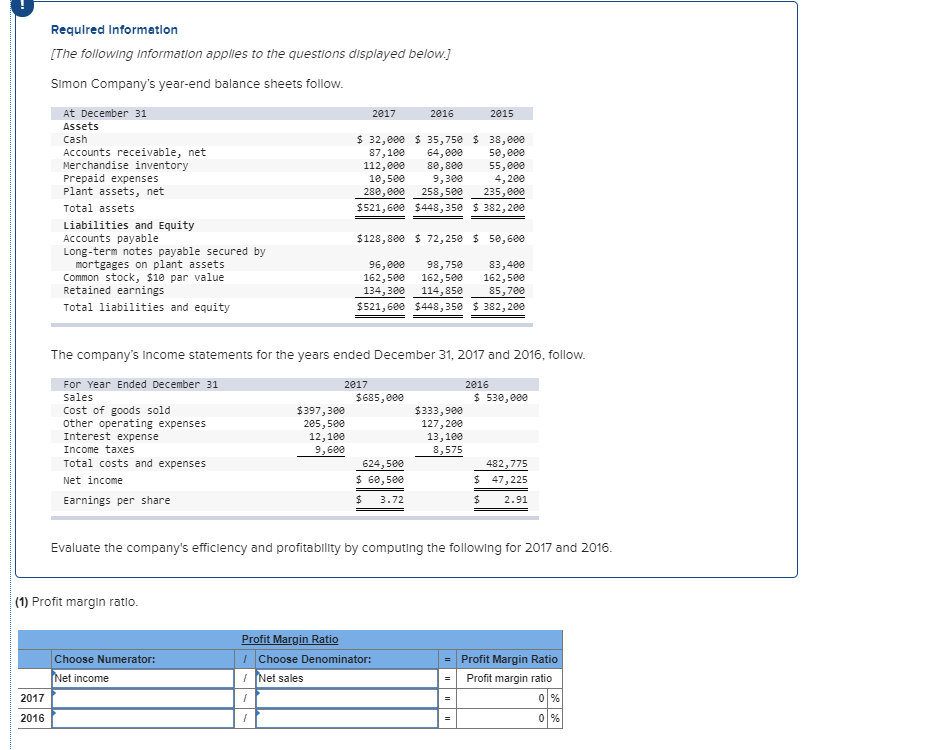

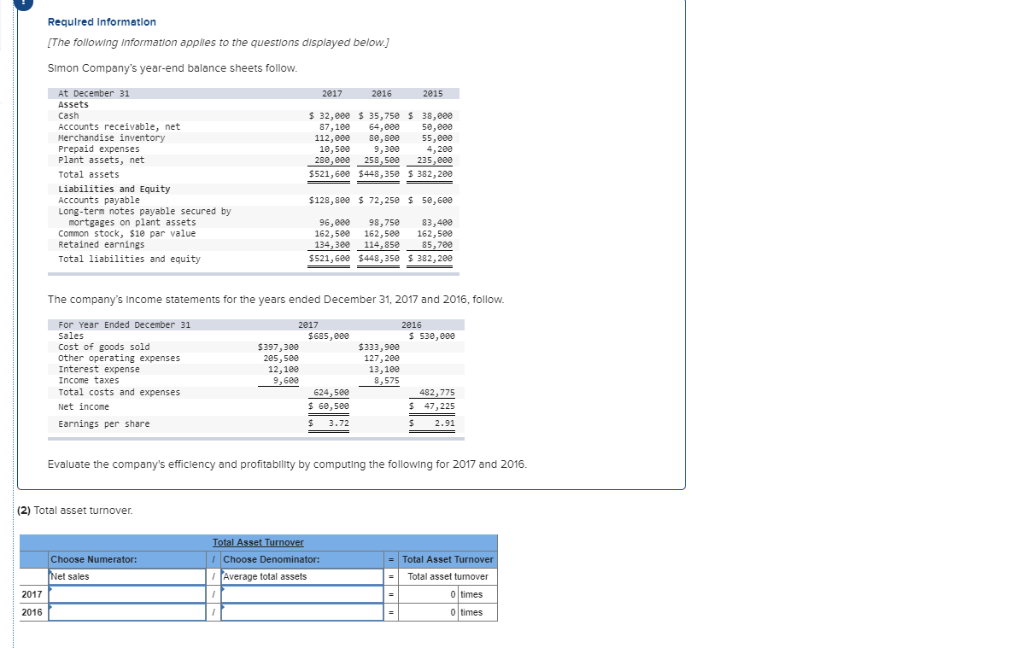

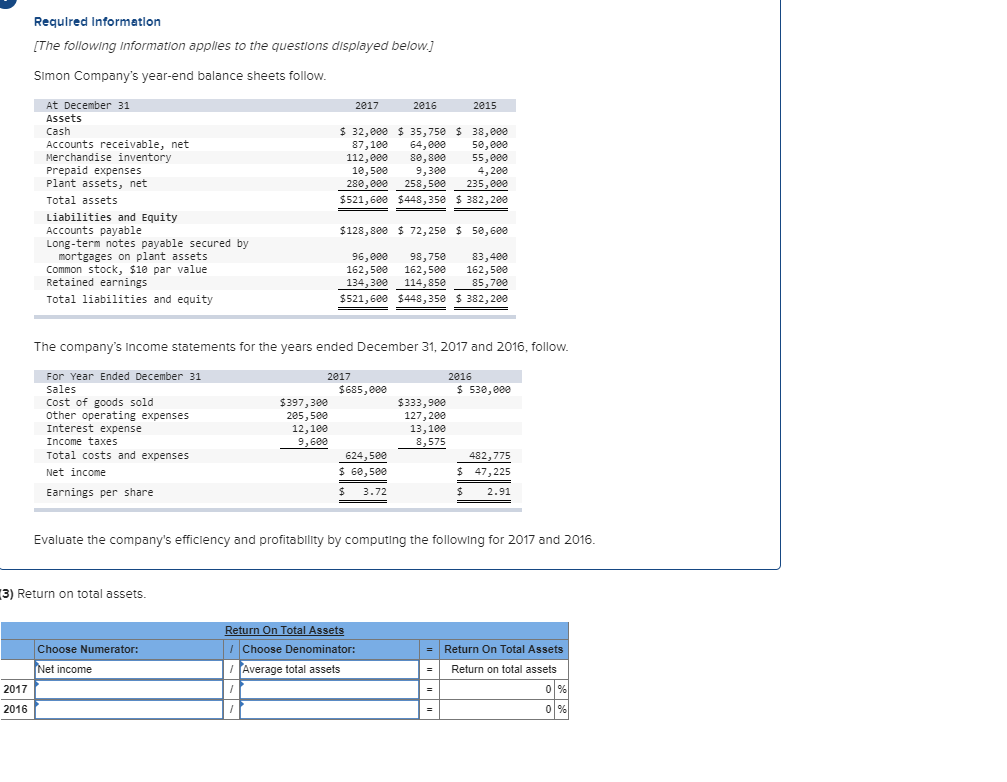

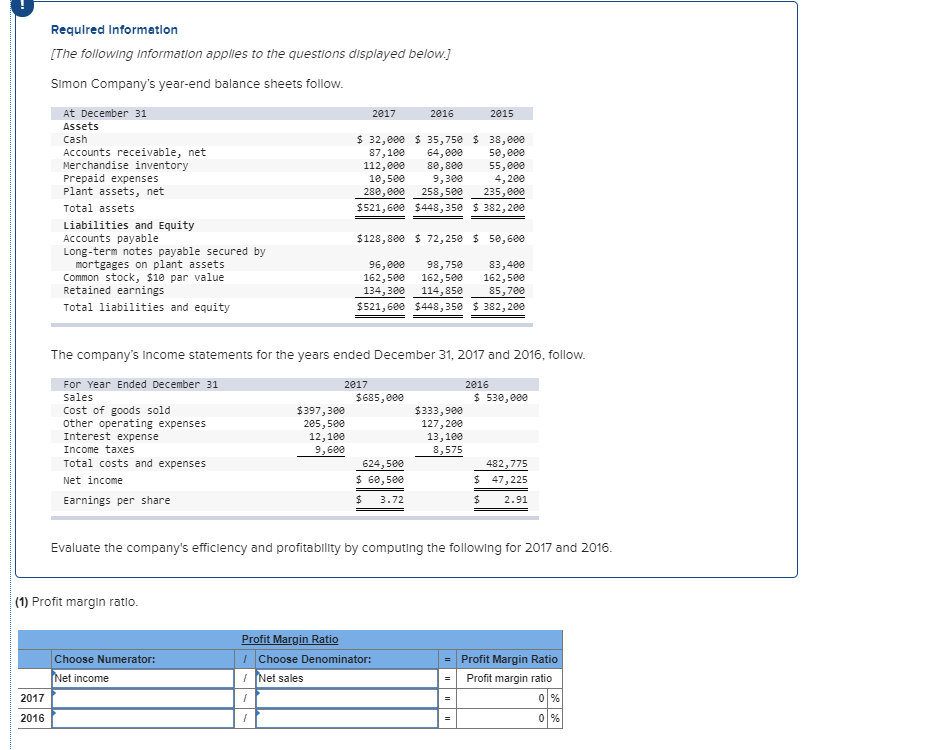

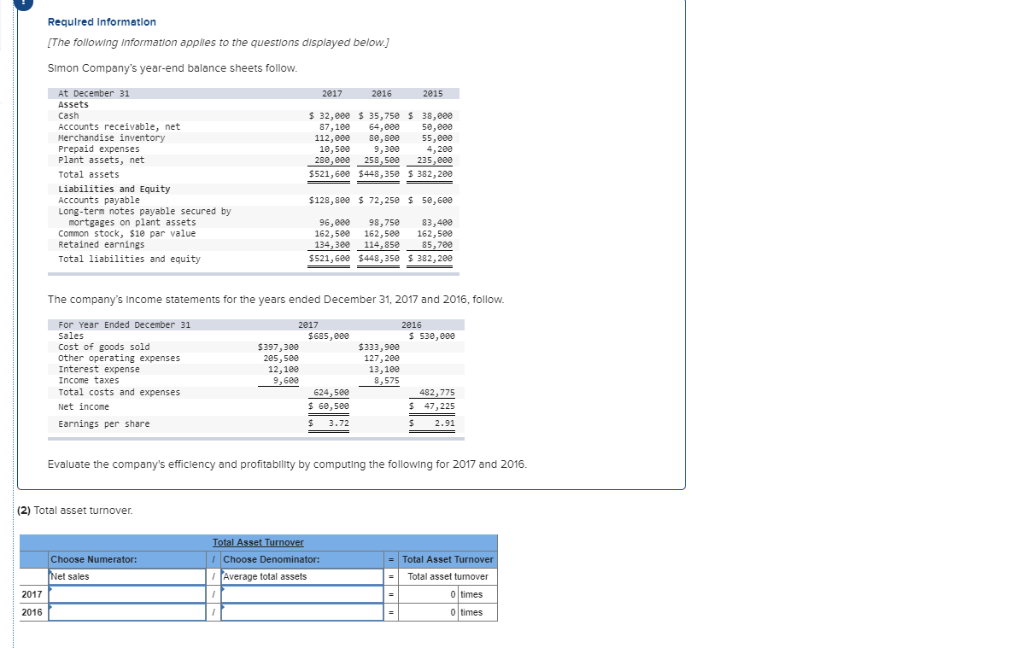

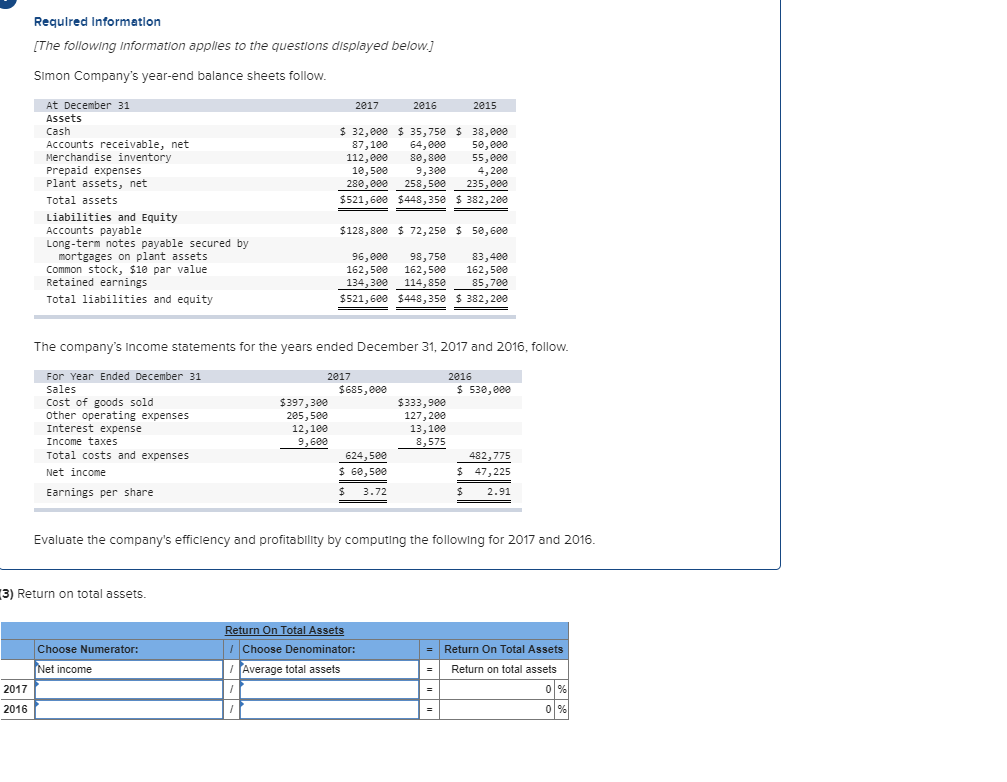

Required Information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets 32,0ee 35,750 $ 38,eee Cash Accounts receivable, net Merchandise inventory 64,eee 8e,8ee 5e, eee 55, eee 4,20e 235,eee 87,10e 112,eee 10,5ee 280,eee Prepaid expenses Plant assets, net 9,3ee 258,50e $521,600 $448,350 382,200 Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $128,80e 72,250 5e,6ee 98,750 162,5ee 114,850 96,eee 162,5ee 83,400 162,50e 85,70e 134,300 Total liabilities and equity $521,600 $448,350 382,20e The company's Income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended Decemberr 31 2017 2016 Sales $685,eee 530,eee Cost of goods sold other operating expenses Interest e: $397,300 $333,90e 