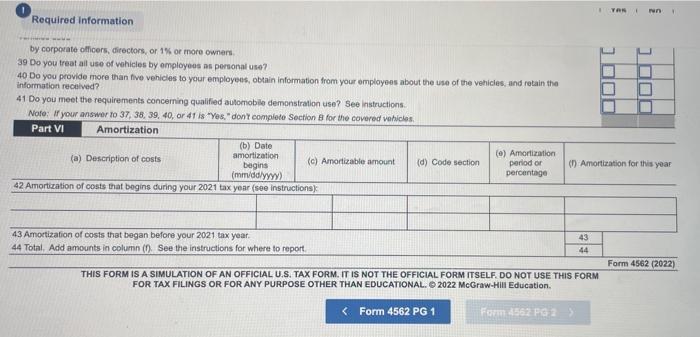

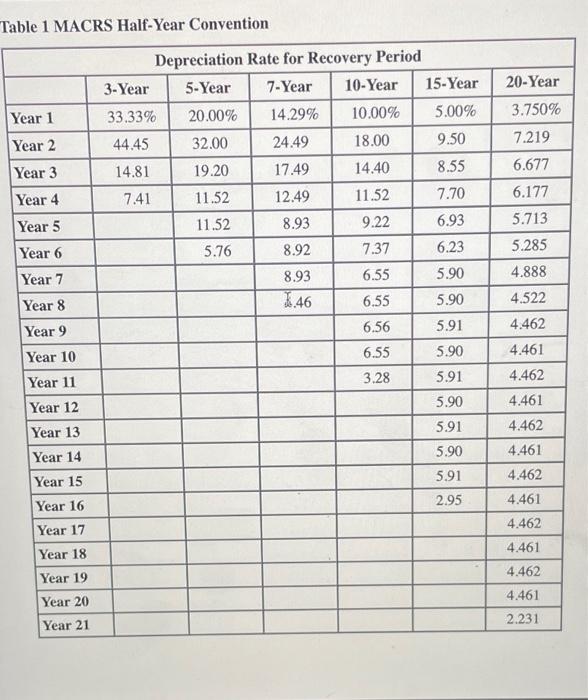

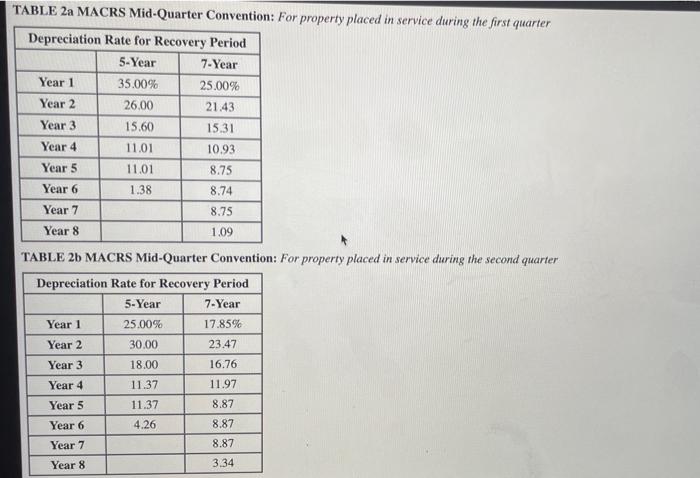

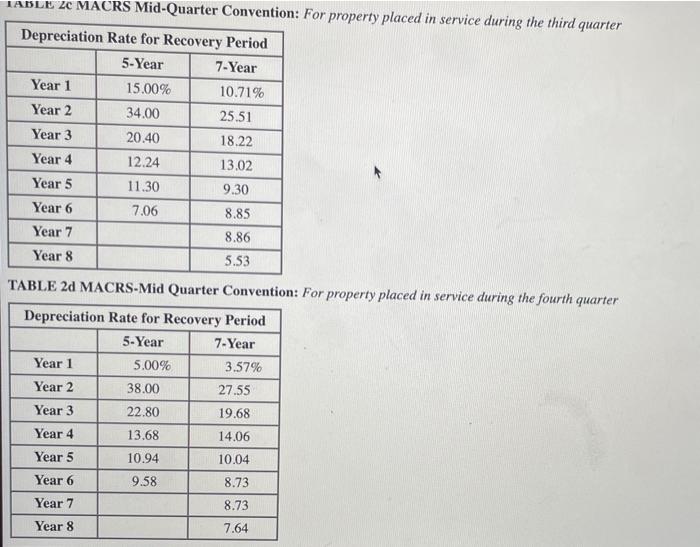

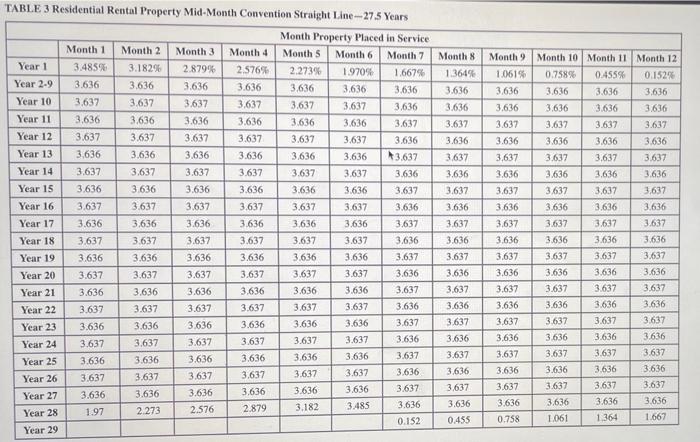

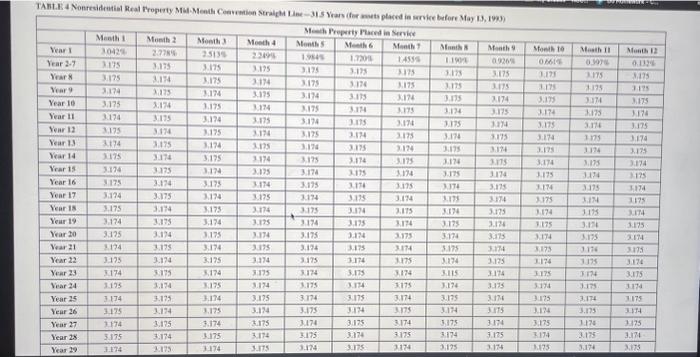

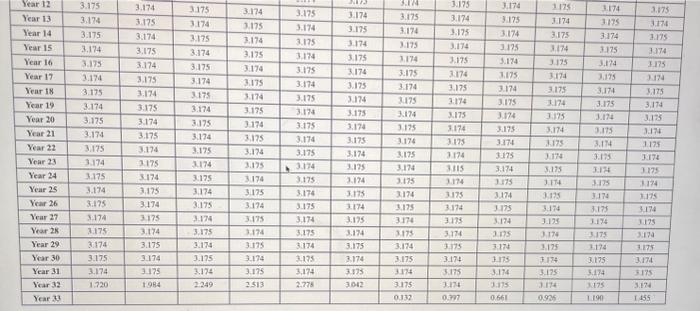

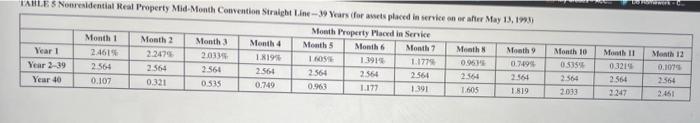

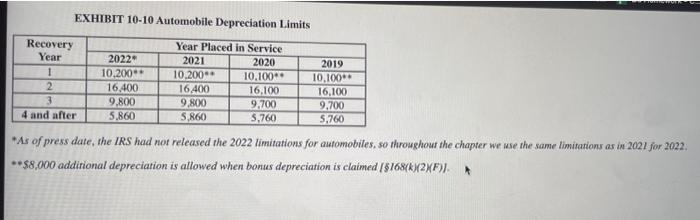

Required information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021 : "Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022 : "Used 100% for business purposes. Karane generated taxable income in 2022 of $1,745,000 for purposes of computing the $179 expense limitation. (Use MACRS Table 1. Table 2. Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complote Parth. Note: Do not uso Part I/ or Part ill bolow for listed property. Instead, use Part V. 17 MACRs deductions tor atseis piesed an service in ter yerarion A ts if you are escing to proup any assets plscees in tax years beginning bofore 20021 here. Section C_Assets Placed in Service Durina 2021 Tax Year Usine the Alternatlve Deoreclation Svstem. 21 Listed property. Enter amount froni line 28 22. Total, Add ameunts frem line 12, lines 14 through 17, lines 19 and 20 in colume (9), and line 21. Fitar hore ond on the approgriate lines of your retum. Partnerstips and S copporations -see instructions 23 For assels shown above and placed in service during the ourrent yoar, ontor the porton of the baais attributable to section 263 A costs For Paperwork Reduction Act Notice, see separate instruetions. Cat. No. 12906N Form 4562(2022) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FOFM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL- 2022 MeGraw-Hil Educatian. Part V Prage 2 Note: Far (c) Complete this section for vehicles uted by a sola prophietos, partnet, or othar "more than 5% ownar," or relaled person. If you provided vehiclas to your employees, trst anawer the abastions in Section C to sea if vou meet an exceotion to cemaletina this section for those veficlas. the questons in section C to see if you meet an exosption to corrpletng tha section tar thanew whinke. Answer theae questions to detersine if you meet an exception lo complating Section \& for yoticles usted ty amotore by Their Employees instrucliant. 37 Do you maintain a witlea poicy statement that prohibits all personal use of vehicles, including cemmuting, by your anrioyees? 39 Do you maintain a written policy statement that protibits perional use of vahicles, exocpt comesthy by your ampiayeee? Soe the indtructiers isr vohicles used by carperate officers, directors, or 1% or more owners. 39 Do you teat al use of veticles by employees as personal use? 40 Do you provide more than five vohicies to your employees, obtain infcemation from your amployeas about the use of Pte vehicles, and tetan the informatan reseived? 