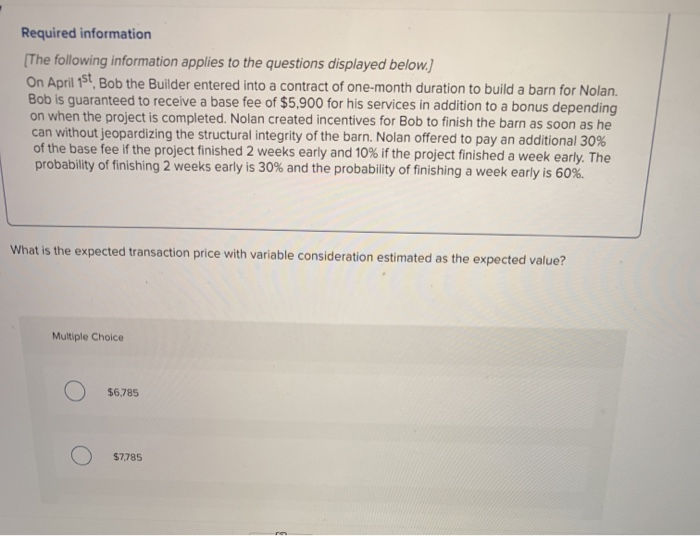

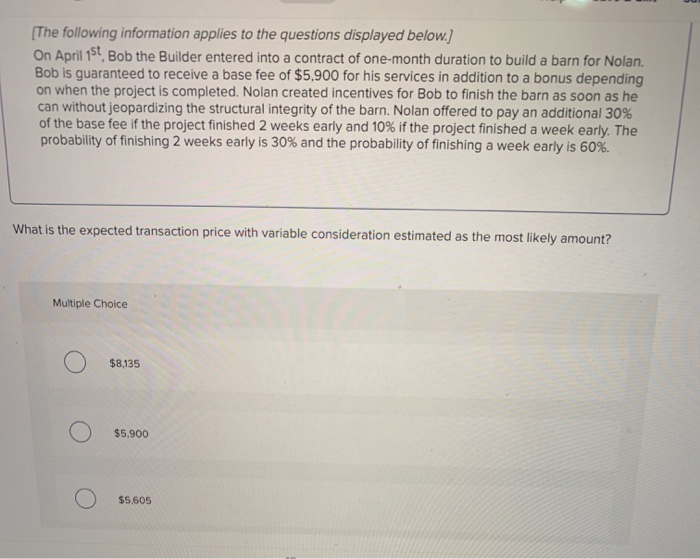

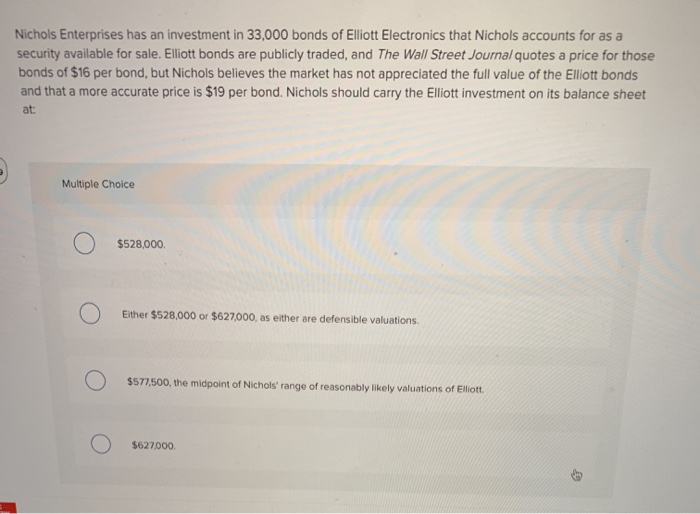

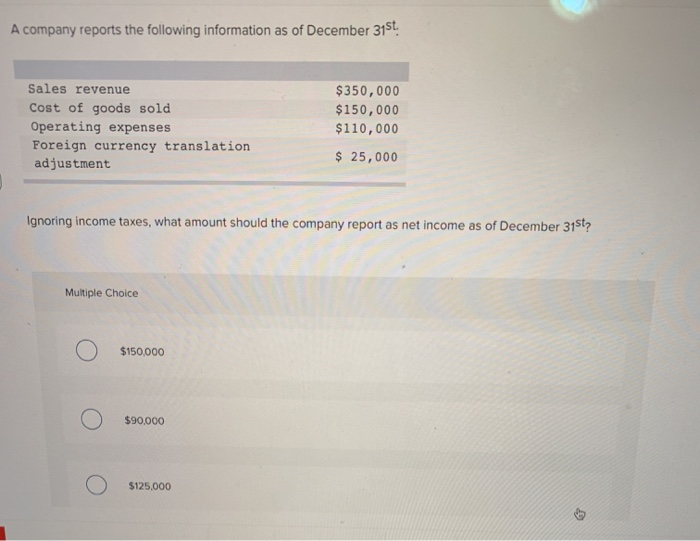

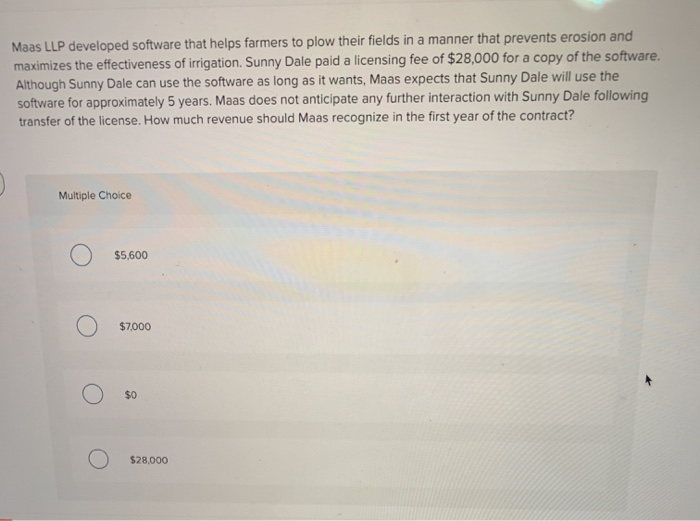

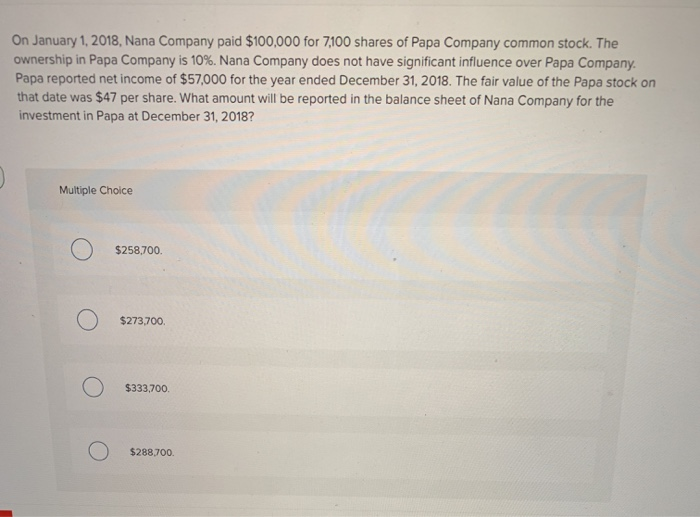

Required information (The following information applies to the questions displayed below. On April 1st, Bob the Builder entered into a contract of one-month duration to build a barn for Nolan Bob is guaranteed to receive a base fee of $5,900 for his services in addition to a bonus depending on when the project is completed. Nolan created incentives for Bob to finish the barn as soon as he can without jeopardizing the structural integrity of the barn. Nolan offered to pay an additional 30% of the base fee if the project finished 2 weeks early and 10% if the project finished a week early. The probability of finishing 2 weeks early is 30% and the probability of finishing a week early is 60%. What is the expected transaction price with variable consideration estimated as the expected value? Multiple Choice $6,785 $7785 ce The following information applies to the questions displayed below. On April 1st, Bob the Builder entered into a contract of one-month duration to build a barn for Nolan Bob is guaranteed to receive a base fee of $5,900 for his services in addition to a bonus depending on when the project is completed. Nolan created incentives for Bob to finish the barn as soon as he can without jeopardizing the structural integrity of the barn. Nolan offered to pay an additional 30% of the base fee if the project finished 2 weeks early and 10% if the project finished a week early. The probability of finishing 2 weeks early is 30% and the probability of finishing a week early is 60% What is the expected transaction price with variable consideration estimated as the most likely amount? Multiple Choice $8,135 $5,900 $5,605 Nichols Enterprises has an investment in 33,000 bonds of Elliott Electronics