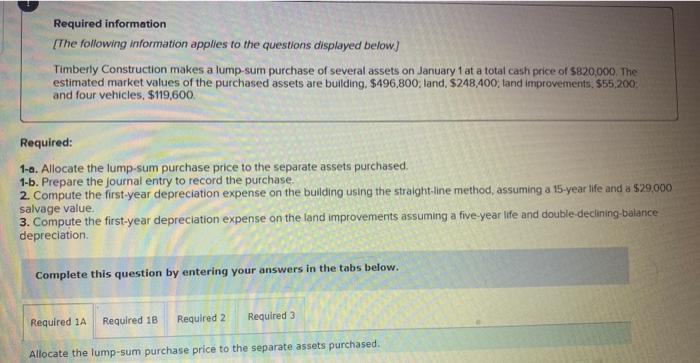

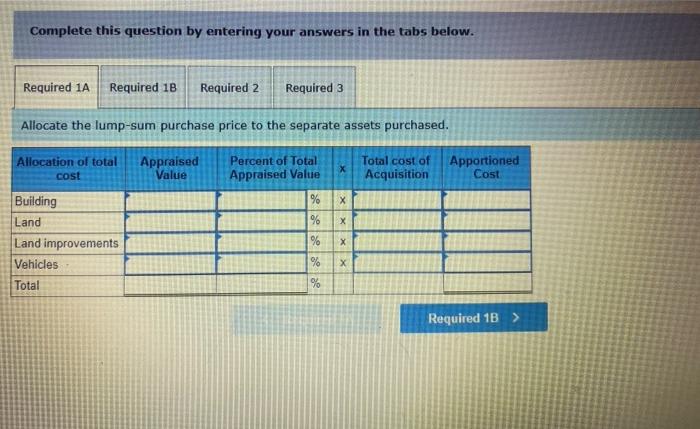

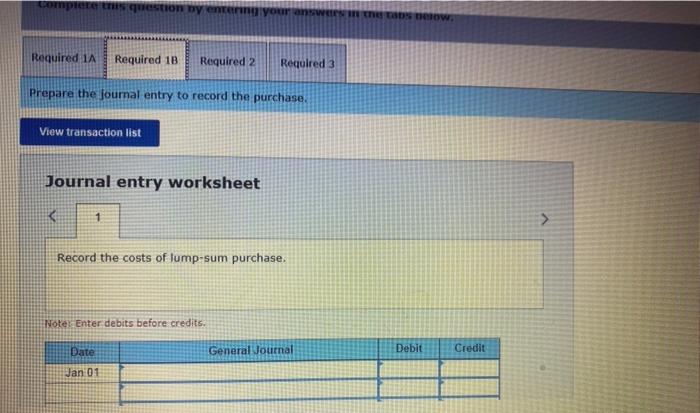

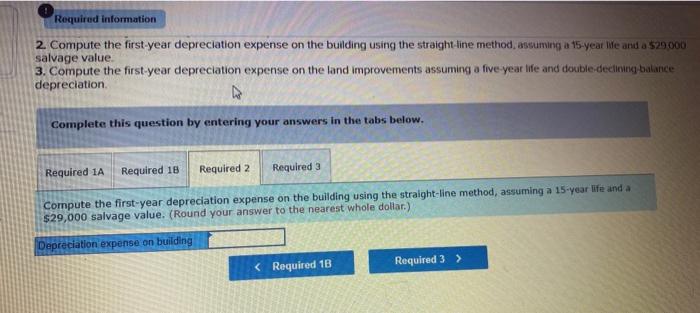

Required information [The following information applies to the questions displayed below) Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $820,000. The estimated market values of the purchased assets are building. $496,800; land, $248,400, land improvements, $55,200 and four vehicles. $119,600. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight line method, assuming a 15-year life and a $29.000 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double declining balance depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Allocate the lump-sum purchase price to the separate assets purchased. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Allocate the lump-sum purchase price to the separate assets purchased. Allocation of total cost Appraised Value Total cost of Apportioned Acquisition Cost Percent of Total Appraised Value % % % Building Land Land improvements Vehicles x X % Total Required 1B > compiere uns STION by your answer the tasten Required 1A Required 1B Required 2 Required 3 Prepare the journal entry to record the purchase. View transaction list Journal entry worksheet 1 Record the costs of lump-sum purchase. Noter Enter debits before credits Date General Journal Debit Credit Jan 01 Required information 2. Compute the first-year depreciation expense on the building using the straight line method, assuming a 15-year We and a $29.000 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double declining balance depreciation Complete this question by entering your answers in the tabs below. Required 2 Required 1A Required 18 Required 3 Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. (Round your answer to the nearest whole dollar) Depreciation expense on building Required information 2 Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15 year life and a $29,000 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five year life and double declining balance depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation Depreciation expense on land improvements