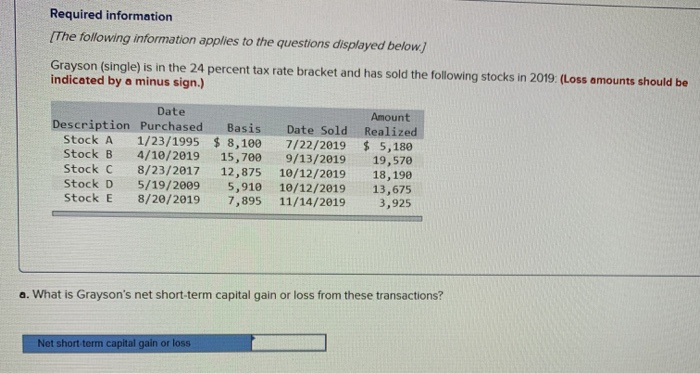

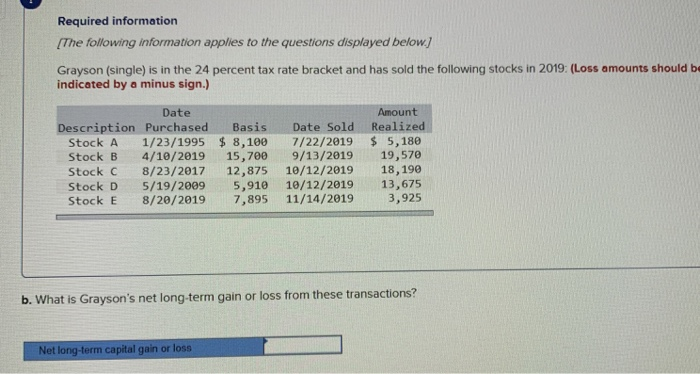

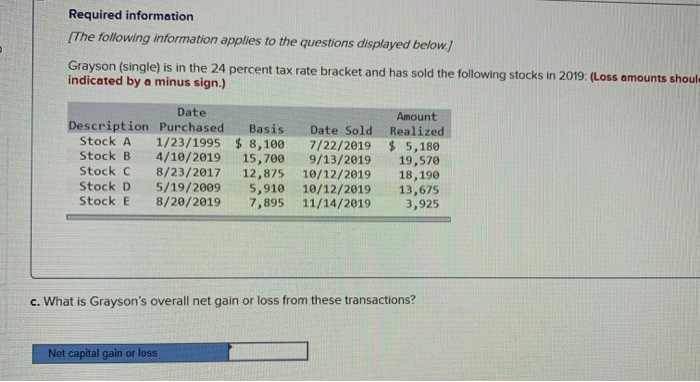

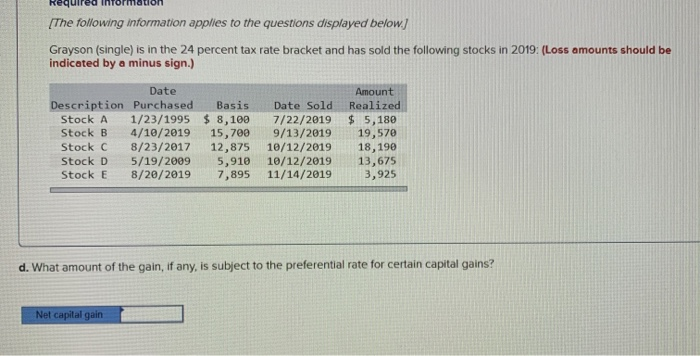

Required information The following information applies to the questions displayed below) Grayson (single) is in the 24 percent tax rate bracket and has sold the following stocks in 2019 (Loss amounts should be indicated by a minus sign.) Date Description Purchased Basis Stock A 1/23/1995 $ 8,109 Stock B 4/10/2019 15,700 Stock C 8/23/2017 12,875 Stock D 5/19/2009 5,910 Stock E 8/20/20197 ,895 Date Sold 7/22/2019 9/13/2019 10/12/2019 10/12/2019 11/14/2019 Amount Realized $ 5,180 19,570 18,190 13,675 3,925 a. What is Grayson's net short term capital gain or loss from these transactions? Net short-term capital gain or loss Required information (The following information applies to the questions displayed below.) Grayson (single) is in the 24 percent tax rate bracket and has sold the following stocks in 2019: (Loss amounts should b indicated by a minus sign.) Date Description Purchased Basis Stock A 1/23/1995 $ 8,109 Stock B 4/10/2019 15,700 Stock C 8/23/2017 12,875 Stock D 5/19/2009 5,910 Stock E 8/20/20197 ,895 Date Sold 7/22/2019 9/13/2019 10/12/2019 19/12/2019 11/14/2019 Amount Realized $ 5,180 19,570 18,190 13,675 3,925 b. What is Grayson's net long-term gain or loss from these transactions? Net long-term capital gain or loss Required information (The following information applies to the questions displayed below) Grayson (single) is in the 24 percent tax rate bracket and has sold the following stocks in 2019: (Loss amounts should indicated by a minus sign.) Date Description Purchased Basis Stock A 1/23/1995 $ 8,100 Stock B 4/10/2019 15,700 Stock C 8/23/2017 12,875 Stock D 5/19/2009 5,910 Stock E 8/20/20197,895 Date Sold 7/22/2019 9/13/2019 10/12/2019 10/12/2019 11/14/2019 Amount Realized $ 5,180 19,570 18,190 13,675 3,925 c. What is Grayson's overall net gain or loss from these transactions? Net capital gain or loss Required Information (The following information applies to the questions displayed below! Grayson (single) is in the 24 percent tax rate bracket and has sold the following stocks in 2019: (Loss amounts should be indicated by a minus sign.) Date Description Purchased Basis Date Sold Stock A 1/23/1995 $ 8,100 7/22/2019 Stock B 4/10/2019 15,7009 /13/2019 Stock C 8/23/2017 12,875 10/12/2019 Stock D 5/19/2009 5,910 10/12/2019 Stock E 8/20/20197,895 11/14/2019 Amount Realized $ 5,180 19,570 18,190 13,675 13,925 d. What amount of the gain, if any, is subject to the preferential rate for certain capital gains? Net capital gain