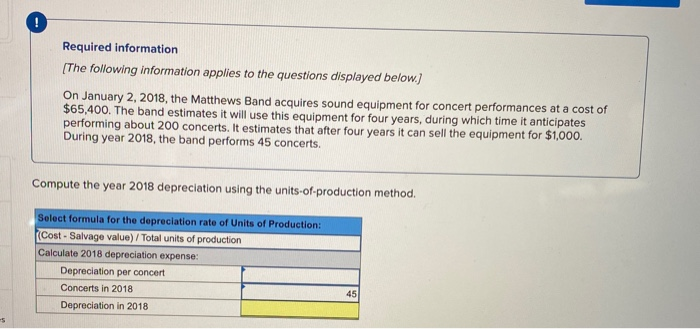

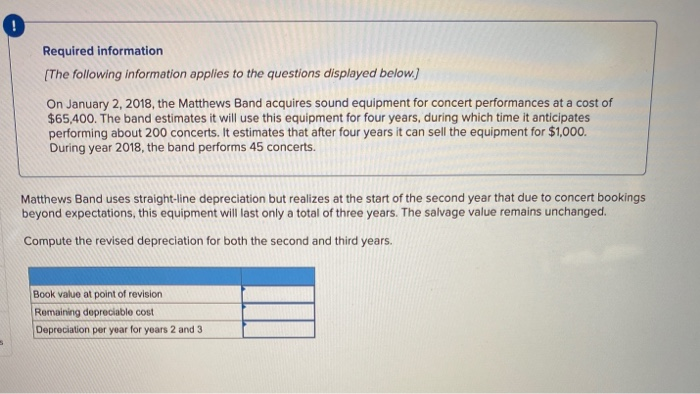

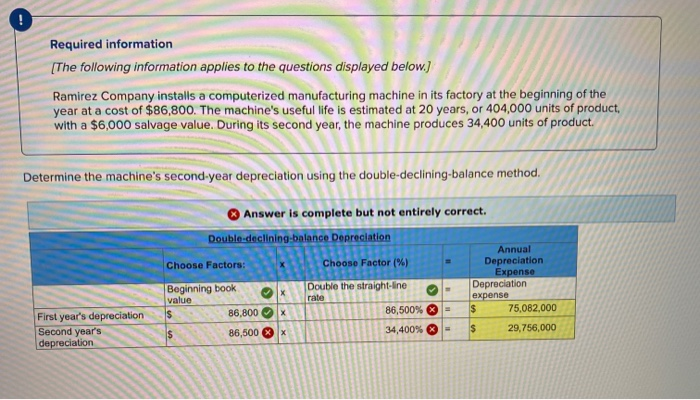

Required information [The following information applies to the questions displayed below.) On January 2, 2018, the Matthews Band acquires sound equipment for concert performances at a cost of $65,400. The band estimates it will use this equipment for four years, during which time it anticipates performing about 200 concerts. It estimates that after four years it can sell the equipment for $1,000. During year 2018, the band performs 45 concerts. Compute the year 2018 depreciation using the units-of-production method. Select formula for the depreciation rate of Units of Production: (Cost - Salvage value) / Total units of production Calculate 2018 depreciation expense: Depreciation per concert Concerts in 2018 Depreciation in 2018 Required information (The following information applies to the questions displayed below.) On January 2, 2018, the Matthews Band acquires sound equipment for concert performances at a cost of $65,400. The band estimates it will use this equipment for four years, during which time it anticipates performing about 200 concerts. It estimates that after four years it can sell the equipment for $1,000. During year 2018, the band performs 45 concerts. Matthews Band uses straight-line depreciation but realizes at the start of the second year that due to concert bookings beyond expectations, this equipment will last only a total of three years. The salvage value remains unchanged. Compute the revised depreciation for both the second and third years. Book value at point of revision Remaining depreciable cost Depreciation per year for years 2 and 3 Required information [The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $86,800. The machine's useful life is estimated at 20 years, or 404,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 34,400 units of product. Determine the machine's second-year depreciation using the double-declining balance method. Answer is complete but not entirely correct. Double-declining balance Depreciation Choose Factors: Choose Choose Factor (%) Double the straight-line . Annual Depreciation Expense Depreciation expense $ 75,082,000 $ 29,756,000 rade Beginning book value $ 86,800 86,500 First year's depreciation Second year's depreciation 86,500% 34,400%