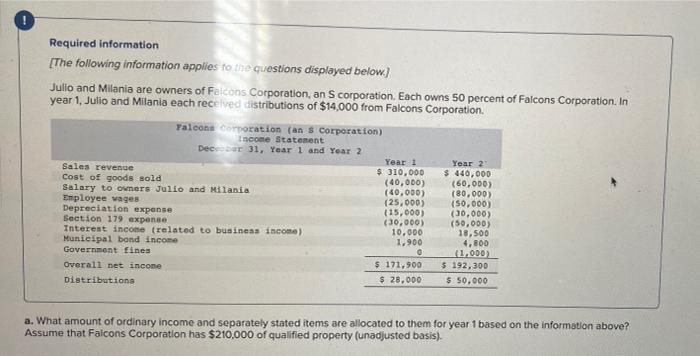

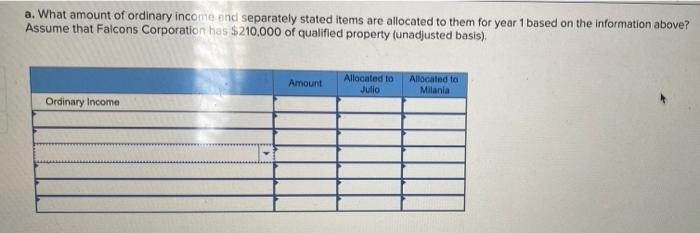

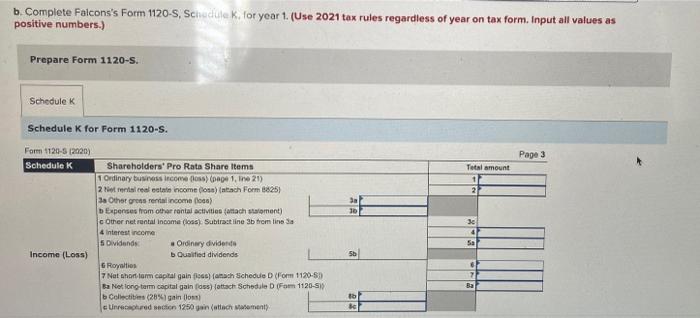

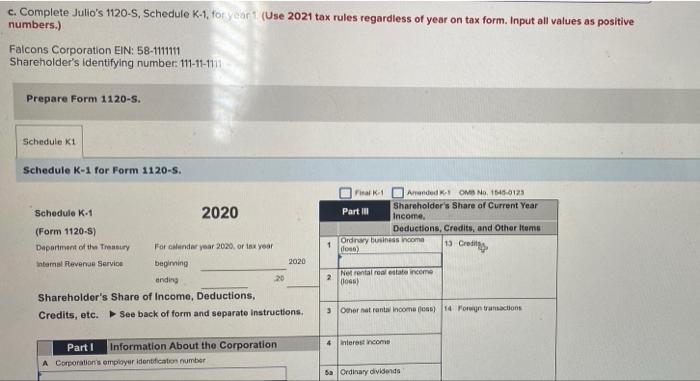

Required information [The following information applies to the questions displayed below.) Julio and Milania are owners of Falcons Corporation, an Scorporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $14,000 from Falcons Corporation. Yalcons oration (ans Corporation) Income Statement Dec 31, Year 1 and Year 2 Year 1 Year 2 Sales revenge $ 310,000 $ 440,000 Cost of goods sold (40,000) (60,000) Salary to owners Julio and Milania (40,000) (80,000) Employee wages (25,000) {50,000) Depreciation expense (15,000) (30,000) Section 179 expense (30,000) (50,000) Interest income (related to business income) 10.000 18,500 Municipal bond income 1,900 4,800 Government fines (1.000) Overall net income $ 171,900 $ 192,300 Distributions $ 28.000 $ 50.000 a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $210,000 of qualified property (unadjusted basis). a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $210,000 of qualified property (unadjusted basis) Amount Allocated to Julio Allocated to Milania Ordinary Income b. Complete Falcons's Form 1120-s, Schedulek. for year 1. (Use 2021 tax rules regardless of year on tax form. Input all values as positive numbers.) Prepare Form 1120-s. Schedule K Page 3 Total amount 1 2 10 Schedule K for Form 1120-s. Form 1120-5 (2020) Schedule K Shareholders' Pro Rata Share Items TOrdinary business income foss) (page 1. in 21) 2 til real estate income oss) (atach Form $825) 3 Other grans reincome osa) D Expenses from other rental activities attach statement) cother net rental income (los) Subtract line 3b tremtinos 4 Interest income 5 Dividends Ordinwy dividendo Income (Loss) Qualified dividends Royalties 7 Net short form capital gain (06) (anach Schedule D (om 1120-59 Ba Netlong term capital gain foss) attach Schedule D Fem 1120-51 b Collecties (20%) gainos Unrecured section 1250 gain (attachment Je Sa 56 2 c. Complete Julio's 1120-s, Schedule K-1. for year (Use 2021 tax rules regardless of year on tax form. Input all values as positive numbers.) Falcons Corporation EN: 58-1111111 Shareholder's identifying number: 111-11-1711 Prepare Form 1120-s. Schedule 1 Schedule K-1 for Form 1120-s. Final 1 Amended OMB No 15450123 Shareholder's Share of Current Year Part II Income. Deductions, Credits, and other items Ordrwy business income dos) 1 13 Credit Schedule K-1 2020 (Form 1120-5) Department of the Treasury For calendar year 2020. or tax year intamal Revenue Service beginning 2020 anding Shareholder's Share of income, Deductions, Credits, etc. See back of form and separate instructions. 2 Nefrontal real estate income Boss 3 Othernetrant Income 10) 14 Forrin transactions 4 Interest income Part I Information About the Corporation A Corporations employer identification number da Ordinary dividends