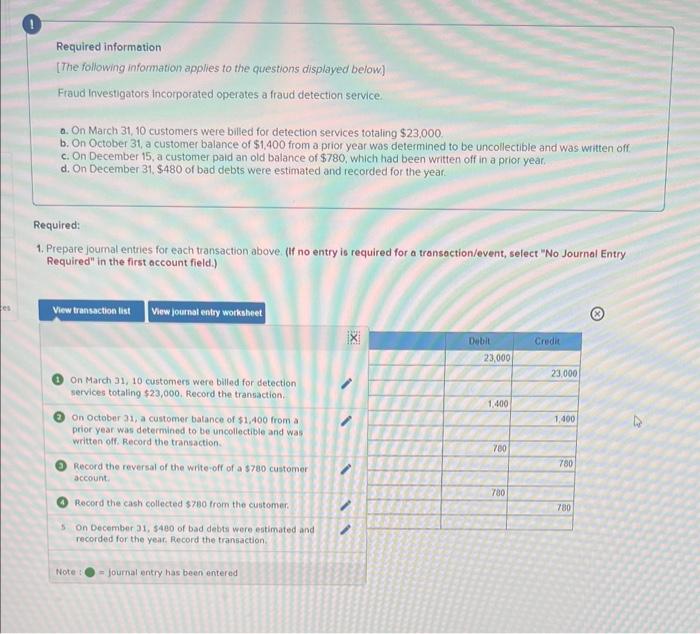

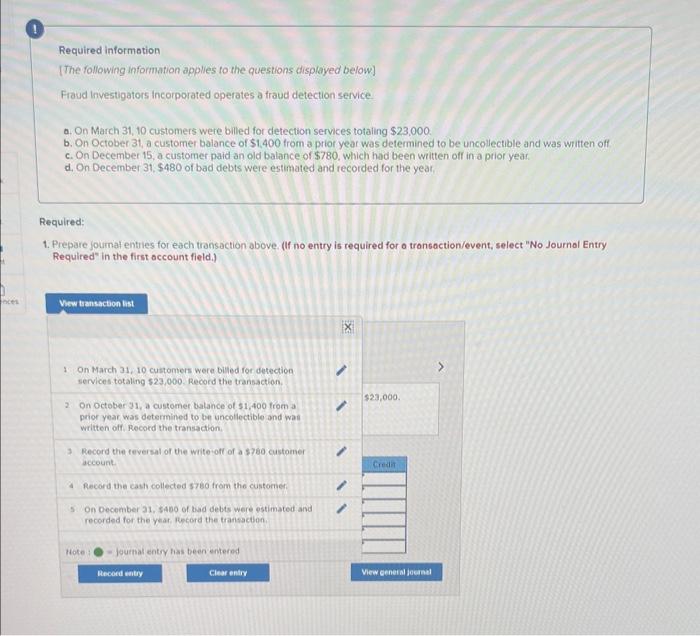

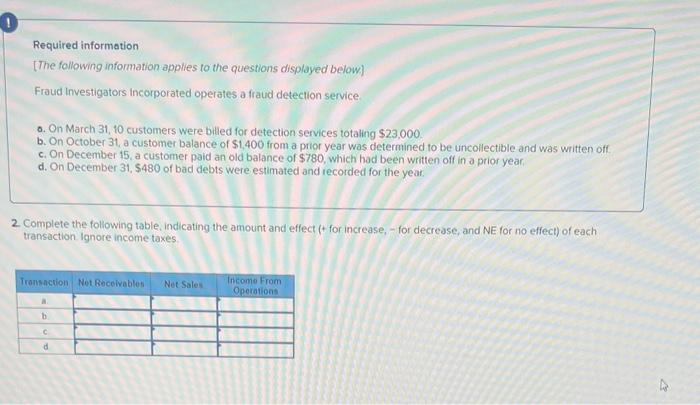

Required information [The following information applies to the questions displayed below] Fraud Investigators incorporated operates a fraud detection service. 0. On March 31, 10 customers were billed for detection services totaling $23,000 b. On October 31, a customer balance of $1,400 from a prior year was determined to be uncollectible and was written off c. On December 15 , a customer paid an old balance of $780, which had been written off in a prior year. d. On December 31, $480 of bad debts were estimated and recorded for the year. lequired: 1. Prepare joumal entries for each transaction above. (If no entry is required for a tronsoction/event, select "No Journal Entry Required" in the first account field.) On March 31, 10 customers were billed for detection services totaling $23,000. Record the transaction. On October 31, a customer batance of $1,400 from a prior year was determined to be uncollectible and was written off: Record the transaction. Record the reversal of the write-off of a s780 customer account. Record the cash collected s7Bo from the customer. 5 On December 31,5480 of bad debts were estimated and recorded for the year. Record the transaction. Note: = journal entry has been entered Required information [The following information applies to the questions displayed below] Fraud investigators incorporated operates a fraud detection service. a. On March 31, 10 customers were billed for detection services totaling $23,000. b. On October 31, a customer balance of $1,400 from a prior year was determined to be uncollectible and was written off c. On December 15, a customer paid an old balance of $780, which had been written off in a prior year. d. On December 31, $480 of bad debts were estimated and recorded for the yeat. Requlred: 1. Prepare journaf entries for each tronsaction above. (If no entry is required for o tronsaction/event, select "No Journol Entry Required" in the first occount field.) 1. On March 31, 10 customers were billed for detection services totaling 523,000 . Record the transaction. 2. On october 31, a customer balance of $1,400 from a prior year was determined to be uncollectible and wa: written off. Rocord the transaction. 3 Record the teversal of the write off of a $780 custome account. Record the castr colleded s7bo from the customen 5 On December 21. sapo of bad debts were estimated and recorded for the year. Record the transaction. Hote: P= joumal entry has been entered Required information [The following information applies to the questions displayed below] Fraud Investigators incorporated operates a fraud detection service 0. On March 31, 10 customers were billed for detection services totaling $23,000. b. On October 31, a customer balance of $1,400 from a prior year was determined to be uncollectible and was written off. c. On December 15, a customer paid an old balance of $780, which had been written off in a prior year. d. On December 31,$480 of bad debts were estimated and recorded for the year. 2. Complete the following table, indicating the amount and effect (+ for increase, - for decrease, and NE for no effect) of each transaction. lgnore income taxes