Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] Company T had 40,000 outstanding shares of common stock, par value $13 per share.

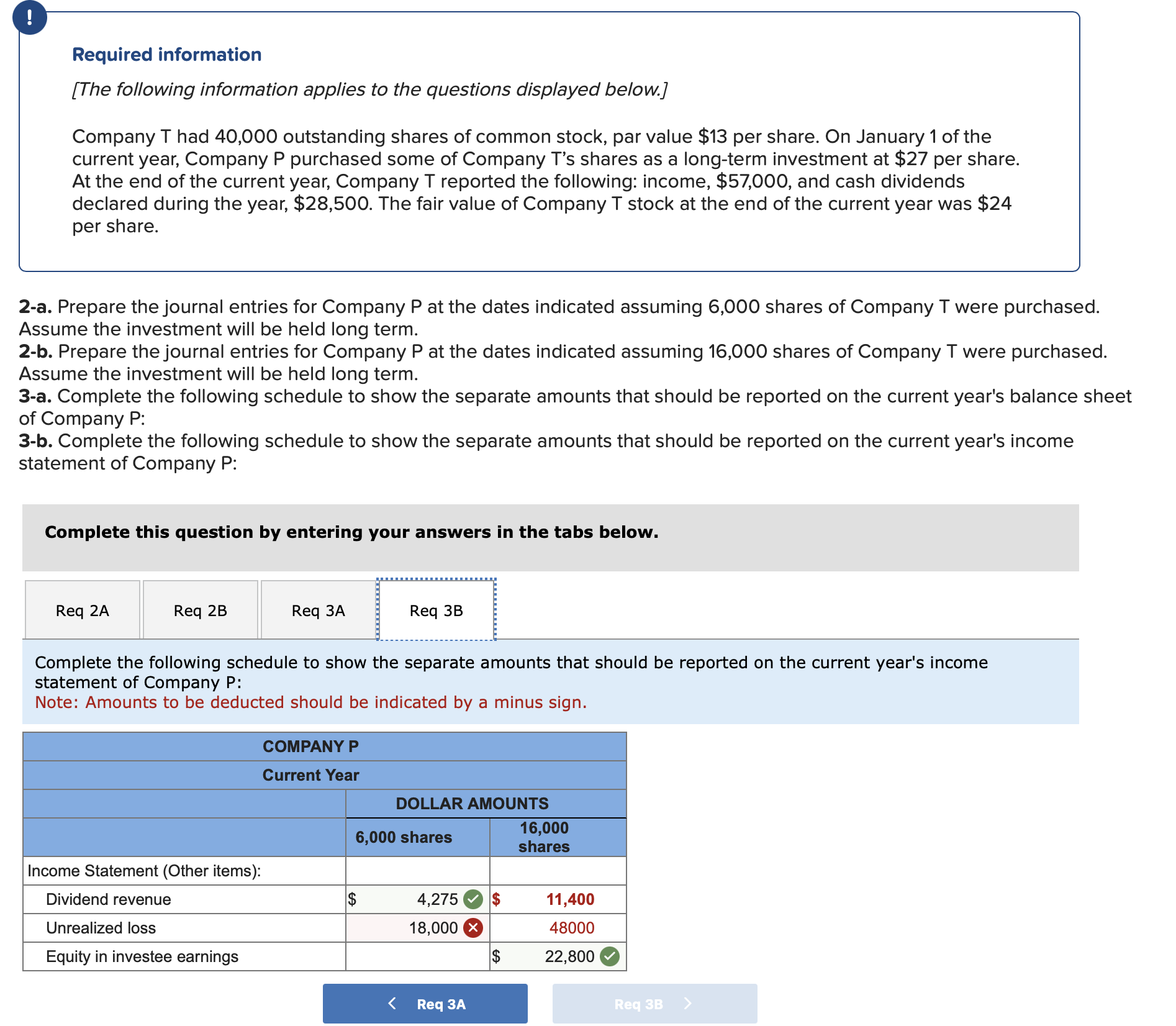

Required information [The following information applies to the questions displayed below.] Company T had 40,000 outstanding shares of common stock, par value $13 per share. On January 1 of the current year, Company P purchased some of Company T's shares as a long-term investment at $27 per share. At the end of the current year, Company T reported the following: income, $57,000, and cash dividends declared during the year, $28,500. The fair value of Company T stock at the end of the current year was $24 per share. -a. Prepare the journal entries for Company P at the dates indicated assuming 6,000 shares of Company T were purchased. ssume the investment will be held long term. -b. Prepare the journal entries for Company P at the dates indicated assuming 16,000 shares of Company T were purchasec ssume the investment will be held long term. -a. Complete the following schedule to show the separate amounts that should be reported on the current year's balance sh Company P : -b. Complete the following schedule to show the separate amounts that should be reported on the current year's income tatement of Company P : Complete this question by entering your answers in the tabs below. Complete the following schedule to show the separate amounts that should be reported on the current year's income statement of Company P: Note: Amounts to be deducted should be indicated by a minus sign

Required information [The following information applies to the questions displayed below.] Company T had 40,000 outstanding shares of common stock, par value $13 per share. On January 1 of the current year, Company P purchased some of Company T's shares as a long-term investment at $27 per share. At the end of the current year, Company T reported the following: income, $57,000, and cash dividends declared during the year, $28,500. The fair value of Company T stock at the end of the current year was $24 per share. -a. Prepare the journal entries for Company P at the dates indicated assuming 6,000 shares of Company T were purchased. ssume the investment will be held long term. -b. Prepare the journal entries for Company P at the dates indicated assuming 16,000 shares of Company T were purchasec ssume the investment will be held long term. -a. Complete the following schedule to show the separate amounts that should be reported on the current year's balance sh Company P : -b. Complete the following schedule to show the separate amounts that should be reported on the current year's income tatement of Company P : Complete this question by entering your answers in the tabs below. Complete the following schedule to show the separate amounts that should be reported on the current year's income statement of Company P: Note: Amounts to be deducted should be indicated by a minus sign Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started