41 Do you reet the requrements concerning qualled automoble demonstration use? See instructions. Note. If yeur answer to 37.38,39,40, or 4t is "Yes," doot compheit Secten A for the covered vehicles. by corpovate officers, directors, or 1% or more owners 39 Do you treat ail use of wehicles by employees as personal use? 40 Do you provide more than five vehicles to your employees, obain information from your employees about the use of the vehicles, and retain the information recelved? 41 Do you meet the requirements conceming qualified aulomobile demonstration use? See instructions. Note: If your answer to 37,35,39, 40, or 41 is "Yes," dont complode section 8 for the covered vehiclas. THIS FORM IS A. SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICLAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 92022 MeGraw-Hill Education. Tahle 1 MACRS Half-Year Convention TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter ABLE LC MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 3 Residential Rental Property Mid-Month Convention Straight Line - 27.5 Years 1AHL.E 5 Nensealdential Real Property Mtid-Month Comention Siralebt line 30 Years (for absets placed in service an or afier May 13, 173) EXHIBIT 10-10 Automobile Depreciation Limits "As of press date, the IRS had not released the 2022 limitations for automobiles, so throughour the chapter we use the same limitations as in 2021 for 2022. $8,000 additional depreciation is allowed when bonus depreciation is claimed [$168(k)(2)(F)]. Required information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021 : "Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022 : "Used 100% for business purposes. Karane generated taxable income in 2022 of $1,745,000 for purposes of computing the $179 expense limitation. (Use MACRS Table 1. Table 2. Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complote Parth. Note: Do not uso Part I/ or Part ill bolow for listed property. Instead, use Part V. 17 MACRs deductions tor atseis piesed an service in ter yerarion A ts if you are escing to proup any assets plscees in tax years beginning bofore 20021 here. Section C_Assets Placed in Service Durina 2021 Tax Year Usine the Alternatlve Deoreclation Svstem. 21 Listed property. Enter amount froni line 28 22. Total, Add ameunts frem line 12, lines 14 through 17, lines 19 and 20 in colume (9), and line 21. Fitar hore ond on the approgriate lines of your retum. Partnerstips and S copporations -see instructions 23 For assels shown above and placed in service during the ourrent yoar, ontor the porton of the baais attributable to section 263 A costs For Paperwork Reduction Act Notice, see separate instruetions. Cat. No. 12906N Form 