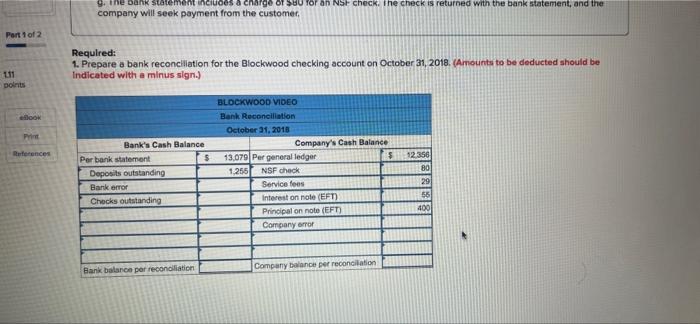

Required Information [The following information applies to the questions displayed below) On October 31, 2018, the bank statement for the checking account of Blockwood Video shows a balance of $13,079, while the company's records show a balance of $12,356. Information that might be useful in preparing a bank reconciliation is as follows: a. Outstanding checks are $1.255. b. The October 31 cash receipts of $810 are not deposited in the bank until November 2. c. One check written in payment of utilities for $142 is correctly recorded by the bank but is recorded by Blockwood as a disbursement of $412. d. In accordance with prior authorization, the bank withdraws $455 directly from the checking account as payment on a note payable. The interest portion of that payment is $55 and the principal portion is $400. Blockwood has not recorded the direct withdrawal. e. Bank service fees of $29 are listed on the bank statement A deposit of $572 is recorded by the bank on October 13, but it did not belong to Blockwood. The deposit should have been made to the checking account of Hollybuster Video, a separate company G. The bank statement includes a charge of $80 for an NSF check. The check is returned with the bank statement, and the company will seek payment from the customer Required: 1. Prepare a bank reconciliation for the Blockwood checking account on October 31, 2018. (Amounts to be deducted should be Indicated with a minus sign.) BLOCKWOOD VIDEO Bank Seconciliation October 31, 2016 Company's Cash Balance cha 9. The bank statement includes a charge of SBU for an Nst check, the check is returned with the bank statement, and the company will seek payment from the customer, Part 1 of 2 Required: 1. Prepare a bank reconciliation for the Blockwood checking account on October 31, 2018. (Amounts to be deducted should be Indicated with a minus sign.) 111 points BOOK Print References Bank's Cash Balance Perbank statement $ Deposits outstanding Bank error Checks outstanding BLOCKWOOD VIDEO Bank Reconciliation October 21, 2018 Company's Cash Balance 13.079 Per general ledger $ 1.256 NSF check Service fees Interest on note (EFT) Principal on note (EFT) Company error 12356 80 29 56 4001 Bank balance per reconciliation Company balance per reconciation