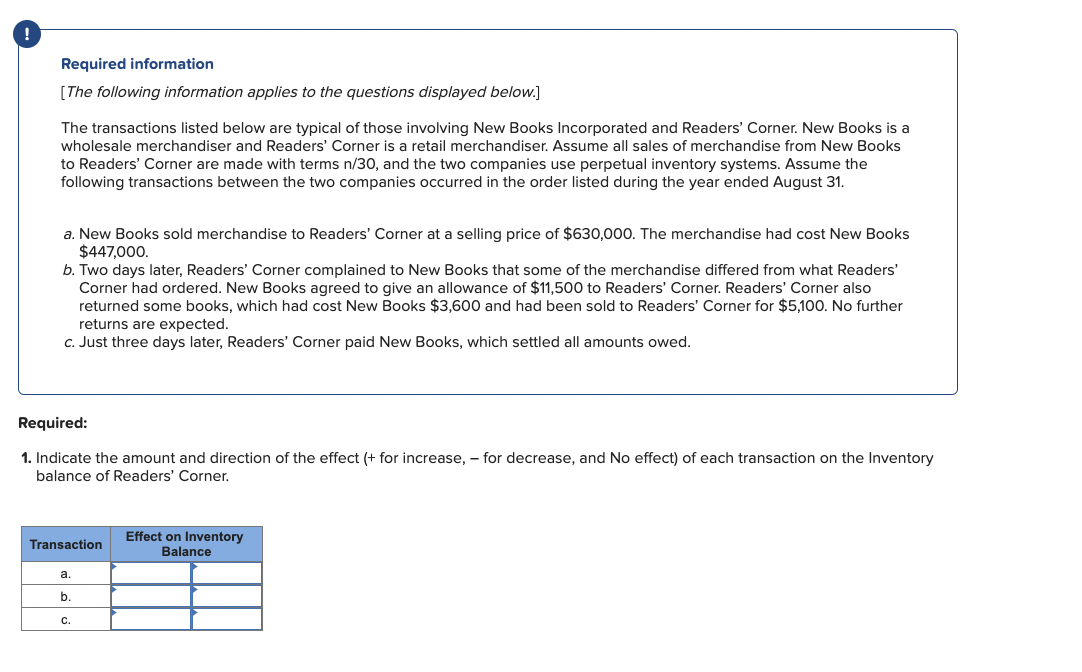

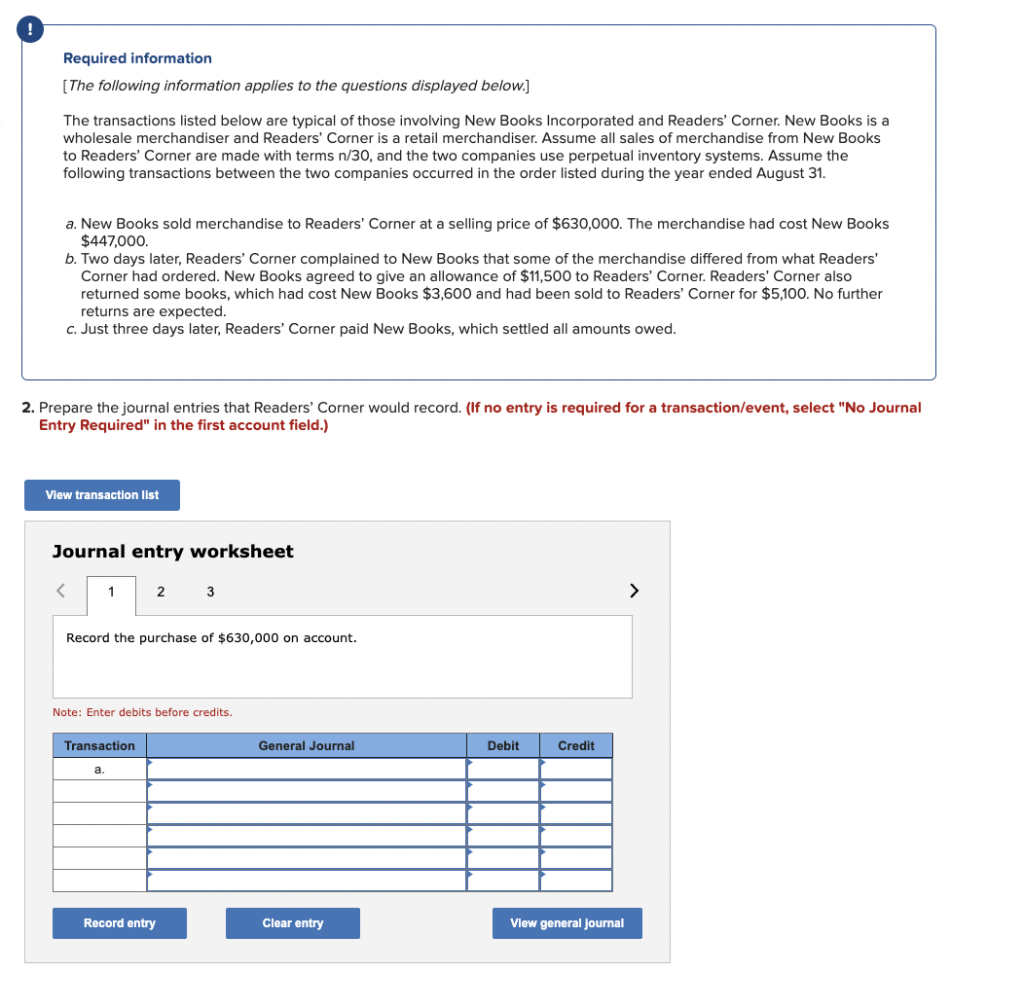

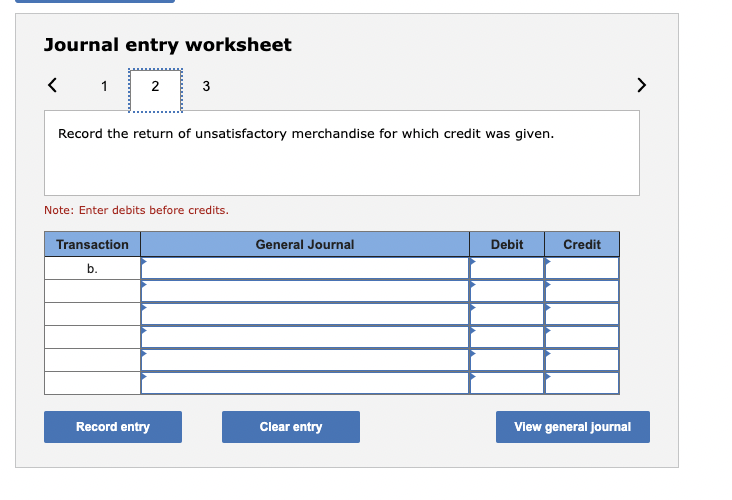

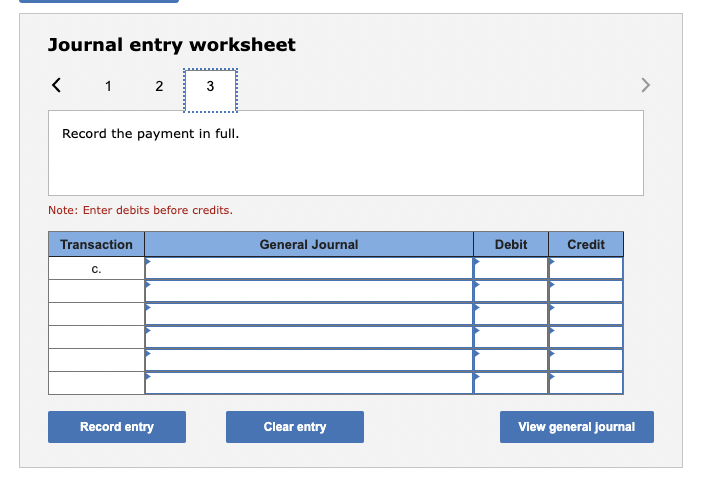

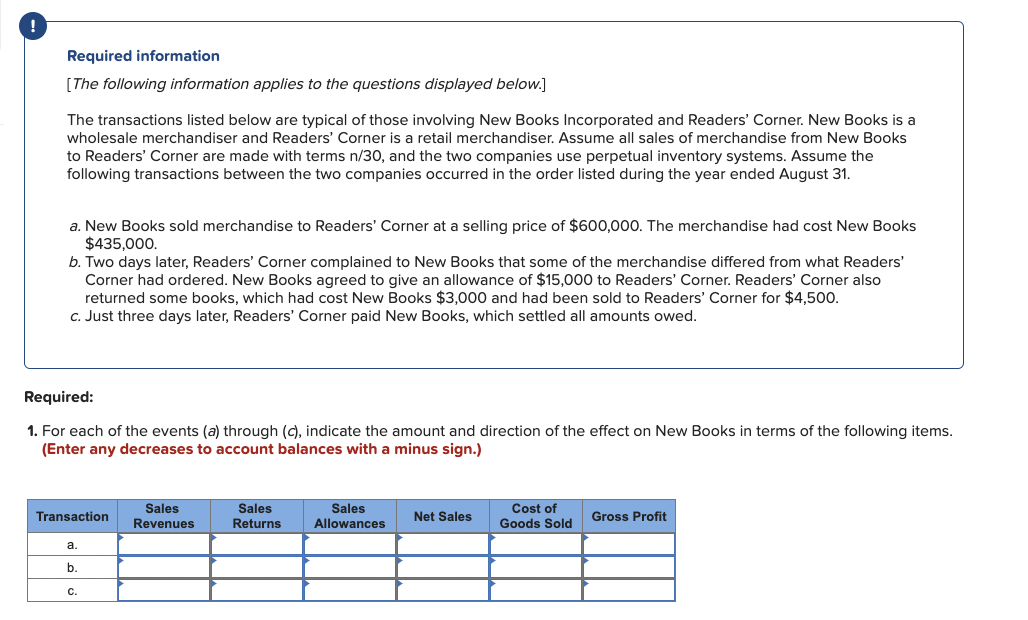

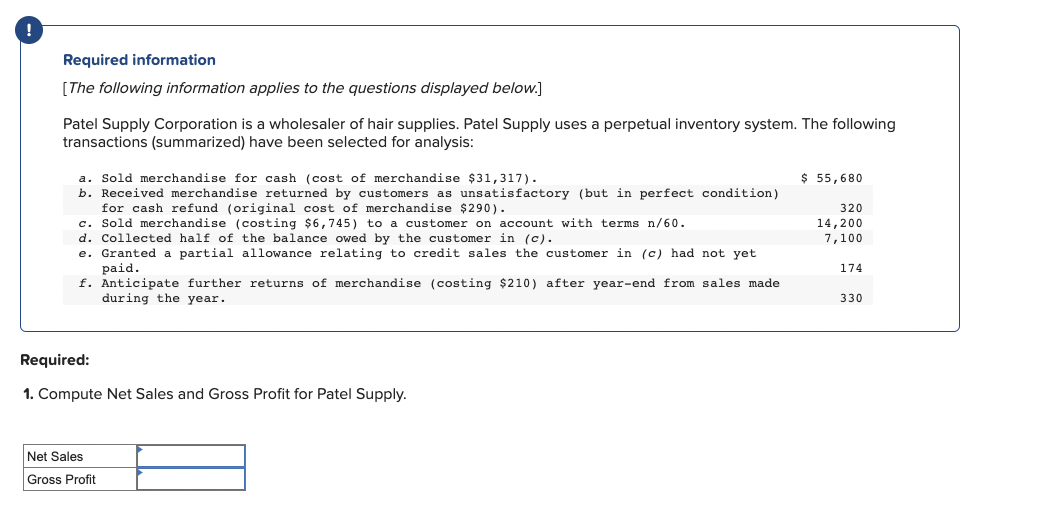

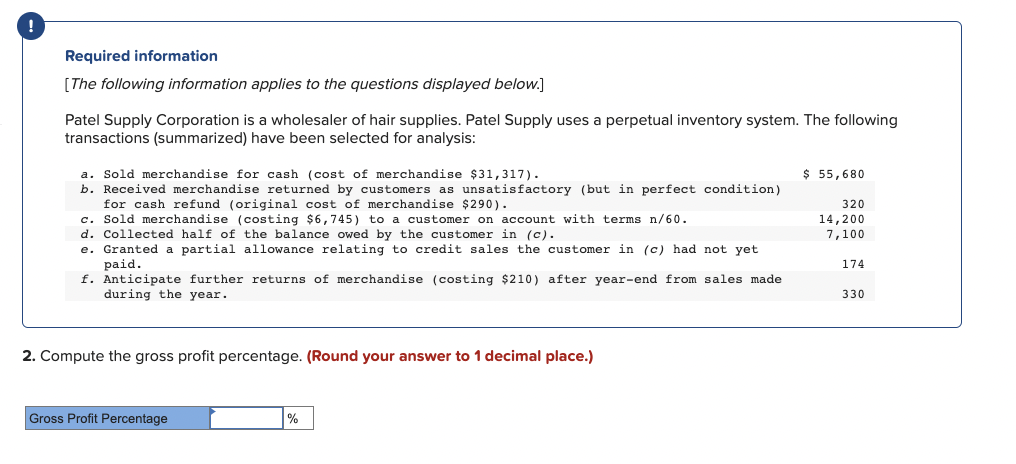

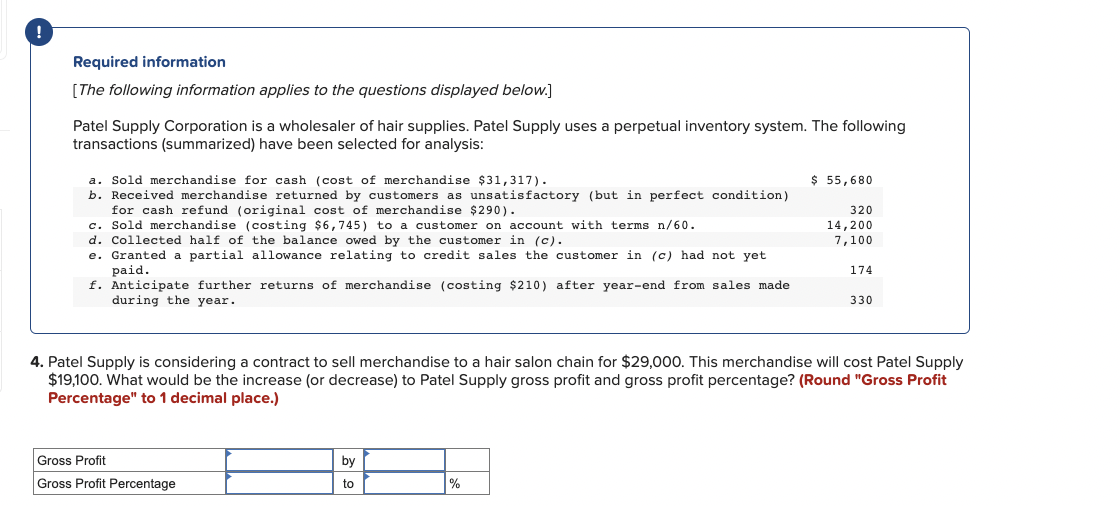

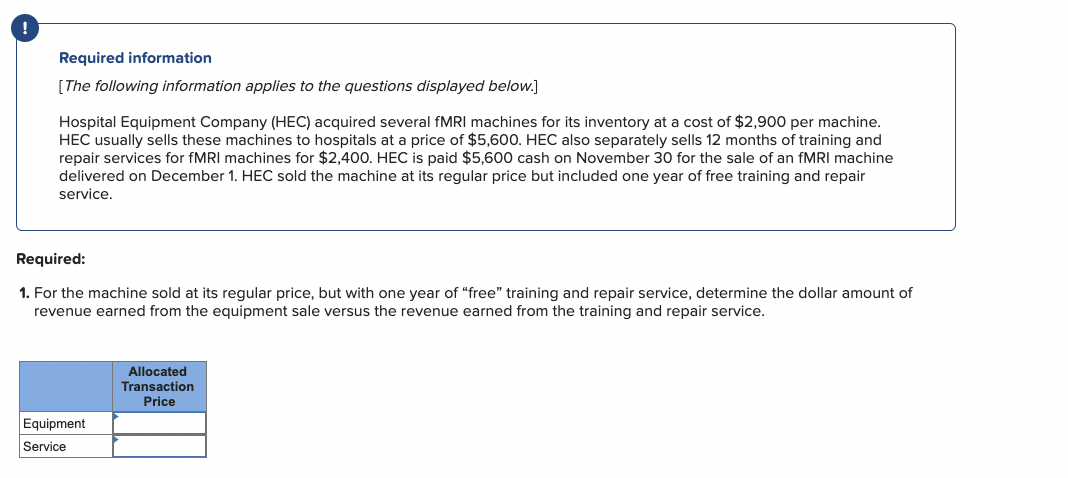

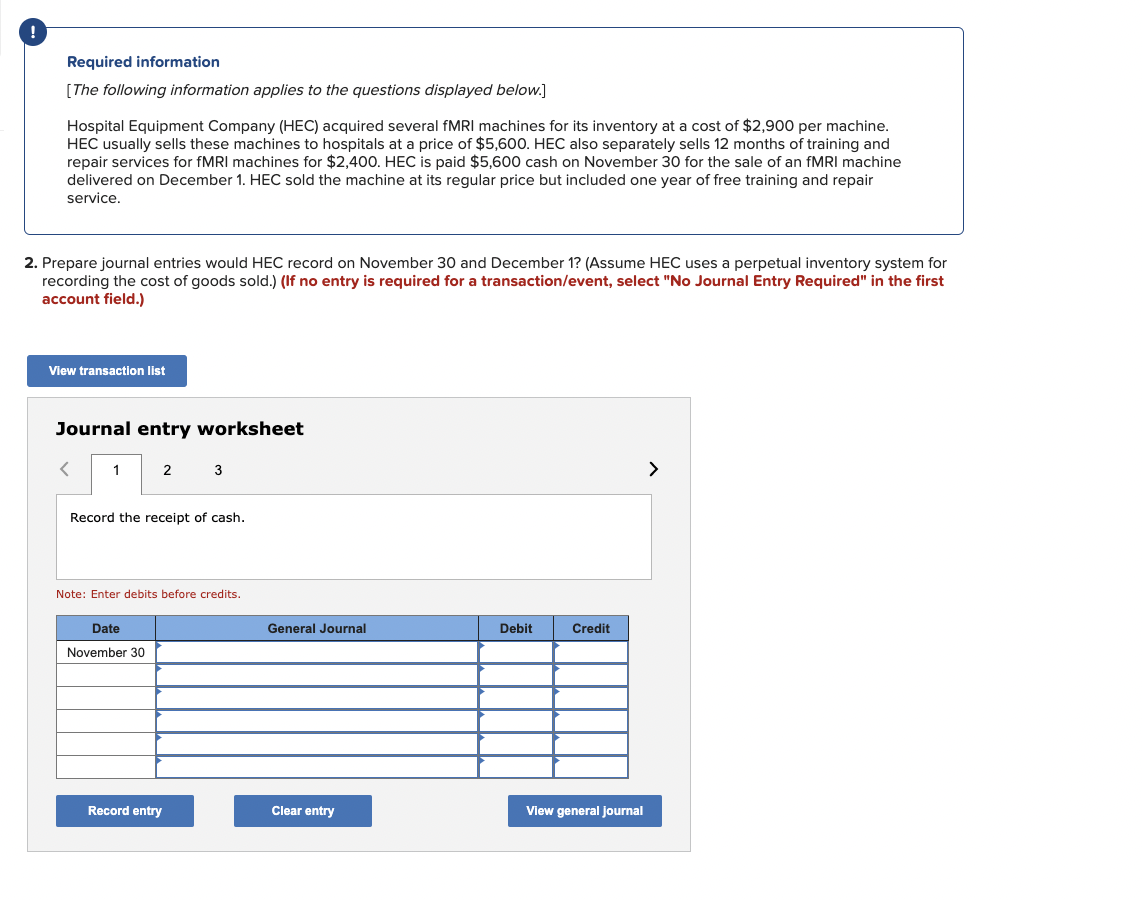

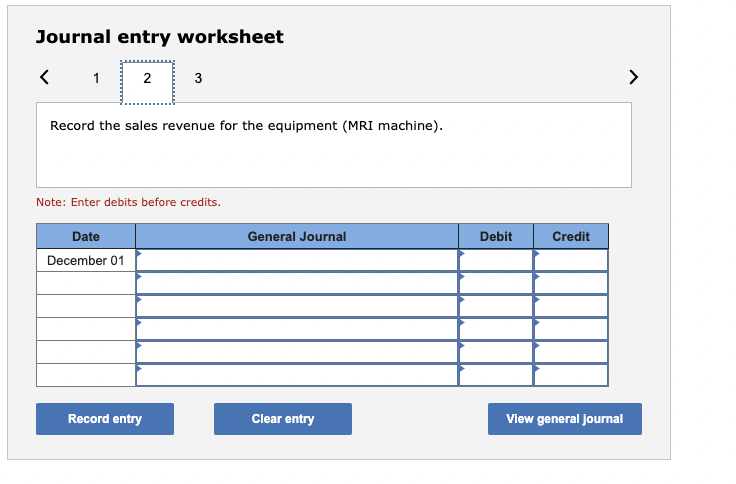

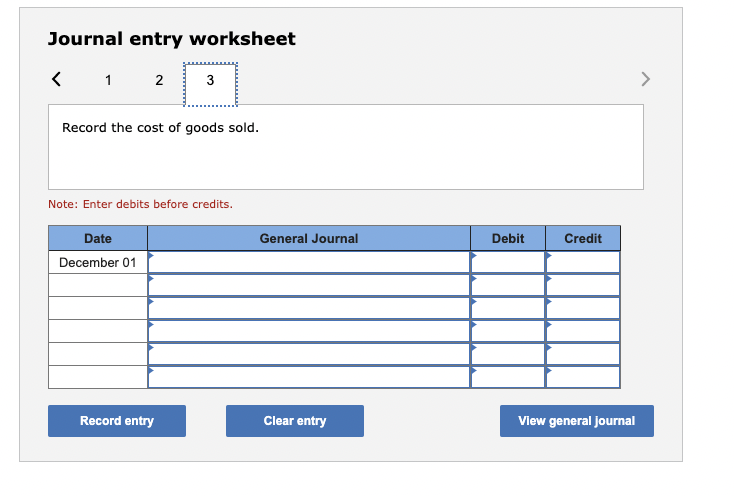

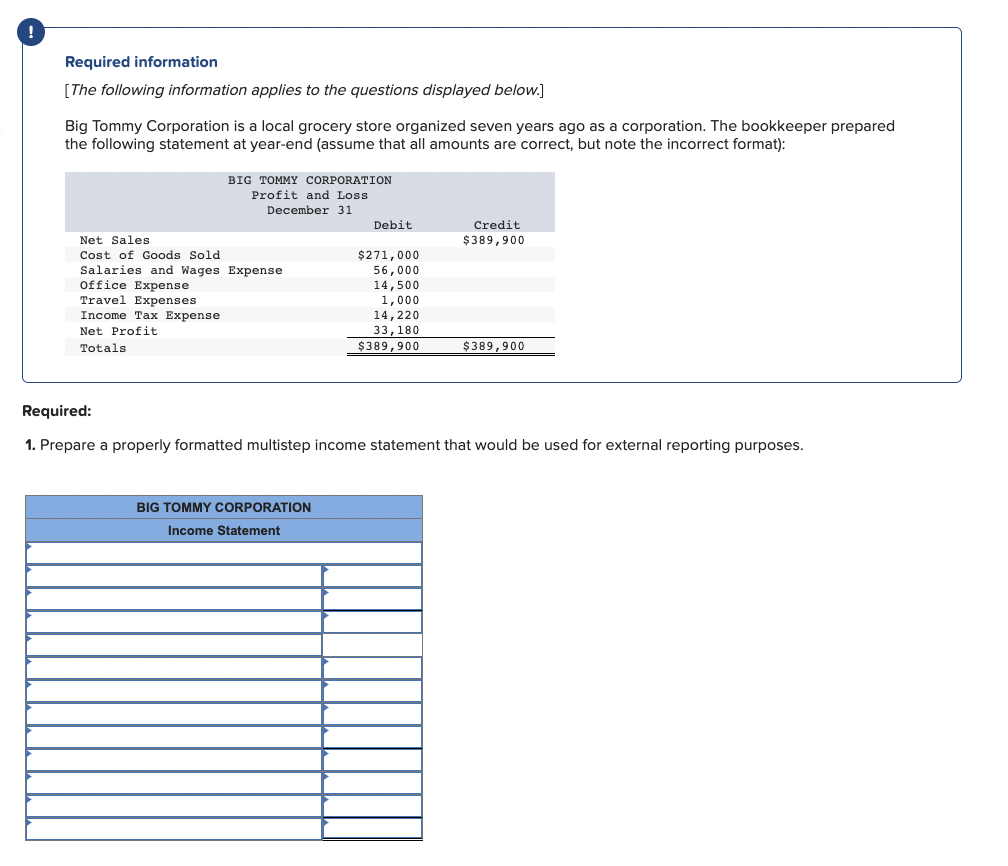

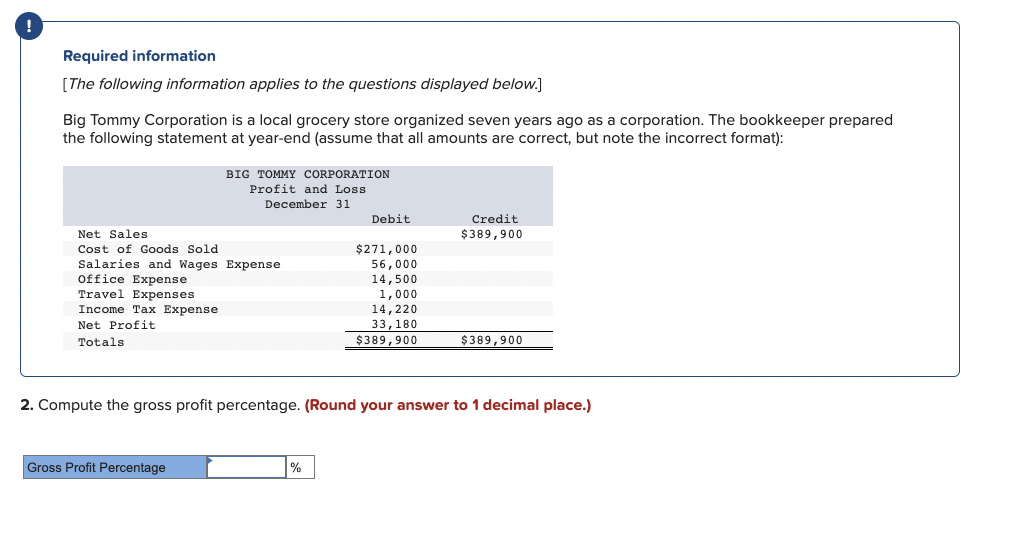

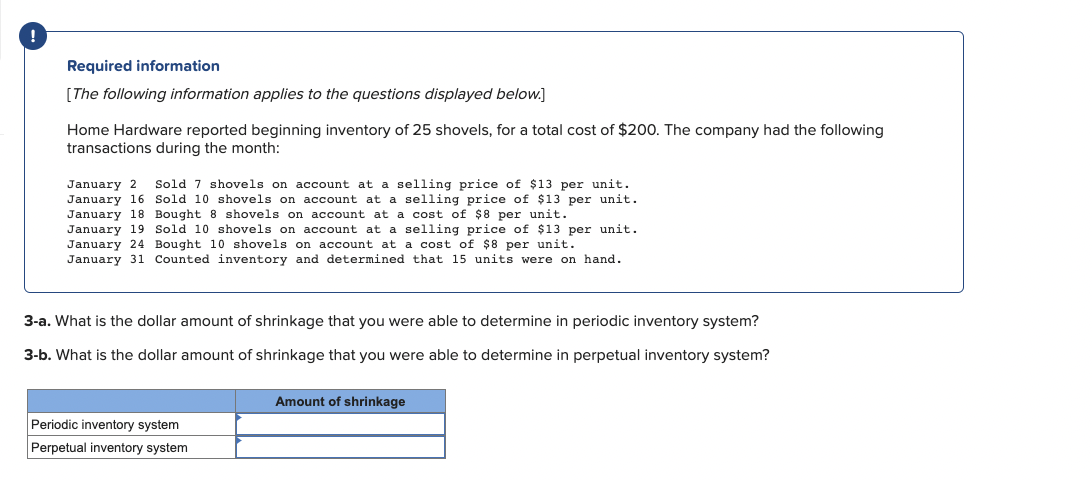

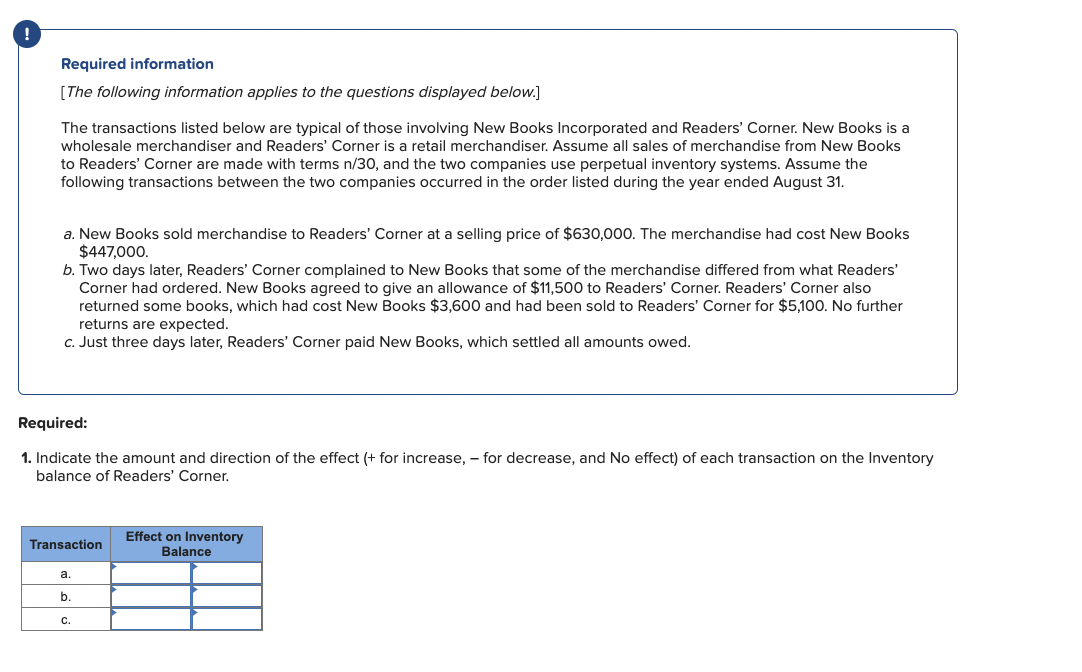

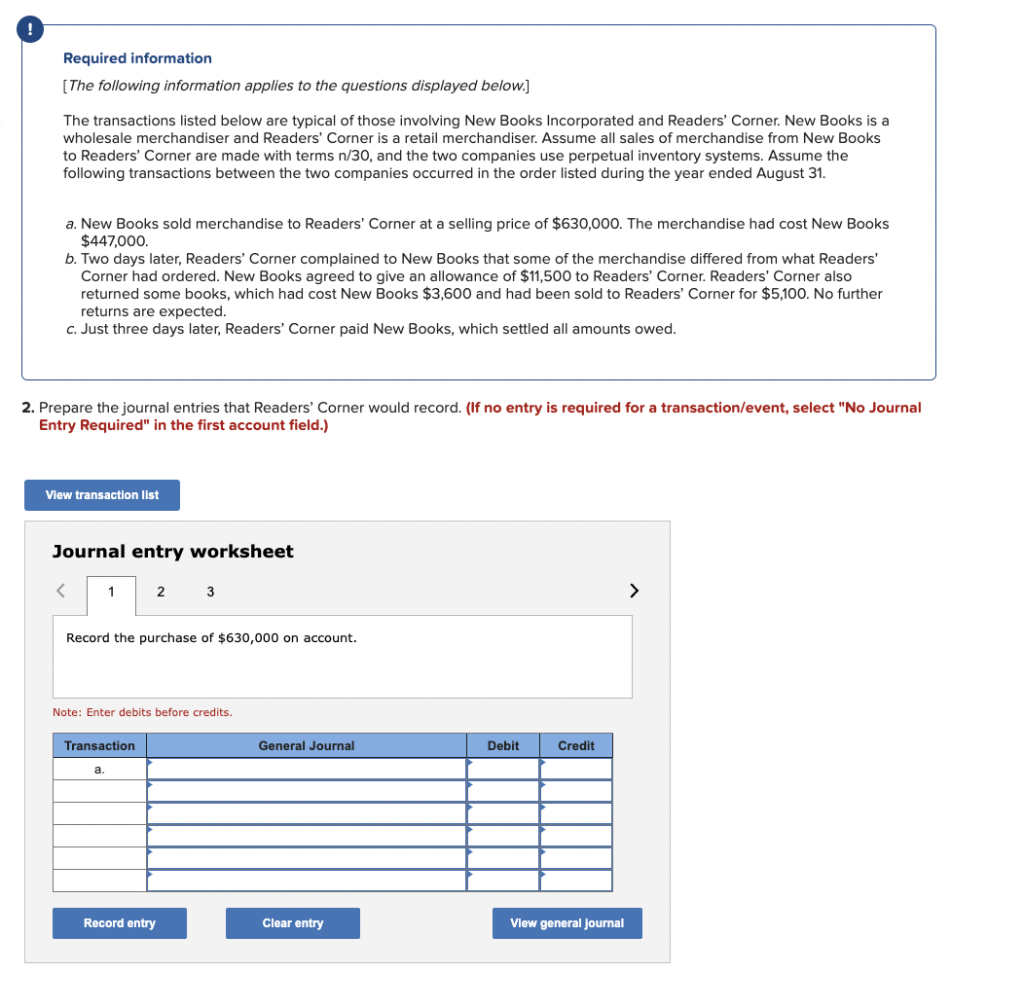

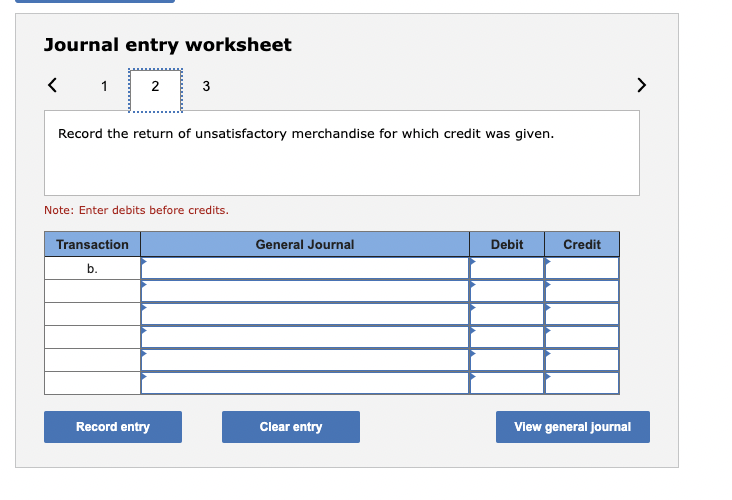

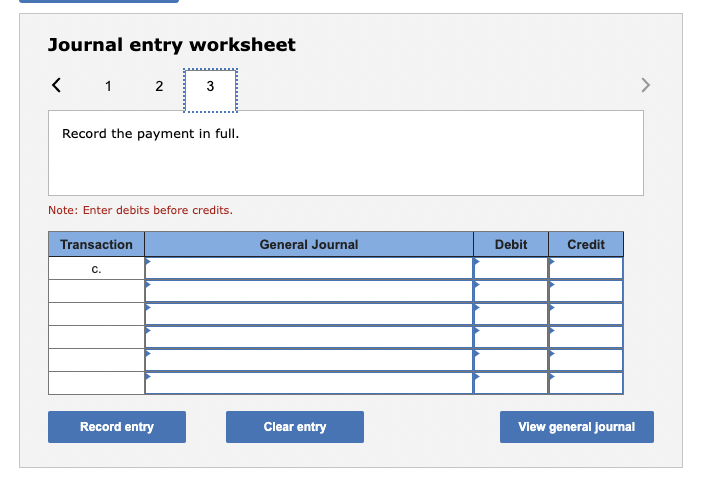

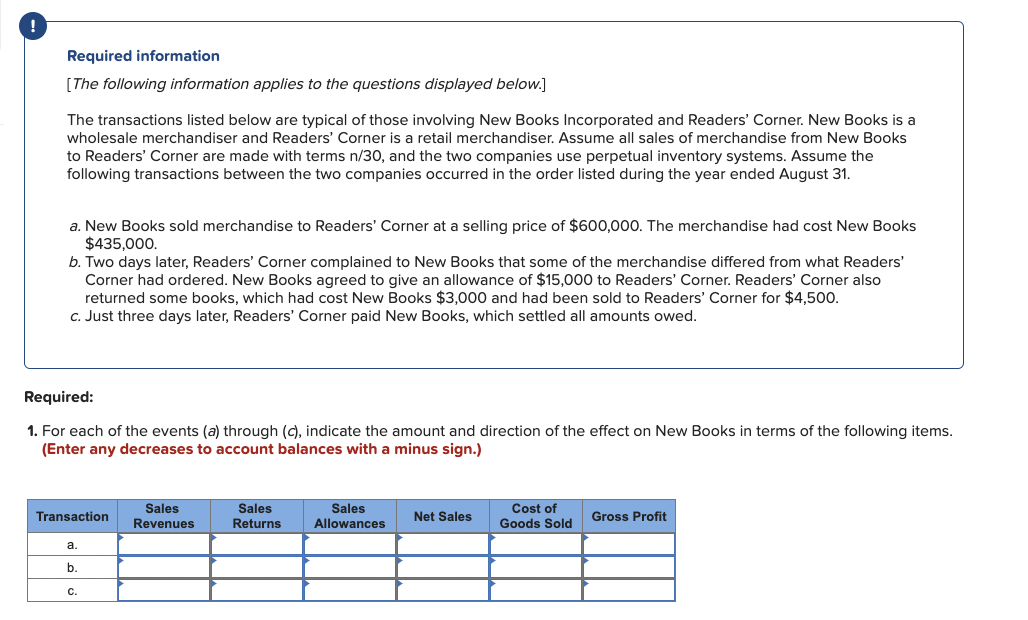

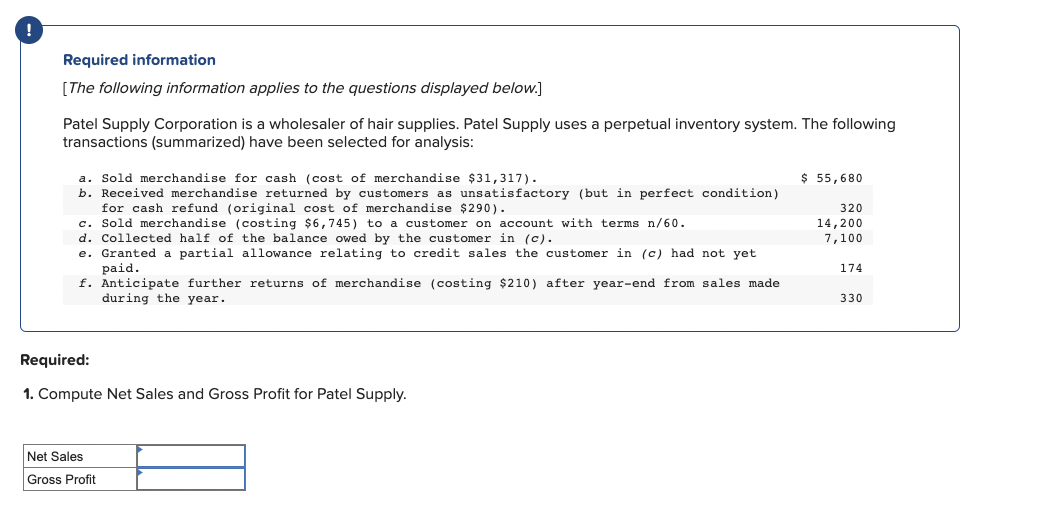

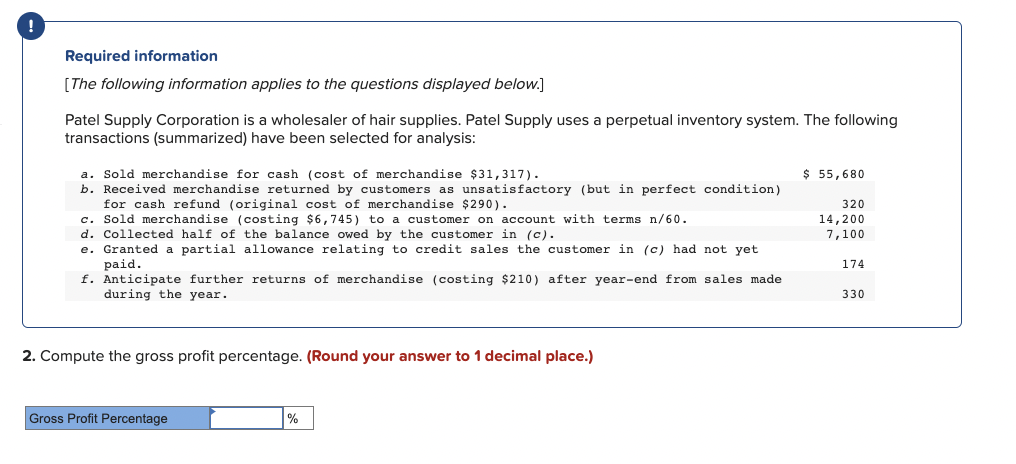

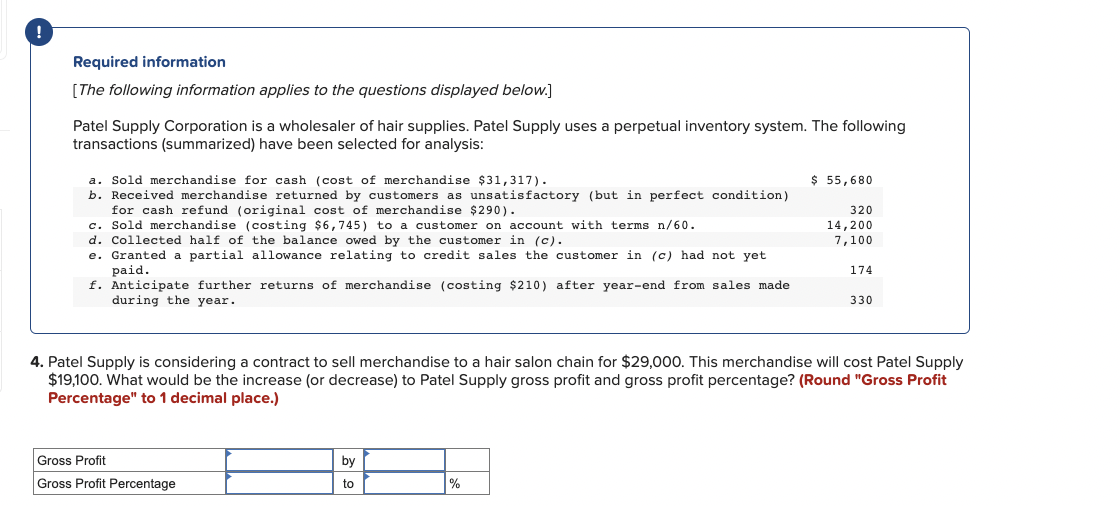

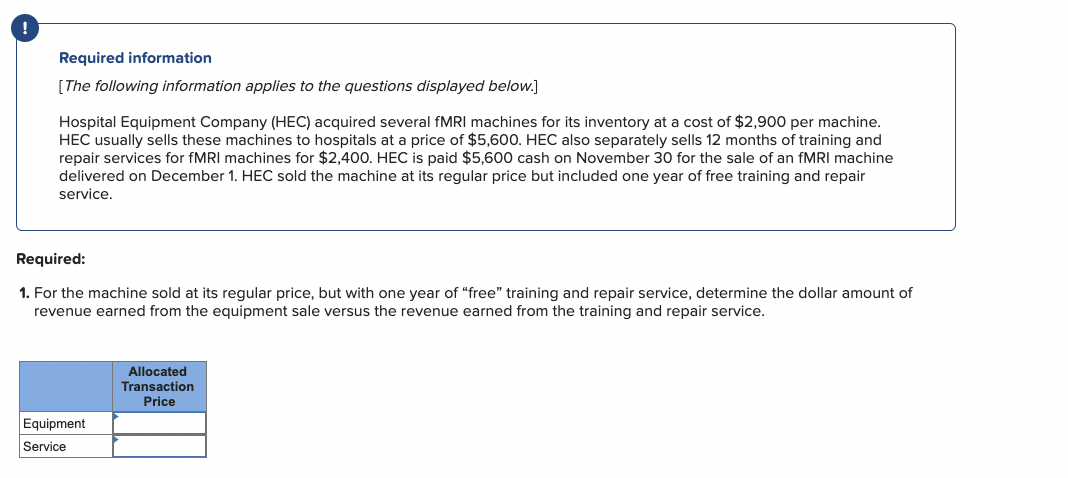

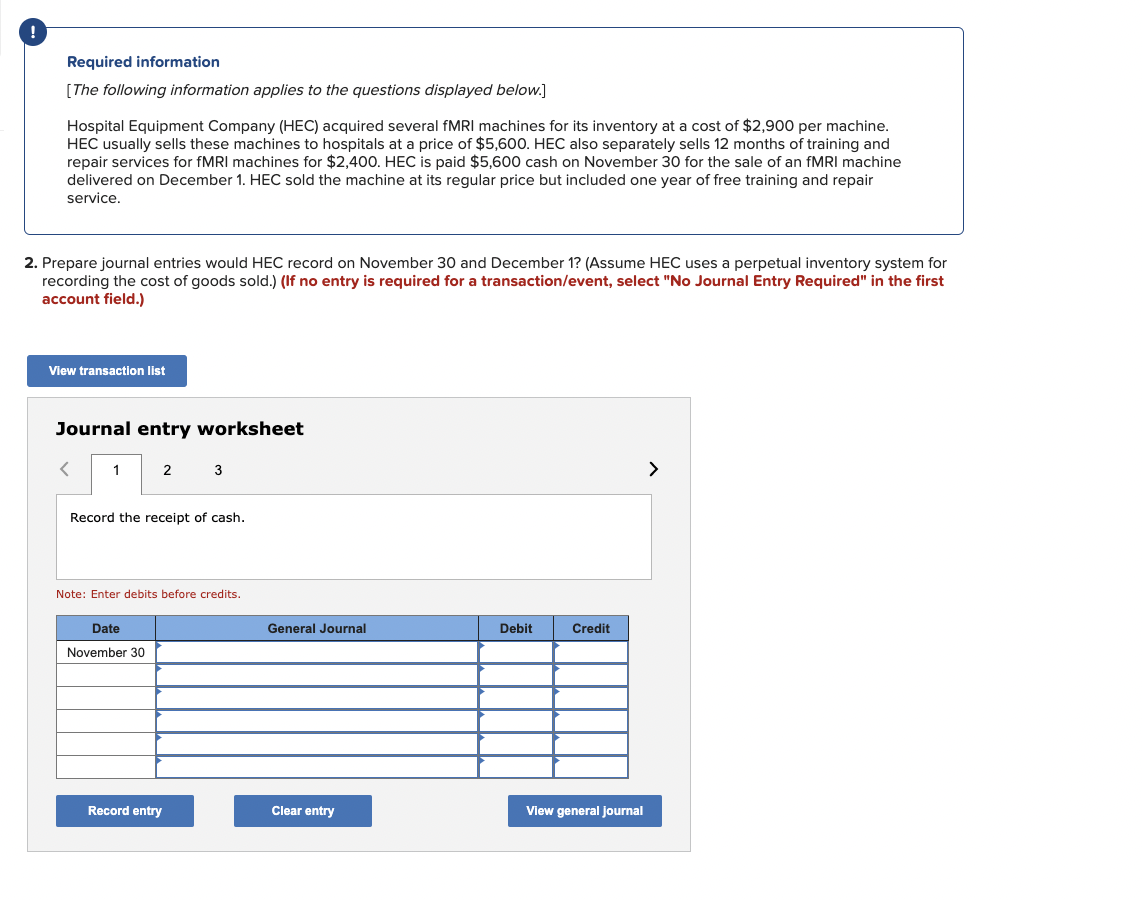

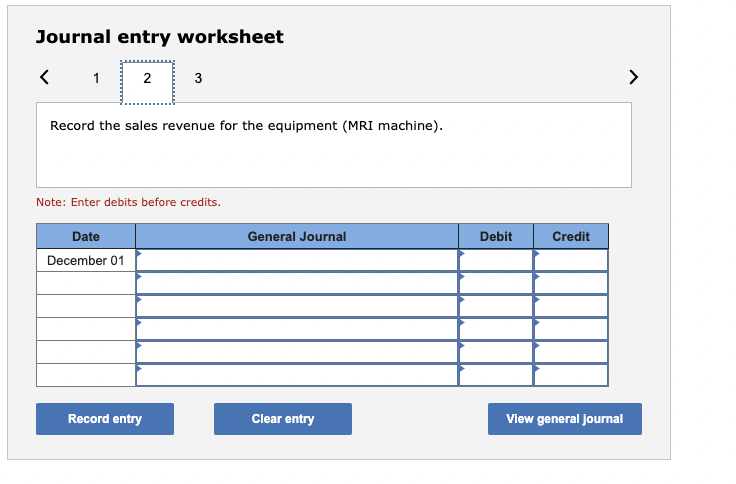

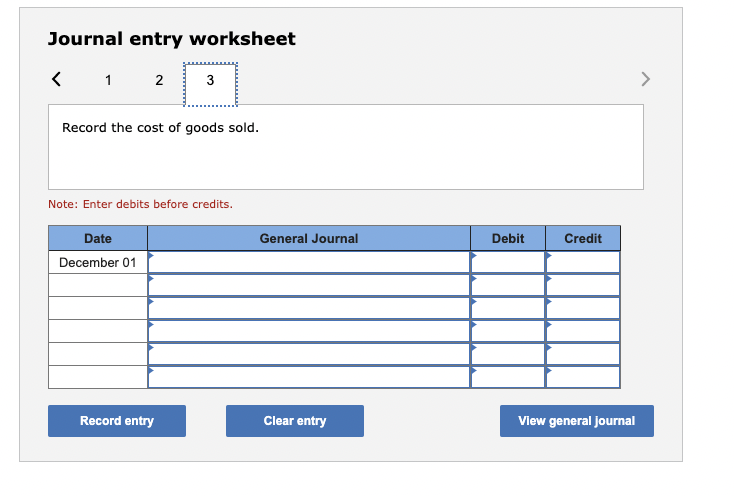

