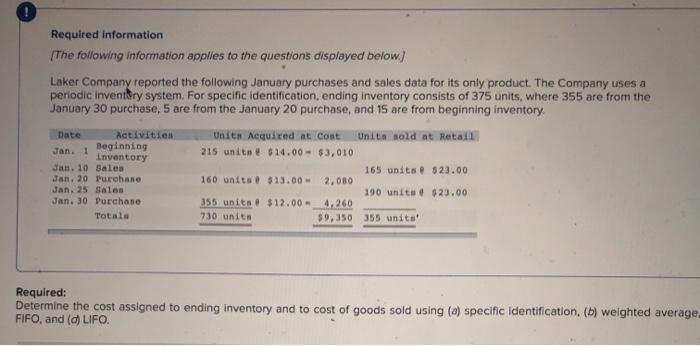

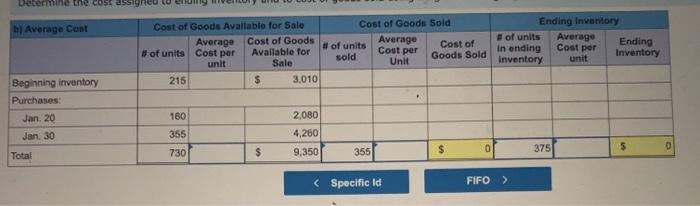

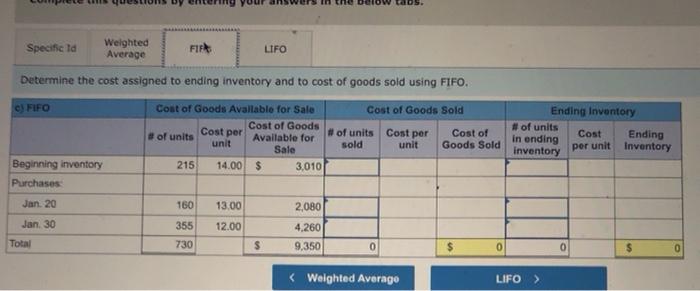

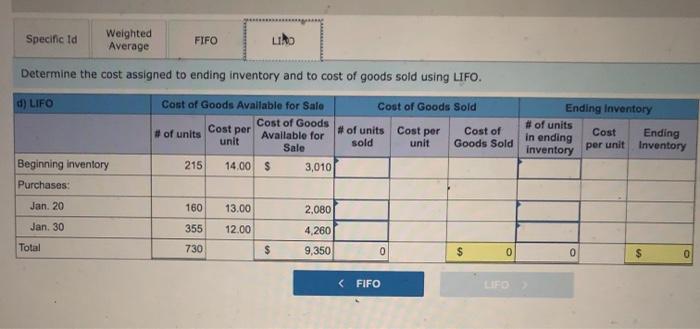

Required information The following information applies to the questions displayed below) Laker Company reported the following January purchases and sales data for its only product. The Company uses a periodic inventory system. For specific identification, ending inventory consists of 375 units, where 355 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory activities Units Aequired at Cost Units sold at Retail Beginning Jan. 1 Inventory 215 unitat 14.00 - $3,010 Jan. 10 Sales 165 units $23.00 Jan. 20 Purchase 160 units $15.00 - 2,080 Jan. 25 Sales 190 units $23.00 Jan. 30 Purchase 355 unitn$12.00 - 4,260 Totals 730 units $9,350 355 unita! Date Required: Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification. (b) weighted average. FIFO, and (c) LIFO. Determine the COS green b) Average Cont Cost of Goods Available for Sale Average Cost of Goods # of units Cost per Available for unit Sale 215 $ 3,010 Cost of Goods Sold Average # of units Cost of Cost per Unit Goods Sold Ending Inventory # of units Averago Ending In ending Cost per Inventory unit inventory sold Beginning inventory Purchases: Jan. 20 Jan. 30 2,080 160 355 4,260 9,350 $ 0 $ 730 0 355 375 Total Specific la Weighted Average FIFA LIFO Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. c) FIFO Cost per Cost of Goods Available for Sale Cost of Goods Sold Cost of Goods of units # of units Cost per Available for Cost of unit unit Goods Sold Sale 215 14.00 $ 3,010 Ending Inventory # of units Cost in ending Ending inventory per unit Inventory sold Beginning inventory Purchases Jan. 20 13.00 2,080 160 355 730 Jan. 30 Total 12.00 4.260 9,350 $ 0 $ 0 0 $ 0 Specific Id Weighted Average FIFO LIO Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. d) LIFO Cost per Cast of Goods Available for Sale Cost of Goods Sold Cost of Goods # of units Cost per Cost of # of units Available for unit sold unit Goods Sold Sale 215 14.00 $ 3,010 Ending Inventory # of units Cost in ending Ending Inventory inventory per unit Beginning inventory Purchases: Jan. 20 160 13.00 2.080 Jan. 30 355 12.00 4,260 9,350 Total 730 $ 0 $ 0 0 $