4562(2022) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FOFM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL- 2022 MeGraw-Hil Educatian. Part V Prage 2 Note: Far (c) Complete this section for vehicles uted by a sola prophietos, partnet, or othar "more than 5% ownar," or relaled person. If you provided vehiclas to your employees, trst anawer the abastions in Section C to sea if vou meet an exceotion to cemaletina this section for those veficlas. the questons in section C to see if you meet an exosption to corrpletng tha section tar thanew whinke. Answer theae questions to detersine if you meet an exception lo complating Section \& for yoticles usted ty amotore by Their Employees instrucliant. 37 Do you maintain a witlea poicy statement that prohibits all personal use of vehicles, including cemmuting, by your anrioyees? 39 Do you maintain a written policy statement that protibits perional use of vahicles, exocpt comesthy by your ampiayeee? Soe the indtructiers isr vohicles used by carperate officers, directors, or 1% or more owners. 39 Do you teat al use of veticles by employees as personal use? 40 Do you provide more than five vohicies to your employees, obtain infcemation from your amployeas about the use of Pte vehicles, and tetan the informatan reseived? 41 Do you reet the requrements concerning qualled automoble demonstration use? See instructions. Note. If yeur answer to 37.38,39,40, or 4t is "Yes," doot compheit Secten A for the covered vehicles. by corpovate officers, directors, or 1% or more owners 39 Do you treat ail use of wehicles by employees as personal use? 40 Do you provide more than five vehicles to your employees, obain information from your employees about the use of the vehicles, and retain the information recelved? 41 Do you meet the requirements conceming qualified aulomobile demonstration use? See instructions. Note: If your answer to 37,35,39, 40, or 41 is "Yes," dont complode section 8 for the covered vehiclas. THIS FORM IS A. SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICLAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 92022 MeGraw-Hill Education. Tahle 1 MACRS Half-Year Convention TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter ABLE LC MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 3 Residential Rental Property Mid-Month Convention Straight Line - 27.5 Years 1AHL.E 5 Nensealdential Real Property Mtid-Month Comention Siralebt line 30 Years (for absets placed in service an or afier May 13, 173) EXHIBIT 10-10 Automobile Depreciation Limits "As of press date, the IRS had not released the 2022 limitations for automobiles, so throughour the chapter we use the same limitations as in 2021 for 2022. $8,000 additional depreciation is allowed when bonus depreciation is claimed [$168(k)(2)(F)]