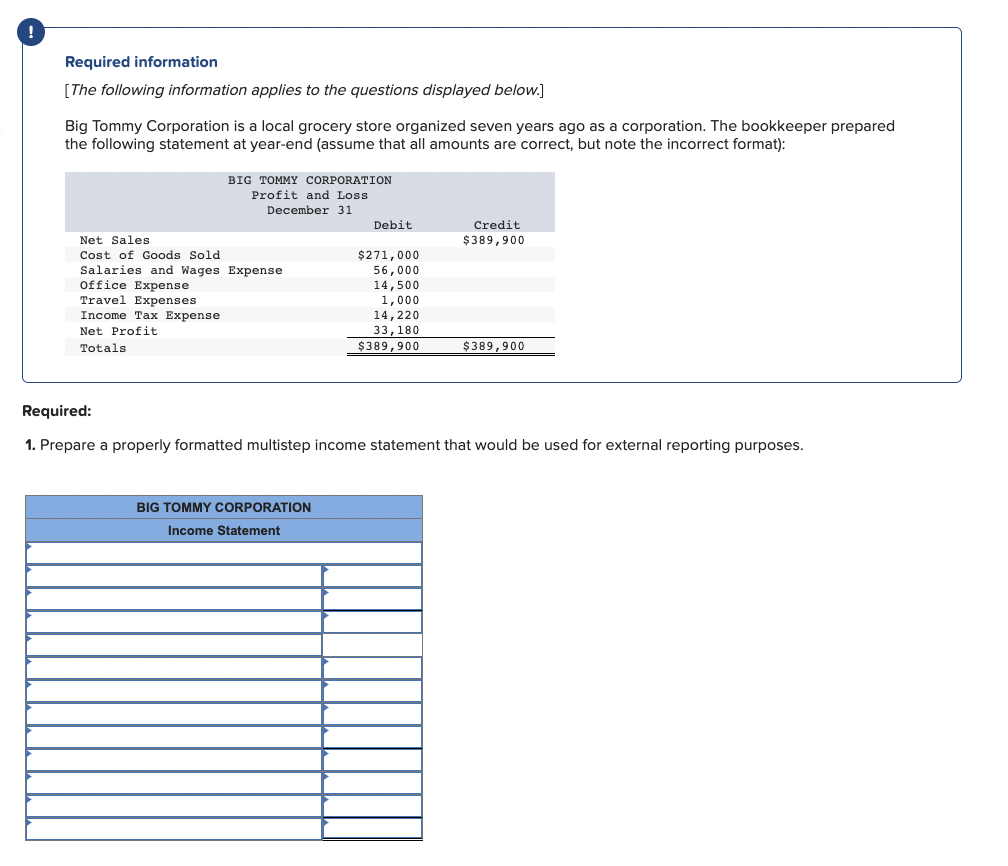

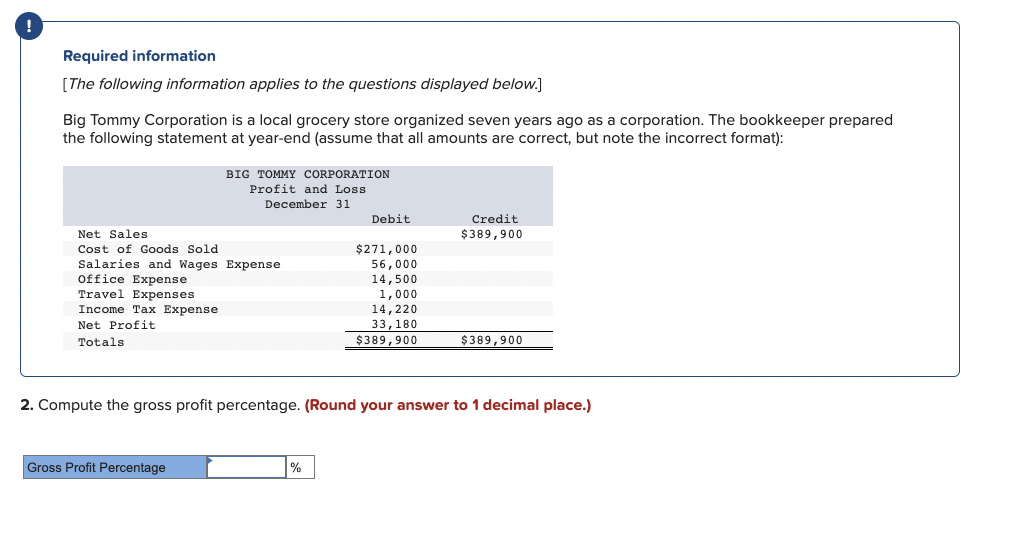

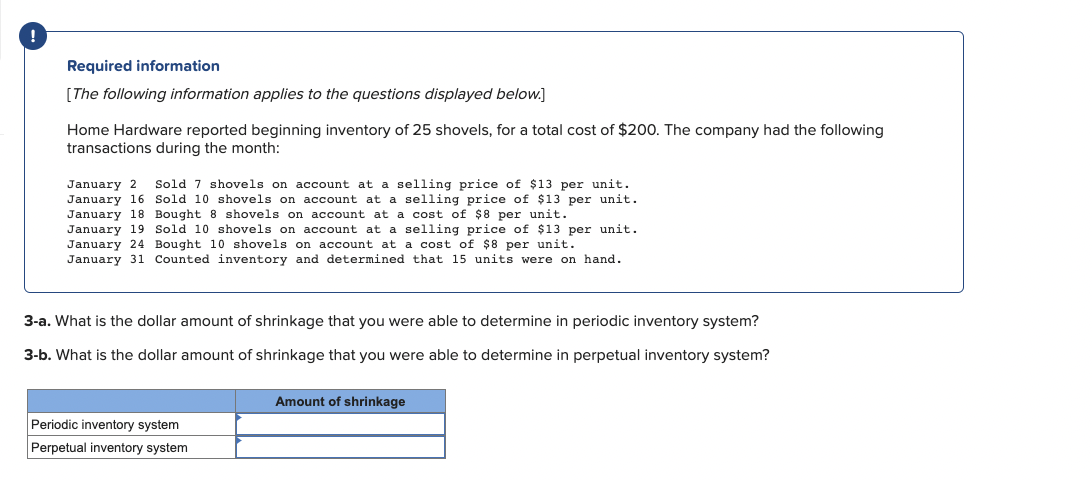

Required information [The following information applies to the questions displayed below.] The transactions listed below are typical of those involving New Books Incorporated and Readers' Corner. New Books is a wholesale merchandiser and Readers' Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31. a. New Books sold merchandise to Readers' Corner at a selling price of $630,000. The merchandise had cost New Books $447,000. b. Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers' Corner had ordered. New Books agreed to give an allowance of $11,500 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $3,600 and had been sold to Readers' Corner for $5,100. No further returns are expected. c. Just three days later, Readers' Corner paid New Books, which settled all amounts owed. equired: . Indicate the amount and direction of the effect (+ for increase, - for decrease, and No effect) of each transaction on the Inventory balance of Readers' Corner. Required information [The following information applies to the