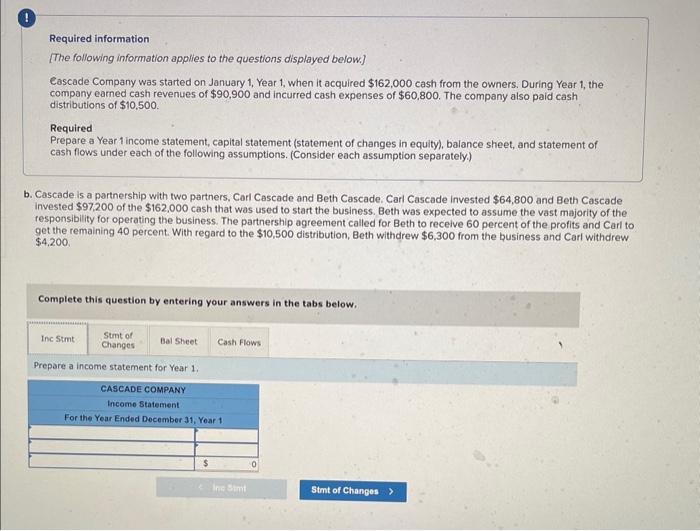

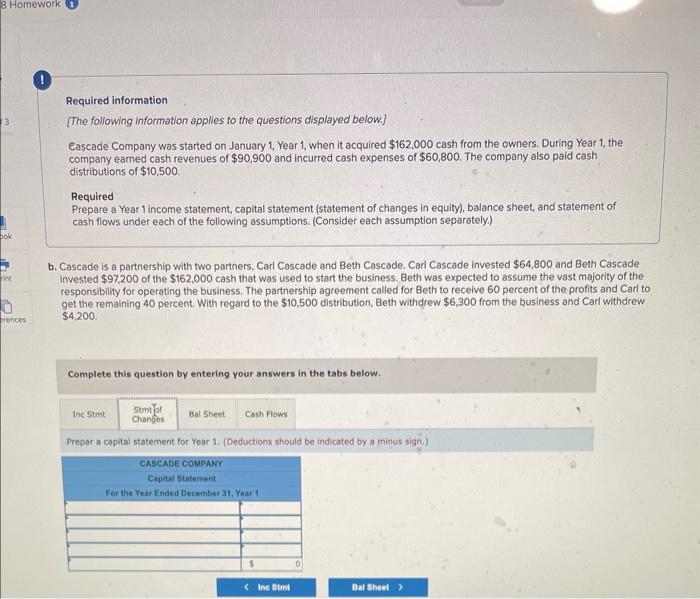

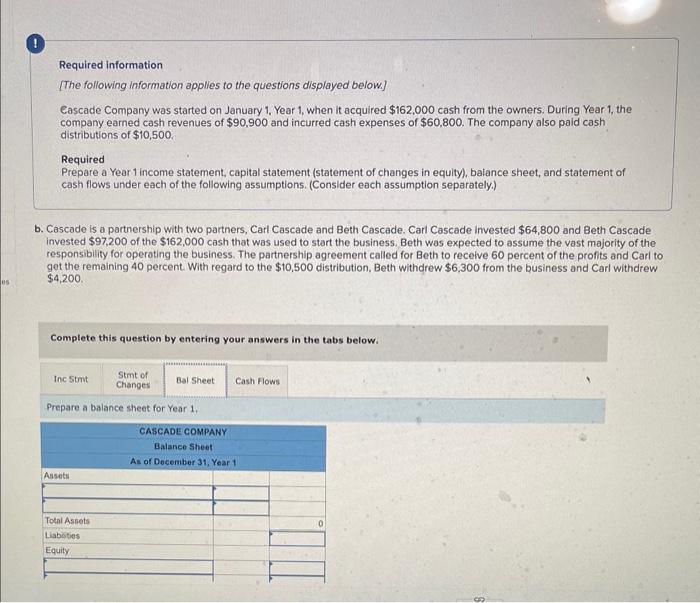

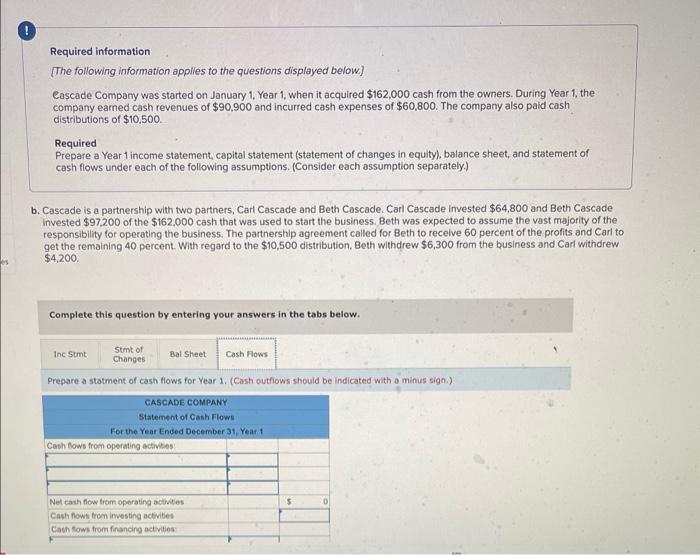

Required information [The following information applies to the questions displayed below] Cascade Company was started on January 1, Year 1, when it acquired $162,000 cash from the owners. During Year 1, the company eamed cash revenues of $90,900 and incurred cash expenses of $60,800. The company also paid cash distributions of $10.500. Required Prepare a Year 1 income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows under each of the following assumptions. (Consider each assumption separately.) b. Cascade is a partnership with two partners, Carl Cascade and Beth Cascade. Carl Cascade invested $64,800 and Beth Cascade invested $97,200 of the $162,000 cash that was used to start the business. Beth was expected to assume the vast majority of the responsibility for operating the business. The partnership agreement called for Beth to receive 60 percent of the profits and Carl to get the remaining 40 percent. With regard to the $10,500 distribution, Beth withdrew $6,300 from the business and Cari withdrew $4,200 Complete this question by entering your answers in the tabs below. Prepare a income statement for Year 1 . Required information [The following information applies to the questions displayed below.] Cascade Company was started on January 1, Year 1, when it acquired $162,000 cash from the owners. During Year 1, the company earned cash revenues of $90,900 and incurred cash expenses of $60,800. The company also paid cash distributions of $10,500 Required Prepare a Year 1 income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows under each of the following assumptions. (Consider each assumption separately.) b. Cascade is a partnership with two partners, Carl Cascade and Beth Cascade. Carl Cascade invested $64,800 and Beth Cascade invested $97,200 of the $162,000 cash that was used to start the business. Beth was expected to assume the vast majority of the responsibility for operating the business. The partnership agreement called for Beth to recelve 60 percent of the profits and Carl to get the remaining 40 percent. With regard to the $10,500 distribution, Beth withdrew $6,300 from the business and Carl withdrew $4,200 Complete this question by entering your answers in the