that Nichols accounts for as a security available for sale. Elliott bonds are publicly traded, and The Wall Street Journal quotes a price for those bonds of $16 per bond, but Nichols believes the market has not appreciated the full value of the Elliott bonds and that a more accurate price is $19 per bond. Nichols should carry the Elliott investment on its balance sheet at: Multiple Choice $528,000. Either $528,000 or $627,000, as either are defensible valuations. $577,500, the midpoint of Nichols' range of reasonably likely valuations of Elliott $627000 A company reports the following information as of December 31st Sales revenue $350,000 Cost of goods sold $150,000 Operating expenses Foreign currency translation adjustment $110,000 $ 25,000 Ignoring income taxes, what amount should the company report as net income as of December 31st? Multiple Choice $150,000 $90,000 $125,000 Maas LLP developed software that helps farmers to plow their fields in a manner that prevents erosion and maximizes the effectiveness of irrigation. Sunny Dale paid a licensing fee of $28,000 for a copy of the software Although Sunny Dale can use the software as long as it wants, Maas expects that Sunny Dale will use the software for approximately 5 years. Maas does not anticipate any further interaction with Sunny Dale following transfer of the license. How much revenue should Maas recognize in the first year of the contract? Multiple Choice $5,600 $7,000 $0 $28,000 On January 1, 2018, Nana Company paid $100,000 for 7,100 shares of Papa Company common stock. The ownership in Papa Company is 10%. Nana Company does not have significant influence over Papa Company Papa reported net income of $57,000 for the year ended December 31, 2018. The fair value of the Papa stock on that date was $47 per share. What amount will be reported in the balance sheet of Nana Company for the investment in Papa at December 31, 2018? Multiple Choice $258,700. $273,700 $333,700. $288,700