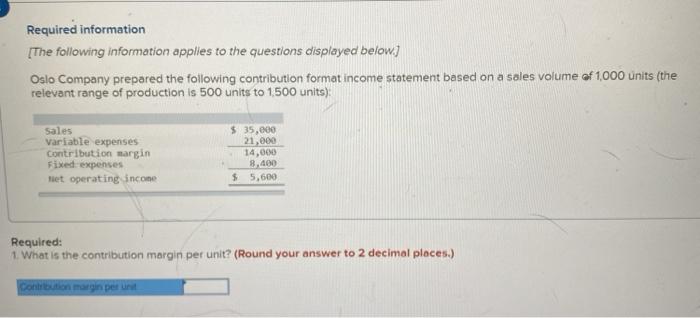

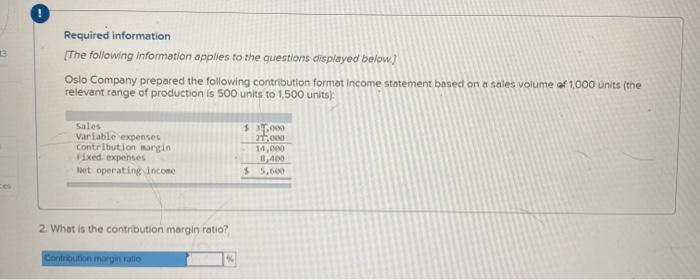

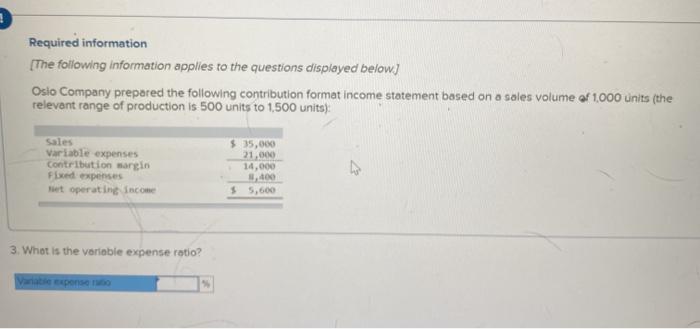

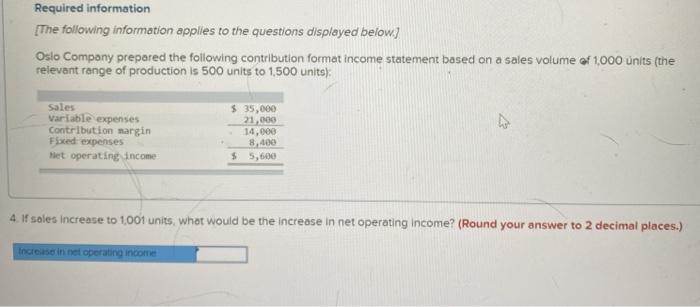

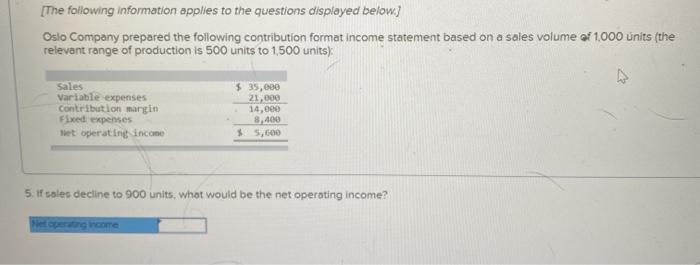

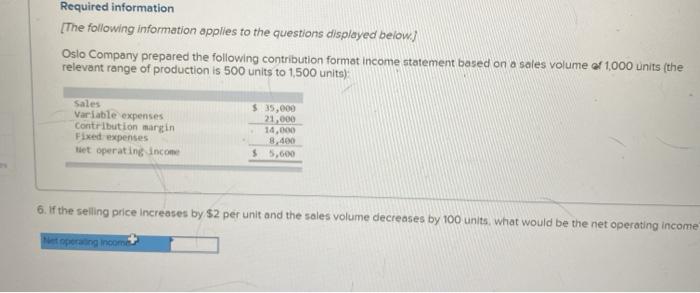

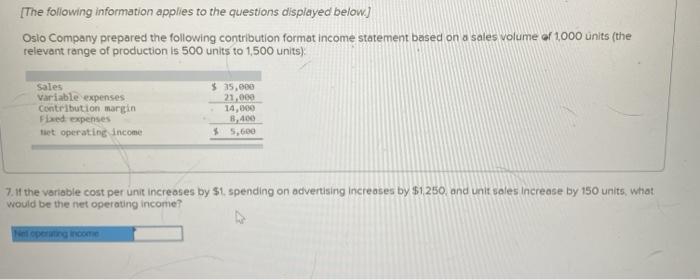

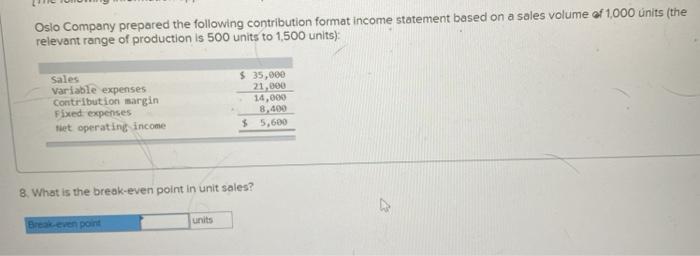

Required information [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1.500 units): Sales Variable expenses Contribution margin Fixed expenses Het operating income $ 35,000 21,000 14,000 8.400 $ 5,600 Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.) Required information [The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses wet operating income $ 1.000 21.00 14,000 8.400 $ 5,600 2. What is the contribution margin ratio? Contbon margin ratio Required information [The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1.000 units (the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses wat operating income $ 35,000 21,000 14,000 400 $ 5,600 3. What is the variable expense ratio? Van expense Required information [The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1.000 units (the relevant range of production is 500 units to 1.500 units): Sales Variable expenses Contribution margin Fixed expenses met operating income $ 35,000 21,000 14,000 8.400 $ 5,600 4. If soles increase to 1.001 units, what would be the increase in net operating Income? (Round your answer to 2 decimal places.) Increase in net operating income [The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1000 units (the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses Het operating income $ 35,000 21,000 14,000 8.400 $ 5,600 5. If soles decline to 900 units, what would be the net operating income? Het operating income Required information [The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1000 units (the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses het operating income $ 35,000 21,000 14,000 8.400 $ 5,600 6. If the selling price increases by $2 per unit and the sales volume decreases by 100 units, what would be the net operating income Netopeng income [The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1000 units (the relevant range of production is 500 units to 1.500 units) Sales Variable expenses Contribution margin Fbed expenses het operating income $ 35.000 21,000 14,000 8,400 $ 5,600 7.14 the variable cost per unit increases by $1. spending on advertising increases by $1.250, and unit sales increase by 150 units, what would be the net operating income? rra income Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution sargin Fixed expenses tiet operating income $ 35,000 21,000 14,000 8.400 $ 5,600 8. What is the break-even point in unit sales? Ereak even point units