127,200 13,10e 8,575 205,50e 12,100 nse Income taxes 9,600 Total costs and expenses 624,5ee 482,775 60,5ee Net income 47,225 $ Earnings per share 3.72 2.91 Evaluate the company's efficlency and profitability by computing the following for 2017 and 2016. (1) Profit margin ratio. Profit Margin Ratio Choose Denominator: Choose Numerator: Profit Margin Ratio Net income Net sales Profit margin ratio 0 % 2017 0 % 2016 Required Information [The following Information apples to the questlons displayed below.] Simon Company's vear-end balance sheets follow 2015 At December 31 2017 2016 ASsets seCounts receivable, net Merchandise inventory Prepaid expenses 112.000 se,see 55,e0e 10,500 9,300 4,200 $521,680 $448,350 $ 382.280 Total assets Liabilities and Equity Accounts payable $128,80e 72,250 50,6ee by Lo BOrteages on plant assets common stock, $1e par value 96,000 98,750 162,58e 83,400 162.58e 162, 50e 85,7ee $448,350 382,200 Retained earnings 134,30e 114,85e Total liabilities and equity $521,600 The company's Income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended December 31 201 3.900 2017 $685,000 Cost of goods sold $397.300 $333,900 127,200 other operating expenses 205,5ee nse 1: 9,6ee Income taxes Total costs and expenses s.575 624,500 482,775 $ 60,500 $ 47,225 Net income Earnings per share 3.72 2.9 Evaluate the company's efficiency and profitability by computing the following for 2017 and 2016 (2) Total asset turnover Total Asset Turnover Total Asset Turnover Choose Denominator: Choose Numerator: Net sales Average total assets Total asset tumover 0 times 2017 o times 2016 Required Information [The following information applles to the questions displayed below.] Simon Company's year-end balance sheets follow At December 31 2017 2016 2015 Assets Cash 32,e0e 35,750 38,eee nts receivable, net Merchandise inventory Prepaid expenses se, 8ee 112,eee 55,e0e 10,5ee 4,200 9,30e 258,5e0 Plant assets, net 280,eee 235,000 $521,600 $448,350 $ 382,20e Total assets Liabilities and Equity Accounts payable $128,800 72, 250 50,60e Long-term notes payable secured by 96,000 98,750 83,400 Common stock, $10 par value Retained earnings 162,500 162,5ee 114,85e 162,50e 85,700 134,30e Total liabilities and equity $521,600 $448,350 382,28e The company's Income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended December 31 2017 2016 Sales $685,eee 530,eee $3 d sold expenses 127 223 Otha Interest expense Income taxes Total costs and expenses 12,100 9,60e 13,1ee 8,575 624,50e 482,775 $ 47,225 Net income 60,5ee $ 3.72 Earnings per share 2.91 Evaluate the company's efficlency and profitabllity by computing the following for 2017 and 2016. 3) Return on total assets. Return On Total Assets Choose Denominator: Average total assets =Return On Total Assets Choose Numerator: Net income Return on total assets 0 % % 2017 2016