questions displayed below.] The transactions listed below are typical of those involving New Books Incorporated and Readers' Corner. New Books is a wholesale merchandiser and Readers' Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31. a. New Books sold merchandise to Readers' Corner at a selling price of $630,000. The merchandise had cost New Books $447,000. b. Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers' Corner had ordered. New Books agreed to give an allowance of $11,500 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $3,600 and had been sold to Readers' Corner for $5,100. No further returns are expected. c. Just three days later, Readers' Corner paid New Books, which settled all amounts owed. Prepare the journal entries that Readers' Corner would record. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the purchase of $630,000 on account. Note: Enter debits before credits. Journal entry worksheet Record the return of unsatisfactory merchandise for which credit was given. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] The transactions listed below are typical of those involving New Books Incorporated and Readers' Corner. New Books is a wholesale merchandiser and Readers' Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31. a. New Books sold merchandise to Readers' Corner at a selling price of $600,000. The merchandise had cost New Books $435,000. b. Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers' Corner had ordered. New Books agreed to give an allowance of $15,000 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $3,000 and had been sold to Readers' Corner for $4,500. c. Just three days later, Readers' Corner paid New Books, which settled all amounts owed. Required: 1. For each of the events (a) through (c), indicate the amount and direction of the effect on New Books in terms of the following items. (Enter any decreases to account balances with a minus sign.) Required information [The following information applies to the questions displayed below.] Patel Supply Corporation is a wholesaler of hair supplies. Patel Supply uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $31,317 ). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $290 ). c. Sold merchandise (costing $6,745 ) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). 