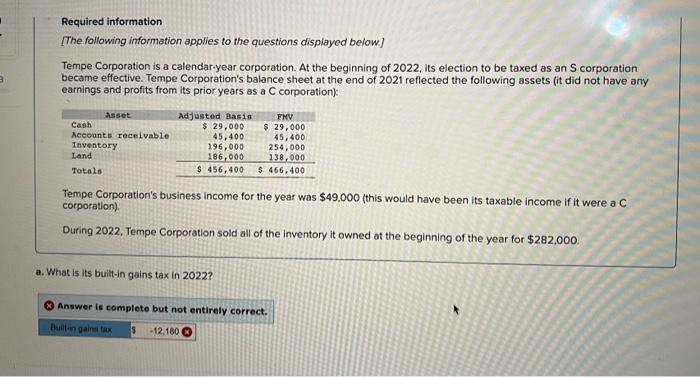

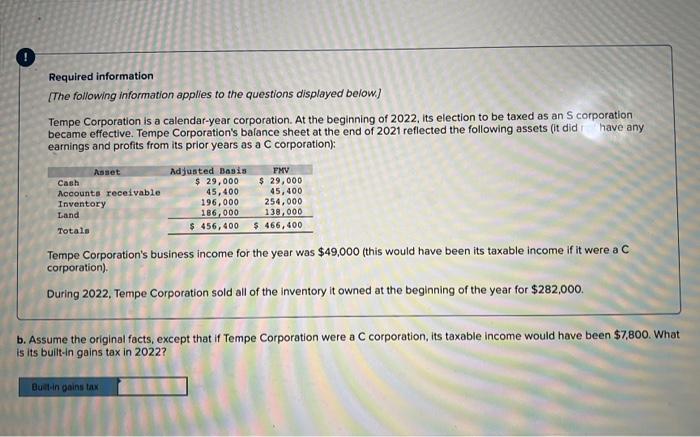

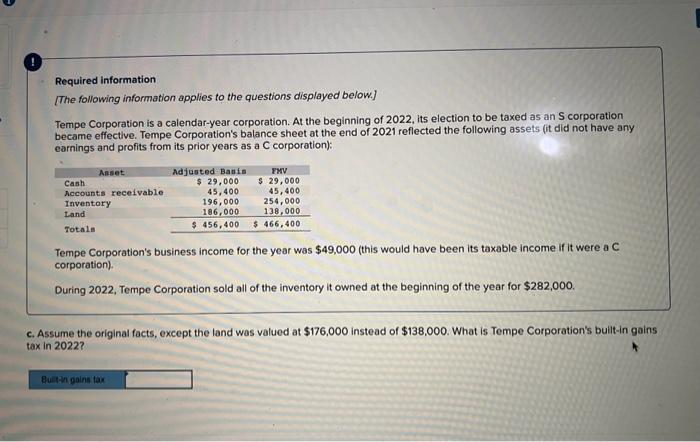

Required information [The following information applies to the questions displayed below] Tempe Corporation is a calendar-year corporation. At the beginning of 2022, its election to be taxed as an S corporation became effective. Tempe Corporation's balance sheet at the end of 2021 reflected the following assets (it did not have any earnings and profits from its prior years as a C corporation): Tempe Corporation's business income for the year was $49,000 (this would have been its taxable income if it were a C corporation). During 2022, Tempe Corporation sold all of the inventory it owned at the beginning of the year for $282,000. a. What is its built-in gains tax in 2022 ? Answer is complete but not entirely correct. Required information [The following information applies to the questions displayed below] Tempe Corporation is a calendar-year corporation. At the beginning of 2022, its election to be taxed as an 5 corporation earnings and profits from its prior years as a C corporation): Tempe Corporation's business income for the year was $49,000 (this would have been its taxable income if it were a C corporation). During 2022, Tempe Corporation sold all of the inventory it owned at the beginning of the year for $282,000. b. Assume the original facts, except that if Tempe Corporation were a C corporation, its taxable income would have been $7,800. What 5 its built-in gains tax in 2022? Required information [The following information applies to the questions displayed below.] Tempe Corporation is a calendar-year corporation. At the beginning of 2022, its election to be taxed as an S corporation became effective. Tempe Corporation's balance sheet at the end of 2021 reflected the following assets (it did not have any earnings and profits from its prior years as a C corporation): Tempe Corporation's business income for the year was $49,000 (this would have been its taxable income if it were a C corporation). During 2022, Tempe Corporation sold all of the inventory it owned at the beginning of the year for $282,000. Assume the original facts, except the land was valued at $176,000 instead of $138,000. What is Tempe Corporation's built-in gains in in 2022