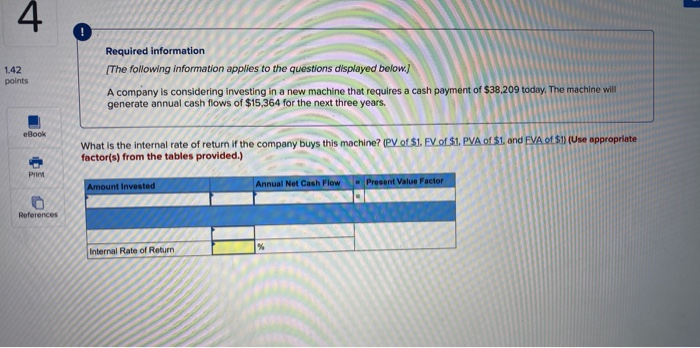

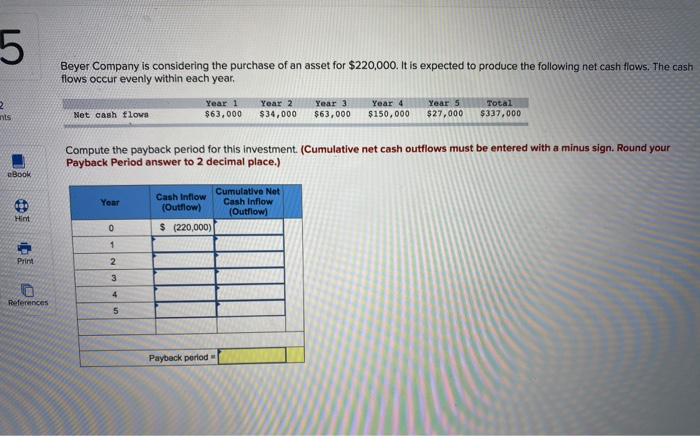

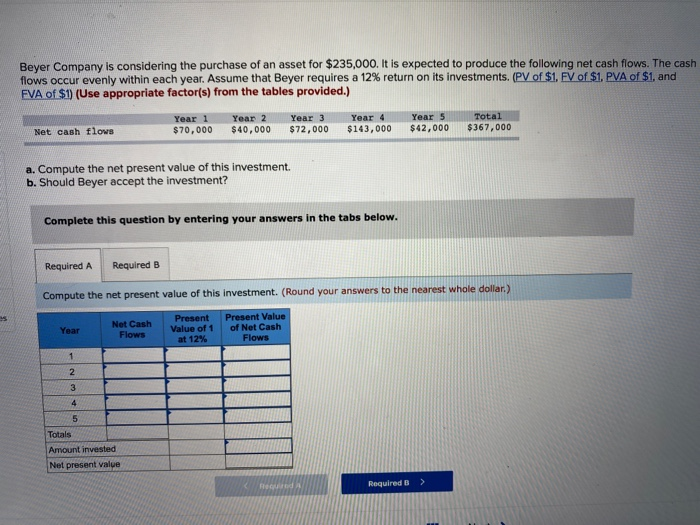

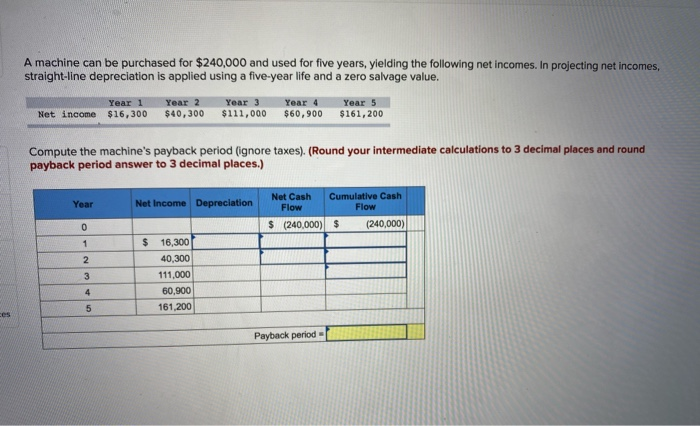

Required information (The following information applies to the questions displayed below.) 142 points A company is considering Investing in a new machine that requires a cash payment of $38.209 today. The machine will generate annual cash flows of $15,364 for the next three years. What is the internal rate of return if the company buys this machine? (PV of $1. FV of $1. PVA of 51 and EVA of $11 (Use appropriate factor(s) from the tables provided.) Pint Amount invested Annual Net Cash Flow Present Value Factor Internal Rate of Return % Beyer Company is considering the purchase of an asset for $220,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year. Year 1 $63,000 Year 2 $34,000 Year 3 $63,000 Year 4 $150,000 Year 5 $27,000 Total $337,000 Net cash flows Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback period answer to 2 decimal place.) Lo ? le tuo Year Cash Inflow Cumulative Net (Outflow) Cash Inflow (Outflow) $ (220,000) 0 1 2 3 4 Payback period Beyer Company is considering the purchase of an asset for $235,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year. Assume that Beyer requires a 12% return on its investments. (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year 1 $70,000 Year 2 $40,000 Year 4 $143,000 $72,000 Year 5 $42,000 Total $367,000 Net cash flows a. Compute the net present value of this investment b. Should Beyer accept the investment? Complete this question by entering your answers in the tabs below. Required A Required B Compute the net present value of this investment. (Round your answers to the nearest whole dollar) Year Net Cash Flows Present Value of 1 at 12% Present Value of Net Cash Flows 1 4 5 Totals Amount invested Net present value Required 8 > A machine can be purchased for $240,000 and used for five years, yielding the following net incomes. In prolecting net incomes. straight-line depreciation is applied using a five-year life and a zero salvage value. Net income Year 1 $16,300 Year 2 $40,300 Year 3 $111,000 Year 4 $60,900 Year 5 $161,200 Compute the machine's payback period (ignore taxes). (Round your intermediate calculations to 3 decimal places and round payback period answer to 3 decimal places.) Net Cash Year Net Income Depreciation Cumulative Cash Flow $ (240,000) $ (240,000) OWN-O 16,300 40,300 111,000 60.900 161.200 Payback period =P