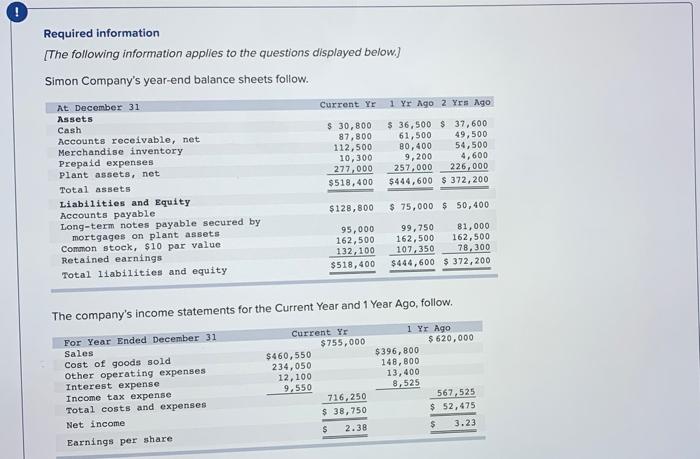

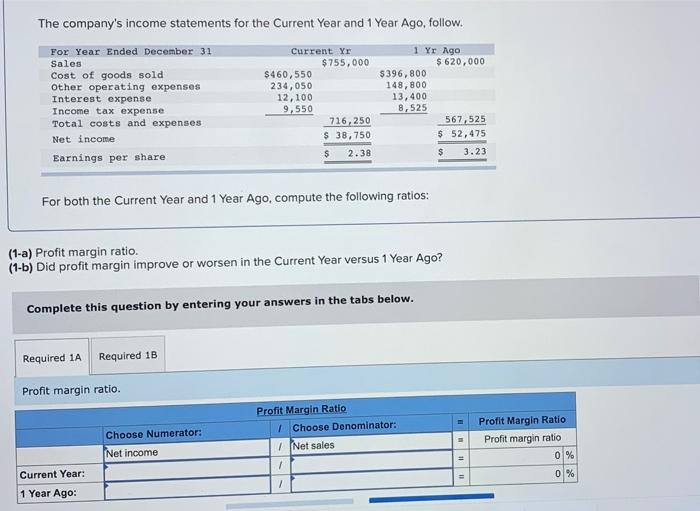

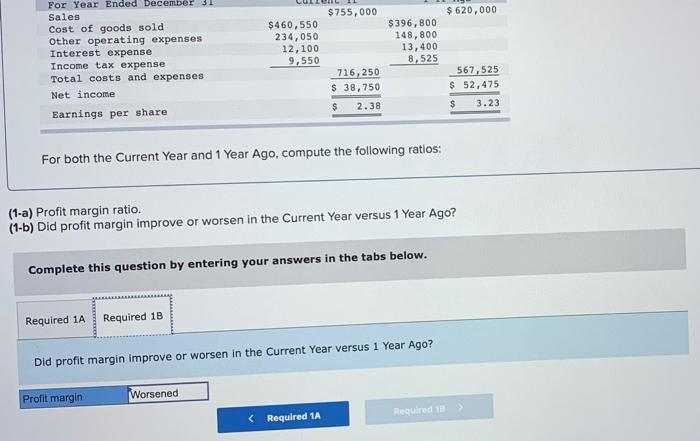

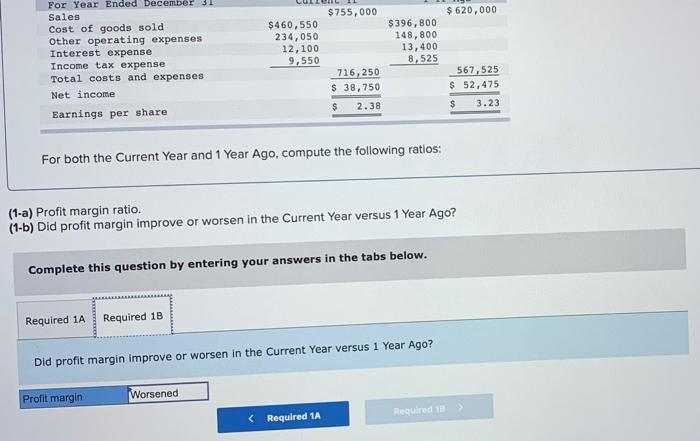

Required information [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 30,800 87,800 112,500 10,300 277,000 $518,400 $ 36,500 $ 37,600 61,500 49,500 80,400 54,500 9, 200 4,600 257,000 226,000 $444,600 $ 372,200 Total assets $128,800 $ 75,000 $ 50,400 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 95,000 162,500 132, 100 99,750 81,000 162,500 162,500 107,350 78,300 $444,600 $ 372,200 $518,400 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $755,000 $460,550 234,050 12,100 9,550 716,250 1 Yr Ago $ 620,000 $396,800 148,800 13,400 8.525 567,525 $ 52,475 $ 38, 750 $ 3.23 $ 2.38 Earnings per share The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Current Yr $ 755,000 $460,550 234,050 12,100 9,550 716,250 $ 38,750 1 Yr Ago $ 620,000 $396,800 148,800 13,400 8,525 567,525 $ 52,475 Net income $ 2.38 $ 3.23 Earnings per share For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Profit margin ratio. (1-6) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Profit margin ratio. Profit Margin Ratio 1 Choose Denominator: 1 Net sales Choose Numerator: ### Profit Margin Ratio Profit margin ratio Net income 0 % 1 Current Year: 0 % = / 1 Year Ago: $ 755,000 $ 620,000 For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses $460,550 234,050 12,100 9,550 $396,800 148,800 13,400 8,525 567,525 716,250 $ 38,750 $ 52,475 Net income $ 2.38 $ 3.23 Earnings per share For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Profit margin ratio. (1-1) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Did profit margin improve or worsen in the Current Year versus 1 Year Ago? Profit margin Worsened Required 18