tabs below. Prepar a capital statement for Year 1. (Deductions should be indicated by a minus sign.) Required information [The following information applies to the questions displayed below.] Cascade Company was started on January 1. Year 1, when it acquired $162,000 cash from the owners. During Year 1, the company earned cash revenues of $90,900 and incurred cash expenses of $60,800. The company also paid cash distributions of $10,500. Required Prepare a Year 1 income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows under each of the following assumptions. (Consider each assumption separately.) 2. Cascade is a partnership with two partners, Carl Cascade and Beth Cascade. Carl Cascade invested $64,800 and Beth Cascade invested $97,200 of the $162,000 cash that was used to start the business. Beth was expected to assume the vast majority of the responsibility for operating the business. The partnership agreement called for Beth to receive 60 percent of the profits and Carl to get the remaining 40 percent. With regard to the $10,500 distribution, Beth withdrew $6,300 from the business and Carl withdrew $4,200. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Year 1 , Required information [The following information applies to the questions displayed below] Cascade Company was started on January 1, Year 1, when it acquired $162,000 cash from the owners. During Year 1, the company earned cash revenues of $90,900 and incurred cash expenses of $60,800. The company also paid cash distributions of $10,500. Required Prepare a Year 1 income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows under each of the following assumptions. (Consider each assumption separately.) b. Cascade is a partnership with two partners, Carl Cascade and Beth Cascade. Carl Cascade invested $64,800 and Beth Cascade Invested $97,200 of the $162,000 cash that was used to start the business. Beth was expected to assume the vast majority of the responsibility for operating the business. The partnership agreement called for Beth to receive 60 percent of the profits and Carl to get the remaining 40 percent. With regard to the $10,500 distribution. Beth withdrew $6,300 from the business and Carl withdrew $4,200. Complete this question by entering your answers in the tabs below. Prepare a statment of cash flows for Year 1. (Cish outflows should be indicated with o minus sign.)