7,100 e. Granted a partial allowance relating to credit sales the customer in (c) had not yet 174 f. Anticipate further returns of merchandise (costing $210 ) after year-end from sales made during the year. Required: 1. Compute Net Sales and Gross Profit for Patel Supply. Required information [The following information applies to the questions displayed below.] Patel Supply Corporation is a wholesaler of hair supplies. Patel Supply uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $31,317 ). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $290 ). c. Sold merchandise (costing $6,745 ) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). paid. during the year. 330 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) [The following information applies to the questions displayed below.] Patel Supply Corporation is a wholesaler of hair supplies. Patel Supply uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $31,317 ). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $290 ). c. Sold merchandise (costing $6,745 ) to a customer on account with terms n/60. 14,200 d. Collected half of the balance owed by the customer in (c). 7 , 100 e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $210 ) after year-end from sales made during the year. 4. Patel Supply is considering a contract to sell merchandise to a hair salon chain for $29,000. This merchandise will cost Patel Supply $19,100. What would be the increase (or decrease) to Patel Supply gross profit and gross profit percentage? (Round "Gross Profit Percentage" to 1 decimal place.) Required information [The following information applies to the questions displayed below.] Hospital Equipment Company (HEC) acquired several fMRI machines for its inventory at a cost of $2,900 per machine. HEC usually sells these machines to hospitals at a price of $5,600. HEC also separately sells 12 months of training and repair services for fMRI machines for $2,400. HEC is paid $5,600 cash on November 30 for the sale of an fMRI machine delivered on December 1 . HEC sold the machine at its regular price but included one year of free training and repair service. equired: For the machine sold at its regular price, but with one year of "free" training and repair service, determine the dollar amount of revenue earned from the equipment sale versus the revenue earned from the training and repair service. Required information [The following information applies to the questions displayed below.] Hospital Equipment Company (HEC) acquired several fMRI machines for its inventory at a cost of $2,900 per machine. HEC usually sells these machines to hospitals at a price of $5,600. HEC also separately sells 12 months of training and repair services for fMRI machines for $2,400. HEC is paid $5,600 cash on November 30 for the sale of an fMRI machine delivered on December 1 . HEC sold the machine at its regular price but included one year of free training and repair service. 2. Prepare journal entries would HEC record on November 30 and December 1 ? (Assume HEC uses a perpetual inventory system for recording the cost of goods sold.) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet INote: tncer aedits Derore creaits. Journal entry worksheet Record the sales revenue for the equipment (MRI machine). Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format): Required: 1. Prepare a properly formatted multistep income statement that would be used for external reporting purposes. Required information [The following information applies to the questions displayed below.] Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format): 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) Required information [The following information applies to the questions displayed below. Home Hardware reported beginning inventory of 25 shovels, for a total cost of $200. The company had the following transactions during the month: January 2 Sold 7 shovels on account at a selling price of $13 per unit. January 16 Sold 10 shovels on account at a selling price of $13 per unit. January 18 Bought 8 shovels on account at a cost of $8 per unit. January 19 Sold 10 shovels on account at a selling price of $13 per unit. January 24 Bought 10 shovels on account at a cost of $8 per unit. January 31 Counted inventory and determined that 15 units were on hand. 3-a. What is the dollar amount of shrinkage that you were able to determine in periodic inventory system? 3-b. What is the dollar amount of shrinkage that you were able to determine in perpetual inventory system